Economic pressures hit UK construction activity

The continued challenging economic landscape has resulted in a significant fall in construction sector activity.

2 minutes to read

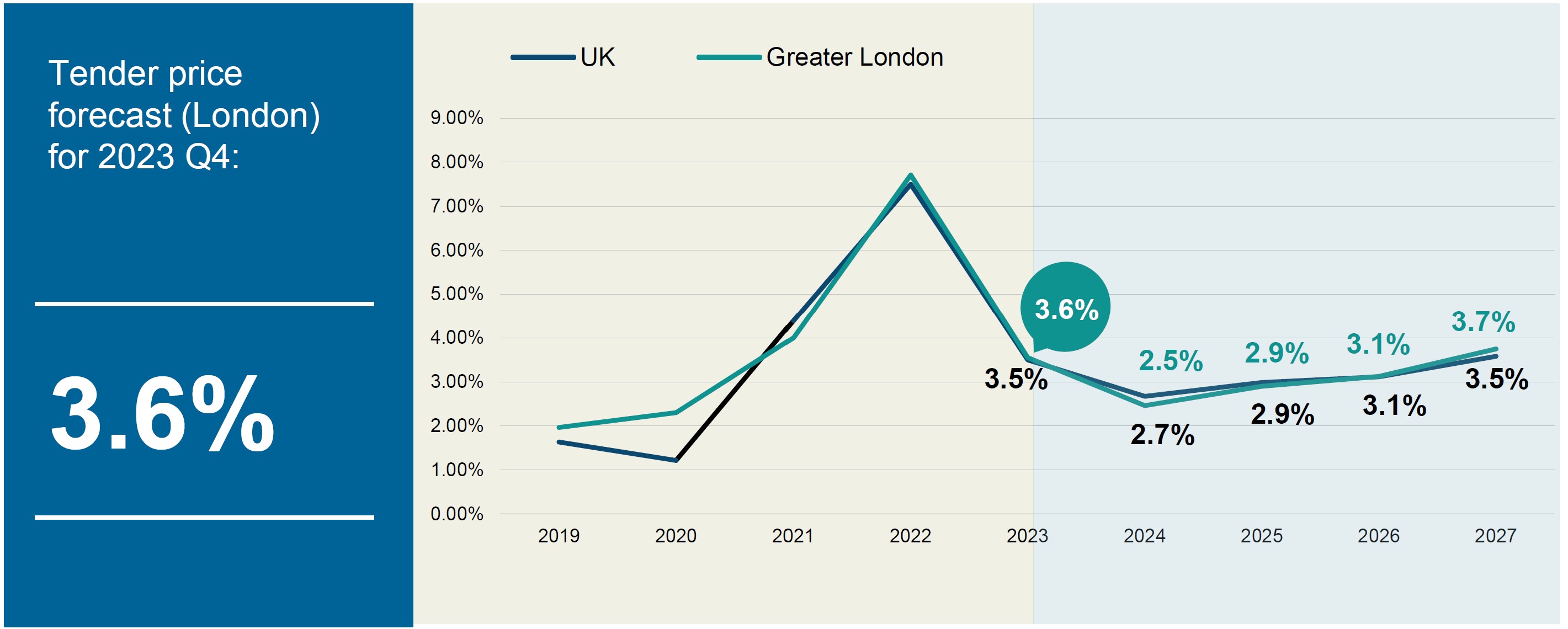

Positive near-term outlook for tender price inflation (TPI) – our latest forecast for London TPI –shows prices rising by 3.6% in 2023 and below or at 3% between 2024-26. These represent the lowest levels of TPI since 2021.

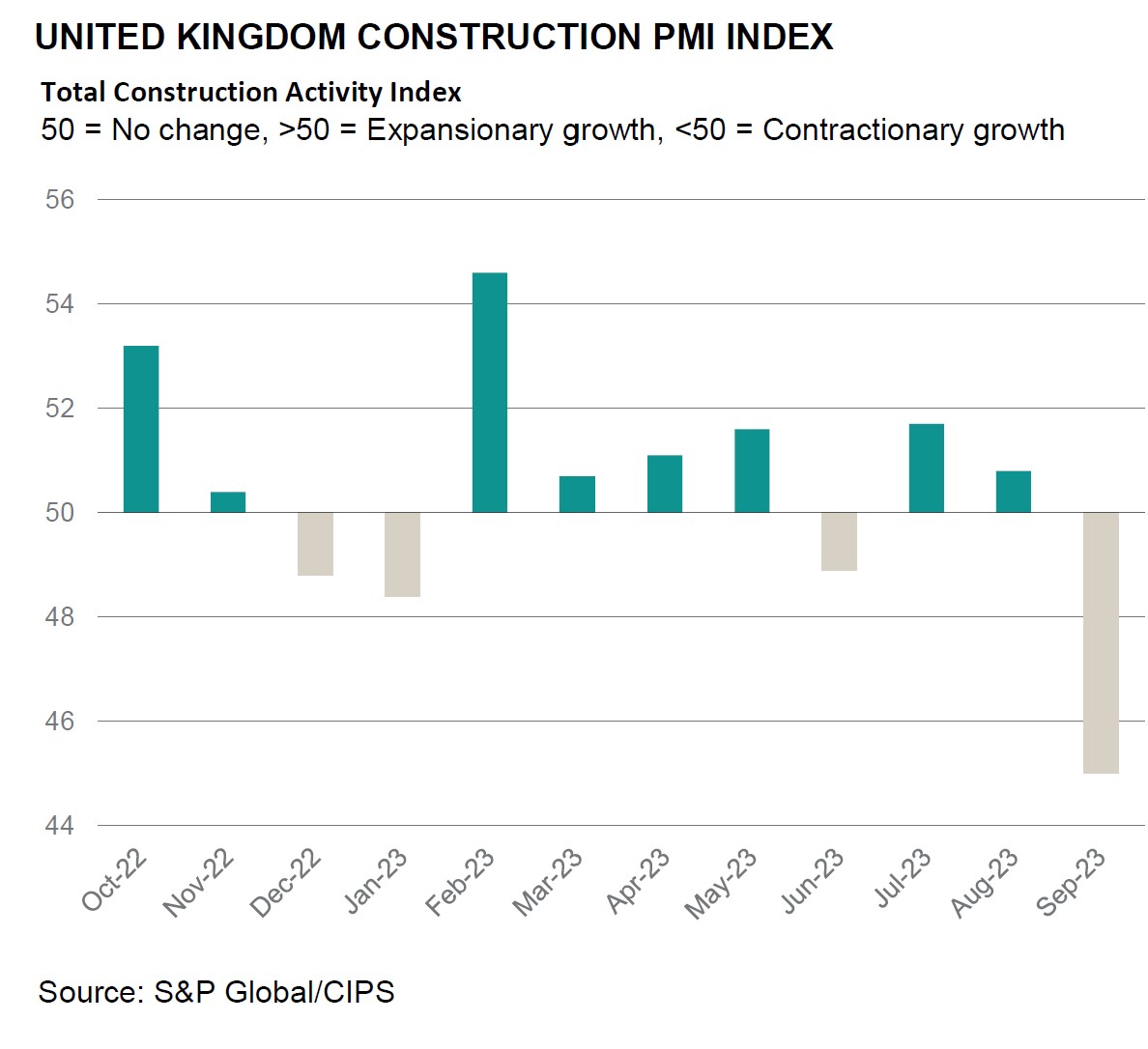

The headline CIPS construction PMI fell to 45.0 in September, indicating contraction, from 50.8 the previous month. There were considerable falls in residential land commercial output whilst the near-term outlook is hindered by falling new orders.

However, cost inflation has markedly eased, providing some respite to the sector as financing costs have accelerated.

Economic picture constraining development

Data from Glenigan illustrates the combination of a slowing economy and higher interest rates are constraining current levels of construction activity, with a fall in main contracts awarded.

Although there has been a 27% rise in planning consents, the number of main contracts awarded between June to August 2023 was 27% lower than the same period in 2022. This fall was especially stark for the office sector, where main contracts awarded have fallen by 67%.

Developer insolvency impact

The Government’s Insolvency Service showed that c. 4,200 construction companies became insolvent in the twelve months to June 2023. One such insolvency was Buckingham Group, the largest company of its type to cease trading since Carillion in 2018. Other notable recent collapses are Henry Construction in June and M&E specialist, MJ Lonsdale in October. The latter, which had been in business for nearly 40 years and was working on schemes such as Battersea Power Station and Broadgate, will have a severe impact on the other contractors in the supply chain.

Despite this concerning rise in insolvencies, the company research platform, FAME, reports that in the 12 months to July 2023, there were 14,513 construction companies, classed as being involved with the ‘development of building projects’ registered in the UK.

Uncertain future

Separately, the Government has announced that the MEES regulatory requirements of an EPC rating of C or higher will not apply to residential properties by 2027. There was no parallel announcement made for commercial properties. The lack of guidance on methods of upgrading buildings and how penalties for not meeting requirements is cause for concern for commercial developers and holding back investment in the sector.

Discover more

Download the report to find out more.

Download the report