Buyers trim budgets rather than abandon purchases

UK regional market goes through period of adjustment as mortgage rates rise.

3 minutes to read

Buyers in UK regional property markets have responded to the recent rise in borrowing costs by realigning their budgets, rather than abandoning purchases.

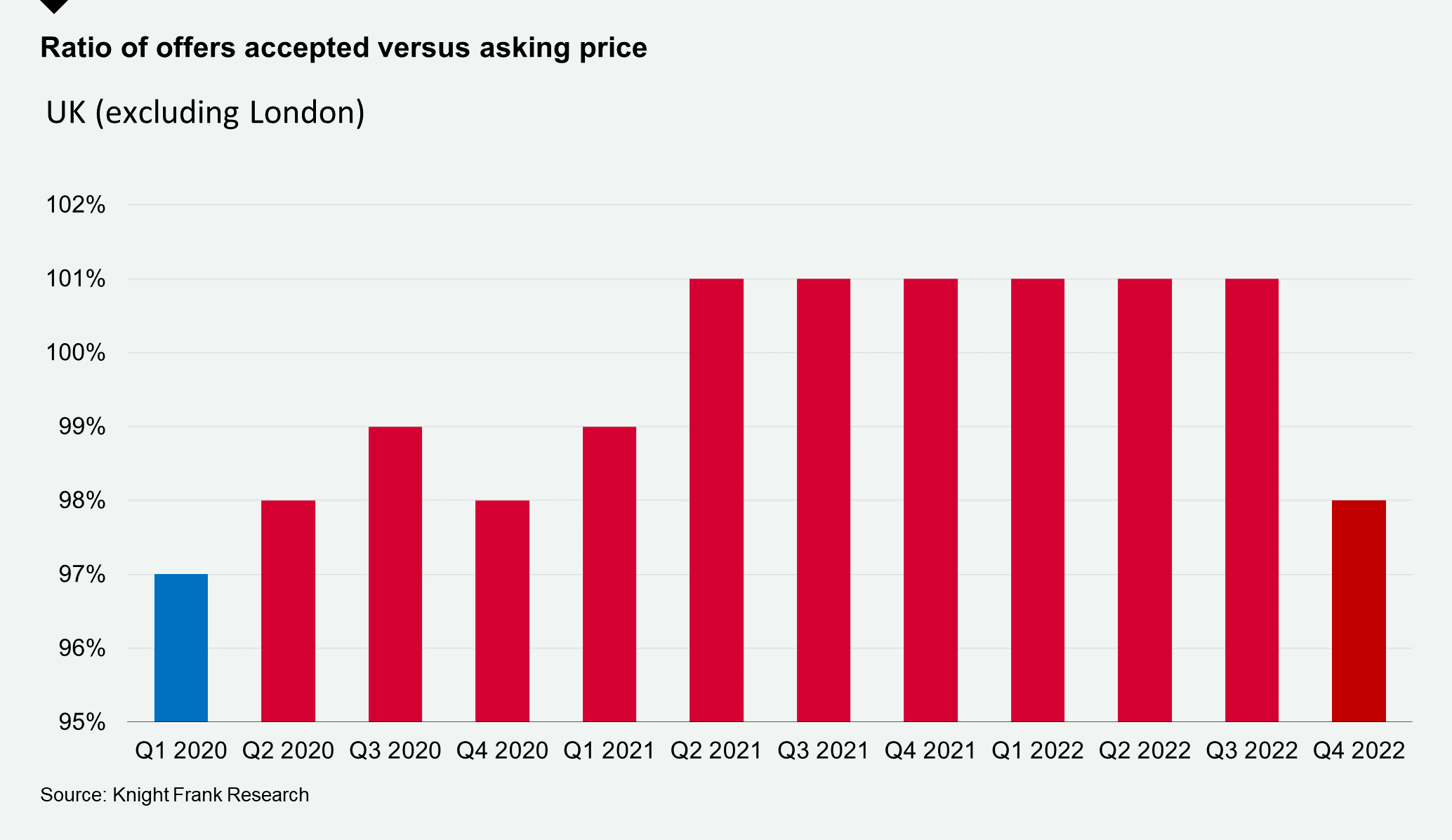

An analysis of Q4 data (which excludes London) found that offers were accepted on average at 98% of the asking price in the fourth quarter of 2022. The figure was last lower in the first quarter of 2020 (97%), just as the pandemic began. Offers have since regularly exceeded the asking price during the so-called race for space.

At the same time, the number of offers accepted and exchanges were both in line with the five-year average in the final quarter of last year.

“We saw a few fall throughs due to funding, but mainly it’s been about adjusting to new circumstances,” said James Toogood, office head at Knight Frank Bristol. “One customer that missed out on a £1.5m home in the summer returned in the autumn searching around the £1.1m mark. Another client is progressing with their purchase but has decided to halve the size of their mortgage.”

“The realignment has also seen some super-prime buyers looking to purchase more manageable homes, which is supporting demand,” said Damian Gray, head of the central region at Knight Frank.

“Whilst the trophy houses are still in demand, we have also seen buyers increase their search areas to stretch their budgets further and make the most of hybrid working,” Damian added.

While buyers remain in the market, those in higher price brackets have more flexibility.

Our latest sentiment survey found that increased borrowing costs had negatively affected the spending power of 41% of those surveyed. However, it also highlighted that cash and equity-rich buyers are aware of the stronger hand they will have in the housing market this year.

The number of cash buyers in prime regional markets outside London was 40% in 2022 compared with 28% in the mainstream market. Above £2m, the percentage of cash buyers was more than half (54%) and at £5m+ more than three-quarters (77%).

New prospective buyers were down 7% outside London in December versus the five-year average (excluding 2020). However, in higher value bands they were up by 39% (£2m to £5m) and by 48% (£5m to £10m).

Market valuation appraisals, a leading indicator of supply, show a similar pattern. The number of appraisals was down overall outside London by 5% in December versus the five-year average (excluding 2020). However, in higher value bands they were up 46% (£2m to £5m) and 19% (£5m to £10m).

Buyers realign ambitions

The mortgage market has been in a state of flux since September’s mini-Budget prompted a leap in rates of around 150 basis points. Although rates are now edging back down, the implications of which for borrowers we look at detail in here, the bank rate is heading in the opposite direction in a bid to counter double-digit inflation. As a result, the era of cheap debt following the financial crisis is over.

The impact of higher borrowing has been blunted by the high proportion of fixed rate mortgages issued in the UK. However, the ONS has calculated that more than 1.4 million households with deals that end in 2023 will face interest rate rises when they renew.

It means the period of adjustment will last beyond 2023 and buyers will be increasing price sensitive. This combined with other cost of living pressures is why we expect house prices to fall by 5% this year in prime regional markets.

However, the higher proportion of cash and equity-rich buyers combined with tight supply will insulate prime regional markets against larger falls.

The amount of property available for sale outside of London has been gradually increasing since last May but was 7% lower in the 12 months to December than a year ago.

Subscribe for more

For more market-leading research, expert opinions and forecasts, sign up to our newsletters below.

Subscribe here