Aspen prices rise as stock levels tumble

Sales slowed in 2022 after the high transaction volumes witnessed during the pandemic years.

1 minute to read

Key findings

Prime property in Aspen has been in high demand since the pandemic, resulting in a continued shortage of stock. The number of new listings declined from 173 in Q3 2020 to 75 in Q3 2022.

This lack of inventory has pushed transactions down, with 135 sales agreed in the first ten months of 2022, less than half of the 325 sales recorded throughout 2021.

This is a further reflection of the wider market readjustments as Colorado’s property sector returns to a more sustainable rate, following strong sales volumes during the pandemic.

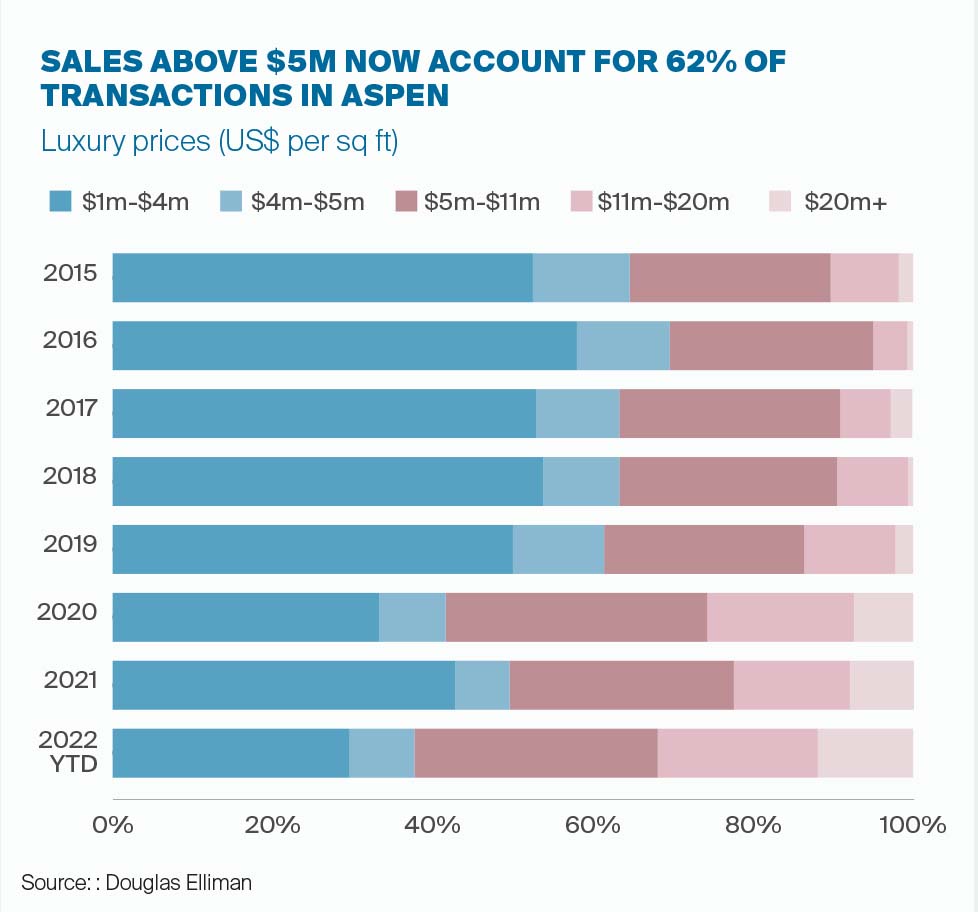

Due to the sustained lack of stock, prices remain robust, and off-market sales have increased. Over 62% of Aspen sales were above US$5 million in the first ten months of 2022, up from 39% in 2019, prior to the pandemic.

US domestic buyers continue to show interest in Aspen, with the prominent economic headwinds failing to deter those looking to enjoy the perks of alpine living. Douglas Elliman, Knight Frank’s partner in the US, currently have over 35 properties pending between US$10 – US$30 million, all of which have been agreed since the Federal Reserve started raising interest rates in March 2022.

Snowmass

The lack of stock and rising prices in Aspen has enhanced interest in neighbouring destinations such as Snowmass and Basalt. Snowmass resort provides a wider range of affordable properties while still providing the benefits of alpine living. Here, over 59% of properties sold in the first nine months of 2022 were below US$4 million. This provides buyers with a more affordable solution, just nine miles from the centre of Aspen.

Download the report here

Subscribe to our ski property research