What’s happening to UK land values

Your monthly residential development news and research round up.

3 minutes to read

The outlook for the UK economy weighed on the residential development land market in the second quarter of this year, leading to a slowdown in activity and a decline in land prices across the board.

We’ve noted previously how the economics of developing new homes in England is challenging. A slower sales market, issues related to nutrient neutrality, biodiversity net gain, higher build costs and local plan failures have all forced housebuilders to rein in construction expectations.

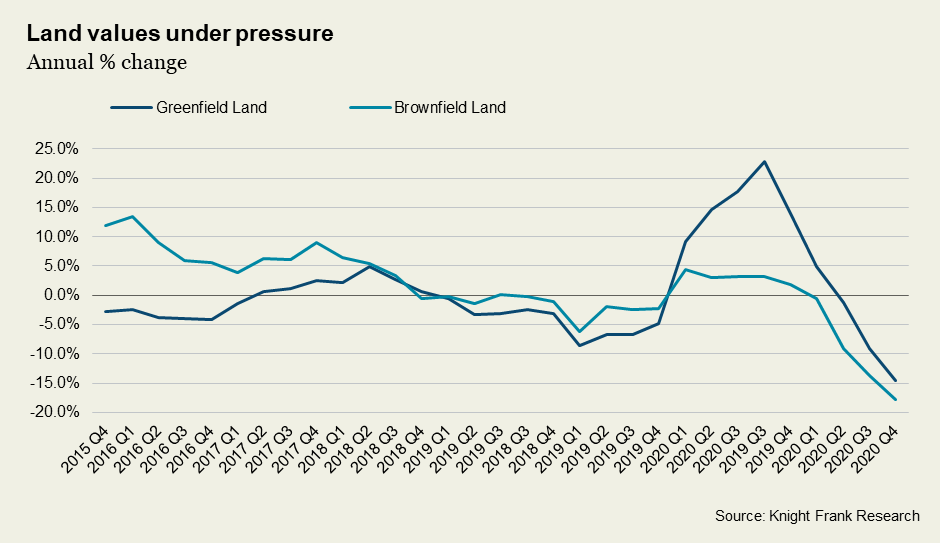

The result? Downward pressure on land values. According to the Knight Frank Residential Development Land Index average greenfield land prices fell by 6.1% on the quarter, taking the annual decline to 14.6%. Prices for brownfield land showed a similar trajectory, dropping 5.9% on a quarterly basis and 17.9% annually.

There are glimmers of hope. Housebuilders are looking at bulk sales to rental and affordable operators to support numbers, while demand from first-time buyers has been stronger than expected. Inflation, whilst still way above the 2% target, is easing and interest rates are likely approaching their peak, preventing further falls in activity and confidence.

An expected reduction in cost inflation later this year should help reduce pressure on margins and give developers more of an incentive to purchase land. The longer-term fundamentals for the new homes market also remain robust, with supply shortages likely to underpin pricing.

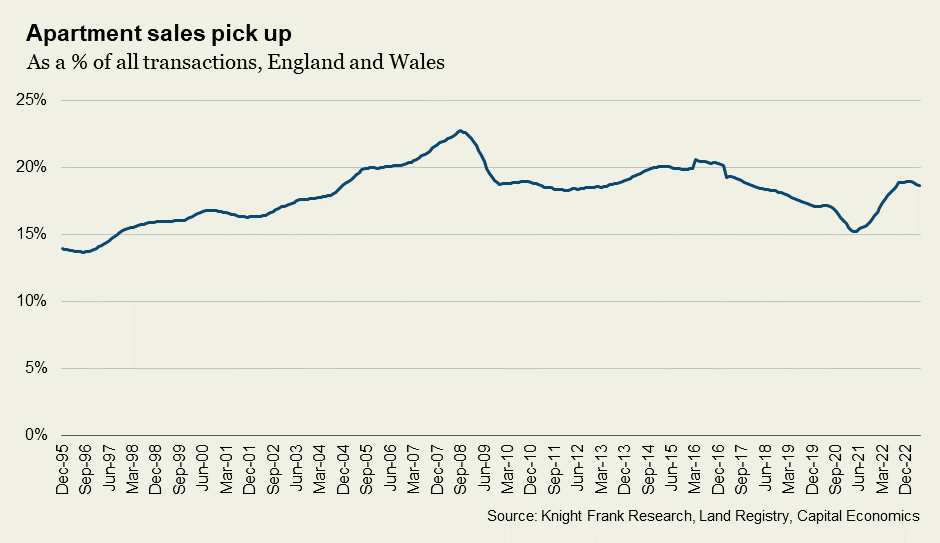

For apartment developers, a recent note from Capital Economics suggests that one upshot from higher mortgage costs will be buyers reassessing what they can afford to buy, which is likely to bring flats back into favour and support values – as was the case when affordability deteriorated in the early 2000s. Indeed, apartment transactions, as a proportion of all sales, have picked up (see chart).

Shifting sentiment

Our latest survey of over 45 volume and SME housebuilders shows that the short-term outlook for the UK economy is one of the biggest concerns. Just over 40% of respondents said that this had been the most challenging factor for their business in Q2, up from 20% who cited this factor in Q1. Likewise, 44% selected ‘mortgage availability and cost’ as the most challenging factor, up from 15% in the first quarter.

The sluggish economy has led to greater caution towards land purchases, with housebuilders looking to reduce outgoings as slowing sales rates, and a need for more competitive pricing, squeeze profitability. Our survey found that deferred payment structures, conditional agreements and withdrawals are all on the rise. Over 40% of housebuilders said they had been involved in a conditional land purchase in the second quarter, 40% had agreed a purchase with a deferred payment structure, a quarter said they had renegotiated a purchase and a fifth said they had either withdrawn or deferred a purchase.

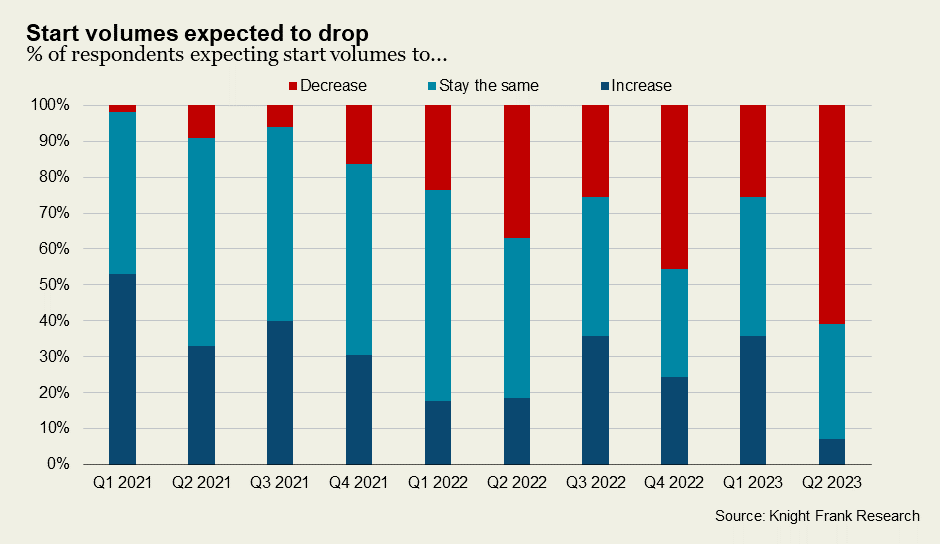

Looking ahead, our survey points to a slowdown in delivery. Some 61% of respondents expect start volumes to decrease in the third quarter, the highest proportion since we started gauging housebuilder sentiment back in 2021. Over half of respondents also think land values will fall again in Q3.

Government to scrap nutrient neutrality rules

It’s not all bad. News that the government plans to scrap nutrient neutrality regulations is a positive development which has been welcomed by the sector. The HBF estimates that the regulations have held up 145,000 plots in the planning system, while a quarter of housebuilders we surveyed believe environmental and ecological regulations have posed a challenge to housing delivery.

It's a helpful step, but other blockages remain. It must be viewed alongside a lack of clarity around the future direction of planning policy and the scrapping of mandatory local housing targets. These have led to some local authorities pausing local plans, which is creating a delay in the volume of land being allocated for development.

I’ll leave you with the thoughts of Stuart Baillie, Head of Planning at Knight Frank, who outlined five ways to fix the housing crisis in a comment piece for The Sunday Times:

“If the next government can create a national strategy that supports housing delivery, make more land available to stimulate house building, overhaul the over-burdened and under-resourced planning system and conquer Nimbyism, we may have some hope of fixing the housing crisis.”