The Bank of England is worried about mortgage rates

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Projections

The Bank of England executed its widely-anticipated 75bps hike yesterday to bring the base rate to 3%. It also forecasted eight successive quarters of economic contractions with unemployment doubling to 6.5%, none of which it believes will actually happen.

The Bank's central projection is based on the two-week-old market-implied path of interest rates, which had a peak of 5.25% in 2023. The commentary published alongside the decision makes it clear that officials believe that was too high. Markets have since been drip fed details of the government's demand-crushing austerity package and those bets have come down to around 4.5% - 4.75%. Even that is too high, Bank Governor Andrew Bailey told reporters yesterday.

To hammer home the point, the Bank published a separate projection showing that, even if the base rate were to remain at 3%, inflation would fall back to the 2% target by 2024 and even undershoot that the following year. But that's not going to happen either - the Bank explicitly states that it thinks interest rates will need to rise further.

Mortgage rates

What are we to make of that? Well, the reality is probably somewhere in the middle and we'll know more after the government's fiscal statement on November 17th. This was clearly an effort to bring down the market's expectations of peak interest rates, which should mean lower mortgage rates in the weeks ahead - Mr Bailey definitely isn't happy about the current pricing of fixed rate mortgages.

Simon Gammon of Knight Frank Finance considers what's likely to happen next and offers a couple of strategies to borrowers. Many fixed rate products sit somewhere between 5.5% and 6%, which is a large spread over the base rate. More stability will mean more borrowers accessing fixed rate products starting with a four - still high by recent norms but some way off the worst case scenarios of the past month.

“I think the most likely thing is that we see longer-term interest rates moderate," says one senior banking executive quoted by the FT. "In time it will hopefully bring mortgage interest rates down a bit — but it will take a while for it to filter through and for expectations to shift.”

Should conditions continue as they are, we’d expect the appeal of tracker products to erode steadily. Before today’s decision tracker rates sat at about 3.5%, which is appealing relative to fixed rates. Today’s hike should see those move to about 4.25%. It’s entirely possible that the two come closer together during the months ahead – we may even see moments at which tracker products are more expensive than some fixed products. See the piece at Knight Frank Finance for more on that.

Higher but slower

The Federal Reserve on Wednesday gave us the same sized rise in the key interest rate but with a slightly inverted message.

After four consecutive 75bps hikes, the federal funds rate now has a target range of 3.75%-4%. More hikes are coming and rates will likely need to move higher than markets are currently pricing, the Fed's Jerome Powell said. However, the size of the increases may slow during the months ahead as the Fed digests the impacts of its actions so far - there is general consensus that the real world impacts of rate hikes have about a twelve month time lag.

Jobs market data due out later today is likely to show the labour market cooling for a third consecutive month. The housing market is cooling rapidly - see last Wednesday's note for more on that.

The week has illustrated the difficulties central bankers are having communicating their intentions while economic conditions are evolving rapidly. To get a better feel for how global investors are digesting it all - specifically from a commercial property perspective - I spoke with Will Matthews, Knight Frank's head of commercial research, and Simon Marx, research head at Lothbury Investment Management. You can listen to the twenty minute conversation here, or wherever you get your podcasts.

Construction slows

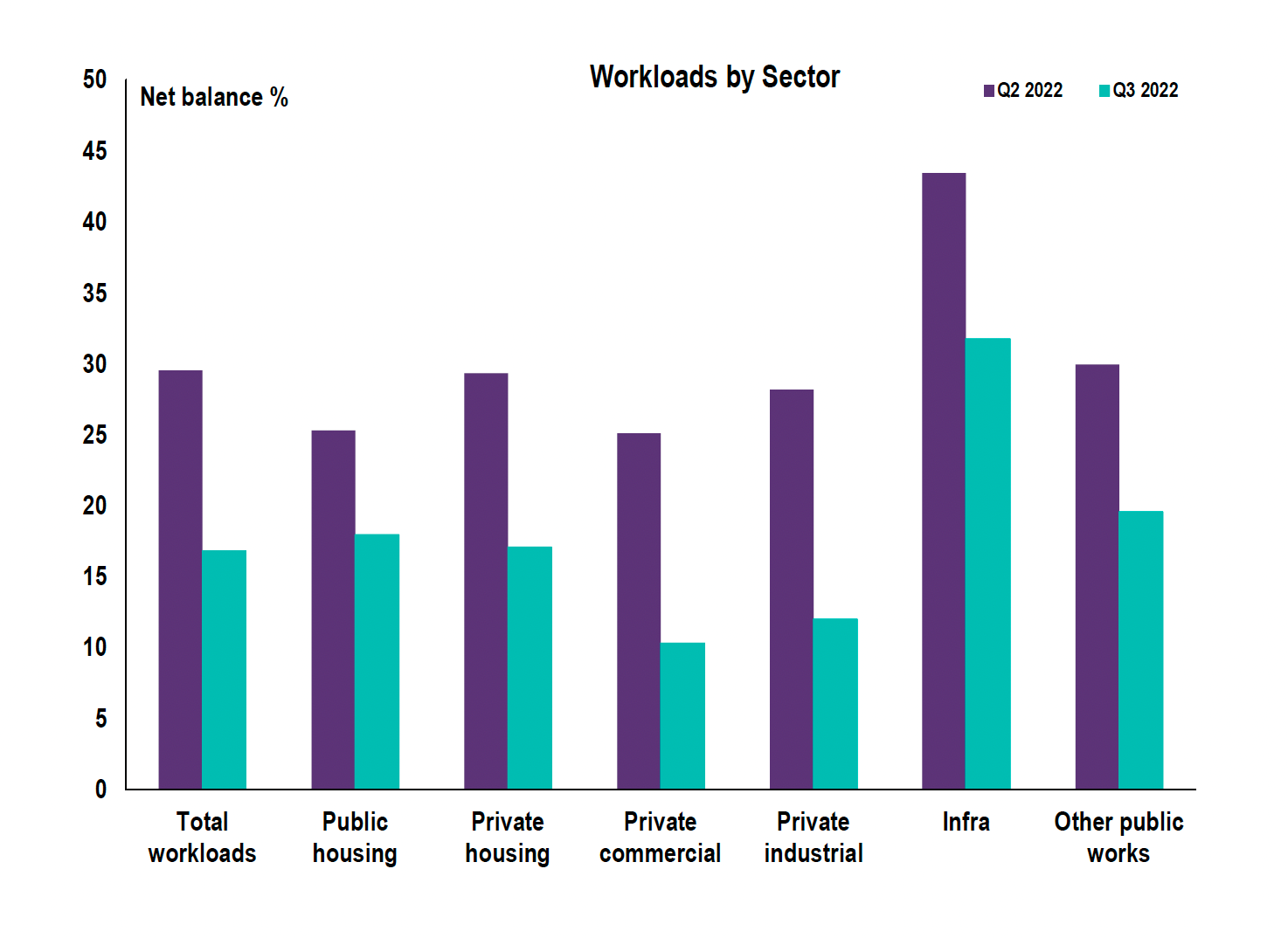

The momentum of UK construction slowed markedly during Q3, according to the latest RICS monitor. A net balance of +17% of respondents reporting an increase, compared to +30% in the previous three month period - see charts below.

Shortages in materials and labour continue to weigh on activity, but there is now greater concern about how the macro outlook will impact the industry, "specifically with respect to credit constraints," the report said.

Officials figures released Wednesday showed that construction materials price inflation was running at an annual rate of 16.7% in September, a third consecutive fall from the peak of 26.8% in June.

In other news...

The latest edition of the London Review, our quarterly publication providing a detailed analysis of the prime central London sales and lettings markets, is out now.

Madrid emerges as a top logistics location. Rosa Uriol parses the data.

Elsewhere - The reimagining of Canary Wharf (FT).