BlackRock wants you back in the office

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

The UK economic outlook

UK economic conditions are improving. Or at least they were until the collapse of Silicon Valley Bank, and the long term ramifications of that are still unclear at the moment (more on that shortly).

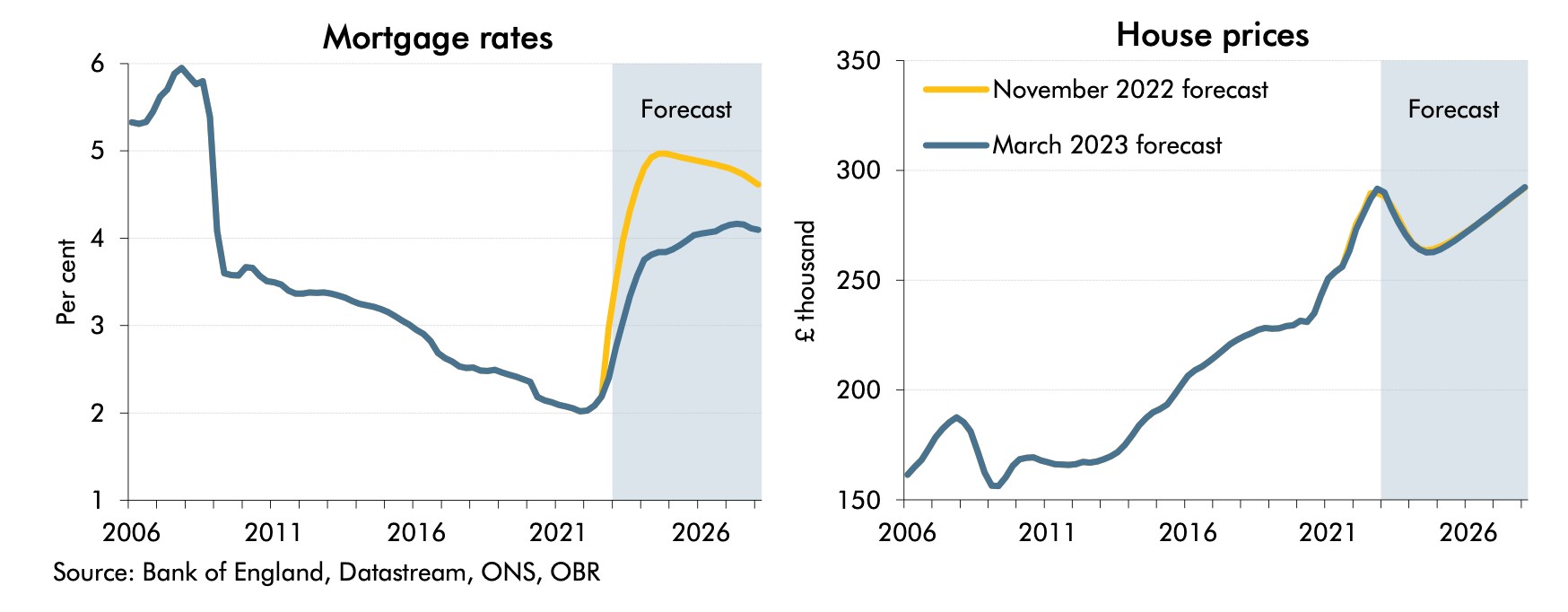

Wholesale gas prices have more than halved over the past six months and will keep falling, according to new forecasts published by the Office for Budget Responsibility alongside the Budget this week. The Base Rate is now expected to peak at 4.25%, rather than the 5% the OBR expected in November. Several challenges remain - gas prices remain more than twice their pre-pandemic level, business investment has stagnated since 2016 and labour market inactivity is stubbornly high - but there is little doubt that the near-term outlook has improved.

The OBR now expects house prices to fall by 10% from their high in the final quarter of 2022 (see charts). That's a 1% larger decline than the watchdog's November forecast and is broadly in line with our own. Leading indicators from Halifax and Nationwide suggest that house prices have already fallen by 3 to 6%. Property transactions are expected to drop by 20%.

The Budget

The Budget itself was pretty lightweight on policy. Investment Zones are an interesting idea, but the paltry £80 million of funding available to each zone over five years will limit progress. The consultation on Nutrient Neutrality is welcome, but light on detail. The team has published a round up here.

The new OBR forecasts, the impending Bank of England Monetary Policy Committee meeting and the evolving crisis in global banking make it an ideal moment to weigh the outlook for real estate markets. I gathered members of the research team to do just that for a new edition of Intelligence Talks, out this morning. Listen here, or wherever you get your podcasts.

Preserving stability

Stress in the banking system has clouded the outlook of interest rates. Can central banks keep hiking while global institutions like Credit Suisse are wobbling?

The European Central Bank pushed ahead with an expected 50bps rate hike yesterday anyway. With inflation running at an annual rate of 8.5%, it had few good choices, but it's also clear via Bloomberg and others that officials feared triggering panic among investors. A pause would lead some to question what officials knew about financial stability in the eurozone.

Instead, the ECB dropped all language about the future path of interest rates and said:

"The governing council is monitoring current market tensions closely and stands ready to respond as necessary to preserve price stability and financial stability in the euro area. The euro area banking sector is resilient, with strong capital and liquidity positions."

Liquidity

A more dovish outlook for interest rates would normally be supportive for activity in real estate markets, but lower interest rates are of limited use if banks are reluctant to lend.

SVB and Credit Suisse have dominated discussions at the MIPIM conference in Cannes this week. Much of the talk has centred on the degree to which banks will hoard capital in order to shore up balance sheets - this is a good example from Bloomberg. There is already a deficit between the amount owed by commercial property owners and the credit likely to be available when loans mature - a figure that has come to be known as "the funding gap". AEW's forecasts suggest that gap amounts to circa €32 billion.

"It does seem inevitable that some banks will now need to pull back on lending to shore up their balance sheets, and we’re likely to see stricter capital standards for banks," BlackRock chairman and CEO Larry Fink said in his annual letter to investors this week.

Forging connections

Mr Fink's letter is worth reading for his views on everything from inflation (likely to run close to 4% for years) to the impacts of climate change on housing markets (the potential for mass relocations away from at risk coastal zones).

Of most interest, perhaps, are his evolving views on work. Mr Fink and his colleagues manage $8.6 trillion in assets and have significant stakes in companies around the world. Few people have more exposure to corporate leaders.

Mr Fink said he wrote to corporate leaders last year about the importance of adapting to the new world of work and forging strong connections with employees. He reminded them of BlackRock research showing a strong correlation between companies with better culture and values ratings compared to industry peers and their stock returns.

He builds on those themes in this year's letter, adding that "the lack of face-to-face interaction has had a profound effect on humanity", and "video calls are no substitute for meeting in person or sharing a meal."

"We always want to stay ahead of our clients’ needs, and to do so we need to maintain a focus on productivity, innovation, and connectedness," he concludes. "That means having people working side-by-side, not staring at one another on screens."

In other news...

Key expectations for the European logistics market in 2023, from Claire Williams.

US jobless claims rise more than expected (Reuters), Goldman raises US recession probability (Bloomberg), a $30 billion lifeline for First Republic (Bloomberg), and finally, UK threatens developers over failure to sign building safety contract (FT).