Commercial real estate investment – who is investing capital and where?

Private investors were most active buyers in commercial real estate investment in 2022, what trends emerged as a result?

3 minutes to read

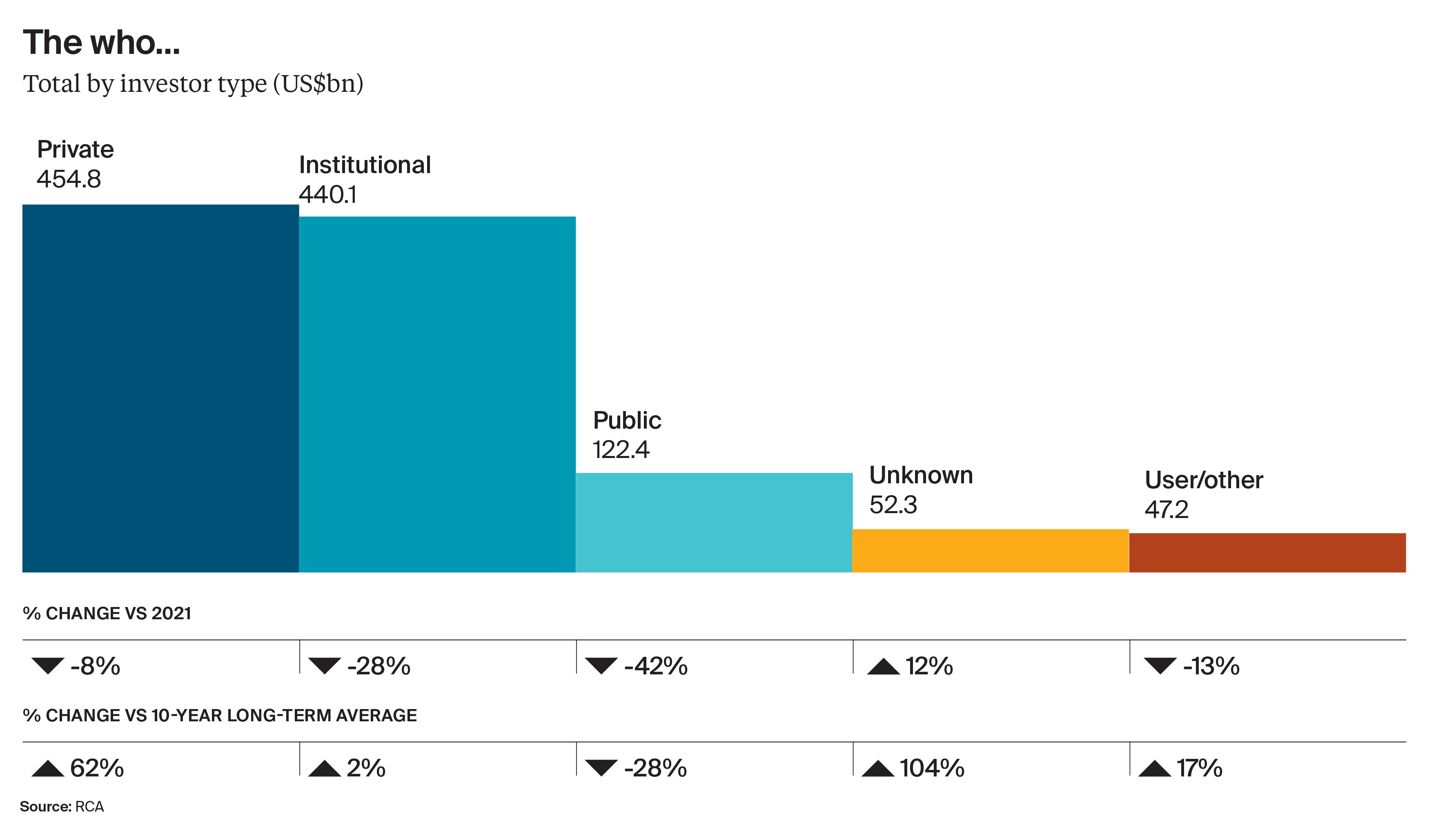

Despite the global macroeconomic and geopolitical headwinds that persisted throughout 2022, investment from private sources remained robust. Private investors were the most active buyers in global commercial real estate markets in 2022 with US$455 billion invested, accounting for 41% of the total, according to RCA.

This represents private buyers’ highest share of global commercial real estate investment on record. It’s also the first time private investment has surpassed institutional investment. Institutions invested a total of US$440 billion in 2022, 28% below 2021 volumes, but 2% above the 10-year average.

By comparison, while private investment was down from its all-time high of US$493 billion in 2021, 2022 was still the second strongest year in history, sitting 62% above the 10-year average.

Investment sectors of choice

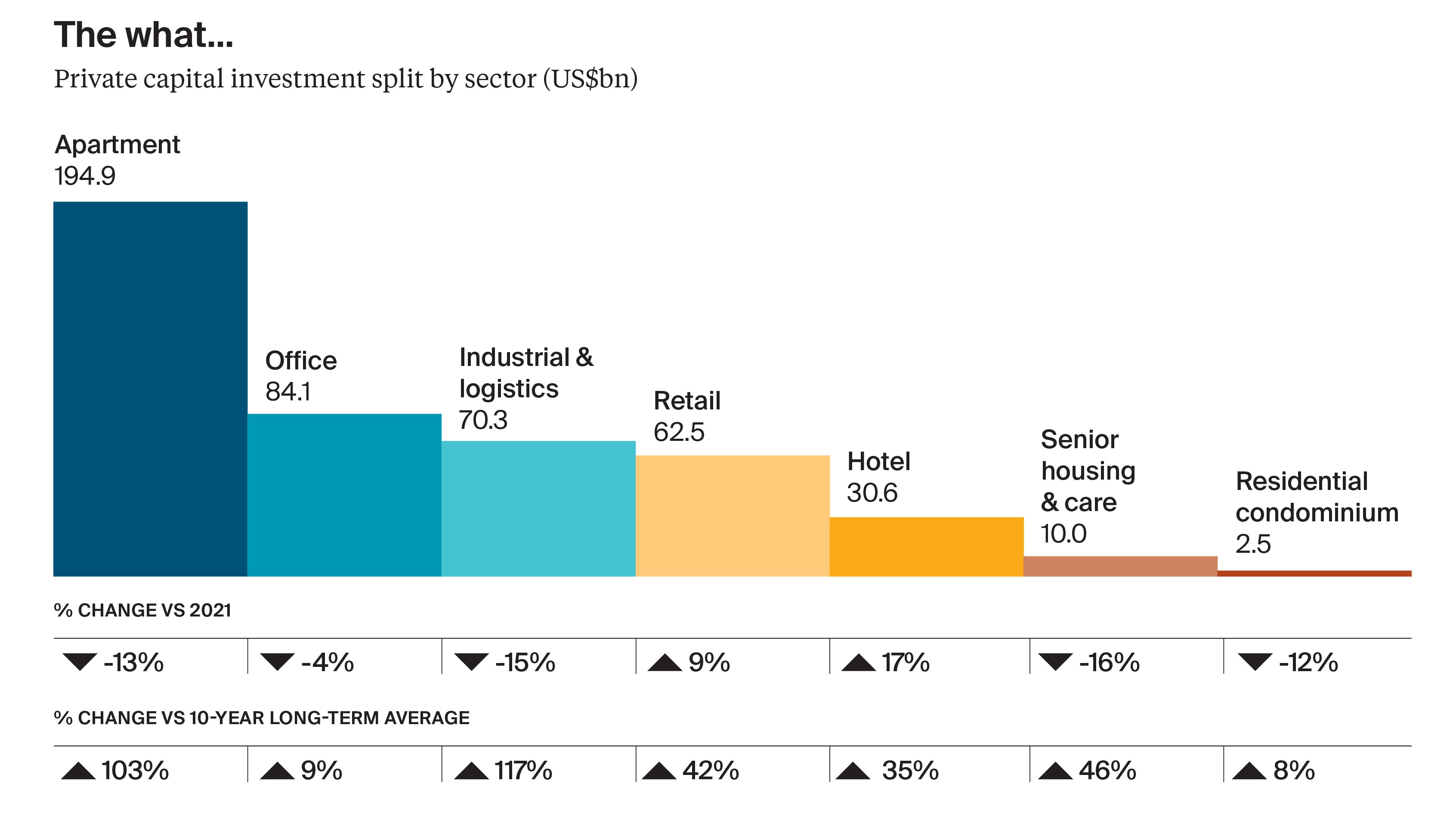

Multifamily residential – or private rented sector (PRS) – offices and industrial assets attracted the greatest interest, as reflected in our Attitudes Survey which shows that 43% of respondents are already invested in offices and 40% in industrial assets. Ownership in retail, life sciences, healthcare, PRS, data centres and education real estate all increased in 2022 compared with the previous year.

Top destinations for capital

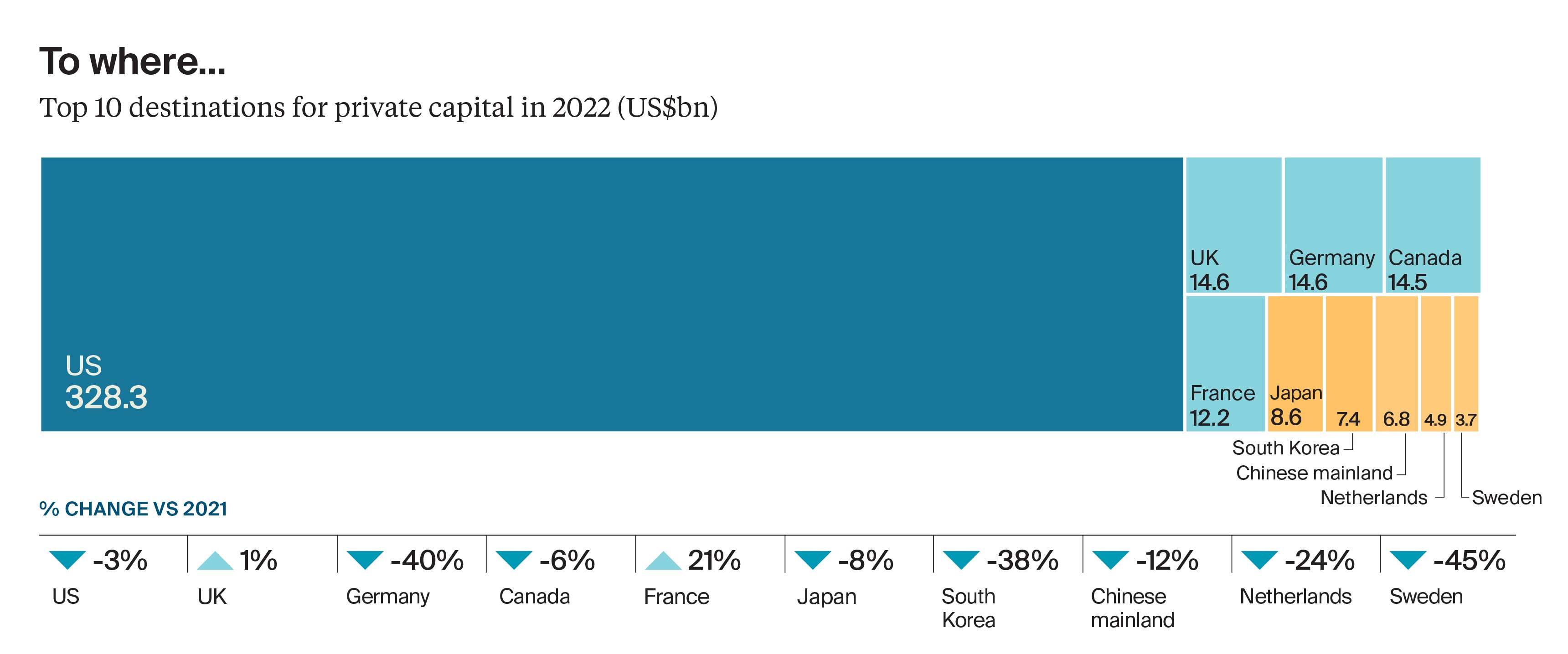

The US, UK, Germany, Canada and France were the top targets for private capital last year. However, of the top 10 destinations, the UK and France were the only countries to see year-on-year increases in total private investment: up 1% to US$14.6 billion in the UK while France, with its resilient economy and relatively low inflation levels compared with the rest of Europe, jumped 21% to US$12.2 billion.

What is driving investment decisions?

Inflation will be a significant factor driving investment decisions in 2023, with 80% of respondents to our HNW (high-net-worth) Pulse Survey stating that it would influence their investment decisions either significantly (37%) or to some extent (43%).

In order to navigate the higher inflationary environment, investors may pivot towards commercial real estate due to its strong growth potential, particularly in assets with indexation.

Nevertheless, there are indications that inflation may already have peaked across most major economies, and we could see its influence on investment choices start to moderate as the year progresses.

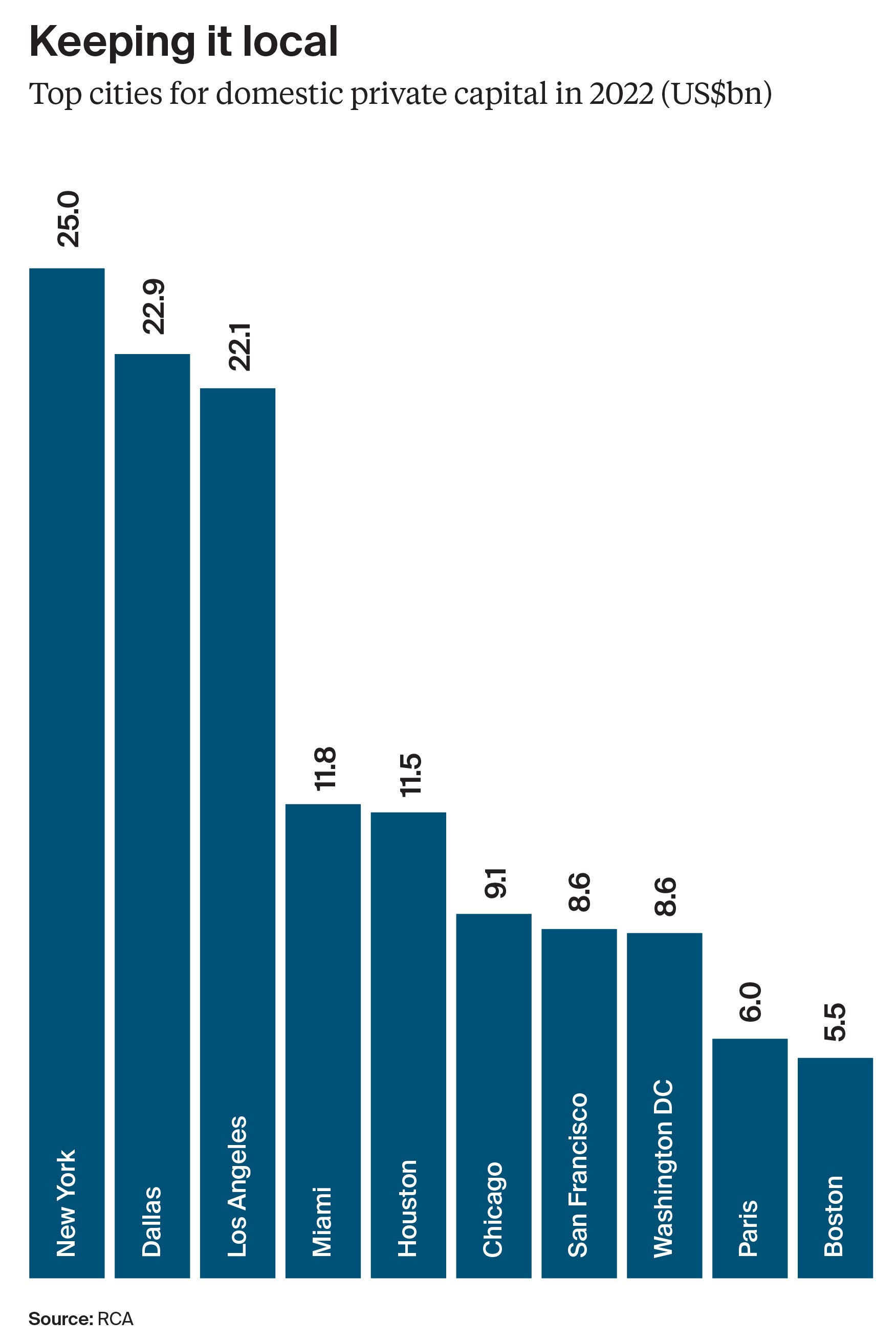

US cities remained a target for private buyers in 2022. Of the cities attracting private capital investment, US metropolises accounted for 67% of the total volume, with Paris the only non-US cities to feature in the top 10.

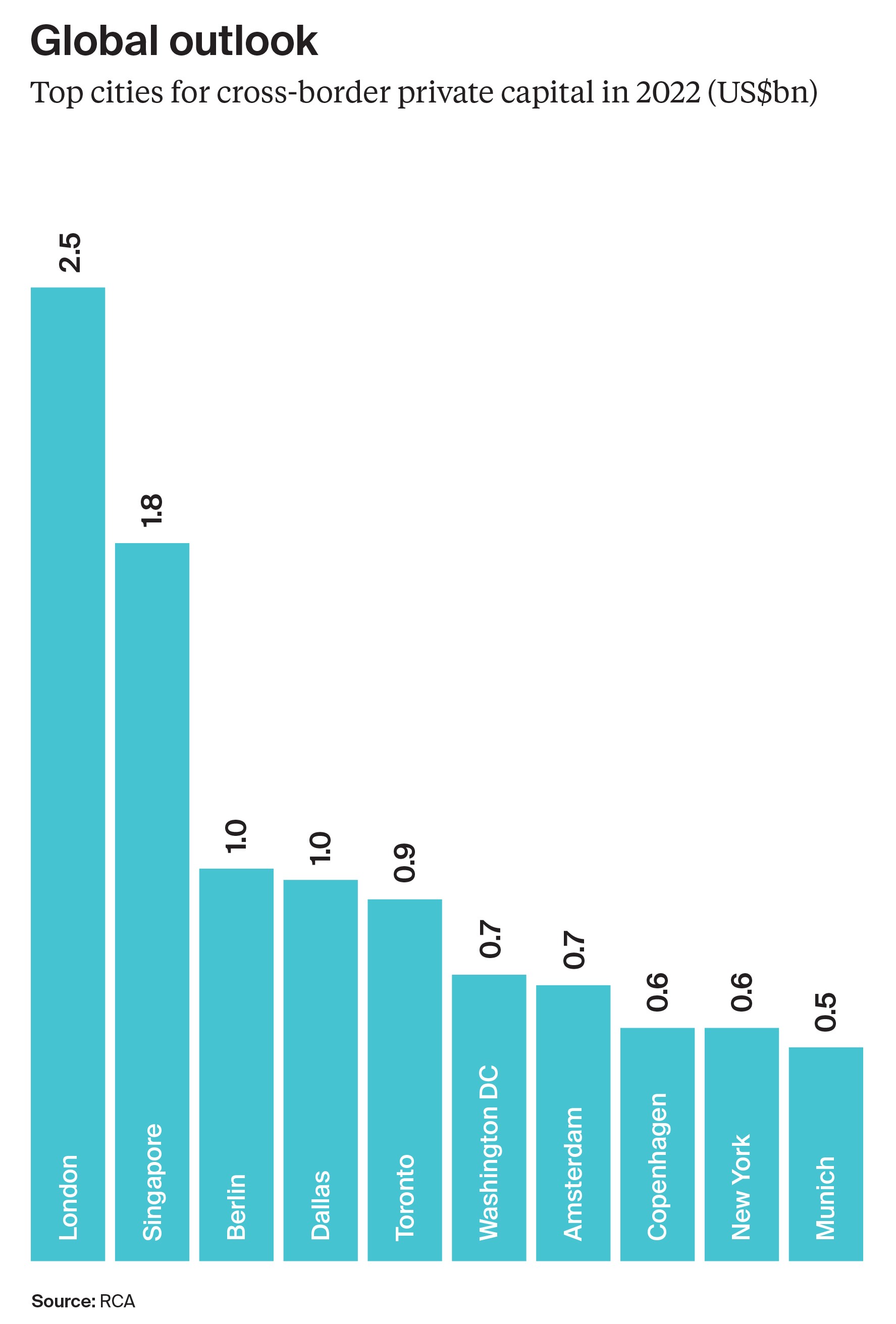

While eleventh overall for total private investment (cross-border and domestic) in 2022, London was top for cross-border private capital with US$2.5 billion. Overall, this accounted for 44% of the total private investment into the city and 15% of total global cross-border private investment into cities in 2022.

Private investors from the US were the largest source of capital last year, with US$302 billion invested – more than a quarter of total commercial real estate investment and 66% of private investment. However, investment from US private buyers was down 3% year-on-year.

Of the top 10 sources of private capital last year, investors from France and the Chinese mainland were the only buyers to increase investment in 2022, up 27% and 25% on the previous year to US$13.8 billion and US$6.3 billion, respectively.

Download the full report

Download the full report for more in depth analysis and the latest trends relating to global wealth.

Download the report