A record year for Ski property

Making sense of the latest trends in property and economics from around the globe.

3 minutes to read

Energy prices

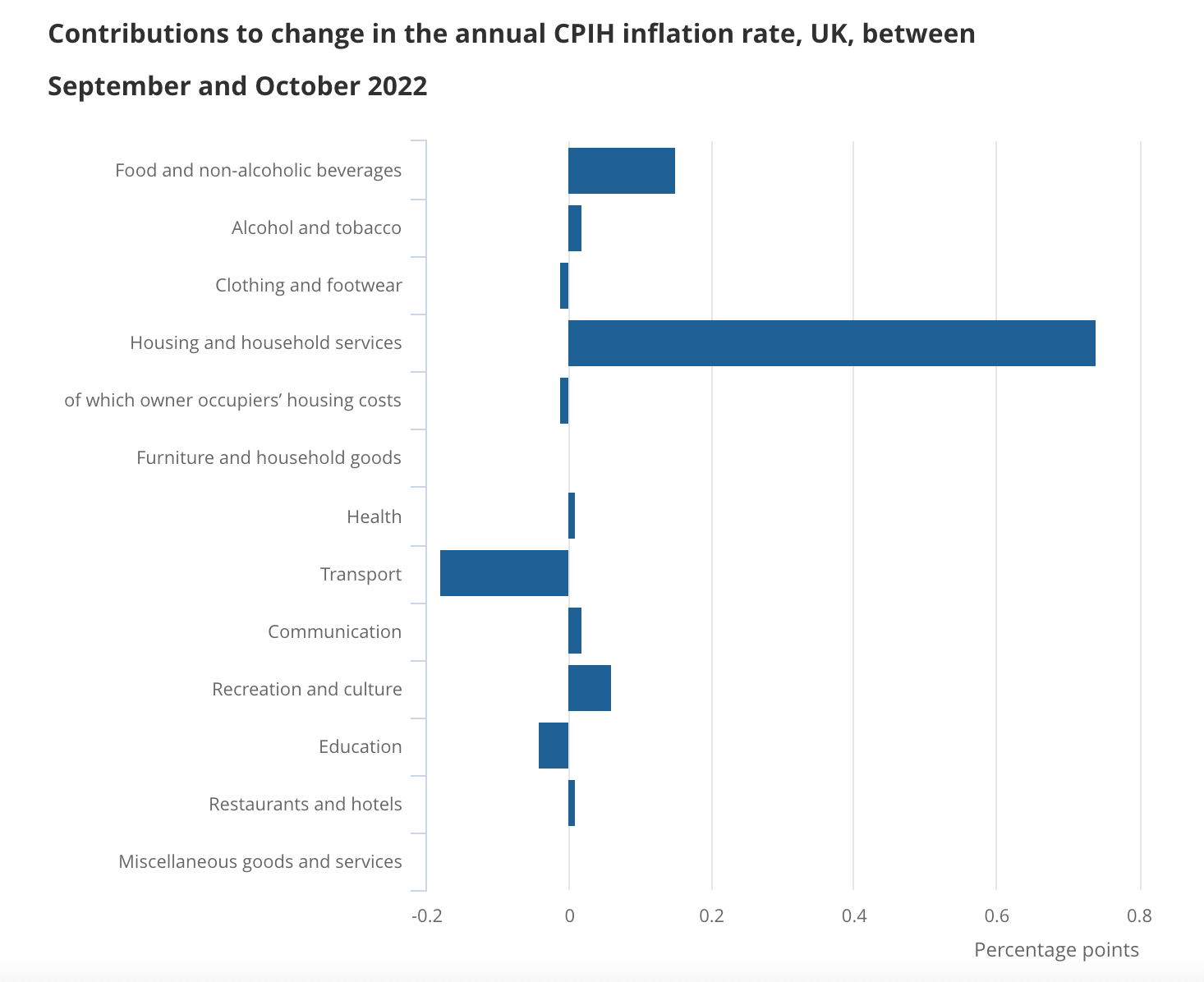

The consumer price index climbed 11.1% in the year to October, up from 10.1% in September, according to ONS data out this morning. That's higher than consensus among economists and Bank of England forecasts.

Rising energy prices are largely to blame - see the "housing and household services" bar on the chart below - though food costs also rose substantially.

It's hard to know where that leaves Bank of England rate setters. The rest of the data looks pretty benign and inflationary pressures are clearly easing across a range of key sectors. We'll know what markets think when interest rate futures start trading so we'll return to it on Friday.

Ski property

The pandemic might have disrupted three consecutive ski seasons but the subsequent surge in demand for a mountainside base is undeniable.

The move to hybrid working, a rekindled love of the great outdoors and heightened interest in wellbeing have all fuelled demand, pushing this year's Sky Property Index up 5.8% in the most recent twelve months, the strongest rate of growth for eight years. That rate of growth is unlikely to be repeated during the short term amid rising mortgage and energy costs.

One in four ski home buyers are now seeking either a second home or co-primary property entirely for their own personal use, with no plans to rent their property. The Swiss resorts of Crans-Montana and St Moritz lead our index, both registering an annual increase of 14% in the year to June 2022. Both resorts offer year-round appeal, long ski seasons and good transport links.

Kate Everett-Allen has more.

Prime London lettings

Average rents rose by 17.8% in prime central London (PCL) and 15.4% in prime outer London (POL) in the year to October as demand continues to outstrip supply.

A supply shortage has been a feature of the market since the second quarter of 2021 as landlords sold to take advantage of the strong sales market and more property reverted to the short-let market as Covid restrictions were relaxed. The number of new prospective tenants was 60% above the five-year average (excluding 2020) in October while new listings were down by about a third.

However, as the outlook for the sales market becomes more uncertain, there are early signs that the supply of lettings stock is increasing, a trend confined so far to higher-value properties. These are often more discretionary sellers who can sit out periods of economic volatility by letting their property.

Market valuation appraisals are a good leading indicator of supply and for properties valued between £1,000 and £5,000 per week, the number was 17% higher in October than it was in January. “My sense is that we are approaching the end of the period where supply and demand are completely out of step,” says David Mumby, head of prime central London lettings at Knight Frank. See the piece from Tom Bill for more.

Diversification

Investors committed more than £2 billion to the UK Seniors Housing market in the first nine months of 2022, already surpassing the full year figure for 2021, according Knight Frank's Seniors Housing Annual Review 2022/23.

The sector is weathering economic pressures due to a clamour for diversification among investors. Our latest residential investment survey representing the views of 54 institutional investors (including student and BTR) revealed that only 31% are currently active in the seniors housing sector, while 67% expect to be active in five years.

We expect to see yield compression for investors in the medium term driven by increased investment, the expansion of the sector, as well as maturing operational businesses. Investors who can deliver on strong development pipelines are likely to benefit from first mover advantage in the race to scale.

In other news...

British Land half year results (Investegate), Landsec half year results (Investegate), optimism builds for China's property sector (FT), and finally, JPMorgan forms JV for $1 billion in US rental homes (Bloomberg).