UK inflation accelerates again

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

Muddying the waters

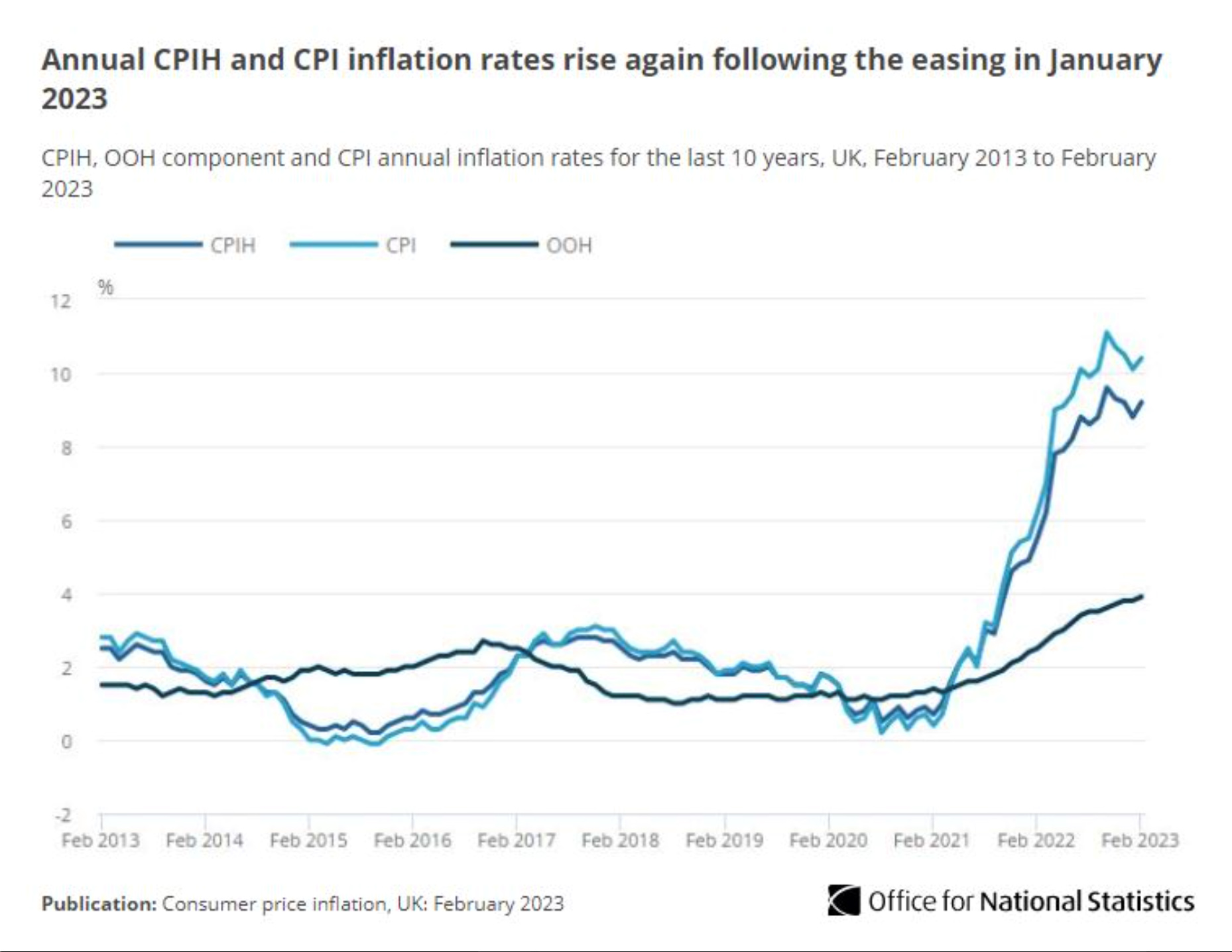

The UK's annual rate of inflation accelerated unexpectedly to 10.4% in February, up from 10.1% a month earlier (see chart). The reading out this morning cuts the likelihood that the Bank of England will opt to hold interest rates at 4% on Thursday amid fears over financial stability.

Restaurants and cafes, food, and clothing were the biggest contributors to the rise, and there is little in there to suggest that policymakers will feel safe to pause tightening until the outlook becomes clearer.

The reacceleration of inflation comes as fears of further banking contagion are easing, at least in the US. Late yesterday Treasury secretary Janet Yellen pledged to take "similar action" should another SVB situation appear. Bank shares rallied across the board. The Federal Reserve will publish its decision on interest rates later today. Futures pricing puts the probability of a 25bps hike a shade under 90%.

The long tail of the mini-budget

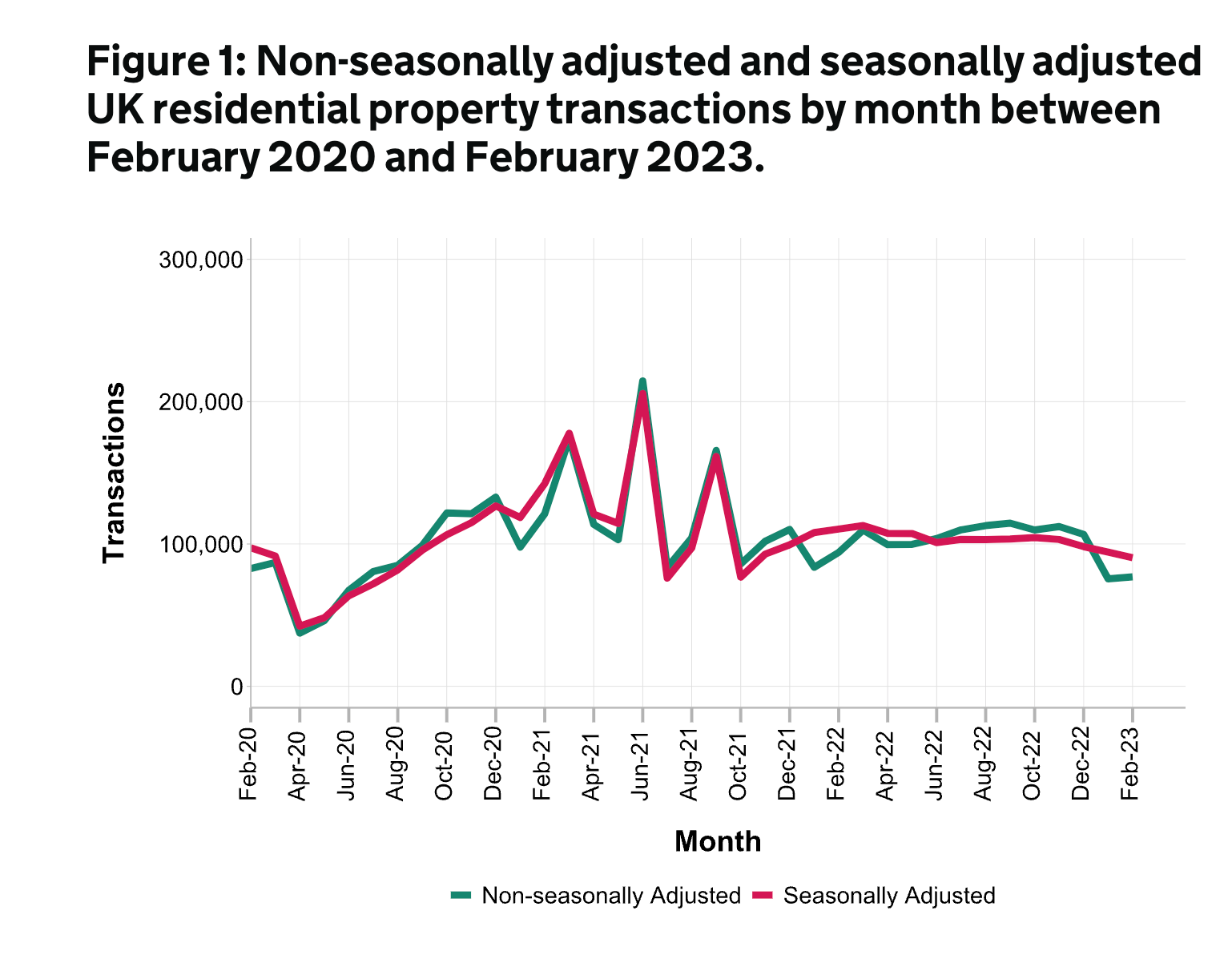

UK residential transactions fell to 90,340 in February, a 4% fall compared to January and a drop of 18% compared to the same month a year earlier, according to provisional data from HMRC, out yesterday.

"Today’s figures underline the extent of the hangover from the mini-Budget for the UK housing market," Knight Frank's Tom Bill told MoneyWeek. "February’s drop in sales needs to be seen in the context of a housing market that effectively switched off for the last quarter of 2022 and only turned back on again after Christmas. For anyone who knows how long it takes to buy a house in the UK, it shouldn’t be a surprise when next month brings similarly weak numbers."

Indeed, demand and supply have been solid so far this year and sales volumes will eventually catch up against an economic backdrop that has proved stronger than expected. Prices will continue to come under pressure as more owners move onto higher mortgage rates and supply builds from the lows of the pandemic. You can read our forecasts here.

Single family housing

Single family housing (SFH) remains in the early stages of its evolution in the UK compared with the more mature multifamily market, but it is growing rapidly.

The number of complete and operational purpose-built rental properties in suburban SFH schemes stands at just shy of 10,000, up 11% since 2021. A further 9,520 SFH units are either under construction or have full planning permission. We expect that number will increase rapidly, supported by a significant uptick in investment. Already in 2023, more than £450 million in SFH deals have been agreed - surpassing the full-year 2022 figure.

We have identified a further £8 billion of capital set aside to target SFH over the next three to five years either through funds already secured or active fundraises.

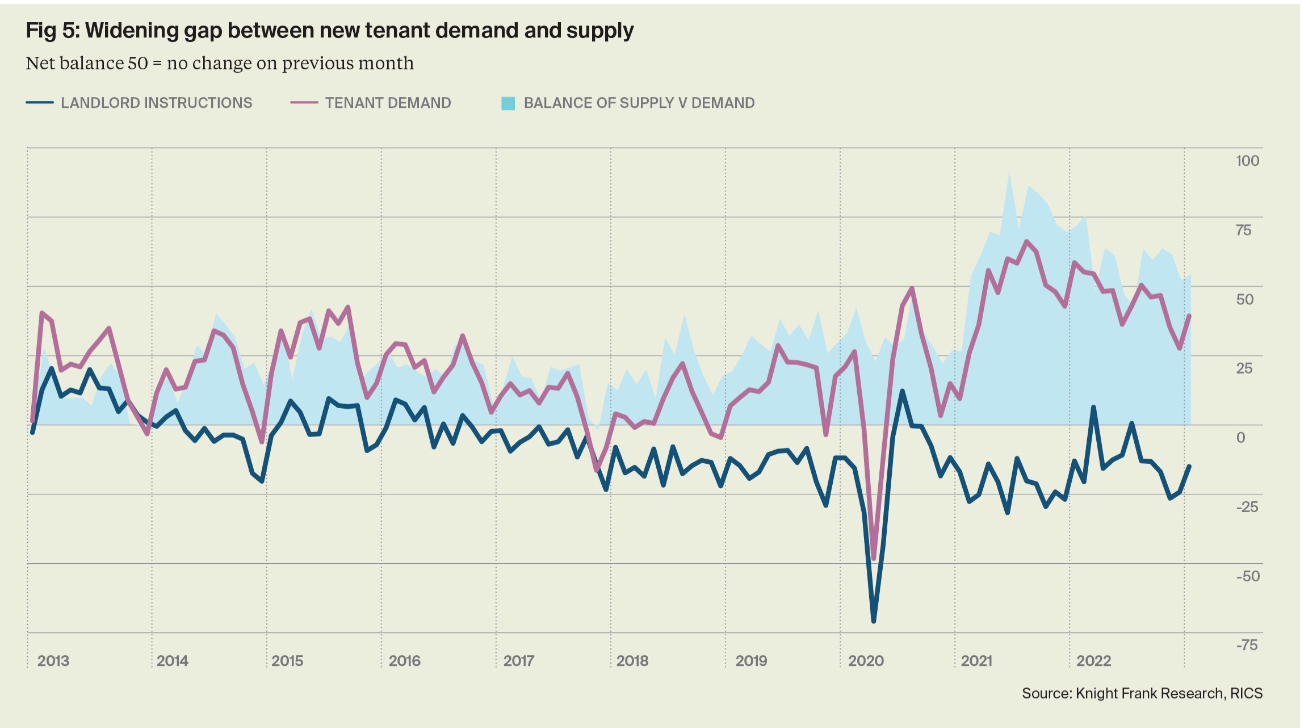

Rising institutional investor interest in the SFH rental market comes at a time when the supply of rental properties across the market is constrained (see chart). According to data from Rightmove, the volume of rental listings for houses across the UK in Q4 2022 was 42.6% lower than the 2017-19 pre-pandemic average, while the RICS Market Survey continues to report a fall in landlord instructions.

One of the biggest challenges for the SFH market has been gaining access to oven-ready sites and building platforms of a meaningful scale. A strong sales market has provided housebuilders with little impetus to do bulk deals, but SFH investors may provide the volume builders with a useful platform to offload some risk over the months ahead.

New York

Economic volatility across many asset classes is generally supportive of prime property prices in global cities.

Manhattan's luxury market provides a good example. While the S&P 500 fell 19% in 2022, and estimates suggest crypto plummeted 50%, luxury homes in New York registered 2.7% average growth, despite the Federal Reserve embarking on its fastest pace of rate hikes since the 1980s.

Cash buyers account for about eight in ten new home purchases in Manhattan, better insulating the market from rate hikes relative to the wider housing market, where median sales prices of existing homes slid in February for the first time since 2012.

We expect to see growth of 2% in 2023, higher than the city’s 10-year average performance of 1.1% (see chart). You can read more in our Q2 New York Insight, out now.

In other news...

Kate Everett-Allen looks back at a decade of prime property price changes.