City housing market recovery and UK house prices reality

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

To receive this regular update straight to your inbox every Monday, Wednesday and Friday, subscribe here.

House price growth across more than 100 global cities continues to slow, but there are now distinct signs of recovery emerging.

Knight Frank's Global Residential Cities Index climbed 1.7% in the year to Q2, down from 3.2% in the previous quarter. That's down from a peak of 11.2% growth in the year to Q2 2022. However, recent data tells a more complex story. The index edged up 1.3% in the most recent three months, up from a contraction in the final quarter of last year. Prices in 40% of markets fell during Q2, narrowing from 48% in Q1.

Improvements over the last three months are widespread – but the US, Canada, and Australia are standout examples. At the end of 2022, 10 of the 12 US markets we track were seeing quarterly price falls. By Q2 this year all 12 were seeing positive price growth. Similarly in Canada, all three of the markets we track were falling in Q4 last year and are now rising – and at a strong quarterly rate. In Australia it is the same story with all cities in our basket seeing quarterly price growth in Q2.

Managing expectations

We ought not overstate the pace of the recent price recovery. The current rate of annual growth is lower than that experienced in the first wave of the pandemic, when growth reached a low of 2.9% in Q2 2019. In fact the last time growth was this slow was in Q1 2012, when the European Debt Crisis was putting sharp downward pressure on values.

However, we are moving towards a more certain environment, with rate rises likely behind us, even if rates remain at levels which are high by recent historical standards. Meanwhile, a lack of new construction activity in recent years, coupled with lower market liquidity, has created a shortage of available properties to buy. This liquidity squeeze has been prompted by households avoiding moving to retain the benefit of low long-term fixed-rate mortgages.

Some markets have also already experienced significant residential market repricing. Eight markets have experienced drops of more than 10%, and 25 markets have seen declines of over 5% since their 2022 market peak. Finally, some countries, most noticeably Australia, are experiencing a resurgence in inward migration after a pandemic-induced pause, leading to an increase in housing demand and prices.

This quarter’s results points to an embryonic improvement in market conditions, but while impact of higher rates may be stabilising, but it hasn’t disappeared. There will be a lagged impact from higher mortgage costs – which will be felt as a rising number of borrowers remortgage over the next 12 to 18 months.

Relative value

UK house prices were unchanged in September, leaving the annual decline at 5.3%, Nationwide said on Monday. Mortgage rates have been easing since late-July, which has helped improve sentiment, but we expect pressure on values will continue has borrowers roll off sub-2% mortgage deals.

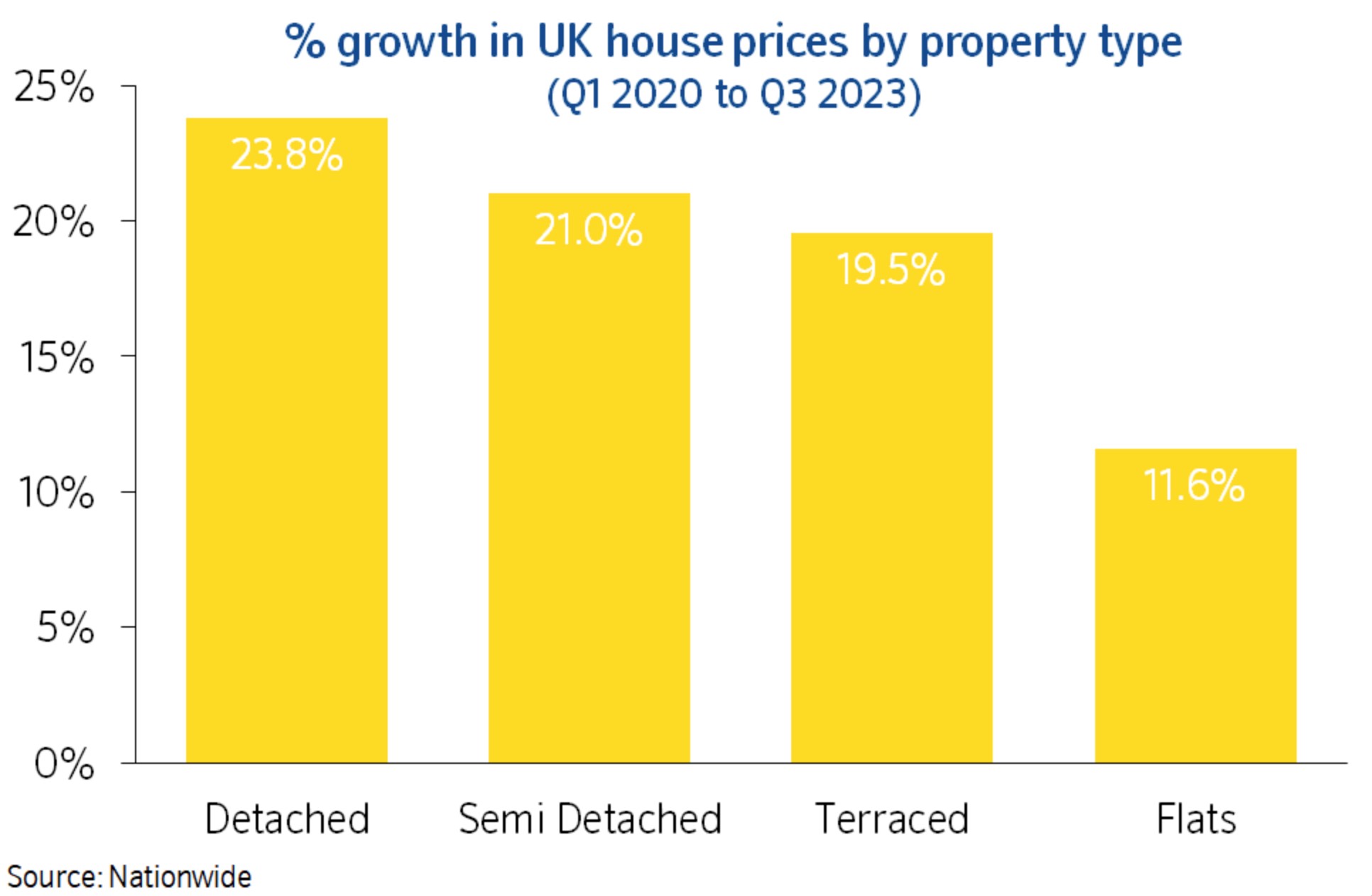

There are signs that buyers are looking towards smaller, less expensive properties, with transaction volumes for flats holding up better than other property types, the lender added. Flats look more affordable in relative terms - prices are up 12% since the beginning of the pandemic, compared to detached properties, which are up 24% (see chart).

Transaction volumes continue to fall. Net mortgage approvals for the purchase of homes, a good indicator of future borrowing, dropped to 45,400 in August, from 49,500 in July, the Bank of England said on Friday. That's the most subdued reading in six months.

The ‘effective’ interest rate – the actual interest paid – on newly drawn mortgages saw a 16 basis point increase in August and now sits at 4.82%.

Global interest rates

The rapid rise in global interest rates means many leveraged investors in commercial property markets are focused on reworking their existing assets rather than seeking out new purchases. This thinner pool of capital is creating opportunities for others - high-net-worth investors and Sovereign Wealth Funds are picking up trophy assets, charities are building portfolios and US private equity houses are currently leading the pack in terms of cross-border activity.

That's according to Victoria Ormond's updated outlook for Active Capital. Victoria outlines why investors are likely to focus on the ‘beds and sheds’ narrative over the rest of the year, and sees opportunities for investors amid the risk that US and European office markets are oversold.

In other news...

JPMorgan pursues Sports Direct over commercial property spat (FT), construction industry bears brunt of cooling UK labour market (FT), Blackstone buys two UK country clubs from Abu Dhabi wealth fund (Times), business rates rise will add £1.5bn to bills (Times), World Bank cuts growth forecasts for East Asia as China falters (Bloomberg), and finally, London on cusp of becoming Europe's largest stock market, again (Bloomberg).