How can real estate investors identify promising opportunities in these uncertain times?

As interest rates remain elevated, we expect private capital led by high-net-worth-individuals to continue powering the region's CRE market forward.

2 minutes to read

In our Horizon: Asia-Pacific Tomorrow report, we weigh in on the asset classes poised for growth in 2024 and examine the decisive role HNWIs are playing in steering the Asia-Pacific commercial real estate (CRE) market.

These investors are driving growth in the CRE sector, thanks to their capital preservation mindset and cash reserves.

High-Net-Worth investors take the wheel in Asia-Pacific CRE market

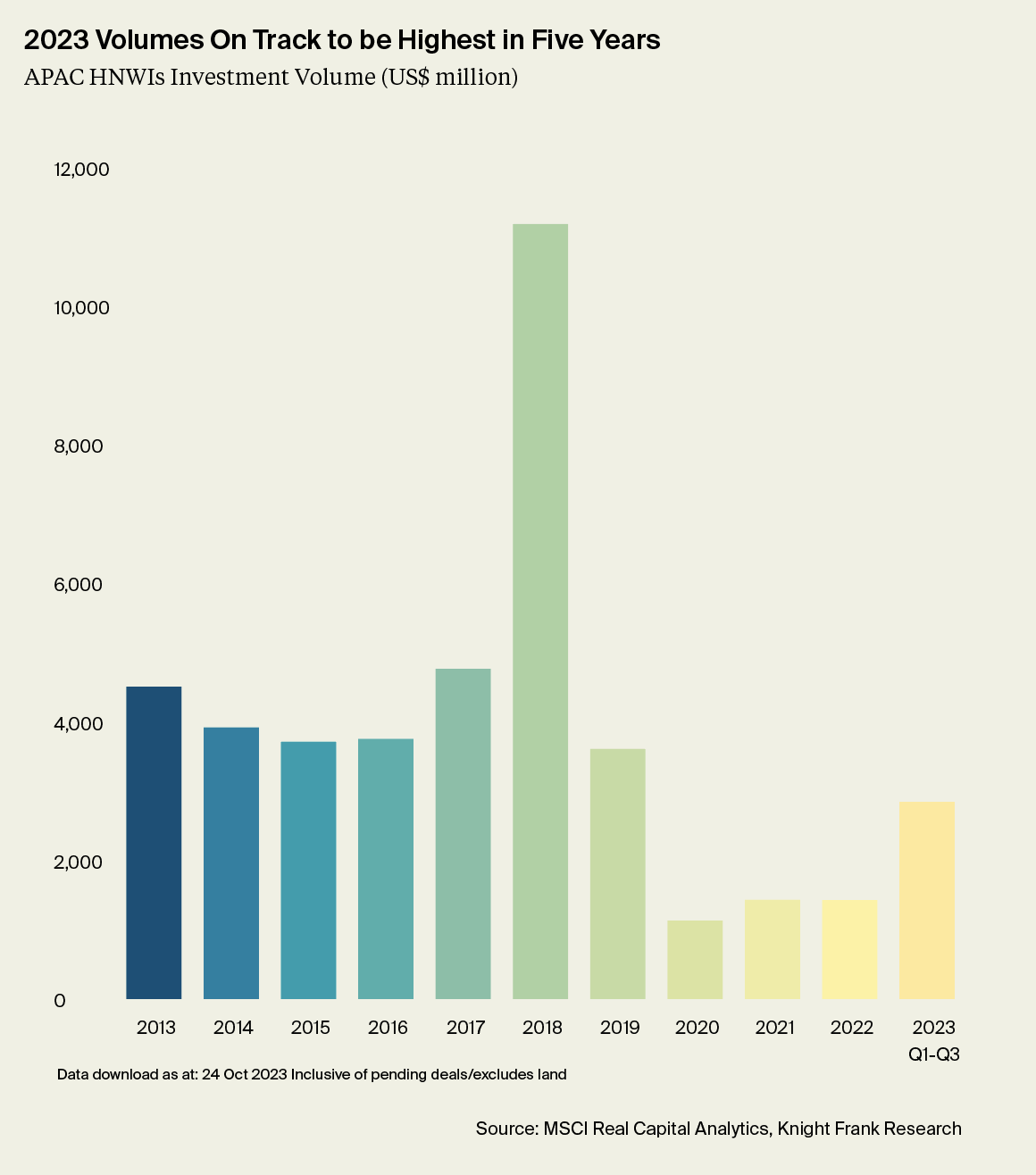

Amidst economic uncertainty, Asia-Pacific HNWIs have taken a proactive stance in the CRE market. Knight Frank's HNW Pulse Survey and recorded investment volumes show that they have increased their exposure to CRE, motivated by capital preservation rather than yield chasing. Their ample cash reserves enable them to quickly secure assets at competitive prices without relying on debt. With higher interest rates likely here to stay, private capital, led by HNWIs, is expected to remain a driving force in the Asia-Pacific CRE market.

Opportunities abound amidst uncertainty: How to Capitalise in 2024

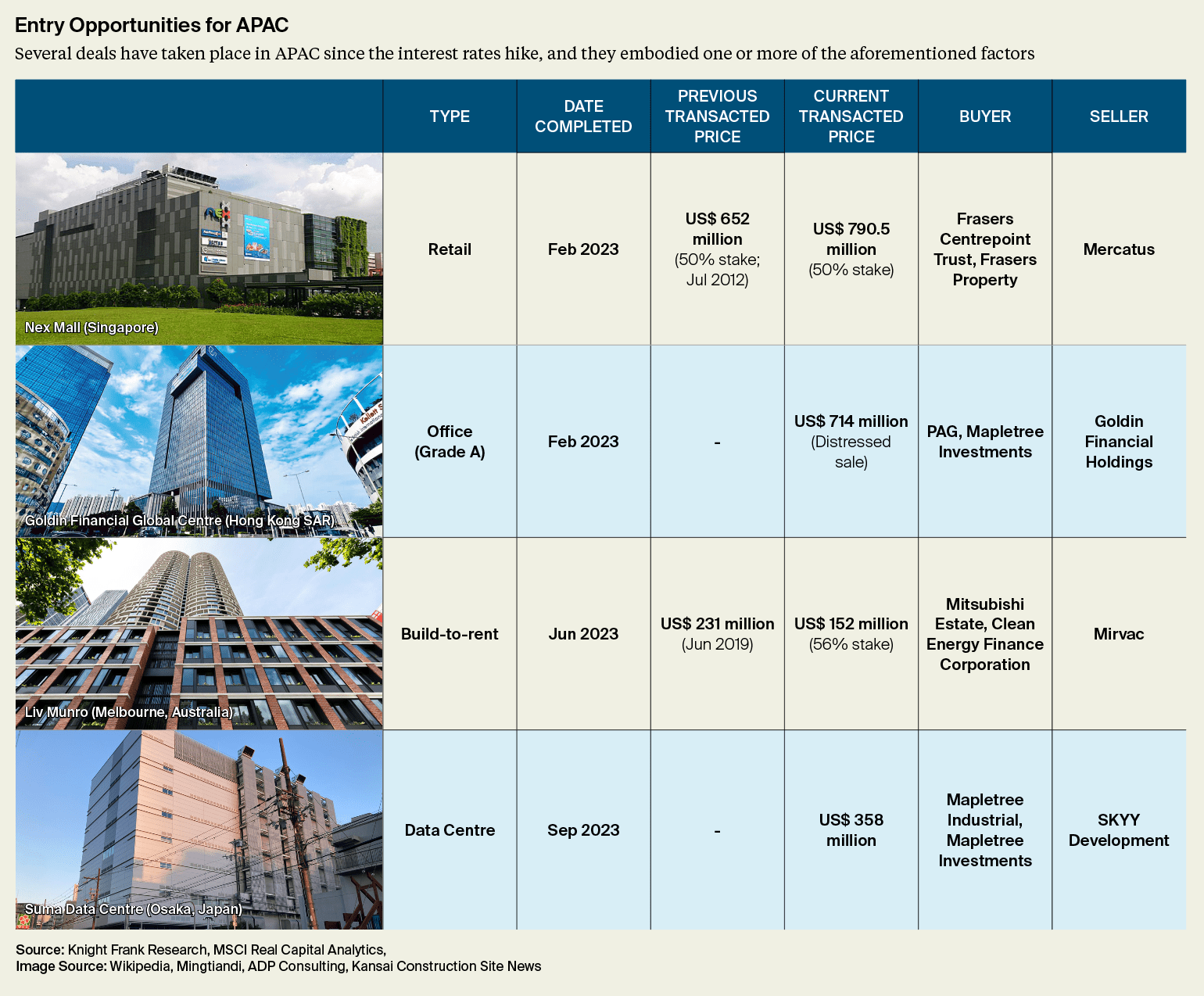

Despite the headwinds, savvy investors can still find gems amidst the volatility. With a disciplined approach and a keen eye for value, investors can reap the rewards of capital appreciation and positive rental reversions in sectors such as living, life sciences, and data centres. The figure below illustrates some examples of such opportunities.

The quest for stability: why investors are favouring core assets to mitigate portfolio risks

Market turmoil has triggered a pivot towards core assets as investors prioritise stability over risk. ANREV's Investment Intentions Survey shows that core strategies are more sought after than ever, with nearly half of the respondents favouring this approach in 2023. Core assets offer several advantages in the current inflationary environment, including stable cash flow, long-term appreciation, and a hedge against inflation. Given the expectation of high-interest rates through 2024/2025, we predict that investor demand for core assets will remain robust to mitigate portfolio risks.