UK waterfront premium resilient even as race for space fades

Limited supply and cash-rich buyers keep waterfront market buoyant.

2 minutes to read

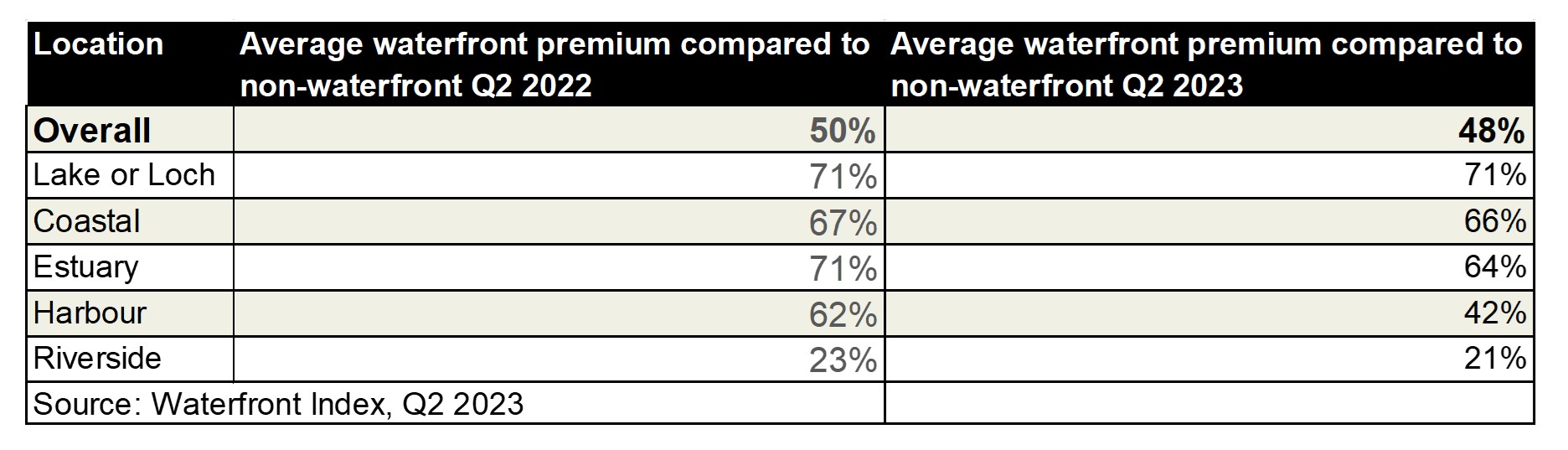

Despite the fading influence of the ‘escape to the country’ trend, a UK home set by the water was worth up to 48% more on average than an equivalent non-waterfront property in Q2 2023.

The overall premium was just two percentage points lower than a year ago according to the Knight Frank Waterfront Index, underlining the depth of demand for such properties.

This is despite the Bank of England increasing the bank rate to 5% in June, stretching affordability and weakening sentiment further in a market that has seen volumes and prices dip.

There were 80,000 residential property transactions in May, which was down by just more than a quarter on the same month the previous year as higher mortgage costs took their toll. As of May, the average house price had declined by 4.1% since the peak in August 2022, according to Nationwide.

However, with more than half (54%) of UK waterfront property buyers purchasing in cash in the last five years, compared to an average of 29% in the overall UK property market, demand remains resilient.

“Not only has the pandemic made the waterfront lifestyle more appealing, but it’s also made it more realistic. A lot of families and their employers have realised they can work efficiently at home, with fewer visits to the office each month,” said Sarah-Jane Bingham-Chick, partner in Knight Frank’s Exeter office.

“Families are therefore opting to bring their dream move forward by ten years to enjoy the benefits of the lifestyle, which is something I don’t see changing anytime soon,” she said.

Lakeside living commands largest premium

The biggest average premium for a property is next to a lake or loch, with an uplift of 71% in Q2 2023, unchanged on last year.

Second was coastal, with an average premium of 66% compared with an equivalent non-waterfront property. In third place –down from joint-first position last year - was estuary, attracting an average premium of 64%.

With inflation proving ‘sticky’, expectations for how high interest rates will go have been revised up.

Against this backdrop, and with an increase in supply relative to the pandemic, we expect house prices will fall by 10% over the next two years.

Waterfront property won’t be immune to this, and average price of a property in the Waterfront Index fell by 2.5% between Q1 and Q2 2023.

However, we expect demand for waterfront property to remain resilient with no material change in the premiums paid due to the scarcity of homes near the water and resilient demand.

“Given that the availability of waterfront property is limited, it’s no surprise that in-demand homes continue to be priced at a premium despite the headwinds facing the UK residential market,” said Chris Druce, senior research analyst at Knight Frank.

View Waterfront Homes

Photo by Paavan B on Unsplash