London office market: resilient take-up despite slow economic growth

Amid a backdrop of slowing economic growth in London, the post-pandemic recovery in office take-up has been robust.

3 minutes to read

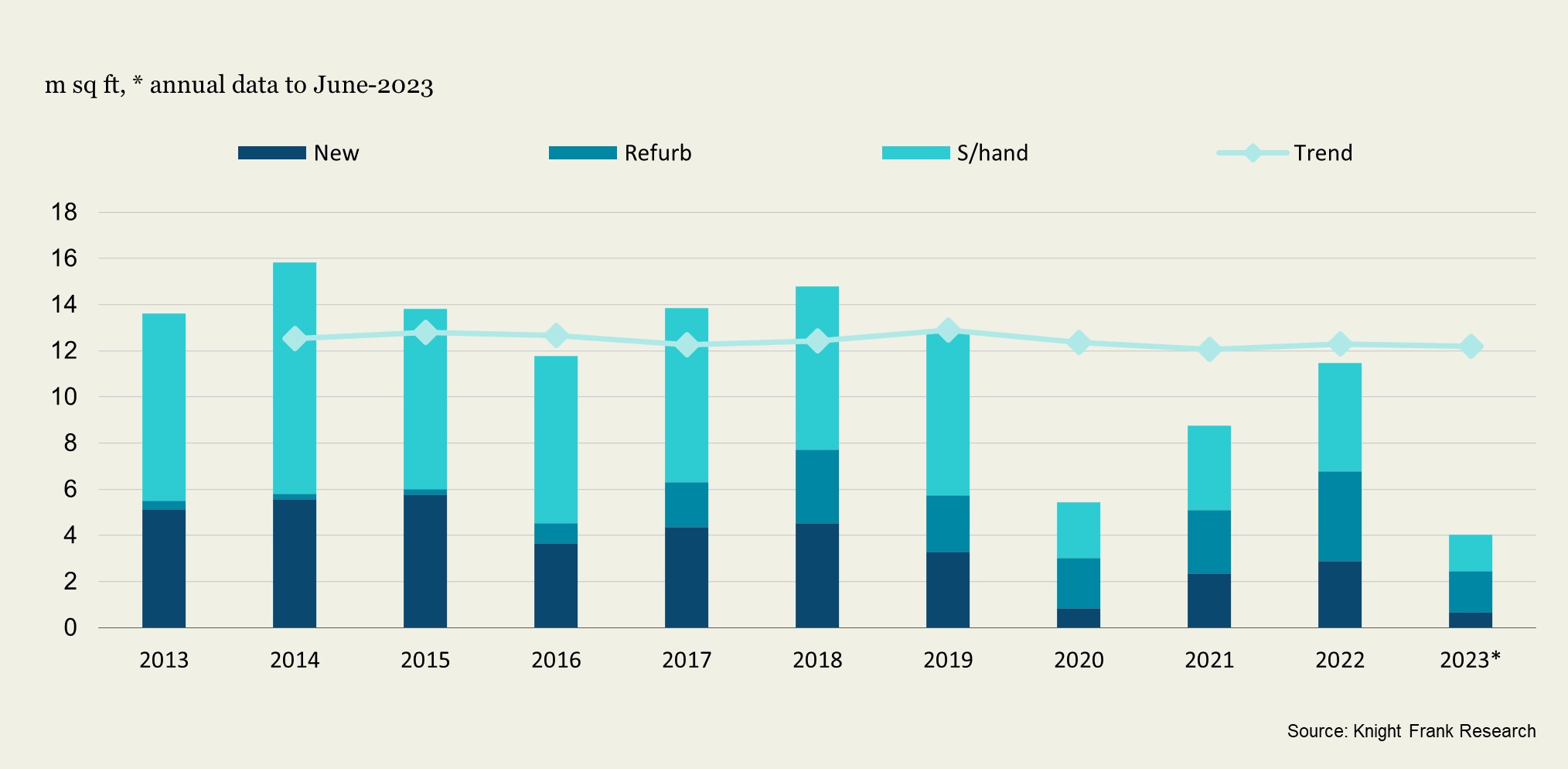

Annual take-up by quality

In the first half 2023, there has been just over 4m sq ft of take-up with almost two-thirds of transactions for the best quality, new and refurbished space.

Despite the economic uncertainty, near-term leasing transactions are supported by 3.3m sq ft of deals under offer, and 9m sq ft of active requirements for space to be occupied in the next 12-18 months.

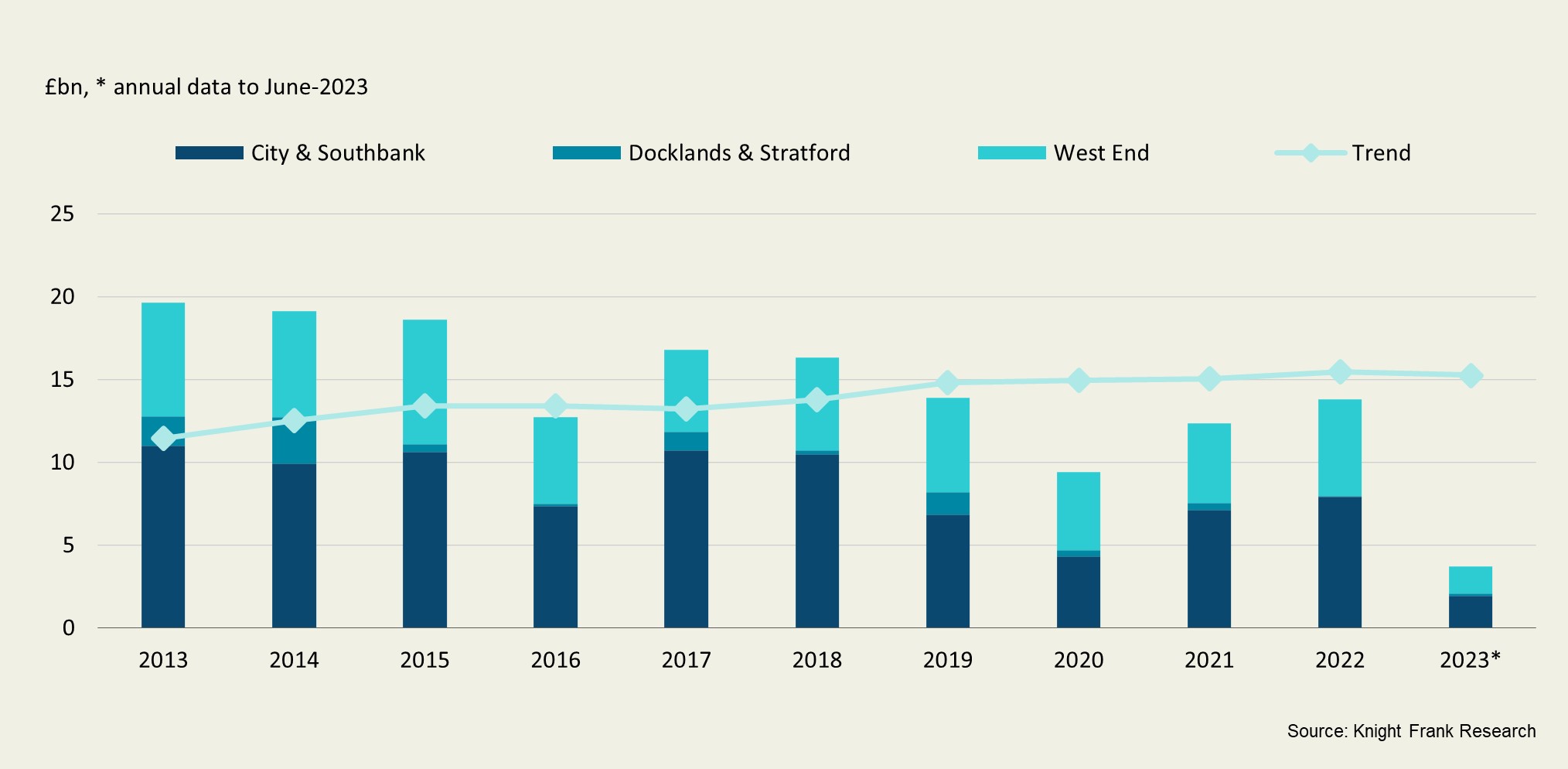

Annual investment volumes by market

The rapid rise in interest rates has led to a considerable reduction in investment transactions for London offices, as debt-sensitive investors have refrained from being active in the market. In the City, where debt is vital for large lot-size transactions, capital values have fallen by 30% in the last 12 months.

Lower barriers to entry have provided an opportunity for private capital to be more active in Central London. During the last 12 months, 45% of transactions have been made by high-net-worth-individuals or private property companies.

Meanwhile, the attractive valuation of prime London offices is amplified to international investors as sterling remains historically low relative to many global currencies.

Our survey of global real estate investors shows c. £43bn of targeted capital allocation to London offices. This is almost five times greater than the available investment stock.

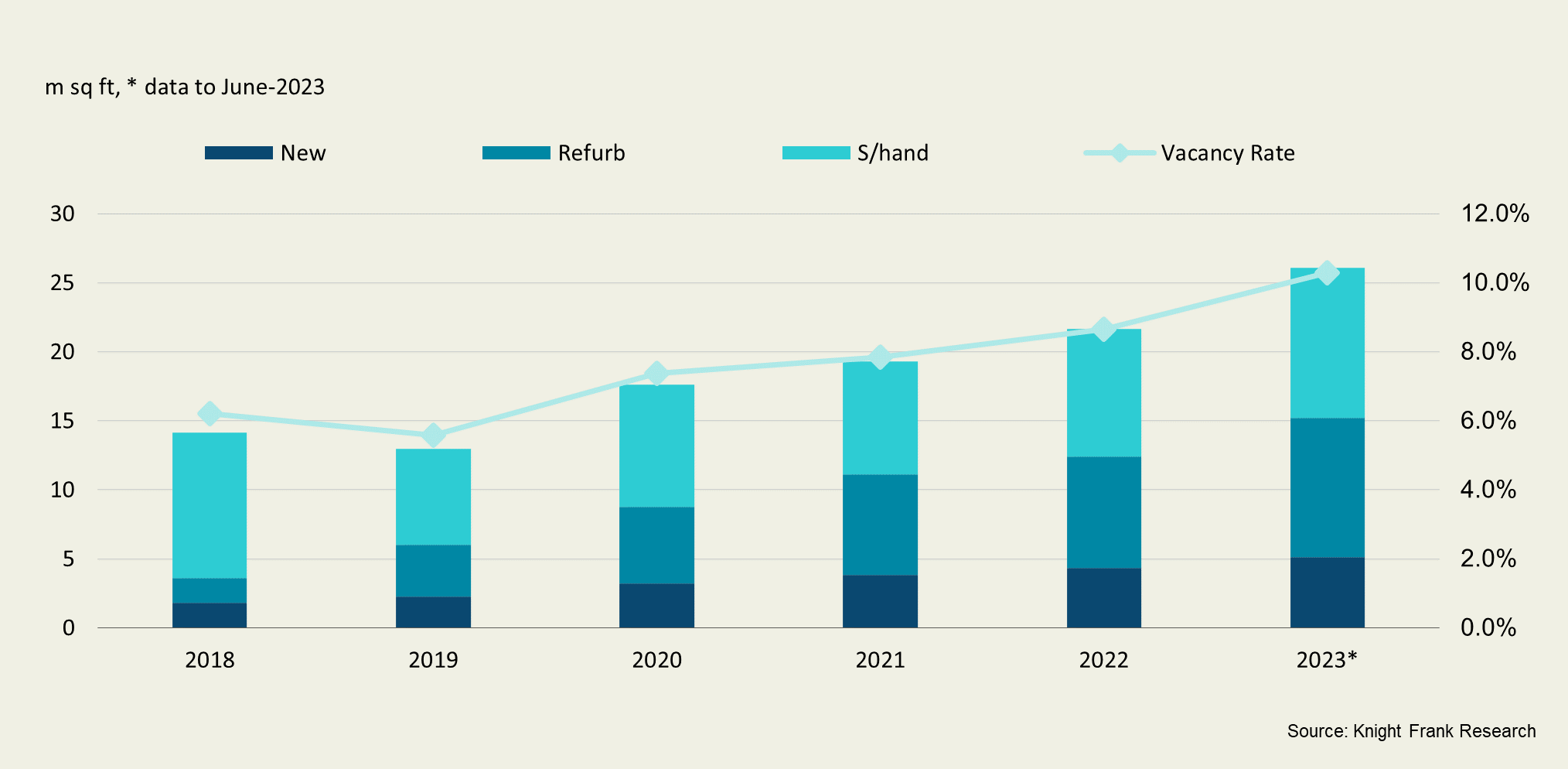

Availability by quality

Available space in London is almost 26m sq ft and a vacancy rate of 10.3%, which is 3.5 percentage points above the long-term average. However, the availability of the best quality buildings is low. There are 595 available, new and refurbished buildings in London, which is only 43% of all vacant buildings. The West End has the lowest share of new and refurbished buildings in London at 37.9%.

The bulk of prime availability is contained in smaller size band buildings less than 40,000 sq ft. Across London there is a shortage of larger size band buildings.

In the City there are no available buildings between the 80-100,000 sq ft size band and only 28 buildings that could accommodate a requirement greater that 60,000 sq ft. In the West End, there are only 16 buildings above 60,000 sq ft.

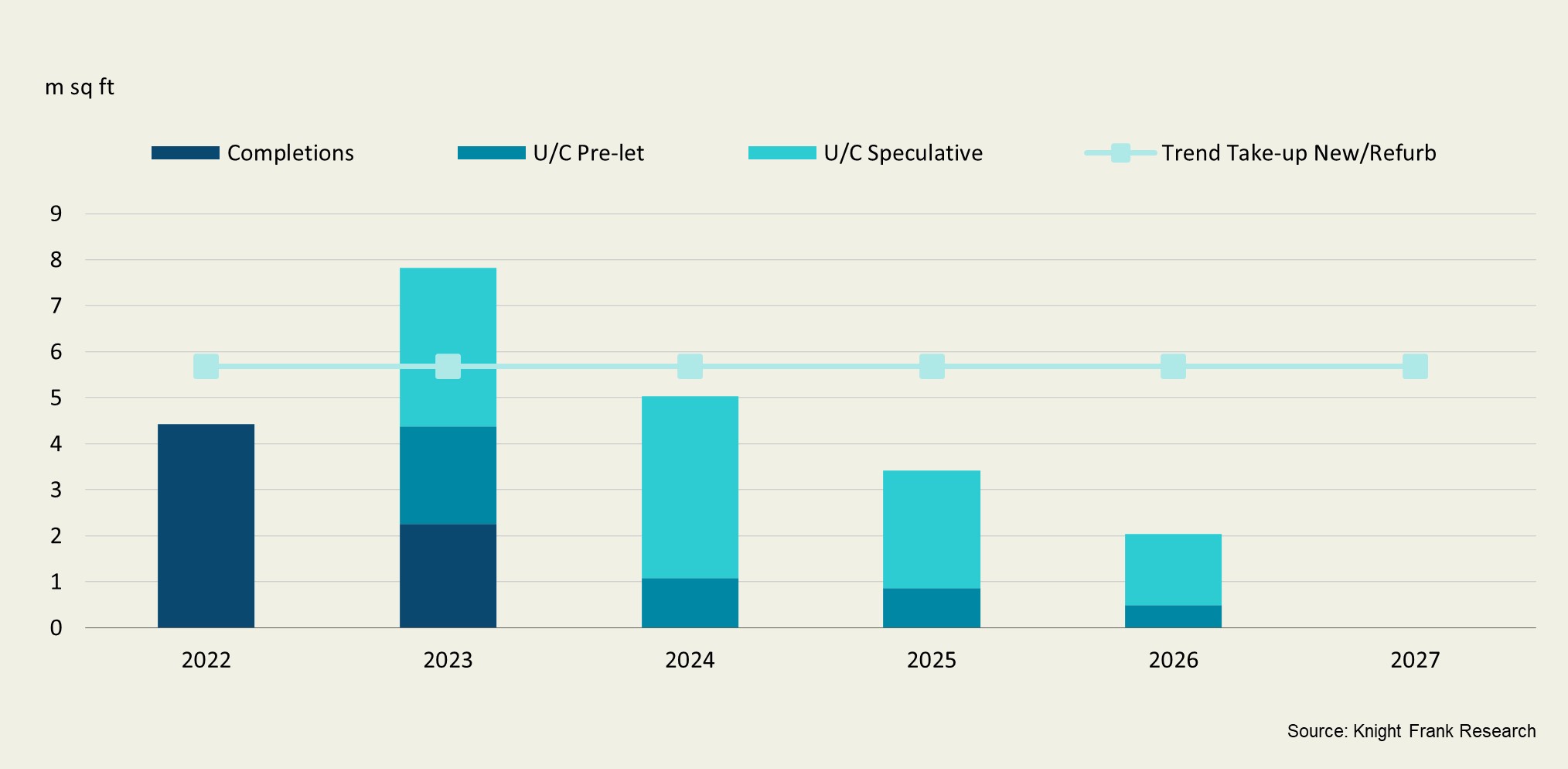

Under-construction development pipeline

The current under-construction pipeline is 15.7m sq ft of which 70% is being built speculatively and completes in 2026. Average annual take-up of new and refurbished buildings is 5.6m sq ft and implying over the 2023-26 period, a shortfall of 9.2m sq ft of new and refurbished space.

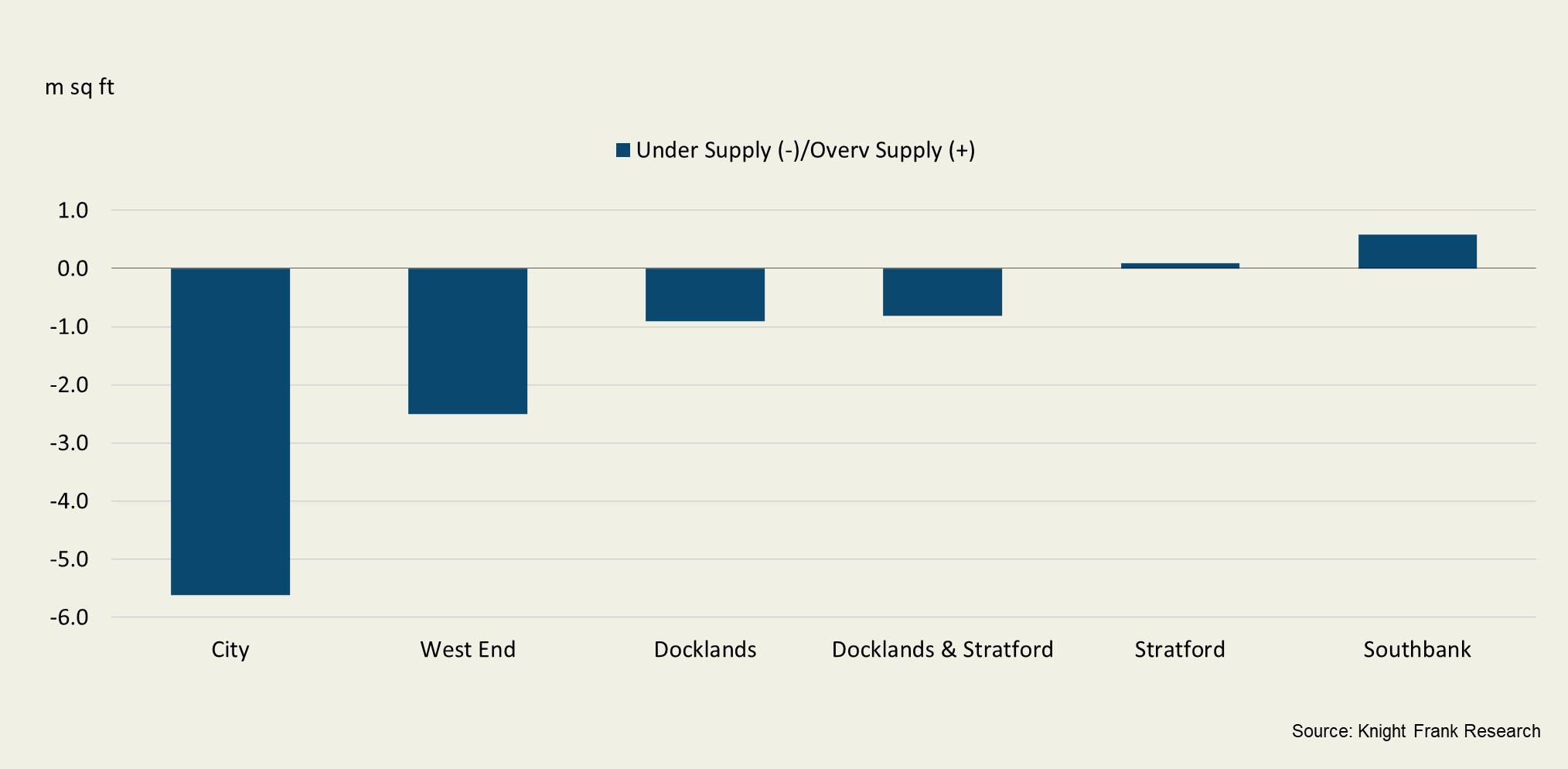

Expected future under/over supply

In the City, the greatest shortfalls in new and refurbished space are expected in the City Core (c. 6m sq ft) and Clerkenwell/Farringdon (c. 1m sq ft). In the West End, the greatest shortfalls are expected in the West End Core (c. 1m sq ft) and King’s Cross/Euston (1.5m sq ft).

We expect the expansionary and relocation plans of businesses to be delayed, leading to continued moderate levels of leasing activity. We expect overall levels of take-up to remain below trend for the remainder of 2023 and the first half of 2024. This is reflected in our forecasts of prime rental growth, with growth of c. 2% in core City and West End submarkets in 2024.

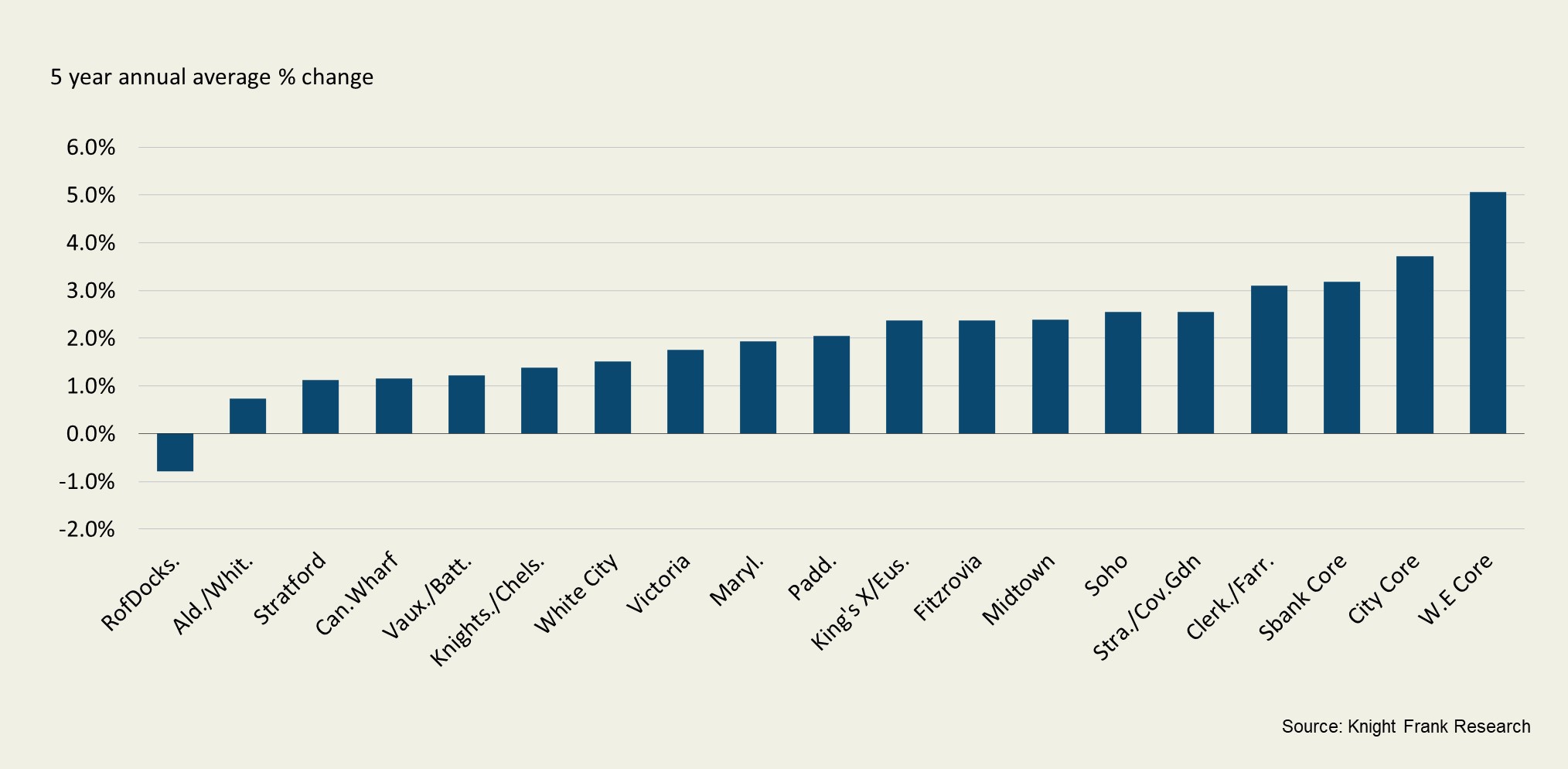

Prime rent forecasts 2023-27

Over the longer-term (2025-27), we expect the ‘supply squeeze’ and pent-up occupier demand to generate greater levels of lettings transactions and fuel growth in prime rents.

Continued demand from large occupiers for amenity rich, sustainable and centrally located offices underpins our five year outlook for the core City and West End. Moreover, the most significant shortfalls of prime space are expected in both submarkets. During the five year forecast period, we expect prime rents to grow by an annual average of 3.7% in the City Core and by 5.1% in the West End Core.

Read more or get in contact: Shabab Qadar, London research

Subscribe for more

Get exclusive market analysis, news and data from our research team, straight to your inbox.

Subscribe here