Food security - Cucumbers versus turnips

The Knight Frank Rural Property and Business Update – Our weekly dose of news, views and insight from the world of farming, food and landownership

10 minutes to read

Opinion

So, what’s caught my eye this week? I think it’s ostensibly well-meaning statements or ideas that don’t necessarily stand up to closer scrutiny. Take the recent pronouncements of Thérèse Coffey the Secretary of State at Defra. In response to the cucumber shortage currently blighting the UK, Dr Coffey said people should return to eating more seasonal food, like turnips. Firstly, the seasonality train has long left the station; rightly or wrongly the public expects to eat what it wants when it wants – that won’t change. Secondly, I have never seen a turnip for sale in my local Co-op. The minister would be better off asking why the UK’s glasshouse sector, which could be supplying more locally grown salad produce, is struggling to survive. And then we have the student union at Cambridge University banning all non-plant-based food. One wonders if they’ve really given much thought to the questionable environmental footprint of many meat and dairy substitutes or the importance of livestock to regenerative agricultural techniques, lauded the world over for their contribution to biodiversity and carbon sequestration. Better IMHO to follow the Sustainable Farming Trust’s call for the consumption of smaller quantities of better quality, higher welfare, locally produced meat than call for an outright ban. All thoughts welcome.

Do get in touch if we can help you navigate through these interesting times. You can sign up to receive this weekly update direct to your email here

Andrew Shirley Head of Rural Research, Mark Topliff, Rural Research Associate

In this week's update

• Commodity markets – Ukraine invasion 12 months on

• The food chain – Turnips v cucumbers

• Veganism – Cambridge Uni goes animal free

• Small abattoirs – Support announced

• Renewable energy – Planning reform for big schemes

• Out and about – The value of an elephant

• Biodiversity net gain – More details released

• Tree safety – Court case highlights dangers

• Compulsory purchase – Help reform the system

• The Wealth Report – 2023 edition out this week

• Farmland Index – Agri-land 2022’s top-performing asset

• Staff Salaries Report – Rural wages benchmarked

• On the market – Kiwi orchard up for grabs

Commodity markets

Ukraine invasion – prices 12 months on

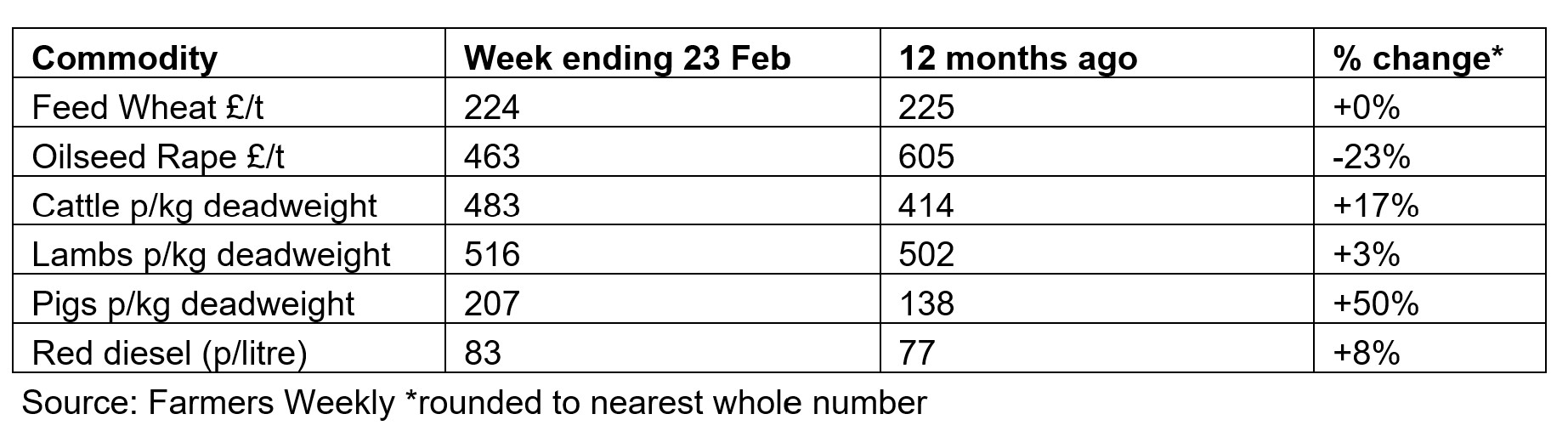

Last Friday marked the anniversary of Russia’s vicious invasion of the bits of Ukraine it hadn’t already annexed or illegally occupied. Twelve months on, we thought it would be interesting to see where commodity markets are now compared with the eve of the war. It’s a mixed picture. On the arable side of things wheat prices have settled back down to where they were, proving even war can’t stop global trade for too long, while oilseed rape values are actually almost 25% lower. Livestock prices, on the other hand, are higher than they were. For beef and lamb other market forces are at play, but the higher cost of feed and energy caused by the war has forced retailers to pay more for pork to prevent the sector, already on its knees, from collapsing. Input costs are still relatively higher, but lower gas and oil prices are bringing fertiliser and diesel costs back down. For a more detailed analysis please read this article by my colleague Mark Topliff.

Talking Points

The food chain – Turnips v cucumbers

Some supermarkets are rationing the sale of tomatoes, cucumbers and other salad produce following a drop in supplies. Unfavourable weather in the key growing areas of Spain and Morocco is being blamed, but the shortages have also raised uncomfortable questions for the government. Brexit is, as ever, being fingered as a culprit with plenty of gloating images of overflowing EU supermarket shelves flooding Twitter. But a lack of support for the UK’s glasshouse industry is perhaps a more realistic target. High energy costs have forced growers to scale back production and a vertical farming project near Bedford, touted as one of Europe’s largest when it opened last June, has reportedly shut for the same reason. One of the few policy initiatives Ranil Jayawardena, Liz Truss’s short-lived Defra Secretary, had time to announce was a plan to boost hi-tech horticulture production. Acknowledging food production is a critical industry when it comes to energy policy would be a start. Instead, current Defra Secretary Thérèse Coffey chose to champion greater consumption of seasonal home-grown veg like turnips.

Veganism – Cambridge Uni goes animal free

As part of its bid to become more sustainable and mitigate climate change, the student union at Cambridge University has now voted to ban the sale of all animal-based products at university-run food outlets. The move follows 2016’s crack down on beef and lamb, but will not apply to individual colleges, which provide their own catering services.

Small abattoirs – Support announced

In a move that probably won’t find favour with the aforementioned students, Farming Minister Mark Spencer announced at last week’s NFU conference that the government is planning a series of funding measures to help the small abattoir sector, which has suffered a catastrophic decline over recent years. According to AHDB figures, 7% of England’s red meat abattoirs shut between 2019 and 2021. Echoing what farmers have been telling the government for years, Mr Spencer said small abattoirs help support local economies and benefit animal health and welfare.

Renewable energy – Planning reform for big schemes

Planning consent for large renewable energy projects could be granted more quickly following the government’s launch of its Action Plan for Nationally Significant Infrastructure Projects (NSIPs). The plan will apply to large energy, transport, water, wastewater and waste projects. The Government reckons it is possible to speed up the delivery of such projects without weakening environmental standards. Over the past 10 or so years there has been a 65% increase in the time taken for projects to go through the NSIP process. On average, an offshore wind project in the UK takes 12 years to deliver.

Out and about – The value of an elephant

Last Tuesday I attended a thought-provoking seminar on the value of natural capital hosted by Rebalance Earth, a provider of “high-integrity” nature credits that aims to boost biodiversity and mitigate climate change. Many of the presentations focused on the metrics and frameworks being employed to measure the value of nature and the damage being done to it by businesses. The message being that when you know the value of something it’s easier to develop finance-based solutions. Seagrass, for example, provides billions of dollars’ worth of carbon sequestration while a forest elephant’s contribution to climate change mitigation adds up to millions of dollars over its lifetime. The audience of enthusiastic fund managers, bankers and wealth managers loved the concept, but others who I’ve spoken to worry that reducing the value of nature to pounds and dollars will degrade what it supposedly seeks to protect. It would be interesting to know what you think.

Need to know

Biodiversity net gain – More details released

The UK government has released details confirming that developers will need to achieve a 10% biodiversity net gain (BNG) at all large domestic, commercial, and mixed-use sites from November 2023 and how the scheme will be implemented. BNG can be provided on-site, off-site or, as a last resort, through purchasing 'statutory credits'.

For land managers considering offering off-site solutions, Rachel Patch of Knight Frank's rural team welcomes the possibility of stacking credits. "Land managers will be able to sell both biodiversity units and nutrient credits from the same nature-based intervention, for example, the creation or enhancement of a wetland or a woodland on the same parcel of land."

Rachel also explains that "Natural England will set up a BNG credit scheme of last resort for developers, but the pricing will be intentionally uncompetitive. It will be interesting to see whether the credit price provides a ceiling for the private market."

If you are likely to be affected by BNG please get in touch. We will also be publishing a more detailed review of the implications soon.

Inheritance Tax – Treatment of environmental schemes

Talking of nature, a new update from the taxman confirms that land being used for environmental schemes could qualify for Business Property Relief if it constitutes part of a wider farming business.

Tree safety – Court case highlights dangers

Left to its own devices nature can be dangerous. A care home provider has been fined £400,000 after an eight-year-old girl was forced to have a leg amputated after part of a rotten lime tree fell on her while she was out jogging with her father. Bupa Care Homes pleaded guilty after it failed to provide a system to manage trees on its site at Oak Lodge Care Home in Bitterne, Southampton.

“This highlights the importance of fulfilling the duty to have a proper tree safety management plan in place on farms and estates, especially where trees are close to roads or footpaths and with the prevalence of ash dieback,” points out my Rural Consultancy colleague Freddie Sandercock.

Compulsory purchase – Help reform the system

The Law Commission, which advises on law reform, has just announced it will review the legislation governing compulsory purchase to make the law "simpler, consistent and more accessible". The review, which will examine the technical laws concerning the procedures governing the acquisition of land through compulsory purchase orders and the system for assessing the compensation awarded to parties, marks the first time the commission has considered compulsory purchase powers since 2004.

If you would like to feed in any comments to the review please get in touch with Tim Broomhead in our Compulsory Purchase team. “As all the trials and tribulations surrounding the claims of our clients affected by HS2 reveal, the law is in desperate need of reform,” says Tim.

Knight Frank Research

The Wealth Report – 2023 edition out this week

Knight Frank’s leading piece of thought leadership on property and wealth trends is out this week and includes an interview by me with one of Scotland’s pioneering rewilders, as well as some thoughts on why farmland could be one of this year’s most in demand property investments. Register for the global launch event on Wednesday to find out more.

Farmland Index – Agricultural land top-performing asset in 2022

As predicted, the latest results of the Knight Frank Farmland Index show that agricultural land as an investment beat inflation in 2022 and outperformed other asset classes, including mainstream house prices, luxury London house prices, the FTSE 100 share index and even gold. According to our index the average value of farmland rose by 13% over the year to hit over £21,000/ha, a record high. A shortage of supply and continued strong demand from a wide range of buyers underpinned the market. Download the full report for more facts and figures.

You can also hear some thoughts from my colleagues and me on the outlook for property markets in 2023 in the latest edition of Intelligence Talks, our research podcast.

Estate Staff Salaries Survey – Rural wages benchmarked

Just a reminder that the latest edition of the Knight Frank Estate Staff Salary Survey has recently been published. The report reveals the average salaries paid for a wide range of rural estate and farming roles and level of wage increases being offered by rural businesses. Also highlighted are the key employment issues facing the rural economy. Download your copy here or get in touch with Chris Terrett for more details.

On the market

Kiwi orchard up for grabs

The impact of Cyclone Gabrielle, which ripped through North Island , is set to make a severe dent in the food-producing capacity of New Zealand, according to our man on the ground Nick Hawken, who heads up the rural team at Knight Frank associate Bayley’s. The Hawkes Bay area was particularly hard hit, reports Nick. However, his team has still managed to launch a fantastic 31-hectare kiwi-farming opportunity near Ōpōtiki in the eastern Bay of Plenty. Guide price is NZ$21 million reflecting the profitability of kiwi production.

Photo by nrd on Unsplash