Classic car values continue to accelerate

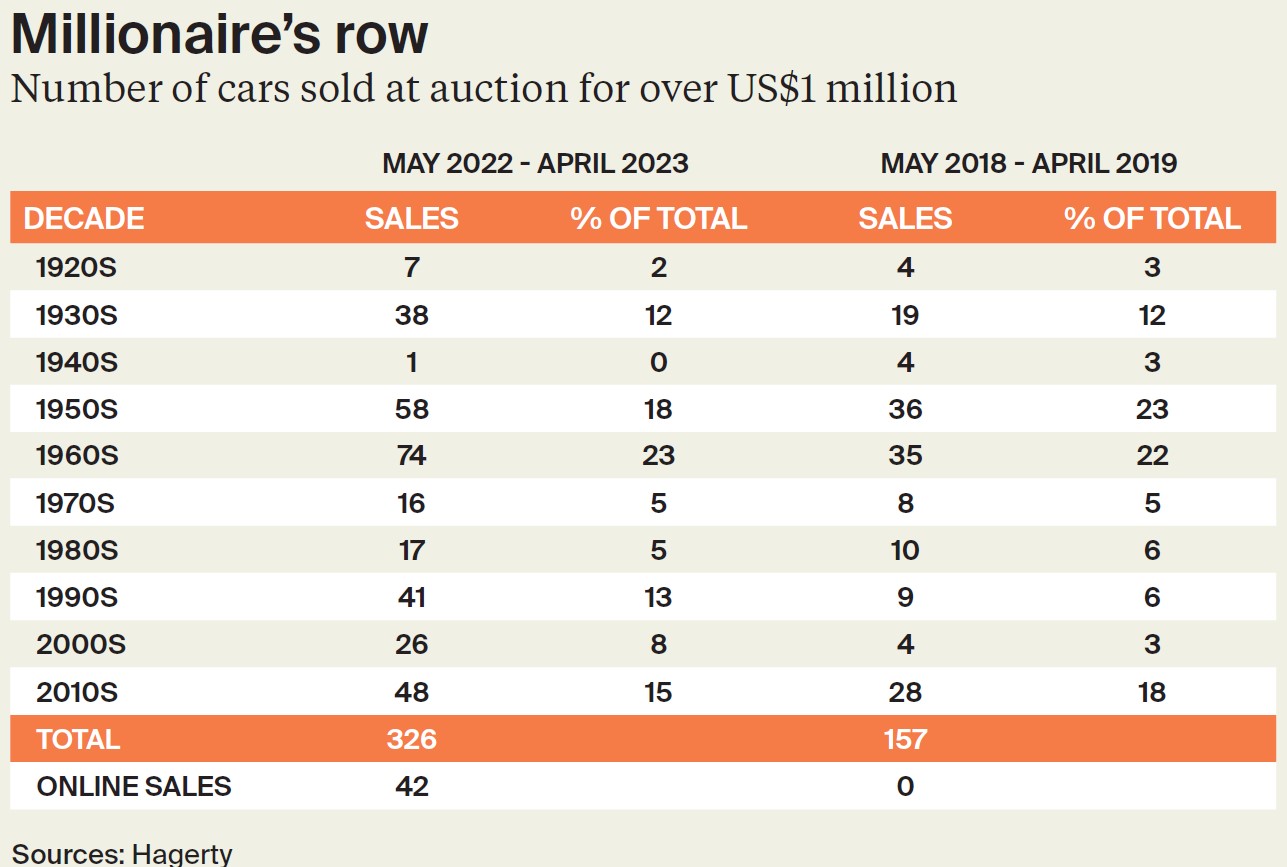

The sale of US$1million+ classic cars has doubled in the last five years.

3 minutes to read

John Mayhead, Editor of specialist insurer Hagerty’s Price Guide UK, takes a deep dive into the top end of the classic car collector market.

This update comes from the Luxury Investments report from The Wealth Report Series, giving high-net-worth-individuals a guide to investments of passion.

In the past five years, the number of US$1million+ open-market cars tracked by Hagerty has more than doubled, with the private market estimate – based on Hagerty’s global insurance data – growing at an even higher rate.

Back in 2018/19, online-only auction sales of this type of car were unheard of, but have now become a regular feature, even in the UK.

The first online-only US$1 million+ sale in the US, of a 1956 Mercedes-Benz ‘Gullwing’ 300SL, took place on Bring A Trailer in June 2019 and the first UK £1 million+ sale, of a Ferrari F40, on The Market in July 2019.

When we drill down into the decades in which the cars were produced, the US$1 million+ sales increases fall almost entirely within just two decades: the 1990s and 2000s, with the 1990s increasing its proportion share the most by almost 7%. The number of 1950’s sales fell most, down by just over 5%.

Along with the median value, which increased only slightly, this shows that the typical increase has been in modern classics at the more conservative end of the price range.

What collectable cars have increased in value?

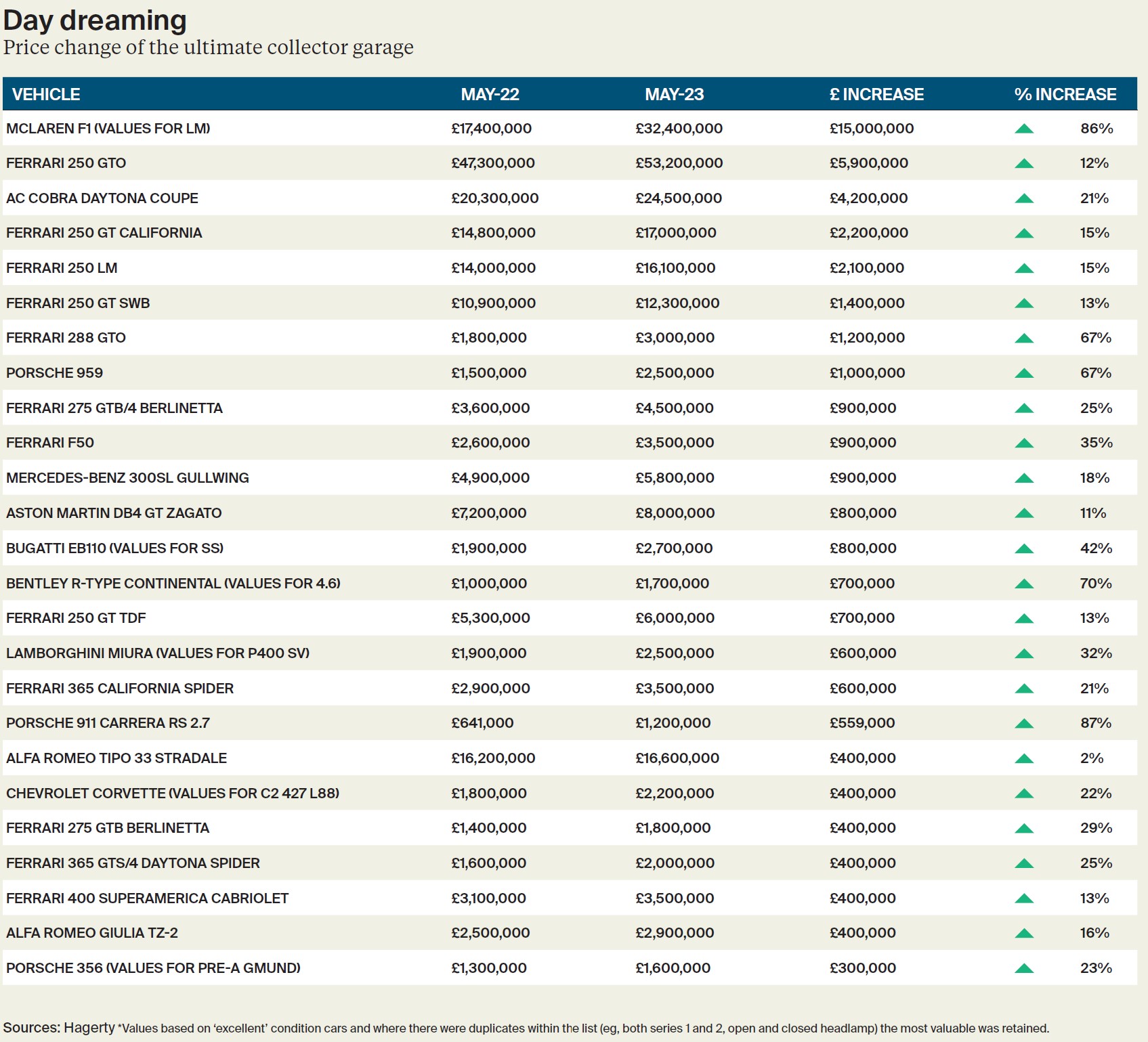

Defining ‘collectability’ is difficult. But Hagerty has selected 25 cars every collector would like to own that have increased the most in value in the past 12 months, according to our Price Guide.

The list is led by a newly crowned champion: the McLaren F1. Values of both F1 LM – which increased by a huge 86% in the past year and ‘standard’ F1 models soared this year as demand surged. The other measure of collectability that Hagerty analysed was the volume of cars sold at public auction.

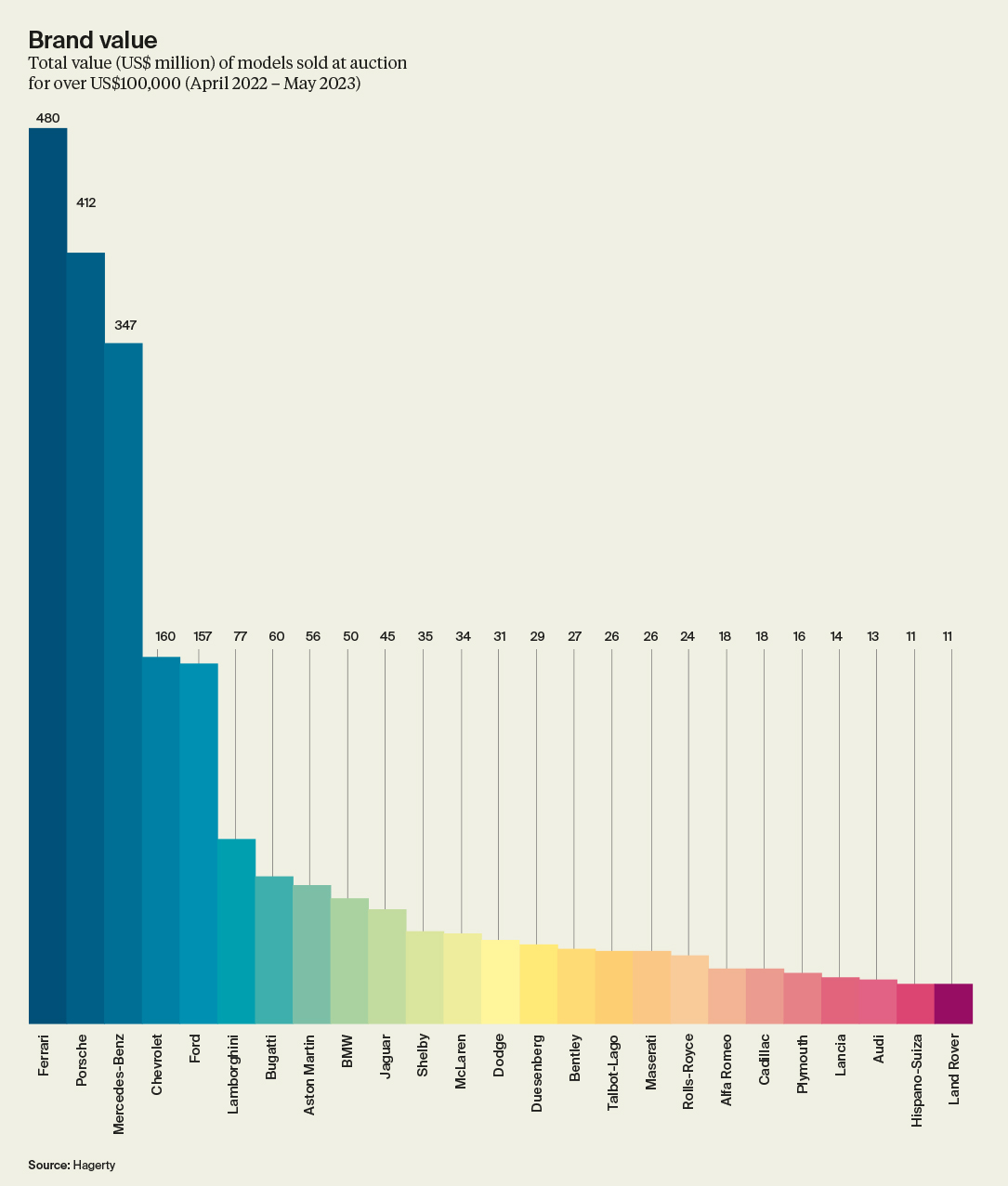

Total sales of cars worth in excess of US$100,000 were listed (see table below). The podium places are as expected, but Chevrolet at number four shows that quantity has a quality all of its own.

Land Rover is a surprising entry at number 25, benefitting from sales of North American Specification (NAS) Defenders, James Bond ‘Spectre’ vehicles and some early Range Rovers that cross into the US$100k+ category.

Best and worst performing brands

In terms of overall market performance, the top collector car marques show similar trends, with growth leading up to the end of 2019, an immediate fall caused by the initial response to the Covid-19 pandemic, followed by a very strong recovery.

Jaguar

Jaguar, however, has been a bit of an outlier with values continuing to weaken.

This is a result of the Jaguar market already having been overheated, with record prices paid during the mid-2010s for the rarest examples such as the E-Type S1 OTS (flat floor with outside bonnet lock) and the alloy-bodied XK120. We were already tracking a correction in these values even before the pandemic.

Lamborghini

On the other hand, Lamborghini values have continued to rise sharply in percentage terms post-pandemic.

This is partly because they have manufactured fewer models - 15 are monitored by the Hagerty Price Guide, in contrast to 136 models from the brand with the second highest number, Mercedes-Benz.

That means that its average is affected more by big price gains in a small number of models, in this case the Countach and Miura, both of which rose significantly over the period.

Classic car buyer demographic

The buyers of classic and collectable cars are changing in age as Generation Xers reach peak earning potential, their kids leave home, and they buy the cars they have always been lusting after.

Although boomers still own 52% of all the cars Hagerty covers, Generation X and younger accounted for 63% of insurance quotes in 2023 so far. But quotes from the younger millennial and gen Z generations have grown faster and may soon comprise the largest group of buyers.

Subscribe

Subscribe for all the latest insights and additional content from The Wealth Report.

Subscribe