Living sectors investment, Super-Prime market and ESG importance

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

To receive this regular update straight to your inbox every Monday, Wednesday and Friday, subscribe here.

Higher interest rates have impacted even the top slice of the luxury residential market.

Residential sales above US$10 million in the 12 cities covered by the Knight Frank Global Super-Prime Intelligence report totalled 422 in Q2 2023, a 13% fall compared to the same period a year earlier. That said, the 1,638 global sales in the 12-month period up to June of this year represent a significant uptick on pre-pandemic sales rates. There were 1,009 sales in 2019, for example.

Despite the year-on-year decline in overall sales, four markets saw volumes rise, led by Dubai (up 79% between Q2 2022 and Q2 2023), Sydney (up 46%), Paris (up 17%), and Geneva (up 7%). The biggest declines over the year were seen in key US markets, led by Los Angeles (down 63%).

Total sales in the 12 months up to June in all markets stood at just under US$30 billion, down from the peak of US$40.7 billion seen in 2021 but well ahead of the pre-pandemic figure of US$18.6 billion in 2019.

Activity falls

House prices and sales activity continued to weaken through August, according to the RICS UK Residential Market Survey. A headline net balance of -47% of respondents reported a decline in new buyer enquiries during the month - broadly in line with the previous two months. New sales also registered -47%, the weakest reading since the early phases of the pandemic. A reading of below zero indicates a contraction.

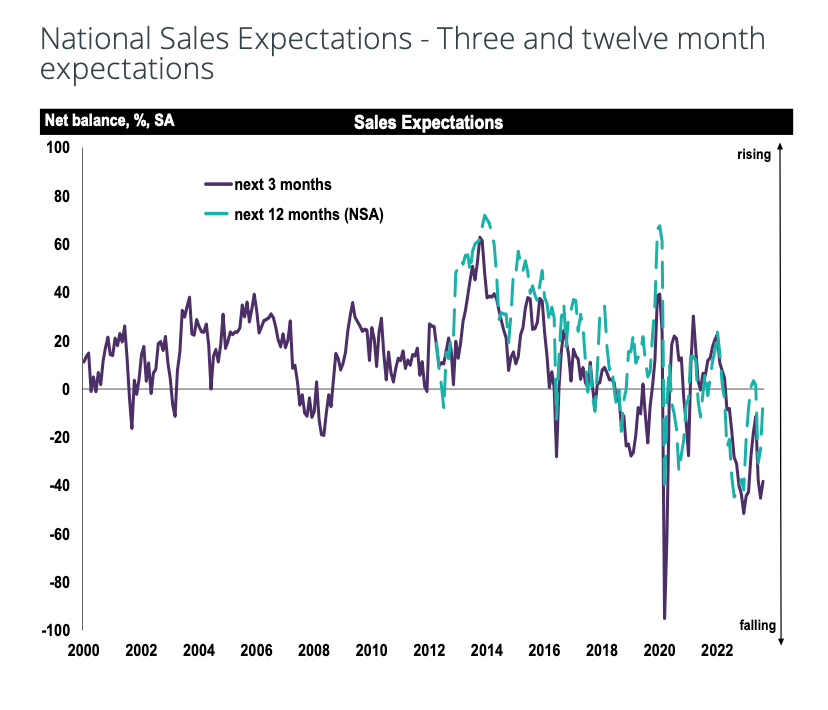

Near-term sales expectations remain subdued, albeit the headline net balance did turn marginally less negative, at -38%, compared to last month’s reading of -45%. On a twelve-month view, the trend in home sales volumes is anticipated to flatten out, evidenced by the net balance moving from -25% in July to -5% in August - see chart.

Average mortgage rates have been edging down since late July, but remain above levels seen in the weeks following the mini-budget. Nearly all 65 economists in a Sept. 11-13 Reuters poll expect the Bank of England to hike the base rate by 25 basis points to 5.50% next week, a move that we expect to have little impact on mortgage rates. Economists generally expect the base rate to peak at 5.50% and stay there until mid 2024, though 30 of the 65 respondents said they expect a peak of 5.75% or higher in the final quarter.

Supply and demand

Conditions continue to deteriorate for tenants. A net balance of +47% of RICS survey respondents said demand rose during August. Landlord instructions continued to fall.

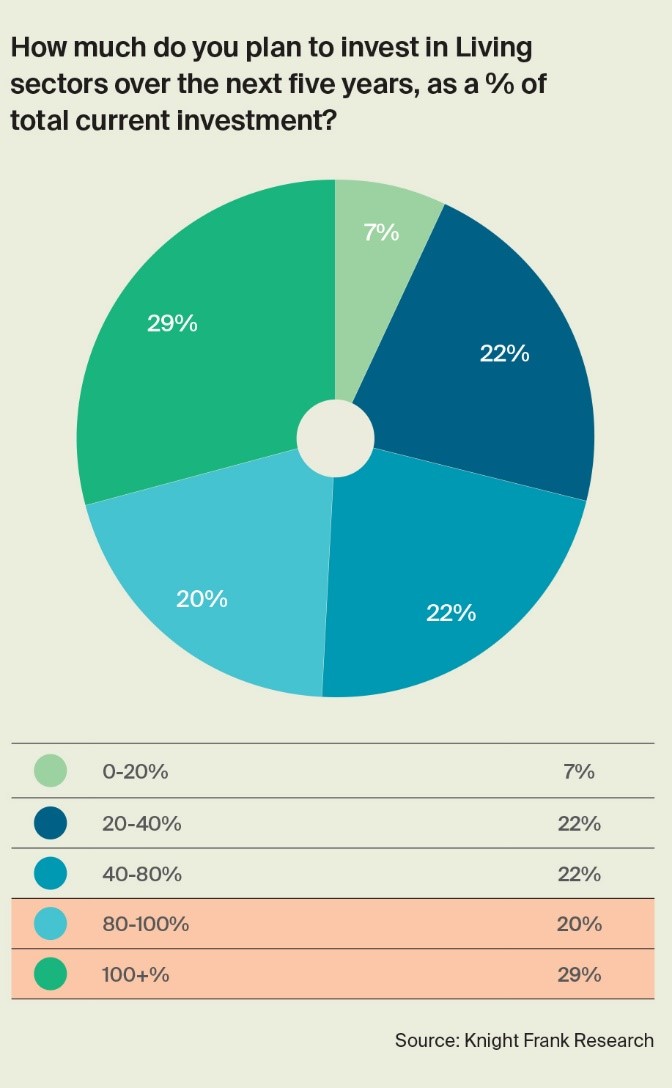

The growing imbalance between supply and demand is one of several reasons why investors have set aside £45 billion to invest in the UK living sectors over the next five years, according to our latest survey. Figures for 2023 suggest that institutions committed a further £4 billion in the first six months of the year.

Rising interest rates, stubbornly high inflation and elevated build costs all present challenges to deploying capital, but the longer-term view remains positive. There are few, if any, signs that the supply and demand imbalance can be resolved without proper supply-side incentives, student numbers will continue to rise and the ageing population will require a substantial uptick in the delivery of specialist rental homes. We'll take a deeper dive into the results next week.

ESG and investing

Institutional investors want buildings with top ESG credentials, which is driving a growing divide in values between the greenest properties and everything else.

In June, we surveyed 45 investors with nearly £300 billion of assets under management about ESG and their property investments. More than three quarters now apply minimum environmental certification criteria to their investments. Of those targeting EPCs, more than 50% require a minimum B rating, the proposed minimum energy efficiency rating in the UK from 2030. Similarly, 47% require BREEAM ‘Excellent’ or ‘Outstanding’ ratings.

Our previous research found that central London offices command a rental and sales premia for BREEAM- certified buildings. For those in our sample rated ‘Excellent’, the sales premium was 10.5%, when compared to the equivalent unrated building, with a rental premium of 4.7%. However, the rental premium was far higher at 12.3% for ‘Outstanding’ rated buildings.

For a more detailed analysis of the results, see Flora Harley's newsletter, out yesterday.

In other news...

UK government defeated over plan to relax water pollution rules to boost homebuilding (Reuters), repeat after me: building any new homes reduces housing costs for all (FT), income gap between Londoners and rest of UK hits record high (FT), ECB raises rates to record high, signals end to hikes (Reuters), and finally, California approves sweeping emissions disclosure rules for big business (AP).