UK industrial and logistics: improving rental growth prospects in higher interest rates environment

A higher for longer interest rate environment now anticipated, though improving rental growth prospects will help boost returns and investment into the sector.

4 minutes to read

The Consumer Prices Index (CPI) rose by 8.7% in the 12 months to April 2023, down from 10.1% in March. Despite a fall to single figures, April’s consumer price inflation of 8.7% is significantly above the Bank of England’s expectations (of 8.4%). It is considerably higher than that in the US or Eurozone.

Persistent inflationary pressures make it likely that the BoE will need to make further interest rate hikes. Swap markets are now pricing in further rate hikes this year, with rates expected to peak at around 5.3% by year-end (from 4.5% currently). The increased likelihood of further interest rises will mean borrowing costs remain high and could increase over the short to medium term.

Gilt yields rising

The announcement of higher than anticipated inflation figures also impacted gilt yields. As of the 29th May, 10-year gilts were yielding 4.34%, up from 3.86% at the end of April and the highest since mid-October, when they spiked following the Truss governments mini-budget in September 2022.

Higher debt costs and gilt yields could lead to renewed upward pressure on prime industrial yields. Yields for prime distribution and warehousing have compressed slightly since peaking around February 2023. Prime distribution yields (with a 15-year income) are currently 5.25% (Knight Frank yield guide, May 2023), down from 5.25-5.50% earlier this year.

Equivalent yields for industrial property have started to stabilise in recent months following a period of decompression since June 2022. The latest monthly figures (April 2023) show an equivalent yield of 6.00%, just 1bps above the previous month.

Investment increases this year

We expect activity in the investment market to increase in the second half of the year. However, the increasing likelihood of further interest rate rises will escalate recessionary fears, and this could lead to hesitancy amongst some investors.

The prospects of a softening economy will have a more significant impact on secondary assets or markets, and investors will demand more favourable pricing.

Improved prospects for rental growth

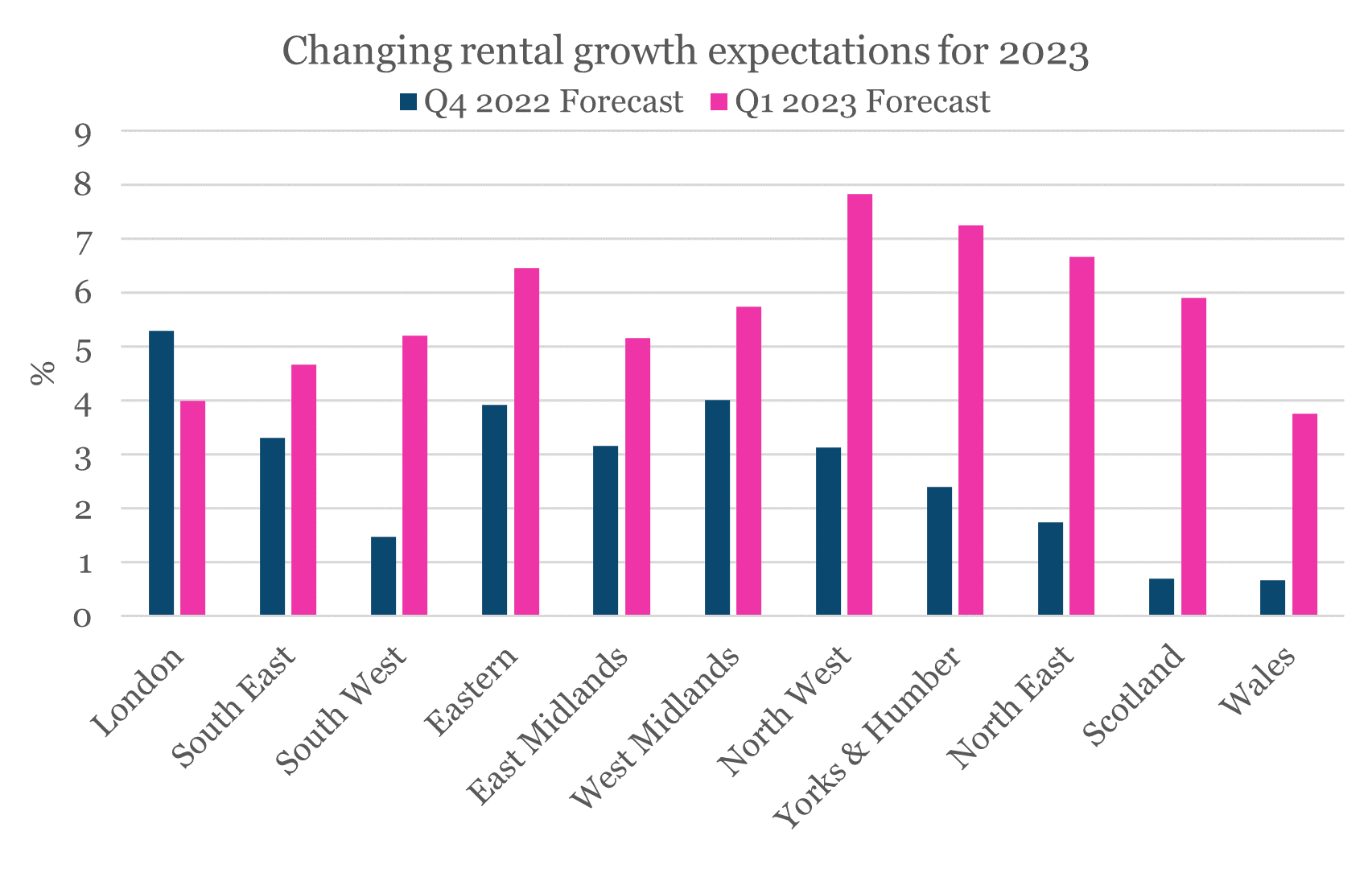

Rental growth expectations have risen. Average rental growth expectations for the UK have been revised from a CAGR of 2.6% (2023-2027) forecast in Q4 2022 to 3.1% (according to the Q1 2023 forecasts).

Rental growth expectations have been revised up across all regions except for London. The largest upward revisions have been in the North West, Yorkshire and Humber and the North East regions.

These upward revisions to rental growth will be positive news for income-driven investors targeting the sector. The allure of stronger returns should help draw capital to the sector. The improved growth prospects for the northern regions could help drive additional investment and development opportunities in these markets.

The North West has seen expectations of rental growth revised from 2.2% per annum (CAGR) to 3.6% per annum. Yorkshire and the Humber and the North East have seen average rental growth expectations shift from below 2% per annum to above 3% per annum.

In Q4 2022, RealFor forecasted the strongest rental growth for London. However, Q1 2023 forecasts show that average rental growth in the Eastern region and the North West is expected to (slightly) outpace that of London, with 3.6% per annum forecast, compared with 3.5% for London.

Source: RealFor

What is behind the shift in rental growth expectations across the regions?

The northern England regions all have seen improving prospects of rental growth. This improvement may be partly due to the lower rents in these regions (compared with London, the South East and the Midlands). Cost-sensitive occupiers who are less location-dependent are likely to be drawn to these locations.

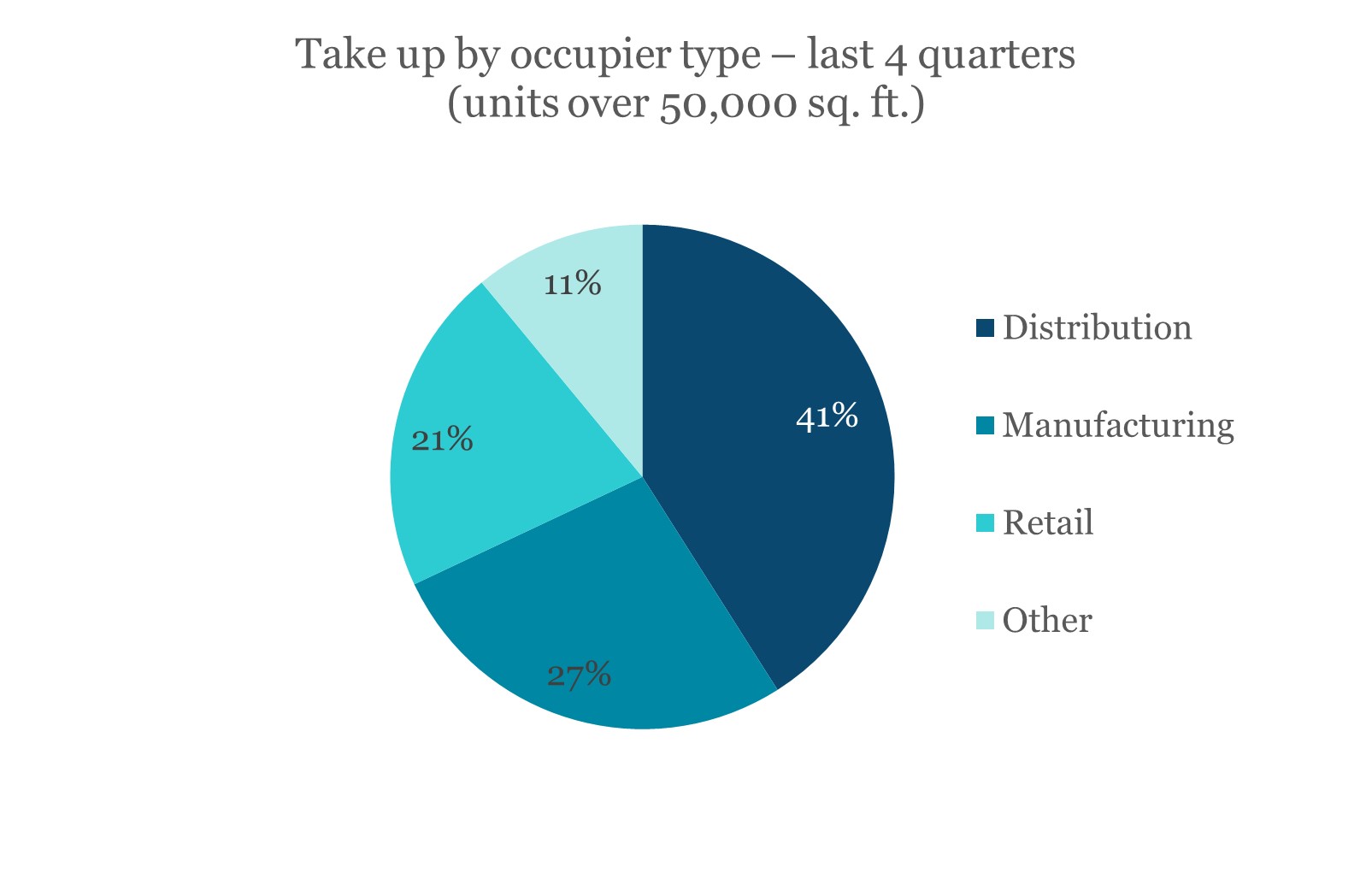

Location is typically less crucial for manufacturing firms, and manufacturing take up has accounted for a larger share of occupier take up in recent quarters. Manufacturing take up accounted for 27% of take up in the past four quarters (to Q1 2023), compared with 19% in the previous four quarters (to Q1 2022) and just 12% in the four quarters to Q1 2021.

Source: Knight Frank Research

London, the only region to see a decline in rental growth prospects, has the highest rents and, with the exception of the Eastern region in 2022, rental growth in London has outpaced all other regions every year for the past five years (2018-2022).

However, high rents coupled with this strong historic rental growth will mean that occupiers in London face the most significant impact from the recent business rates revaluation that came into effect in April 2023.

Based on the rental growth over the revaluation period, rates payable would have risen 55% in London. There will, however, be transitional relief applied. The substantial uptick in operational costs in London may outweigh the locational benefits for some occupiers.

Read more or get in contact: Claire Williams, head of UK and European industrial research

Subscribe for more

For more market-leading research, expert opinions and forecasts, sign up below.

Subscribe here