Real estate trends from the Private Office

What are Private Office clients thinking now, and what do they see as the biggest trends for 2023?

8 minutes to read

We asked our teams on the ground worldwide for their insights.

UK and Europe

Alasdair Pritchard

Volatility will drive activity in prime residential real estate markets through 2023. We speak to a lot of clients seeking to diversify their assets, or hedge against currency movements or large swings in markets.

Growing unpredictability is also driving capital towards real estate. Wealthy individuals living in unstable regions have always sought a “Plan B” (see page 10 in the report) – homes in the US, Australia or Europe that can enable the transition to a new life if needed – but rising geopolitical turmoil has drawn more buyers off the fence, and we expect that to continue through 2023.

The price of a broad range of assets soared during the Covid-19 pandemic and there are now large numbers of wealthy individuals seeking to diversify. Asset prices are coming under pressure from rising interest rates and those that have enjoyed windfalls – many of them working in tech – are seeking new ways to invest capital.

These young, dynamic people increasingly want to invest either in products with good ESG credentials, or in tangible assets such as property.

Locations that offer both favourable tax policies and the kind of lifestyle advantages that became popular during the pandemic will prove particularly competitive during 2023. Wealthy individuals wanting to move their tax residency looked to Swiss locations such as Geneva and Zurich. For those seeking to combine this with more lifestyle elements, Verbier has been an option.

This trend is particularly the case for Italy. Ultra-wealthy individuals taking up residency pay a flat tax of €100,000 a year, regardless of their income, which is hugely competitive. Milan and Florence will experience a large influx of buyers, though we expect fierce competition for a relatively tight supply of suitable property.

United States

Hugh Dixon

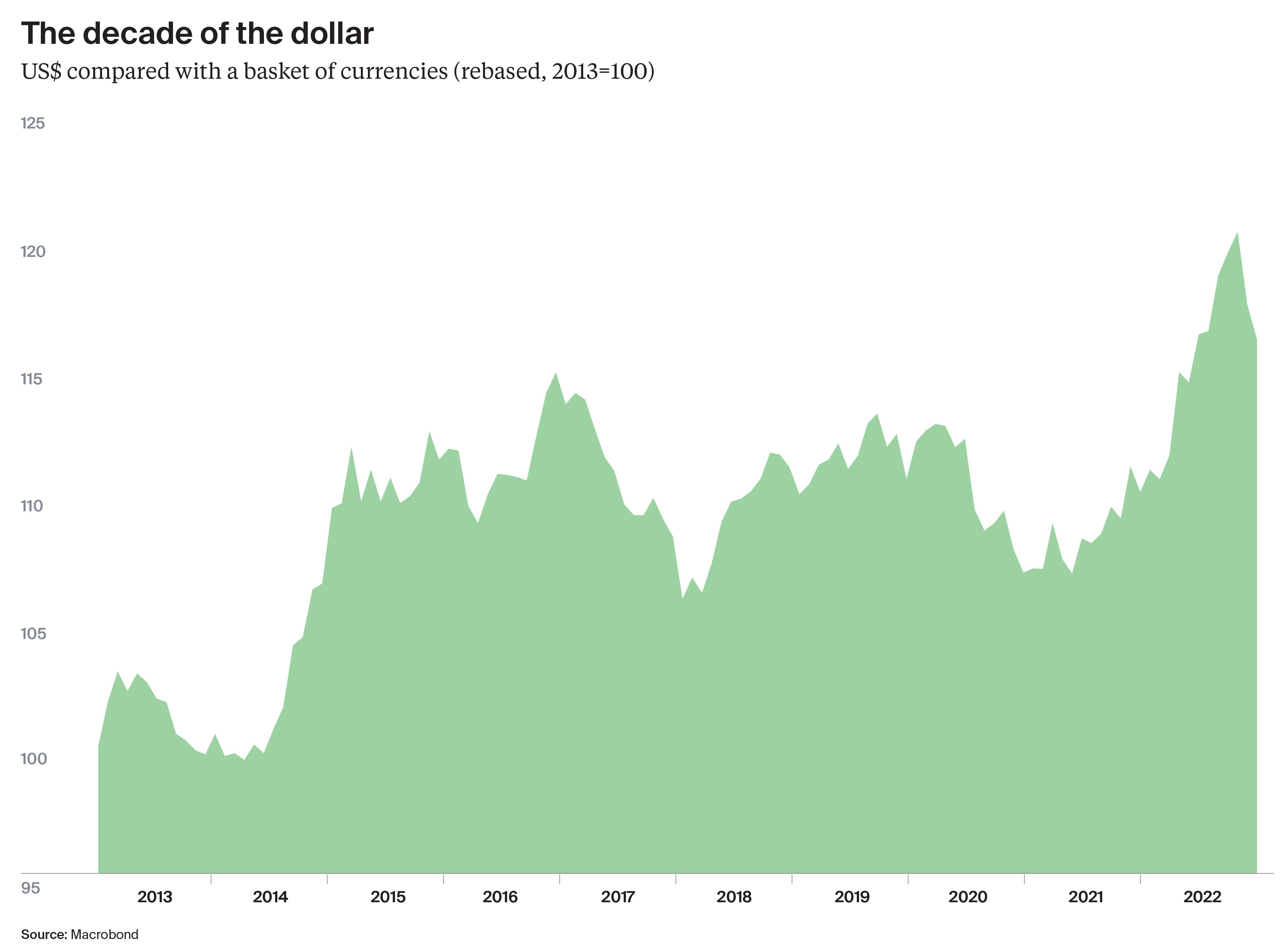

The dollar enjoyed a remarkable 2022, strengthening the position of dollar-based buyers globally. Against a basket of currencies, the greenback climbed more than 12.5% from its mid-2021 low to its October 2022 peak.

Cracks have since emerged amid signs US inflation is peaking, trimming those gains by 5.5% as of late January. However, the dollar remains strong by historic standards and dollar-based buyers will continue to play an outsized role in prime residential markets throughout 2023. Many clients are now seeking to diversify away from the US market, with the UK and Europe looking particularly attractive given the currency play.

The US will also be one of the pre-eminent global destinations for capital, given its political and economic stability, with New York remaining the number one target. Prime prices climbed 2.7% during 2022, down from the 7.1% recorded in the second quarter but well above its average decline of 1.2% over the past five years. The city is among the world’s top destinations both for education and business, making it a perfect location for prime and super-prime buyers with children.

Miami and Aspen both had fantastic years, and we expect demand to remain strong given buyers’ renewed interest in living healthier lifestyles close to nature and open spaces. Los Angeles, too, has grown in popularity with overseas buyers. Prime prices climbed 7.9% in the year to October 2022. The larger markets do face headwinds. The surge in pent-up demand post-pandemic is tailing off, leaving a shortage of stock across key markets.

Owners that can afford to hold on to properties are choosing to do so amid a weakening sales market. Buyers can expect to compete for a limited supply of the best quality property.

Middle East

Henry Faun

Dollar-based buyers – both those in the US and those purchasing with dollar-pegged currencies – have witnessed their spending power increase substantially in the past 12 months. Yet while some Americans buying in prime central London have generated headlines, the number of buyers from the Middle East hit a four year high in the second half of 2022.

There have been some local distractions – the World Cup in Qatar, for example – so we expect Gulf-based buyers to become increasingly active through the year both in the UK and Europe, due to the dollar’s strength against both the pound and the euro.

Buyers typically want to be in central London, within walking distance of Hyde Park and the surrounding hotels, restaurants and nightclubs. Many of the Gulf states are built for cars, so my clients place huge value on London’s walkability. Further afield, the villages and towns of north Surrey offer beautiful greenery just 45 minutes from central London. For between £10 million and £20 million, buyers can secure a large, gated property, with more privacy than properties at comparable prices in central London.

I expect Dubai to remain the Gulf’s leading domestic market during 2023 (see page 40 of the report). Dubai has seen phenomenal growth since the pandemic, fuelled by its safe-haven status and its position as a luxury second home hotspot, combined with the government’s robust response to the pandemic, all of which have spurred business confidence.

UK and Europe

Katya Zenkovich

Large numbers of my clients are re-evaluating their portfolios following the two-year acquisition spree that characterised the pandemic and subsequent period of lockdowns.

The economics look much trickier today than this time last year, and though demand for property is still being driven by a desire to diversify, there are wealthy homeowners now looking at their portfolios, considering the cost and taking the first steps towards rationalisation.

Hopefully that will provide a boost to stock levels in global prime and super-prime markets that have been starved of stock for the best part of two years. It won’t be enough to alleviate shortages in their entirety, so trophy properties will hold their value regardless of pressures in the wider property markets.

Politics and economics will be the key drivers of activity through 2023 and 2024. Demand for prime property in safe-haven markets rises in parallel with geopolitical volatility. The “Golden Triangle” markets of Monaco, London and particularly Switzerland will outperform.

Switzerland is my pick for the year. The flexibility of taxation, the safety, the climate, its position in Europe and the lifestyle afforded by being so close to the mountains will make it the property market of the moment.

The usual buyers from Asia, the Middle East and the US will be prominent; however, I think we will also see meaningful amounts of British wealth flow there over the coming two years.

Italy is a growing market. The one-off flat tax in exchange for residency is a clever idea and has transformed

Italy’s prospects as a prime and super-prime market. Three or four years ago there was very little demand for penthouses in Milan, for example. Now they are virtually impossible to find. Growth will only be held back by a shortage of properties for sale at the level our clients expect.

Demand in prime markets between £3 million and £7 million will prove resilient, particularly among buyers operating out of more sluggish economies. Coastal markets in Italy, France and Portugal offer the lifestyle most people are seeking in the wake of the pandemic with a lower cost of access. Portugal has seen a huge influx of younger wealth in recent years – surfers that have earned money in the US tech sector, for example. That shows few signs of slowing, and with many tech companies setting up offices in Lisbon, the market looks poised to draw larger numbers of investors through 2023 and 2024.

Singapore

Nicholas Keong

Singapore has always been a strong exporter of capital, but during the past five years the city-state has been in fierce competition with Hong Kong to become the dominant financial hub in Asia.

Already positioned as a regional leader in education and secure living, and as a broad, pro-business economy, Singapore has in recent years made particularly large investments in strengthening its foothold as a global wealth hub, most notably via tax perks that incentivise the setting up of family offices. Numbers of single-family offices have jumped nearly threefold since the pandemic began, largely driven by an influx of wealthy Chinese families.

The rising number of wealthy individuals is fuelling upward pressure on prime property prices which we expect to continue through 2023 (see page 40 of the report). A total of 296 luxury non-landed homes were sold in 2022, substantially lower than the 487 transactions recorded the previous year, largely due to dwindling supply. Family-sized units are in particularly high demand. Prices increased 3.9% in 2022.

Outbound capital has always been very UK-centric, and that will continue to be the case through 2023. Values in prime central London still look attractive relative to levels, say, pre-2016, so we expect to see significant

numbers of wealthy individuals looking to purchase second homes in the UK capital this year. The US and Australia are also significant draws – Perth is just five hours away, Melbourne and Sydney around eight. They all have the education, weather and lifestyle to attract more investment.

We’re increasingly seeing wealthy families seeking to gain a foothold in Japan. Low interest rates and the weak yen plus gross yields of 4%–5% are drawing buyers into the Japanese multifamily space. It’s not easy to break into the market – institutions that take the development risk tend to want to hold on to stabilised assets – but when they do become available, we’re seeing huge competition from family offices.

Download the full report

Download the full report for more in depth analysis and the latest trends relating to global wealth.

Download the report