The outlook for property lending in a post-Credit Suisse world

Making sense of the latest trends in property and economics from around the globe.

5 minutes to read

Property lending

Investment in UK commercial real estate saw a sizable pick up during the first quarter as nerves settled in the wake of the mini-budget and pricing fell to levels more in line with buyers' expectations. The office, industrial and retail sectors generated about £6 billion in deals, according to preliminary figures from Costar. That's about a quarter above Q4, though still about half the ten-year average.

Will that recovery continue as more buyers and sellers meet on price, or stall as banks pull back on lending in the wake of the banking crisis? Shares have rallied since the demise of Credit Suisse and there is little evidence of US deposit flight for now, however investors have turned more bearish on large European property companies. The MSCI Europe Real Estate Index dropped to its lowest level since 2009 during the final days of March.

To find out where we go from here, I spoke to Lisa Attenborough, Knight Frank's head of debt advisory. Consensus remains that we'll see some tightening as lenders struggle to assess how to price risk. Plus, the market is still largely dominated by the large banks, who tend to be conservative. That said, the rise of the alternative lenders means there is unlikely to be a meaningful shortage of credit, though these lenders will charge a premium for stepping in.

So it's likely to be an issue of affordability, rather than availability, though there are few signs of major changes so far. Terms sent out over the past month look favourable, and certain sectors will be well insulated regardless - lenders are still very eager to gain exposure to the living sectors, for example. For more, you can listen to the twelve minute conversation here, or wherever you get your podcasts.

House prices

UK house prices fell 3.1% during the year through March, the largest annual decline since July 2009, Nationwide reported last week.

This has further to run as homeowners move onto higher fixed-rate deals and supply rises from the lows of the pandemic. We expect UK prices to fall by a few percent this year, however much of that has been brought forward by the spike in mortgage rates in the wake of the mini-budget.

Mortgage rates have now been stable for several weeks, sentiment is robust and activity levels are no longer falling. Net mortgage approvals for house purchases increased to 43,500 in February, from 39,600 in January, according to Bank of England figures published last week. Though well below trend, that's the first monthly increase since August.

The higher prevalence of cash buyers in prime central London insulates the market from spikes in mortgage rates and it shows. Sales in the year to February were 1.8% higher than the previous 12 months, new Knight Frank data shows. Prices were flat in the past twelve months and have fallen by just 1% in three years.

Prime London lettings

The prime London lettings market is more volatile. Supply dwindled during the months following the pandemic as demand surged. Tenants have struggled with surging rents and properties that were let out before being advertised.

Rental values have risen by 27% in prime central London (PCL) and by 23% in prime outer London (POL) during the three years since the pandemic struck.

Those frenetic conditions are easing, but only to a degree. A better-than-expected sales market means lettings supply has not risen to the extent some expected since Christmas. That has produced fewer so-called ‘accidental landlords’, or owners that decide to let out their property after failing to achieve their asking price. Annual rental value growth in March was 16.9% in PCL and 15.2% in POL, the lowest figures since November 2021 but still well above long-run averages.

You can read more in the latest update from Tom Bill here.

A 2028 deadline for residential landlords

Residential landlords are under significant pressure to upgrade properties to meet new Energy Performance Certificate requirements. It has been widely expected that the government would impose a deadline of 2025 for all newly let rentals to have an EPC rating of at least C, and a deadline of 2028 for all other rented properties.

The deadline for newly let rentals will now be 2028, according to reporting in the Telegraph last week. The government has been "working with banks" on proposals that will cap the maximum spend per property at £10,000, though that cap will work on a sliding scale. A source at the Department for Energy Security and Net Zero told the paper that discussions had been held with stakeholders, but no decision has yet been made.

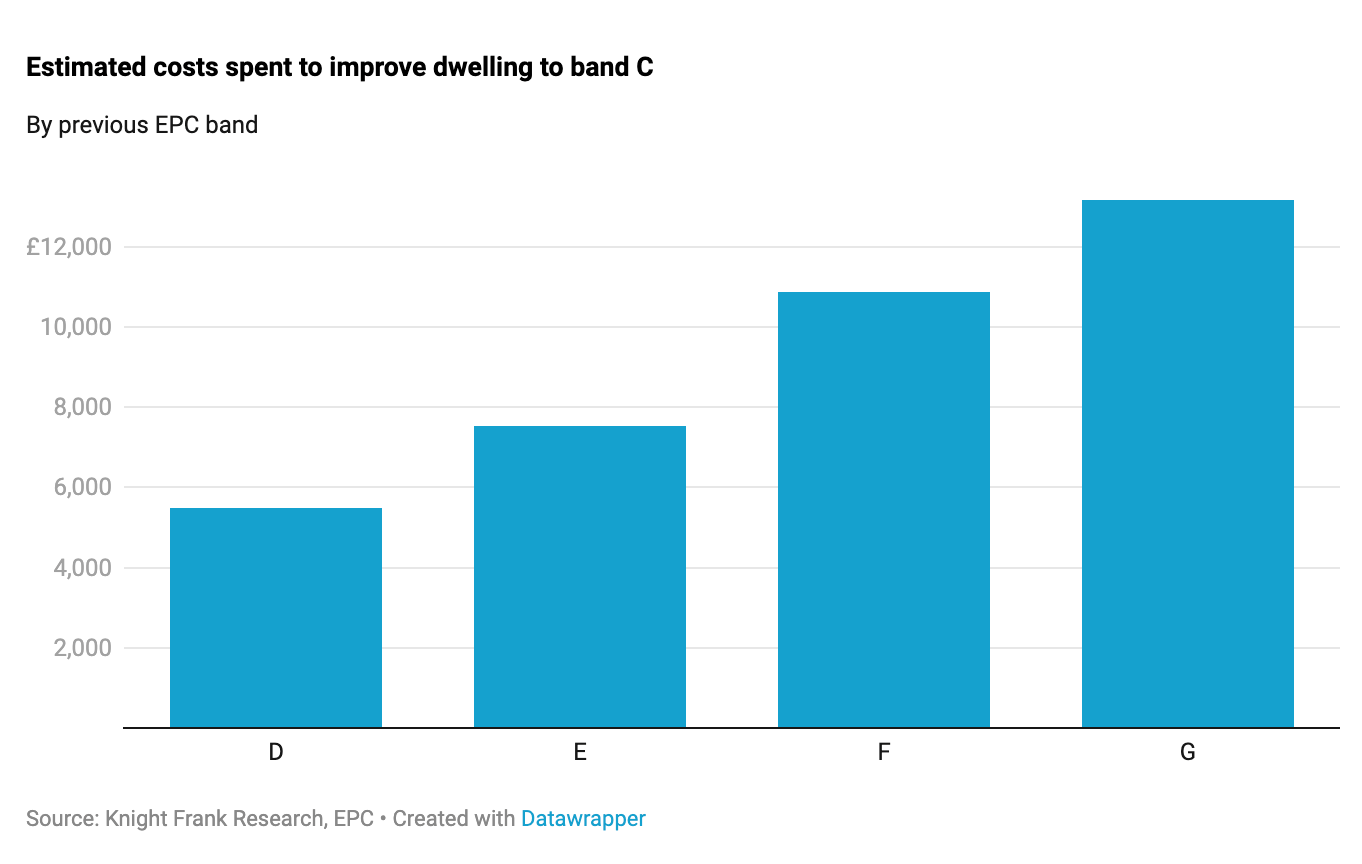

We recently compared the EPC certificates of 30,000 dwellings that improved their home energy performance in the previous five years to find out how the costs stack up (see chart). The average cost spent improving a dwelling previously rated EPC band D or below to at least a band C is £9,260, though that varies depending on numerous factors, not least the size, age and existing efficiency rating of a property.

Properties with an EPC rating in band D typically spent £5,500 on the necessary improvements to move to band C, and that figure almost doubles to over £10,000 on average for properties in bands F and G.

Also last week, the government announced a new £30 million Heat Pump Investment Accelerator aimed at leveraging £270 million private investment to boost the manufacturing and supply of heat pumps. The Boiler Upgrade Scheme, which offers a £5,000 grant to anyone buying a heat pump, will be extended to 2028. We talked about the government's efforts to get heat pump installations up to the necessary levels last week here and here.

In other news...

From our team - the key drivers influencing prime warehousing demand in Africa.

Elsewhere - home working deals blow to defence companies in race with Russia and China (Telegraph), only 5% of FTSE 100 companies have ‘credible’ climate transition plans, says EY (FT), owners of Frankfurt’s Trianon skyscraper seek to restructure debt (FT), Andy Haldane: Pause interest rate rises or risk the recovery (Times), stake sale for Olympic village owner Get Living (Times), and finally, Singapore house price growth accelerates (Bloomberg).