Why US new homes are 2023’s surprise winner

Plus, why capital is “flying out” of Latin America

4 minutes to read

New homes in demand

“Sell, sell, sell” that was the instruction from stock market insiders at the start of the year when it came to US homebuilders. Fast forward five months, and several are eating their words.

What many stock market analysts openly admit is they failed to understand the differing impact that higher mortgage rates would have on existing housing stock versus the new homes sector. Although, in their defence, build costs were surging and materials were in short supply at the time.

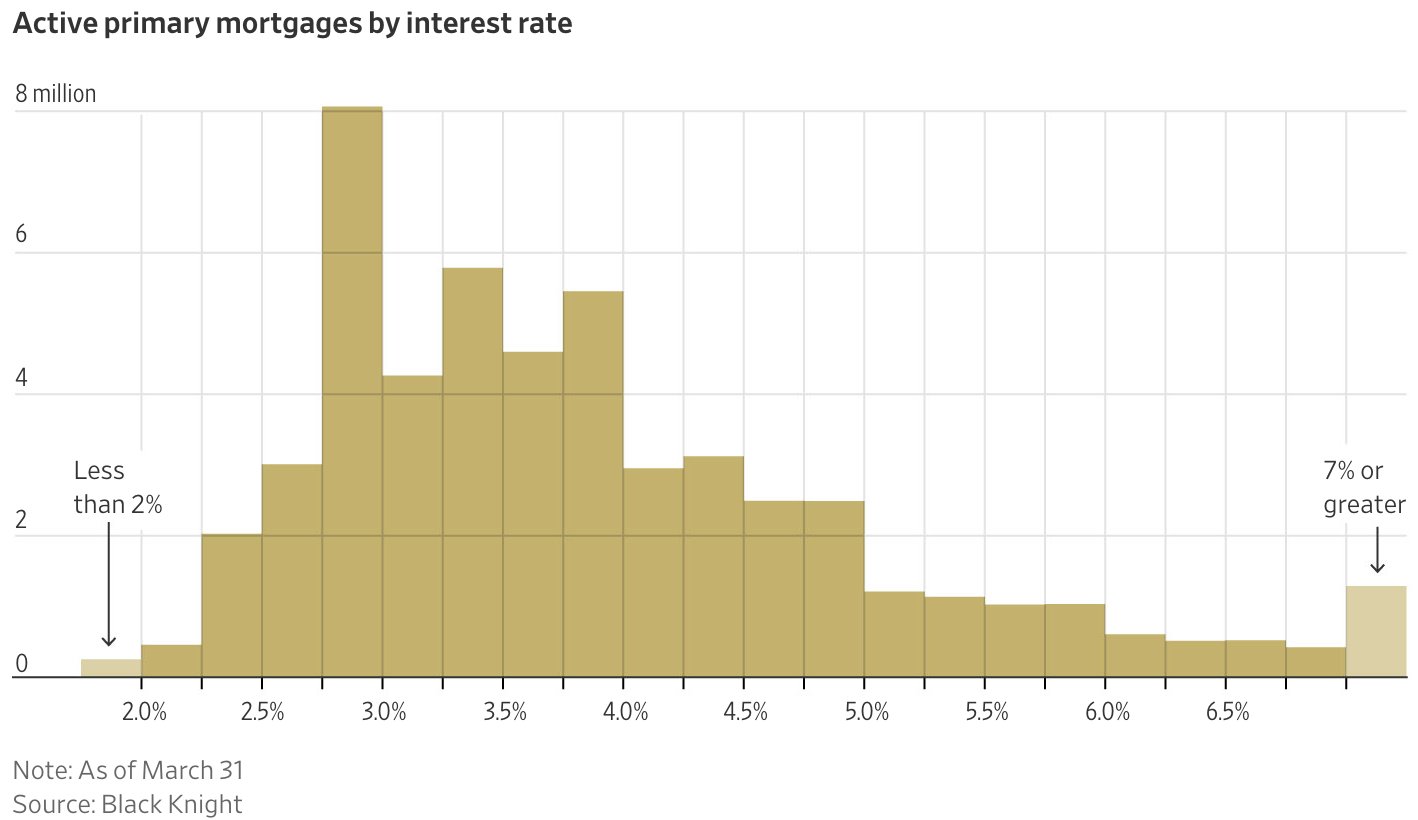

US homeowners are staying put in their homes given they’re tied to ultra-low mortgage rates, this is leading to reduced inventory levels and pushing those that do need to move, as well as first time buyers, towards the new home sector. The Wall Street Journal chart below highlights the issue.

An increasing proportion of US homeowners are trapped in their homes by low interest rates, otherwise referred to as “golden handcuffs.” There are almost as many mortgages below 3% as there are above 5%.

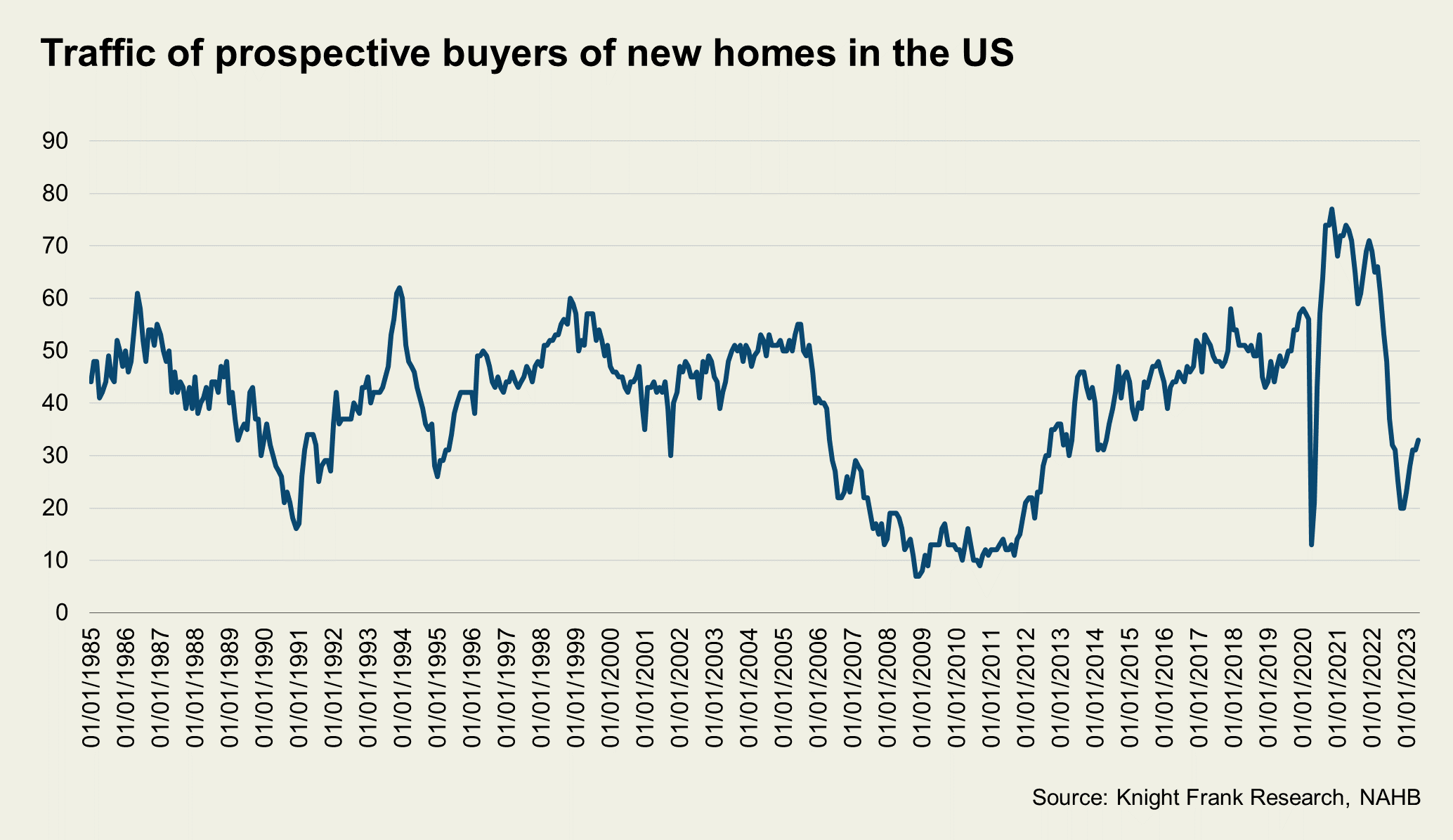

This is pushing demand towards the new-build sector. Data from the National Association of Housebuilders shows an uptick in demand since the start of 2023.

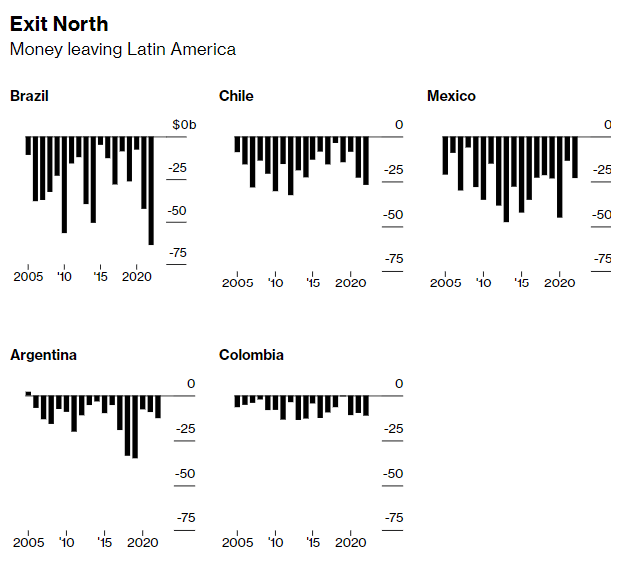

Latin exits

Latin America’s wealthiest residents are moving their money, “capital is flying out of the region” according to Bloomberg. According to data from the Institute of International Finance, around US$137 billion left Latin America’s five largest economies in 2022, up 41% on 2021’s figure.

Why is this happening? Heightened inequality, aggravated by the pandemic, has pushed the region’s politics further to the left. Taxes are rising and the wealthy fear more political and economic upheaval is around the corner.

The US, Spain, Portugal and some Caribbean islands are amongst the target destinations for the region’s wealthy. According to our Madrid office, buyers from Mexico, Peru, Colombia, Argentina and Chile are now the top five overseas purchasers of prime property in the Spanish capital.

Our new Wealth Populations Report, the latest of our bi-monthly Wealth Report updates, highlights which countries and territories are forecast to emerge as key wealth hubs, and a potential source of outbound capital, in the next five years. Spoiler alert, European and Asian markets feature heavily.

Interesting to note, in absolute terms, the US still dominates, home to almost a third of ultra-high-net-worth individuals (UHNWIs) globally and a figure that is set to rise by 25% in the next five years.

Sign up here to receive regular The Wealth Report updates.

Singapore ABSD

Singapore is now the most expensive global market for non-residents when it comes to purchase costs.

On 26 April 2023, the city-state’s Additional Buyers Stamp Duty (ABSD) payable by non-residents in Singapore increased from 30% to 60%.

By comparison, permanent residents in Singapore will pay 5% ABSD for their primary residence, 30% ABSD for their second property and 35% for their third or subsequent property.

Entities or trusts purchasing any residential property will now pay 65%, up from 35%.

We’re monitoring cooling measures and policy shifts impacting global property markets closely. After the pandemic-induced hiatus, 2023 has seen a flurry of announcements with Asia-Pacific markets the epicentre of such moves as affordability and uncontrolled capital flows create headaches for policymakers trying to keep a lid on property price inflation.

Singapore’s move is still less onerous than New Zealand and Canada where foreign buyer bans persist, although with some loopholes in each case.

EU visa landscape shifting

Ireland made the first move, next came Portugal and now Spain is expected to follow suit. The halting of new applications to their Golden Visa programmes will siphon off a valuable source of revenue - Portugal has generated €6 billion from its Golden Visa since it started in 2012 – but the move will placate the EU and silence critics who argue the scheme contributes to deteriorating affordability.

In flexing its muscles, the EU’s goal is to curtail access to the Schengen Zone, improve transparency and reduce potential money laundering.

But, these moves are happening at a time when UHNWIs are seeking more, not less, global mobility.

Some 13% plan to acquire a second passport or new citizenship in 2023, and as we highlighted in The Wealth Report, they are faced with a shrinking pool of locations from which to choose. Italy with its flat tax of €100,000 on all global income is attracting growing interest.

But the overall direction of travel is away from property-acquisition style schemes to ones focused on job creation, innovation and entrepreneurial activity.

More digital nomad schemes are popping up, Spain launched its version in February and several Asian markets, Indonesia, Thailand and Malaysia, have joined the club. These have the power to be significant disruptors influencing tax systems, rental markets and office demand.

In other news…

Japan’s economy grows faster than expected (Bloomberg), China takes the Yuan global (Reuters), and Spain and Portugal plan to boost their public housing stock (FT)

Sign up to the Global Residential Update here