Seniors housing delivery picks up but falls short of demand

The seniors housing market had its strongest year since 2018 in terms of new delivery, led by a further expansion of the IRC market.

4 minutes to read

Delivery up but still falling short

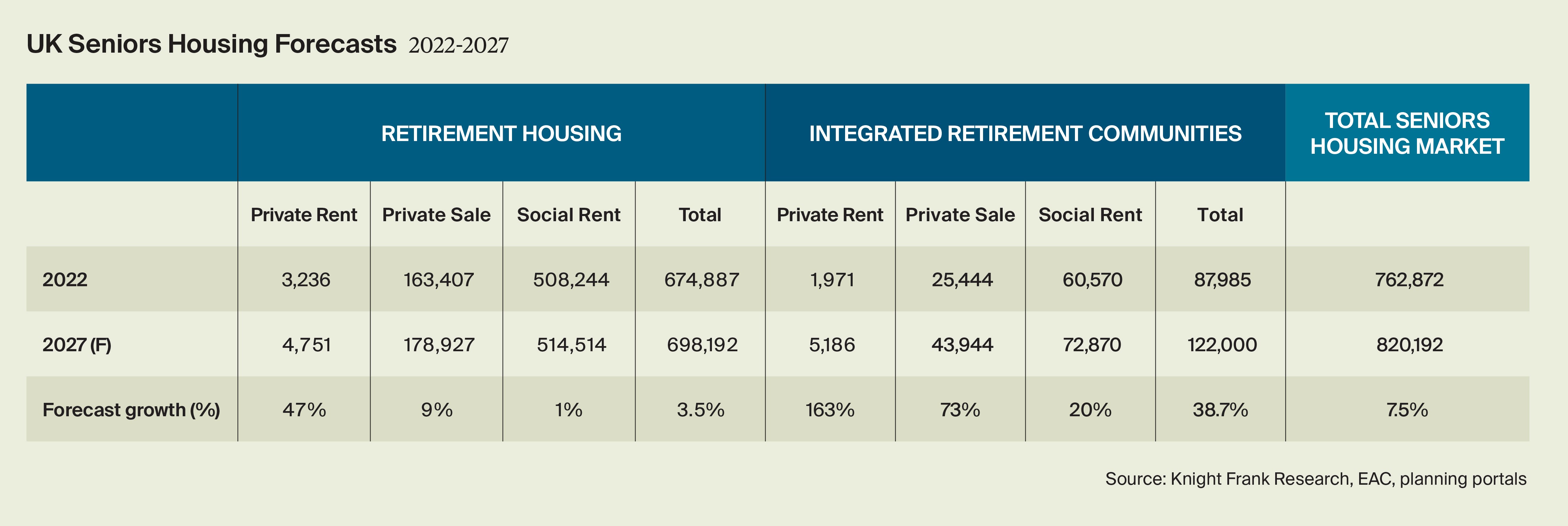

More than 8,000 new senior homes were built last year across 145 schemes, representing a 6.4% increase on the previous year’s delivery. It takes the total number of complete and operational seniors housing units across the UK to 762,872. Just 12% of seniors housing stock was built post-2010, with 69% dated pre-1990 stock.

While delivery of newer seniors housing units has picked up in recent years, annual delivery accounts for around 3% of the total number of new homes built each year, despite the seniors age cohort accounting for the lion's share of past and future population growth.

50,000 units per year needed to keep up with demand

Population forecasts from the Office for National Statistics (ONS) suggest there will be an additional 4.2 million seniors by 2040, at which point 25% of the population will be aged 65 or over. The Mayhew Review, published at end of 2022, provided independent verification of the scale of the accommodation challenge. It recommended that the government adopt a seniors housing target of 50,000 units a year to 2040 to keep up with demand. Based on current supply this equals over a million additional units needed by 2040.

IRCs the dominant form of delivery

Integrated Retirement Community (IRC) schemes are now the dominant form of delivery in the UK, accounting for 58% of all new senior housing units built in 2022 – up from 49% in 2021, and 40% in 2020. More IRC homes were completed in 2022 than at any point since 2016.

Shift to urban locations

As development picks up, we continue to see an evolution of the seniors housing model to cater to a broader range of residents. We are already seeing a trend towards larger developments, for example, typically with 60-200 units. The planning pipeline suggests this will continue – there are 106 schemes with 100+ units in the planning pipeline, compared to 283 currently operational schemes, the majority of which are social housing schemes built pre-2000. This clearly shows the direction of travel, with larger schemes enabling greater economies of scale and supporting a greater range of amenities, as well as fulfilling investor requirements for scale.

There is also increasing development activity in urban and peri-urban locations. Highlighting this shift, some 30% of seniors housing IRC schemes built in the last two years have been delivered in the most urban settlements, up from just 9% for schemes built before 1980s.

More urban schemes support the priorities of the Baby Boomer generation for walkability, convenience, and proximity to culture. Data from the 2021 Census shows that more than eight million over-65s already live in urban areas, up from seven million in 2011. In the next 20 years, the over-65 population is forecast to increase by around a third – meaning seniors will make up an even bigger part of our urban communities.

Supply forecast to increase further

We estimate that with current momentum –supported by the weight of capital chasing the sector – the next five years will see delivery accelerate further. Our expectation is that the total number of specialist seniors housing units in the UK will grow by 7.5% over the next five years, taking the total size of the sector to just over 820,000 units by 2027.

The composition of the market will also shift over this time, as operators continue to broaden the range of options available to seniors through mixed-tenure and rental only options. Affordable housing provision and schemes with varying levels of facilities and services will also increase. The IRC segment of the market will continue to be the dominant form of delivery, driven by even greater institutional backing. IRC supply is forecast to increase by 38.7% (or by 34,015 units) over the next five years. This compares with 3.5% growth (or 23,305 units) in age-restricted retirement housing stock.

Rental options to increase

The data also points to a further increase in the provision of age-targeted rental product, as investors and operators look to offer seniors the broadest choice. For investors, the pace of absorption of rental homes is also faster than sales, particularly given the fact rental supply is constrained.

Consequently, delivery of rental product is expected to increase further in the coming years, with analysis of the pipeline suggesting total private rental units will nearly double to just shy of 10,000 by 2027. Even accounting for such large growth, private rental stock will only account for 1.2% of the total number of specialist senior housing options.

For more information download the full report or get in touch with our Seniors Housing team.