60 Second Property Digest – Inflation impact on UK logistics sector

Claire Williams, partner, commercial research, looks at how operators can stay competitive as inflation continues to impact logistics sector.

5 minutes to read

Inflationary pressures to widen the gap between prime and secondary logistics facilities and locations

For operators, inflationary pressures mean that the location and specification of logistics facilities are now of heightened importance. Rises in transportation and fuel costs have a disproportionately large impact on the logistics sector, they typically account for more than half (55%) of logistics firms’ operational costs. Petrol prices were up 30% year on year (ONS, September 2022).

Some firms also have highly automated facilities, and large warehouses can be expensive to heat or cool. Energy prices have also risen sharply over the past year.

Between Q2 2021 and Q2 2022, the average electricity price (excluding the Climate Change Levy) in the non-domestic sector rose 45% on average, while those consuming large amounts of electricity saw prices rise even further, with the top consumption bands recording increases of 48-55% (ONS). While the Energy Bill Relief Scheme, announced in September is now providing businesses with some support. However, it is for an initial period of just six months and businesses face uncertainty around energy costs from April 2023.

Well-located, energy-efficient facilities that can help firms mitigate costs will be key to maximising efficiencies. Logistics operators with less efficient facilities, or in secondary locations may find it increasingly difficult to manage costs and operate competitively.

Logistics property as an inflation hedge?

For investors, logistics as with other property sectors should provide a good hedge against inflation over the long term, as the income return should keep up with the nominal rate of inflation.

Most industrial leases are either subject to open-market rent reviews or are pegged to inflation.

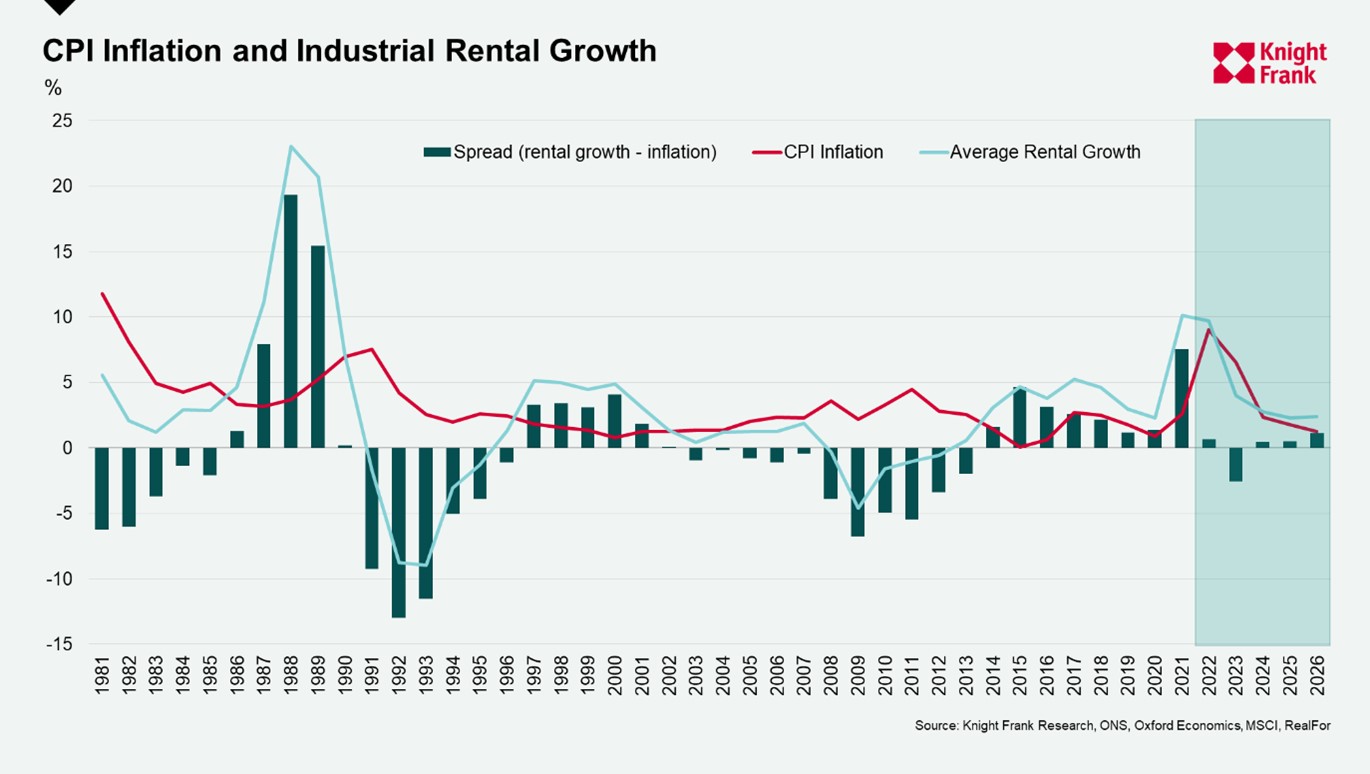

Over the past few years, rental growth has outperformed inflation. In 2021, average rental growth was 10.1% (MSCI) compared with CPI inflation of just 2.6% (ONS), in 2022 average rental growth is forecast to reach 9.7% (RealFor), while CPI inflation is expected to be 9.1% (Oxford Economics).

Rental growth is correlated to economic growth or GDP but is less closely linked to inflation. While there is a cyclical pattern of economic growth and inflation as well as rental growth, the strong performance and rental growth in the industrial sector have also been driven by structural changes in the retail market rather than cyclical trends.

For leases that are pegged to inflation (or index-linked), there is typically a “cap and collar” mechanism, to set a maximum and minimum increase on each review. The rate of inflation is presently at a forty-year high; the annual CPI inflation rate was 10.1% in September 2022 (ONS).

However, most index-linked rent reviews have rent rises capped well below this level. Therefore, in the short term, income returns (with indexation) are unlikely to keep pace with inflation.

Over the long term, industrial rental growth has been shown to outpace inflation and open market rent reviews could therefore offer an effective hedge against inflation.

Between 2012 and 2021, annual rental growth has averaged 3.7% per annum (MSCI), compared with CPI inflation of 1.8% (ONS).

However, while rental growth forecasts remain robust (averaging 2.9% per annum 2023-2026 across the UK), rates of increase will vary and some facilities and locations are likely to see rental growth fall short of inflation over the next few years.

Oxford Economics forecasts annual CPI inflation of 3.0% (2023-2026). The choice of facilities and location will therefore be increasingly important for occupiers and investors alike as they look to protect income from inflation.

Interest rates and corporate debt

With the Bank of England now actively raising interest rates to combat inflation, companies and investors seeking to refinance their debt in the next year face paying higher interest coupons.

Highly leveraged firms may struggle to service rising debt costs, particularly as order books weaken on the back of softening consumer sentiment. The last decade of ultra-low interest rates has encouraged many firms to use more debt.

Higher interest rates, along with tightening credit conditions and reduced liquidity will amplify any existing pockets of distress in the occupier market. This will be compounded as economic growth eases.

Development stymied by construction cost inflation

Demand for space has driven down vacancy rates. Just 3.1% of built stock is currently vacant, and occupier competition for space continues to drive rental growth.

While supply chain issues and materials shortages have eased, high construction costs persist and along with increased funding costs, are capping the developer response, and a relatively limited supply of new facilities will cushion the risk of voids as economic growth slows.

Construction cost inflation is having a deflationary effect on land values. Construction costs have been rising for the past couple of years, on the back of material shortages, supply chain issues and higher shipping costs.

Despite this, land values have also increased over this period due to strong rental and capital growth. However, over the last two quarters (since Q1 2022), yields have softened and capital growth expectations have been revised down.

Over the past six months, the increases in construction costs have not been offset by the forecast growth in rents and capital values, and land values have decreased as a result.

Weaker, secondary locations, may fall below the development viability threshold. Higher construction costs mean that development in some locations is now less viable, with expected end values not high enough to justify the higher construction and financing costs.

A softening in occupier demand could drive up void rates or incentives and secondary locations are likely to be impacted most and with lower capital values, less able to absorb this loss of expected income.

Developers will therefore need to be more selective in terms of location and ensure that they are building assets that meet occupier requirements in terms of specification.

Sign up for more

Get exclusive market analysis, news and data from our research team, straight to your inbox.