Japan's resurgent real estate market - a haven for Singapore investors

With a resilient economy, mild inflation and favourable financing costs, the current landscape in Japan now presents an opportune juncture for investors to ride the wave.

4 minutes to read

Japan is the third most sought-after investment destination within APAC for Singapore-based investors, only trailing behind the Chinese Mainland and Australia.

Between 2013 and 2023, an estimated USD 16.2 billion has been injected into Japan's commercial real estate (CRE) market. Significantly, 12% of this capital influx occurred in the first half of 2023, highlighting a pronounced surge in investor interest.

How have the Japanese government's monetary policies impacted real estate investors?

The Japanese government's monetary policies to stimulate domestic inflation have proven to be a significant advantage for real estate investors. This is particularly evident as the Japanese yen has recently touched multi-year lows compared to major global currencies. This trend has created a favorable environment for those in the real estate market.

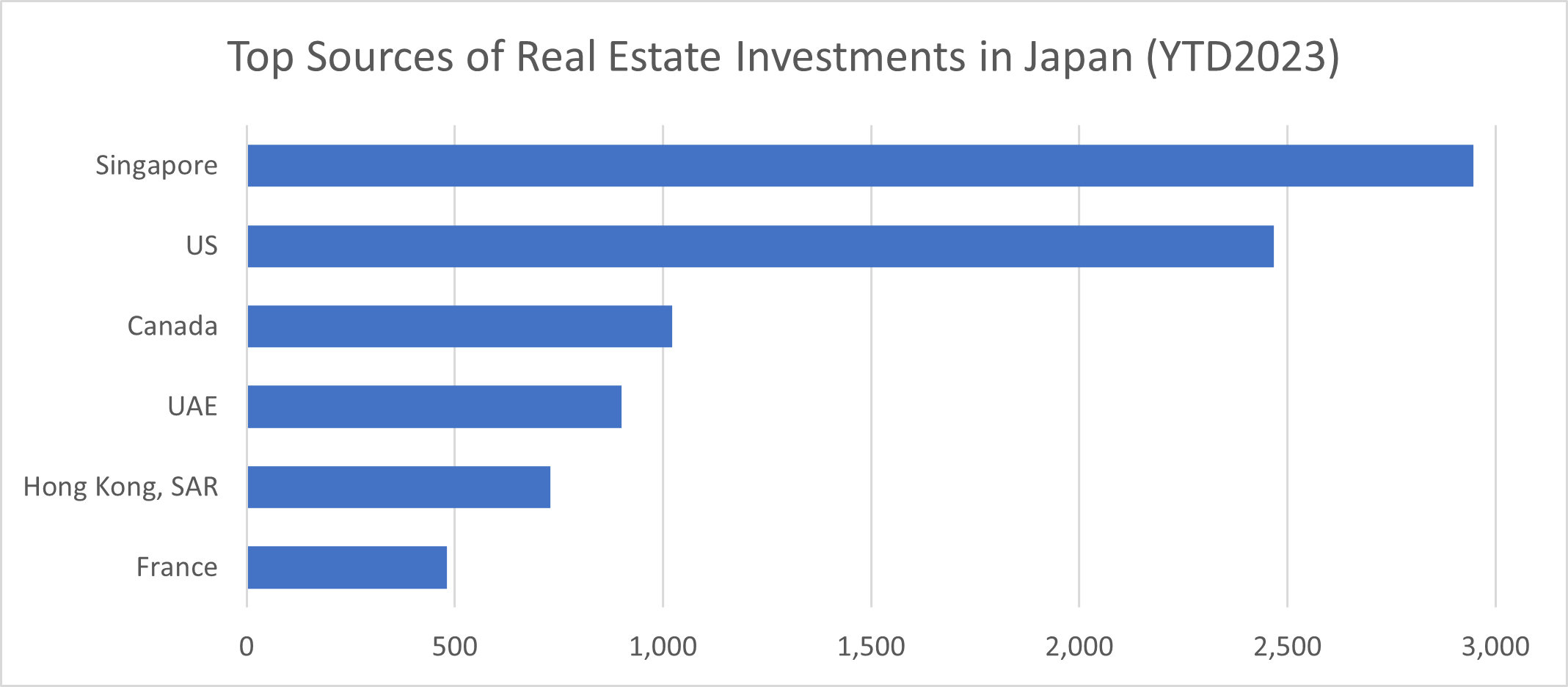

Despite recent adjustments to its yield curve control targets, the yen's depreciation against the Singapore dollar was unmistakably pronounced, hitting an unprecedented low in 2023. The added firepower has put Singapore as the top cross-border investor in Japanese real estate so far this year.

What are some tactical shifts in investor appetite?

Over the past decade, most capital inflows from Singapore were directed towards Japan's office sector, followed by investments in industrial and hospitality assets. However, with the unexpected surge in hybrid work arrangements in Japan and a significant supply anticipated in the near future, there has been a noticeable shift in investors' preferences. The spotlight has shifted towards growth-inducing asset classes such as logistics and hospitality, poised to capitalise on the upward trajectory.

The Japanese logistics sector has experienced impressive growth, primarily fueled by the strong performance of e-commerce and third-party logistics. This heightened demand for high-quality assets has resulted in a notable undersupply, leading to substantial rental increases. Consequently, this has made the sector highly appealing to investors based in Singapore.

In the initial half of 2023, a substantial capital influx from Singapore into Japan's logistics sector amounted to approximately US$1.68 billion. This marks the highest investment volume recorded in a decade. Of particular significance is GIC's substantial investment of US$800 million in a portfolio consisting of six logistics facilities acquired from Blackstone. Despite an anticipated increase in new supply this year, the sector's robust fundamentals suggest that strategically situated, up-to-date facilities will continue to yield resilient cash flow and maintain high occupancies.

How has the resurgence of interest in the hospitality sector fueled increased investments?

After the Japanese government eased border restrictions, there was a surge in international tourists visiting the country, leading to a surge in hotel occupancy and average daily rates. According to an STR study, Japan's average room rate in March surpassed pre-pandemic levels by 21%, showcasing a solid rebound in tourism. Given the limited availability of new hotel rooms in the foreseeable future, the upward trend in occupancy rates is anticipated to continue.

In April, hospitality investments were significantly boosted as the government greenlit the construction of Japan's inaugural integrated resorts (IRs) in Osaka. This monumental $8.1 billion project will showcase Japan's premier casino alongside hotels, conference amenities, and shopping complexes, potentially rivalling Singapore's own IRs.

The surge in tourism demand and constrained supply has reignited Singaporean interest in Japan's hospitality sector. Singapore-based investors are seizing substantial opportunities in this sector, investing US$898 million in hotel assets in 2022. Investments in the year-to-date until August 2023 have already surpassed this figure, reaching US$942 million, supported by a notable transaction in July. A consortium led by SC Capital Partners, Goldman Sachs Asset Management, and the Abu Dhabi Investment Authority acquired a portfolio of 27 resort hotels from Daiwa House Industry for just under US$1 billion.

In a landscape of uncertain asset repricing and tightening global yield spreads, Japanese Commercial Real Estate (CRE) stands out as a promising opportunity for Singaporean investors to revitalize and diversify their real estate portfolios. The recent adjustments in monetary policy by the Central Bank are expected to have minimal impact on CRE investments, both for domestic and international investors. Given Japan's robust economy, modest inflation, and advantageous financing costs, the current scenario offers an auspicious moment for investors to capitalize on the resurgence of the Japanese CRE market.

Subscribe for more

Get exclusive market analysis, news and data from our research team, straight to your inbox.

Subscribe here

Business Times published this article on Sep 9, 2023.