Understanding the countryside

The Knight Frank Rural Property and Business Update – Our weekly dose of news, views and insight from the world of farming, food and landownership

10 minutes to read

Opinion

I’ve been asked what I think about the wildly popular Clarkson’s Farm. On the one hand it’s great that it’s brought the issues facing agriculture to a wider audience, on the other I do cynically wonder how much of the conflict the royally remunerated Mr Clarkson gets involved with has been purposefully stirred up for better TV. But my overriding feeling is that it’s shame it took a celebrity farmer to create this level of awareness among the public when all the issues he experiences have been widely reported on for many years by others. As discussed below, ‘influencers’ like Ben Goldsmith and Bear Grylls whip up their supporters and detractors into a frenzy, but sadly what follows isn’t the sensible debate that is needed, but a series of polarised views flung over a neglected middle-ground. Detail, nuance, compromise and pragmatism all seem lacking from public discourse, with soundbite and social-media obsessed politicians doing little to help. Rural property owners at the sharp end of many of the issues, meanwhile, are often faced with policy vacuums that make long-term planning difficult. It’s good news, therefore, that the government has at last launched a consultation into to the tax treatment of land used to deliver environmental benefits. Behind the scenes lobbying by the likes of the CLA may not get much coverage, but it proves that points sensibly argued still have a role to play in society today.

Do get in touch if we can help you navigate through these interesting times. You can sign up to receive this weekly update direct to your email here

Andrew Shirley Head of Rural Research; Mark Topliff, Rural Research Associate

In this week’s update:

• Commodity markets – Market worries pull back oil prices

• Nutrient neutrality – Call for evidence announced

• Out and about – Farming economics, harvesting natural capital

• Grass-fed livestock – Influencers stir up trouble

• The Budget – IHT, the environment, investment and potholes

• Grants – Countryside Stewardship limit removed

• Basic Payment Scheme – Applications now open

• Cats – Farm moggies exempt from new chipping rules

• International news – UN report on under-pressure food security

• The Wealth Report – 2023 edition out now

• Farmland Index – Agri-land 2022’s top-performing asset

• Staff Salaries Report – Rural wages benchmarked

• On the market – Australia and Africa calling

Commodity markets

Market worries pull back oil prices

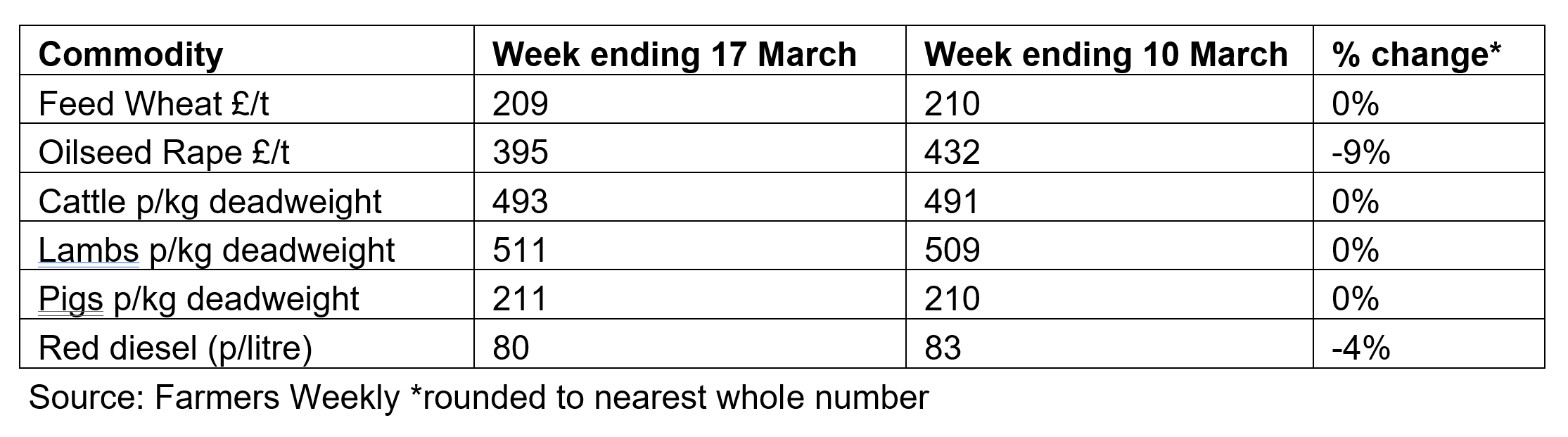

Oil prices slumped to a 15-month low last week amid concerns that the collapse of the Silicon Valley Bank could lead to a wider banking crisis. Red diesel slipped 3% to 80p/litre. However, markets calmed slightly after a US$40 billion lifeline followed by a potential UBS takeover for Credit Suisse, one of the banks considered most vulnerable to any contagion, was announced. The Opec+ cartel remained sanguine about the fall, saying supply and demand fundamentals remained in balance. This suggests further cuts in output that could push up prices are unlikely for the moment. Oilseed rape prices also tumbled to below £400/t – down 9% on the week – a far cry from year-ago prices of almost £750/t. Sterling’s rise against the euro following Jeremy Hunt’s budget was partly to blame.

Talking Points

Nutrient neutrality – Call for evidence announced

As well as the Budget measures discussed in more detail below, Jeremy Hunt also acknowledged the impact of nutrient neutrality rules on home-building targets and the issues it is creating for affected local authorities and developers. The Department for Levelling Up, Housing and Communities (DLUHC) will shortly launch a call for evidence from Local Planning Authorities, backed by a commitment to provide funding for high quality, locally led nutrient mitigation schemes. It will also open a call for evidence from local authorities in England for locally led nutrient neutrality credit schemes. Where high quality proposals are identified, the government says it will provide funding to support clearer routes for housing developers to deliver ‘nutrient neutral’ sites, in line with their environmental obligations.

Out and about – Farming economics, harvesting natural capital

Last week Mark was in Newmarket listening to the widely respected consultants from Andersons share their latest views on the state of UK agriculture PLC. There were plenty of numbers to ponder on. For example, the 2023 crop year looks challenging with total income from farming expected to drop from £5 billion last year to just over £3 billion.

Farm debt has increased by 73% between 2009 and 2022, while annual agricultural productivity growth has flatlined at just 0.7% since 2005.

Meanwhile, I was at the CLA’s Institutional Landowners Conference in London where the big theme was the market for natural capital ‘New Markets Fad or the Future’. A series of thought-provoking speakers emphasised why natural capital is very much part of the future for rural estates, but delegates were still left with the sense that natural capital markets are still in their “Wild West” phase.

Grass-fed livestock – Influencers stir up trouble

Sheep farmers and vegans were both up in arms last week after two well-known influencers shared their controversial views. Writing in the Saturday Times, the adventurer and former staunch vegan Bear Grylls extolled the virtues of his damascene conversion to a meat-based diet particularly heavy on the offal and grass-fed beef. Meanwhile environmentalist Ben Goldsmith, a former Defra non-exec, prompted a huge backlash when he took to Twitter again to claim that rearing sheep across the UK’s uplands is an environmental disaster and should not be subsidised.

Need to know

The Budget – IHT, the environment, investment and potholes

The CLA says Jeremy Hunt’s Spring Budget last week was a missed opportunity that failed to deliver for the rural economy, but there were a number of announcements that could benefit farms and estates.

More of a slow burn than an immediate giveaway, but the announcement of a call for evidence and consultation to explore both the taxation of ecosystem service markets and the potential expansion of agricultural property relief from inheritance tax to cover certain types of environmental land management was a welcome move. The outcome will hopefully provide the clarity that businesses are craving that will allow them to make those longer-term decisions around ecological management. On the subject of inheritance tax, the government has, unsurprisingly following Brexit, decided to restrict the scope of agricultural property relief and woodlands relief to property in the UK from 6 April 2024.

Businesses will be pleased that the Annual Investment Allowance (AIA) will be permanently set at £1 million. It provides 100% first-year relief for plant and machinery investments. However, rural entrepreneurs that operate as sole traders or partnerships will not be able to benefit from the full expensing of capital expenditure in plant and machinery that was also announced.

And finally, something of a relief to all drivers dodging the many potholes that have appeared along country lanes over the winter is that the fund to repair them will be increased by £200m in 2023/24. Apparently, it’s expected to fix the equivalent of up to four million additional potholes across England.

Read more about the Budget

Grants – Countryside Stewardship limit removed

There will be no upper limit on grants relating to boundaries, trees and orchards; air quality; water quality; and flood management under the Countryside Stewardship (CS) capital grants scheme. Defra has removed the maximum £20,000 application amount for each of the four themes. Knight Frank’s grant guru Henry Clemons says, “this will be an excellent opportunity for landowners to get some funding towards projects such as concreting yards to help dirty water management. While capital works are a nice bonus, landowners should also consider other CS options that deliver wildlife habitat improvements and provide an annual income.”

Basic Payment Scheme – Applications now open

The Rural Payments Agency (RPA) has opened the window for Basic Payment Scheme (BPS) applications which can be made without penalty until 11:59 pm on 15 May.

Under the government’s current plans this will be the last year that BPS payments will be linked to land. From 2024 they will be delinked. Claimants, however, will need to have made a claim in 2023 to be eligible for delinked payments between 2024 and 2027. Delinking will also bring with it an end to entitlements and cross-compliance.

The RPA states that “delinked payments will be based on your average BPS payments in a reference period, which is the BPS 2020 to 2022 scheme years.” It also says that progressive reductions will be applied each year as delinked payments are gradually phased out by the end of 2027.

If you need help with a BPS claim, please contact our Agri-Consultancy team.

Cats – Farm moggies exempt from new chipping rules

New rules agreed by parliament last week mean cats must be implanted with a microchip before they reach the age of 20 weeks and their contact details stored and kept up to date in a pet microchipping database. All owners must have their cat microchipped by 10 June 2024 and owners found not to have microchipped their cat will have 21 days to have one implanted, or may face a fine of up to £500. However, it will not be compulsory for free living cats that live with little or no human interaction or dependency, such as farm, feral or community cats.

International news – UN report on under-pressure food security

Food security and healthy nutrition are “under enormous pressure” in Europe and Central Asia following the COVID-19 pandemic and the Ukraine war. A United Nations report published last week highlights that “food and agriculture policies need to be repurposed to make them better suited to addressing the ‘triple challenge’ of current agrifood systems – increasing the affordability of healthy diets, ensuring better livelihoods for farmers, and improving environmental sustainability.” However, it did state that the region as a whole is in a much better position than elsewhere in the world.

To help with this triple challenge, the report says that financial incentives need to be broader than helping individual land managers and additionally help “agricultural research and development, education, pest and disease controls, public food safety control systems, climate-smart agriculture, and emissions-efficient technologies and practices.”

Knight Frank Research

The Wealth Report – 2023 edition is out now

Knight Frank’s leading piece of thought leadership on property and wealth trends was launched last week and includes an interview by me with one of Scotland’s pioneering rewilders, as well as some thoughts on why farmland could be one of this year’s most in-demand property investments. Download your copy to find out more.

Farmland Index – Agricultural land top-performing asset in 2022

As predicted, the latest results of the Knight Frank Farmland Index show that agricultural land as an investment beat inflation in 2022 and outperformed other asset classes, including mainstream house prices, luxury London house prices, the FTSE 100 share index and even gold. According to our index the average value of farmland rose by 13% over the year to hit over £21,000/ha, a record high. A shortage of supply and continued strong demand from a wide range of buyers underpinned the market. Download the full report for more facts and figures.

You can also hear some thoughts from my colleagues and me on the outlook for property markets in 2023 in the latest edition of Intelligence Talks, our research podcast.

Estate Staff Salaries Survey – Rural wages benchmarked

Just a reminder that the latest edition of the Knight Frank Estate Staff Salary Survey has recently been published. The report reveals the average salaries paid for a wide range of rural estate and farming roles and level of wage increases being offered by rural businesses. Also highlighted are the key employment issues facing the rural economy. Download your copy here or get in touch with Chris Terrett for more details.

On the market

Australia and Africa calling

Our global farmland team has just launched a couple of interesting investment opportunities. In Australia, broker Andrew Blake is selling Karakin Farm, near Lancelin, an 8,500 hectare arable and livestock unit, one of the largest private landholdings within 100km of Perth’s CBD. Expression of interest around AU$30 million have been received.

Meanwhile, Tanya Ware, our Head of Farm Sales in Zambia, is looking for buyers for Serenje Farm in the country’s Central Province. The 680-ha arable farm has excellent water access, with irrigation rights for 700 ha of land. Tanya is looking for offers of around US$1.36 million.

Lake District Photo by Jakub Janik