The shortage of lab space in the UK's "Golden Triangle"

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

To receive this regular update straight to your inbox every Monday, Wednesday and Friday, subscribe here

The Prime Minister's plan to make Britain a "science superpower" will require a massive increase in the development of laboratory space.

Businesses are already seeking 2.2 million sq ft of lab space in the “Golden Triangle” between Oxford, Cambridge and London, yet there is only 385,000 sq ft available, according to Knight Frank figures shared with the Times today.

“Recently announced government funding packages and measures aimed at accelerating the sector’s growth... increase the urgency with which new high-quality space must be delivered in markets of particularly high demand,” Emma Goodford, Knight Frank's head of life sciences tells the paper.

Office occupier activity in Oxford and Cambridge was the brightest spot across the south east in the second quarter, according to the M25 Offices report, out last week. Regional take-up hit 671,000 sq ft, 33% higher than recorded in the first quarter - 44% of that was in Oxford and Cambridge.

Gradual, not precipitous

The average UK house price dipped 0.3% in July, Halifax said this morning. That's the fourth consecutive monthly decline that brings the annual drop to -2.4%, easing a little from -2.6% last month.

Despite the worsening outlook for first-time buyers (FTBs) - see Friday's note - the lender said it's seeing activity within the group hold up relatively well, "with indications some are now searching for smaller homes to offset higher borrowing costs." Meanwhile, house prices will continue to ease next year as higher borrowing costs feed through, though declines should be "gradual rather than precipitous," the company added.

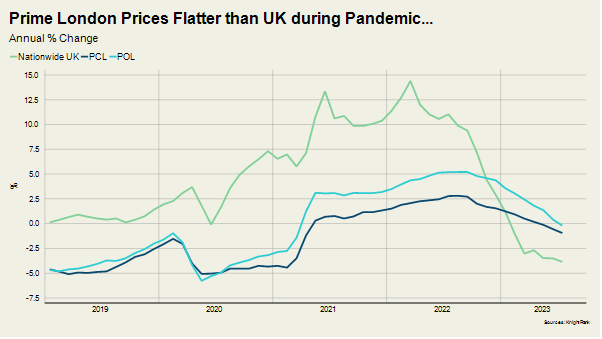

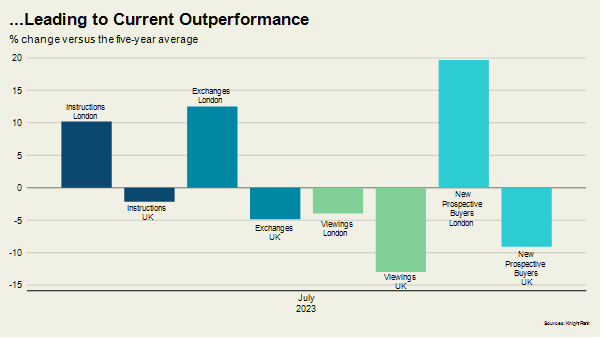

Central London property markets are outperforming the UK due to a greater concentration of cash buyers (see charts), though the discretionary nature of these higher-value markets means they are still impacted by the uncertain economic outlook. Average prices in prime central London fell 0.9% in the year to July, which was the largest drop since April 2021. Meanwhile, prices declined by 0.2% in prime outer London, which was the first fall since March 2021. See the latest prime central London index, out this morning, for more.

The rebalancing

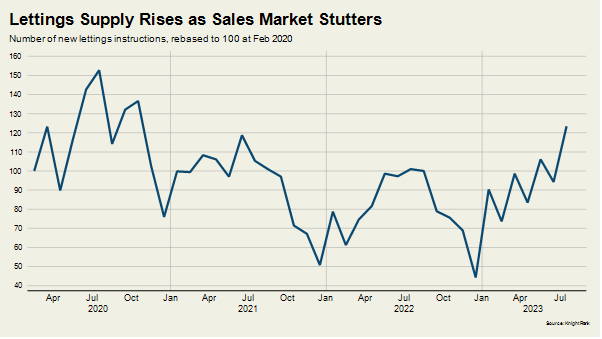

Uncertainty in prime London sales markets is fuelling a long-awaited supply increase in the lettings market. The number of lettings instructions in July in London was 18% higher than the same month last year and the highest for any single month since October 2020 (see chart).

“We are starting to see a noticeable shift in stock from the sales markets to the lettings market as owners are not able to sell for the asking price,” says David Mumby, head of prime central London lettings at Knight Frank.

Average rents grew by 13.7% in the year to July in prime central London, which is down from growth of almost 30% at the height of the stock shortage in April last year.

Housebuilding declines

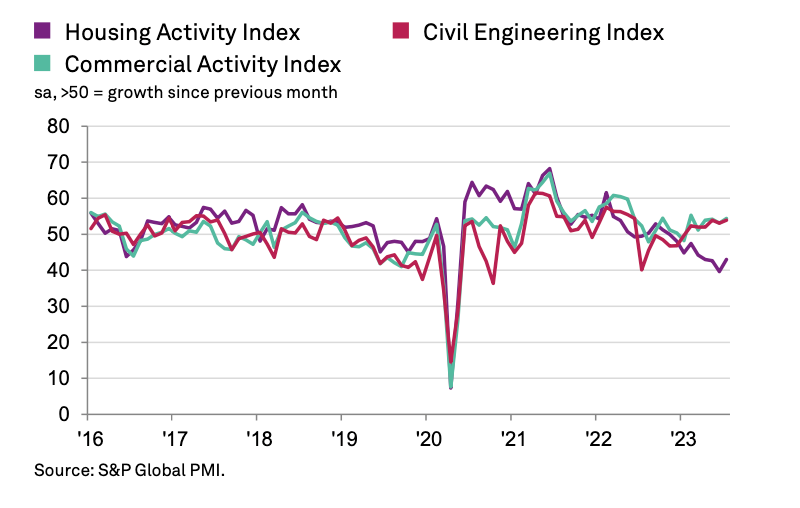

The subdued sales market prompted another steep reduction in housebuilding during July, according to a new Purchasing Managers' Index.

More than a third of respondents reported a decline in residential work during July, while only a fifth signalled a rise. Lower volumes of housing activity have been recorded in each month since December 2022.

Housebuilding stands in contrast to commercial and civil engineering work, which both registered growth (see chart). Survey respondents commented on increased infrastructure work, office refurbishments, and resilient demand for a range of commercial projects.

The pace of job creation accelerated to its strongest since October 2022. Some firms noted that improved candidate availability was a factor encouraging them to boost their workforce numbers, while others typically cited long-term business expansion plans. Meanwhile, a combination of lower demand and rising material availability contributed to a sharp improvement in supplier performance. Latest data illustrated that lead times shortened to the greatest extent for nearly fourteen-and-a-half years. Some survey respondents suggested that increased competition among suppliers had helped to support more favourable price negotiations.

In other news

The number of Seniors Housing units and schemes increased last year as the market continued to evolve. Oliver Knight analyses the shifting composition of a growing market.

Lenders cut mortgage rates despite the latest BoE rate rise (FT), the humble heat pump blows a green wave across Europe (FT), and finally, Foster designs £1billion towers for Sainsbury’s site on the Thames (Times).