Rising mortgage rates put the squeeze on UK housebuilding

Making sense of the latest trends in property and economics from around the globe.

5 minutes to read

Mortgage rates continue rising

Average UK house prices were flat in May following a -0.4% contraction in April, according to the Halifax House Price Index, out this morning. That brings the annual rate of growth to -1%, the first annual decline in the index since December 2012.

We expect prices to ease further to end this calendar year down about 5% as higher mortgage rates feed through. Halifax was one of a number of lenders to announce it would raise rates this week. The rate on its two-year deal with a loan-to-value (LTV) ratio of up to 60% rises to 5.36% as of this morning. It's not always straightforward to see the previous product, but a Reuters report references a guide from June 1st with a rate of 4.54%, so these are quite sizable hikes that will impact demand as they feed through.

That said, declines in house prices will be kept in check by rising wages, low unemployment, cash sales, record-high levels of housing equity, longer mortgages and savings amassed during the pandemic, Knight Frank head of UK residential research Tom Bill said in a quote issued to press this morning.

A Reuters poll of economists taken between May 16th-31st suggests we aren't an outlier. Respondents expect average prices fall 3.0% across 2023 before flatlining in 2024 and rising 3.1% in 2025.

Housebuilding contracts

Rising mortgage rates, build costs and a complex planning environment prompted the house builders to adopt more defensive strategies in the first quarter - see this note from April.

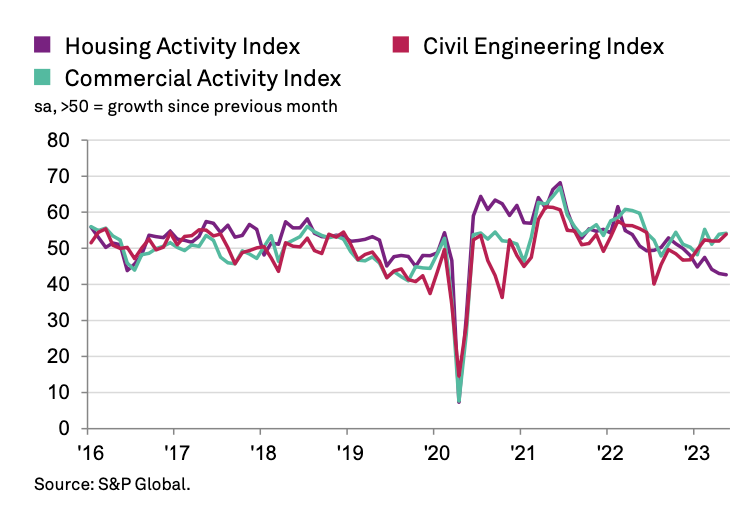

Construction companies have reported declines in residential work for six consecutive months, and May's Purchasing Managers Index registered the steepest monthly fall since May 2020, according to the release published yesterday. The broader index looked pretty healthy - rises in commercial building and civil engineering activity fuelled a modest upturn in construction output during the month. Meanwhile supply chain conditions continued to normalise, with the greatest improvement in vendor lead times since August 2009.

Everything we're seeing suggests we'll see a meaningful drop in housebuilding during the next year or two. The number of Energy Performance Certificates allocated to new homes, a good leading indicator for housebuilding, fell 10% to 53,000 in Q1, according to official figures out earlier this year. The House Builders Federation has warned that net additions could fall from 233k last year to below 120k homes per annum in the coming years.

The Labour Party has seized on those figures by announcing a series of policies that it says will boost delivery - see last Wednesday's note for more.

A tepid decade for growth

Back in March we talked about the transformed outlook for interest rates in the US, Eurozone and UK as banking system stress led traders to rapidly curtail bets on how high and how soon rates would peak.

Much has changed in just three months following a raft of data releases that have suggested inflation's glide down may be more complicated than policymakers had hoped. Another sign came in the form of the US jobs report last week, which showed the economy added 339,000 non-farm jobs in May, almost twice as strong as economists had forecast.

The sharp tightening of monetary policy and persisting inflationary pressures has left the global economy in a "precarious state", the World Bank said in its latest outlook, published yesterday. The world is now seeing a "sharp synchronized slowdown" in which 70% of economies will see weaker growth this year than they did last year.

After growing 1.1% in 2023, the U.S. economy is set to decelerate to 0.8% in 2024. In the euro area, growth is forecast to slow to 0.4% in 2023 from 3.5% in 2022, due to the lagged effect of monetary policy tightening and energy-price increases.

The group thinks the 2020s will be a tepid decade for growth, at best. All of the major drivers of global growth—including productivity, trade, labor force and investment growth—are expected to weaken over the remainder of the decade. Potential growth—the maximum growth the global economy can sustain over the longer term without igniting inflation—is expected to fall to a three-decade low over the remainder of the 2020s.

Buyers in Paris

Post-Brexit, Amsterdam and Frankfurt were due to be the financial winners, but Paris has stolen a march on its European neighbours. Twelve months after the UK officially left the European Union, the number of investment bankers in France increased 70.5%, Germany’s figure was a paltry 35.1% by comparison, according to The European Banking Authority.

Kate Everett-Allen uncovers the impact on the city's prime property market. Average prices in the most desirable 6th, 7th, 8th and 16th arrondissements are up 24.8% on average since the Brexit vote in June 2016, according to the Paris Chambers of Notaires. US buyers expanded their market share in 2022, according to Junot Fine Properties data, accounting for 55% of the team’s overseas buyers.

In other news...

In contrast to the well-documented and defensive approach in the US, lenders remain active in the UK, writes Will Matthews, Knight Frank's head of UK commercial research. In April, net lending to UK CRE (including developments) hit £1.2bn, up +137% m-m and its highest level since December 2021, according to the Bank of England. This aligns with the UK Q1 2023 RICS commercial survey, which reported the first improvement in investment enquiries in a year.

Elsewhere - Canadian fund to boost London office in show of faith in UK capital (FT), ethical ESG funds suffer ‘worst month ever’ for withdrawals (Times), and finally, it pays to be chief investment officer at a US family office (Bloomberg).