The uprising of downsizing

Making sense of the latest trends in property and economics from around the globe.

5 minutes to read

Global house prices

The global slowdown in house prices is taking longer to materialise than we envisaged.

Forty-eight of the 56 countries and territories tracked by our Global House Price Index are still registering price growth on an annual basis. The index rose 8.8% during the year to Q3, down from the 10.9% peak in Q1 2022. In real terms, when accounting for inflation, house prices are now declining by 0.3% year-on-year.

Turkey leads the board but its phenomenal growth can largely be discounted due to rampant inflation. Northern and Central European markets continue to perform strongly with Estonia, Hungary, the Czech Republic, Iceland, Slovakia, North Macedonia and Latvia all registering annual price growth above 16%. Markets that have seen the largest jump in interest rates are sliding down the rankings. Canada has moved from 10th to 34th place. Australia has moved from 28th to 47th. Kate Everett-Allen has more.

Average UK house prices declined 2.3% in November, extending declines of 0.4% during October, according to Halifax data out this morning. That narrows annual growth to 4.7%, from 8.2% last month.

Urban house prices

Urban house prices have outperformed in recent quarters, though annual growth has now fallen below 10% for the first time since Q1 2021. Some 133 of the 150 cities tracked by the index recorded positive annual price growth in the year to Q3 2022, down only marginally from 138 last quarter.

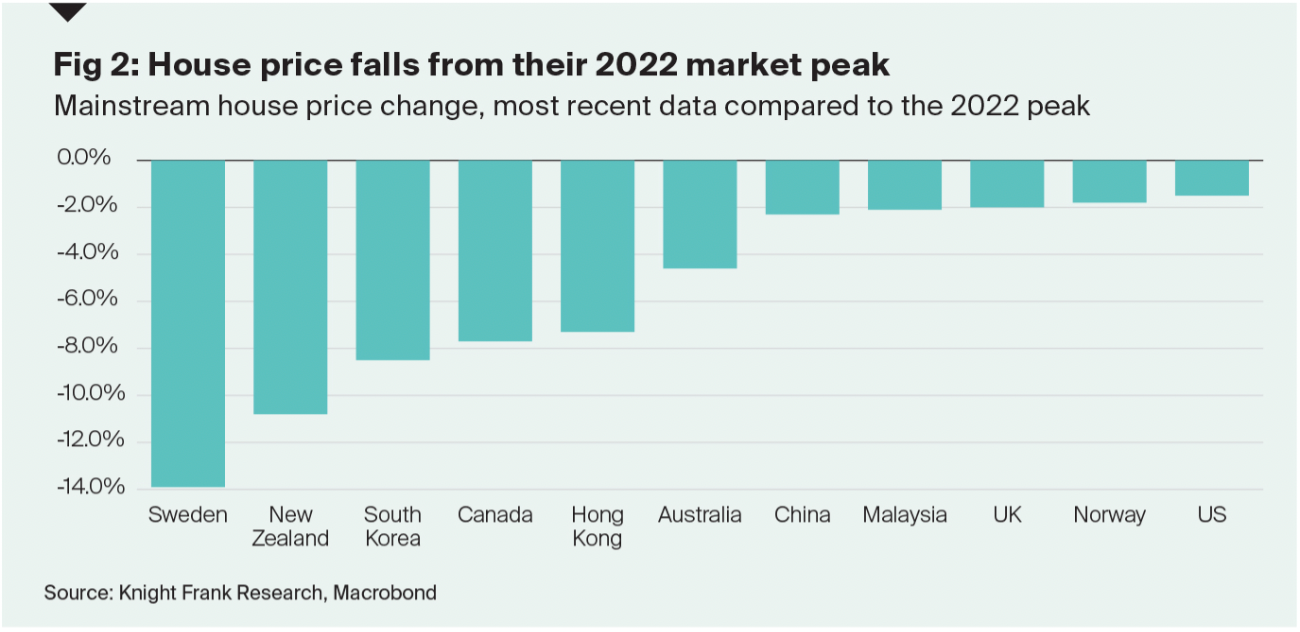

Cities in New Zealand, China and Australia are well represented on the list of cities with the largest declines. Central banks in New Zealand and Australia have now implemented nine and eight rate rises respectively since the pandemic. Wellington (-17%), Hamilton (-14%), Auckland (-13%) and Toronto (-11%) have seen the largest decline in house prices since their 2022 peak, with Canadian cities occupying five of the ten rankings (see chart). Kate has more here.

The Bank of Canada is set to deliver a seventh consecutive rate hike at its meeting today, bringing the key rate to at least 4%. The Bank is likely to indicate that its cycle of hikes is nearing an end - economists surveyed by Bloomberg expect a peak of 4.25%.

Construction slows

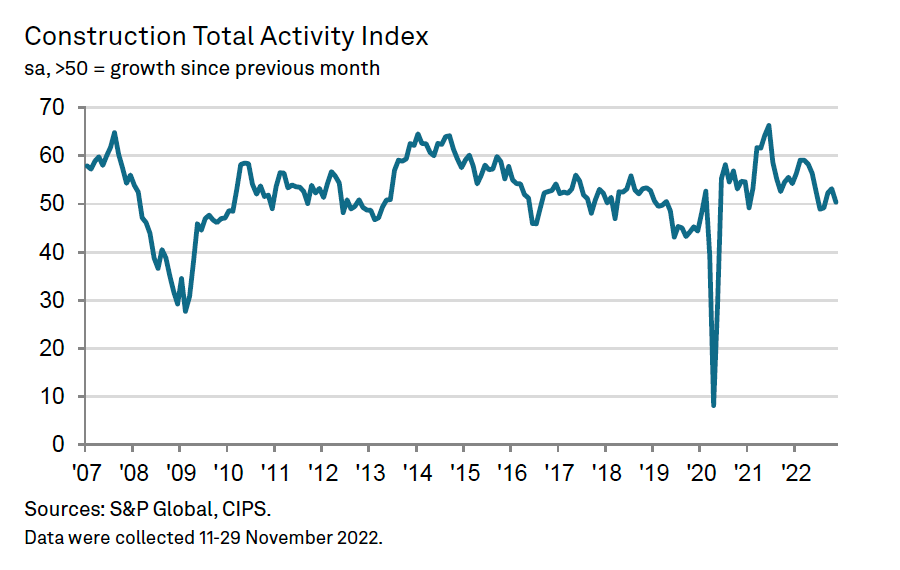

Slowing demand, reduced appetite for risk, higher borrowing costs and worries about the economic outlook are weighing on construction activity. The S&PGlobal / CIPS UK Construction Purchasing Managers’ Index - a key metric of industry activity - registered 50.4 during November, just above the 50 reading that signals neither growth nor contraction.

That's the weakest performance since August, but not too bad considering the circumstances. Approximately 29% of the survey panel anticipates a rise in business activity in 12 months' time, while 26% forecast a decline, which is the lowest degree of confidence since May 2020.

Employment numbers continued to increase in November, but the rate of job creation eased to its slowest since February 2021. Concerns about rising costs and weaker growth has resulted in more cautious hiring policies. The rate of input cost inflation eased to its least marked since January 2021, partly due to softer commodity prices.

"Advisory" housing

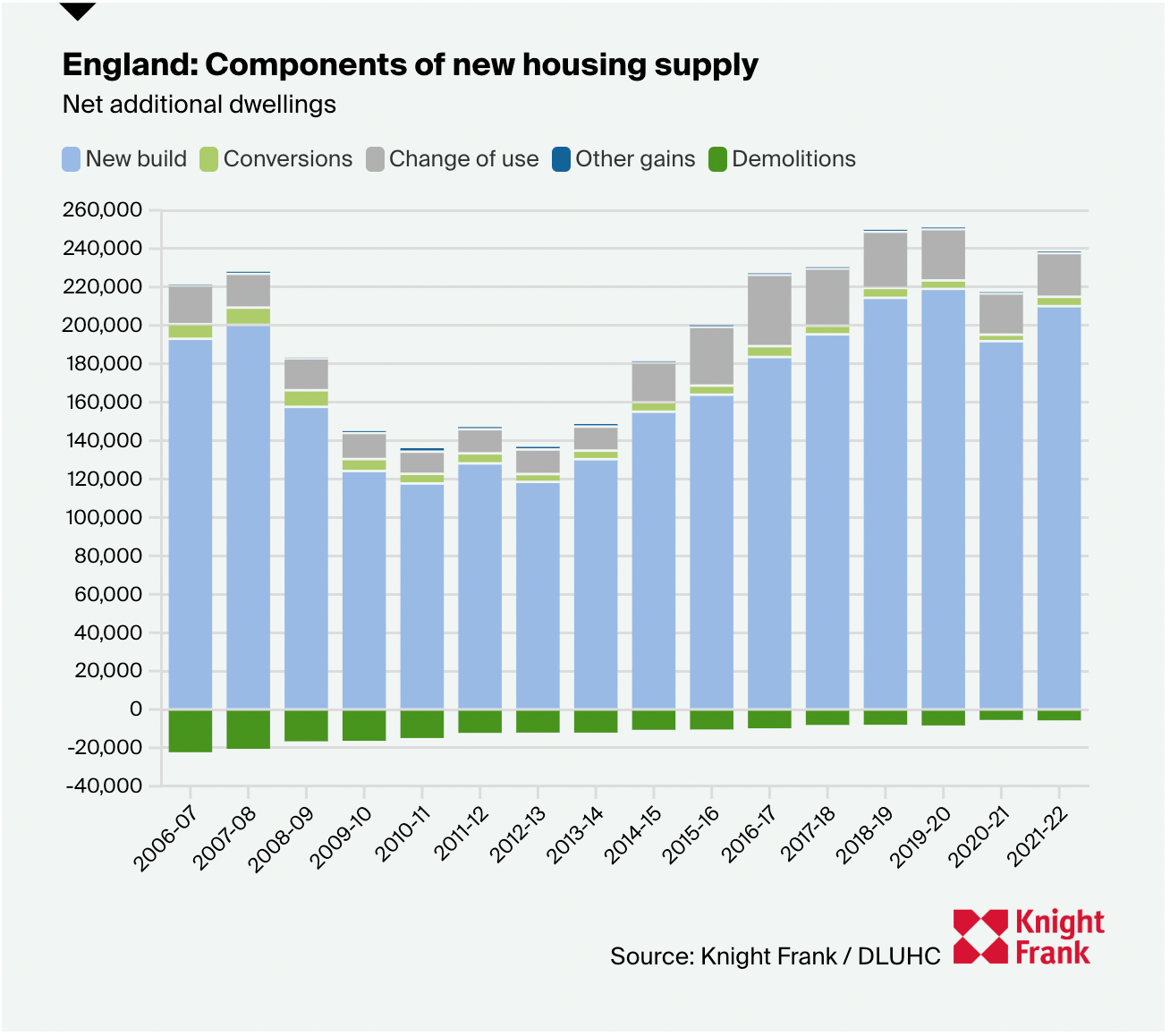

Plans to impose mandatory housing targets have been scrapped in the face of a growing Conservative backbench rebellion. The government will instead publish an amended method for calculating local housing need which will be “advisory”, according to a letter from Michael Gove to MPs. Simon Ricketts of Town Legal has a good summary here:

"Circumstances [by which local authorities can plan for fewer homes] are now to be widened, in ways which are more subjective, eg relying on perceived capacity constraints based on “the character of an area” (the letter to MPs gives the example of for instance “new blocks of high-rise flats which are entirely inappropriate in a low-rise neighbourhood” and talks of the need for “gentle densities”). It will be open season for authorities and/or local campaigners to press the case for lower numbers to be adopted and/or for the required proportion of affordable housing to be set at such a financially onerous level that in practice chokes off the prospect of development."

In total, 232,820 net additional dwellings were added to England’s housing stock in the year to March 2022, the data from the Department of Levelling Up, Housing and Communities (DLUHC) revealed last month (see chart). That represented a 10% rebound from the pandemic-affected low last year, but not quite back to the pre-Covid peak of 243,000.

Downsizing

The number of people looking to downsize has jumped by a third in the past year, according to Knight Frank data.

There could be a few reasons, the largest of which is likely to be early retirees. An ONS study released earlier this year examining the increase in economic inactivity of people over 50 since the pandemic found that the most common reason was retirement. Amongst those that had left employment since the pandemic, 63% felt they had done so sooner than they were expecting.

A meaningful number of downsizers are likely to be capitalising on several years of strong house price growth too. Chris Druce has more.

In other news....

The pandemic provided an opportunity for the UK hotel sector to reset, with strong growth and recovery in trading performance returning in 2022. Philippa Goldstein looks at the key trends.

Stephen Springham on the folly of Black Friday.

Elsewhere - NYC’s Silverstein to raise $1.5 billion for office-to-housing push (Bloomberg), LA ‘Megamansion’ levy to raise as much as $1.1 billion annually (Bloomberg), and finally, UK government to ease ban on onshore wind farms (Reuters).