UK retail: braced but battle-hardened

Consumer demand – a mixed rather than definitively bad picture.

4 minutes to read

The well-documented cost-of-living crisis will only start to really bite in Q4 2022. But the picture will be anything but as black and white as the media are depicting, with a myriad of moving parts and considerable nuances.

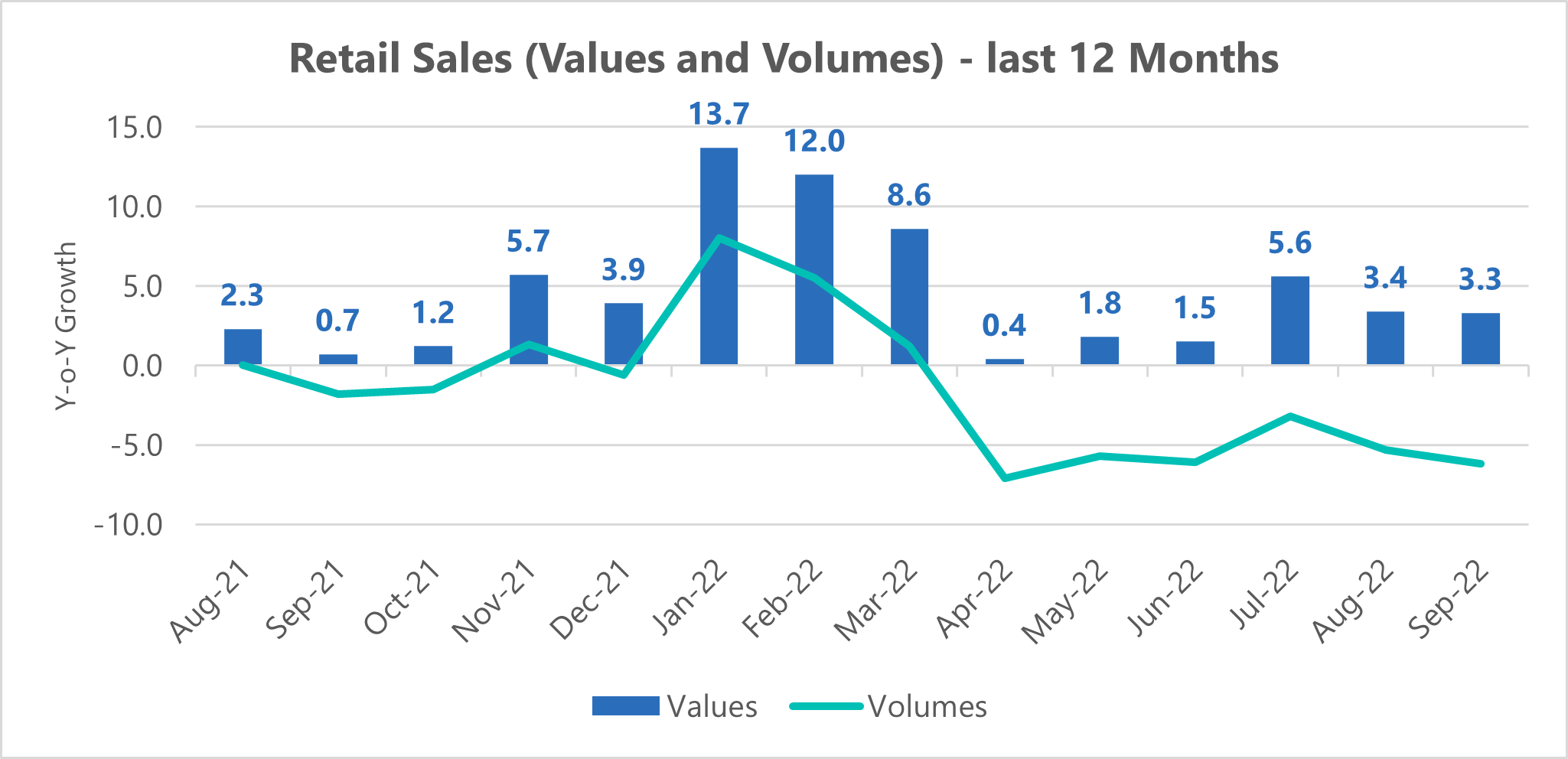

First and foremost, overall retail sales will not simply collapse – retail sales values actually grew year on year (y-o-y) by +4.0% in Q3 2022 and we expect a broadly comparable (if anything, slightly better) performance over the final quarter of the year.

Best ignore the lazy “worst Christmas ever” headlines that have already been written by the media.

Inflation effects

But the negative effects of inflation are also hard to ignore. Retail sales volumes were down -4.7% in Q3 and this trend is unlikely to reverse in Q4 (or until inflation tangibly eases).

Effectively, this means that consumers are tightening their belts in so far as they are buying fewer products, but are still spending more money.

Although far from ideal, this is infinitely more palatable for the retail industry than the situation during Covid when we were in the unprecedented position of both values and volumes collapsing (e.g. Q2 2022 values -7.9%, volumes -12.4%).

This is the perspective that is sadly lacking – challenging as the current economic and political backdrop is, it does not compare with what the retail sector had to endure during the pandemic. Unwelcome as it may be, high inflation is a manageable force; enforced lockdowns were not.

Source: ONS, Knight Frank

Are retail sales really lower than pre-Covid?

Retail Sales Dashboard - September 2022

Occupier markets – on the defensive rather than on the ropes

Occupational markets have stabilised solidly over the last 18 months and this process is ongoing.

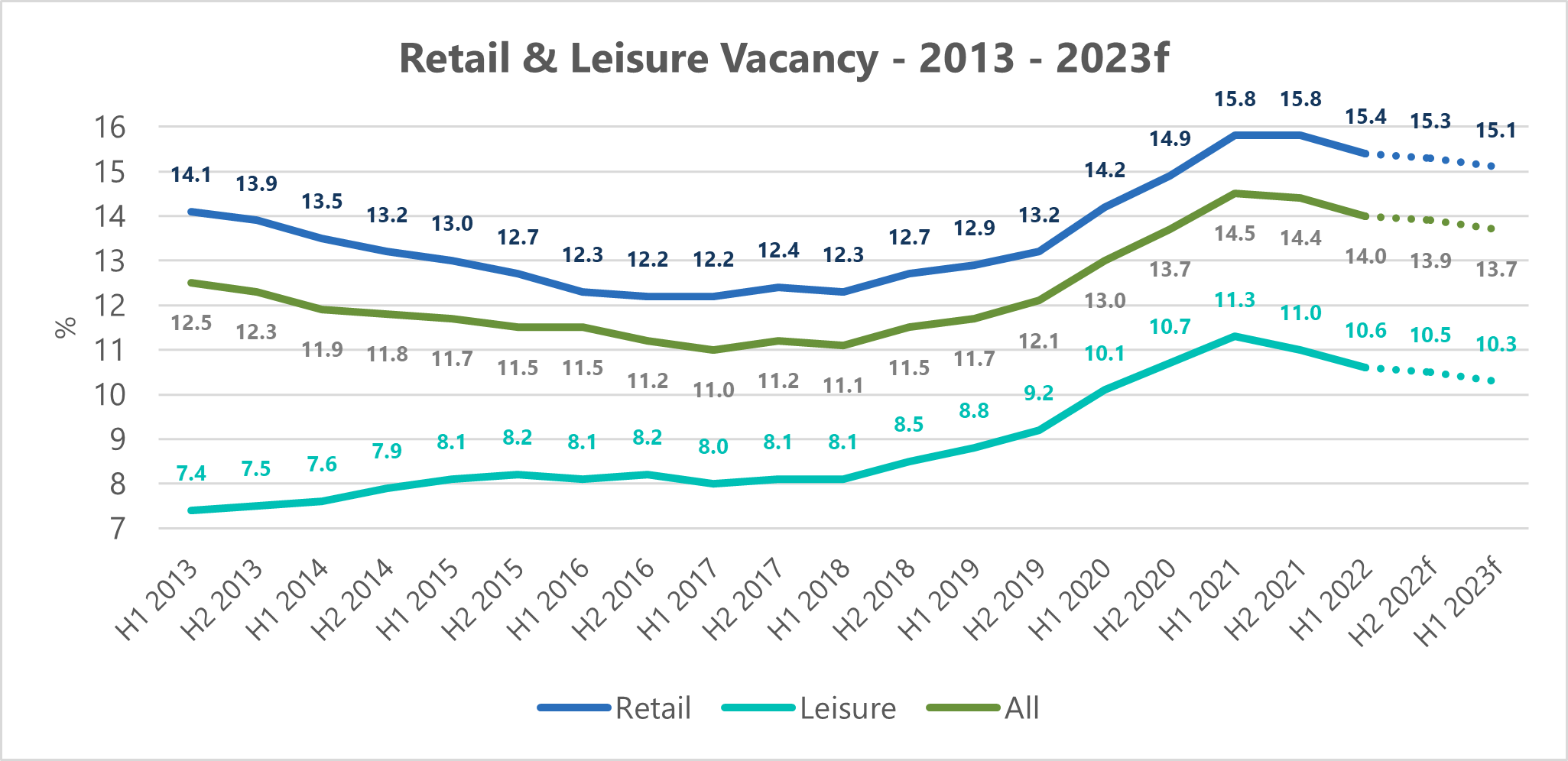

This is reflected in positive trends in vacancy rates. Data from LDC show that high street vacancy rates in H1 2022 were 14.0%, a slight improvement on the 14.4% reported at the end of 2021.

Despite current challenges to the market, this positive direction of travel is forecast to continue, with vacancy rates reducing to 13.7% in H1 2023. There was a discernible slowdown in store closures (24,832) in H1 2022 and a distinct uptick in new openings (23,909) meaning the net reduction in units (-923) was the lowest since 2017.

One of the outcomes of Covid was that it prompted a massive shake-up of the retail occupier market. In what proved the ultimate survival of the fittest test, less able operators fell by the wayside and many succumbed to administration.

Those that did survive undertook a radical review of their operational infrastructure and drastic repair of their balance sheet in order to shore up their defences. The disappearance of any vestiges of complacency continues to prevail and this stoicism will make retailers more durable in the current environment.

Online casualties

There have been very few retail casualties to date this year. In the first six months, the only two of any scale were convenience store chain McColl’s (essentially a resolvable debt issue) and online fashion pure-player Missguided.

Online pure-players Eve Sleep and Made.com have since suffered a similar fate and this is likely to set a precedent for the next year – most of the distress in retail is likely to be amongst the online-only players, for many of whom, time has caught up.

They can only be loss-making for so long and in the current environment, banks and stock markets will be far less forgiving than they have been in the past.

Source: LDC, Knight Frank

Retail vs Reality

Retail Monitor Q2 2022

Retail property: an unlikely star?

Property investment markets have reacted most swiftly to the current political unrest and economic crisis, in sharp contradiction to previous recessions when occupier markets have traditionally been the first to move.

All commercial property yields have moved out by an average of ca. 25bps in reaction to the mini Autumn budget and subsequent economic and political fall-out. But having re-based significantly and ‘right-priced’ over the preceding three years, retail is less exposed than other commercial property sector to deep and sudden correction in pricing.

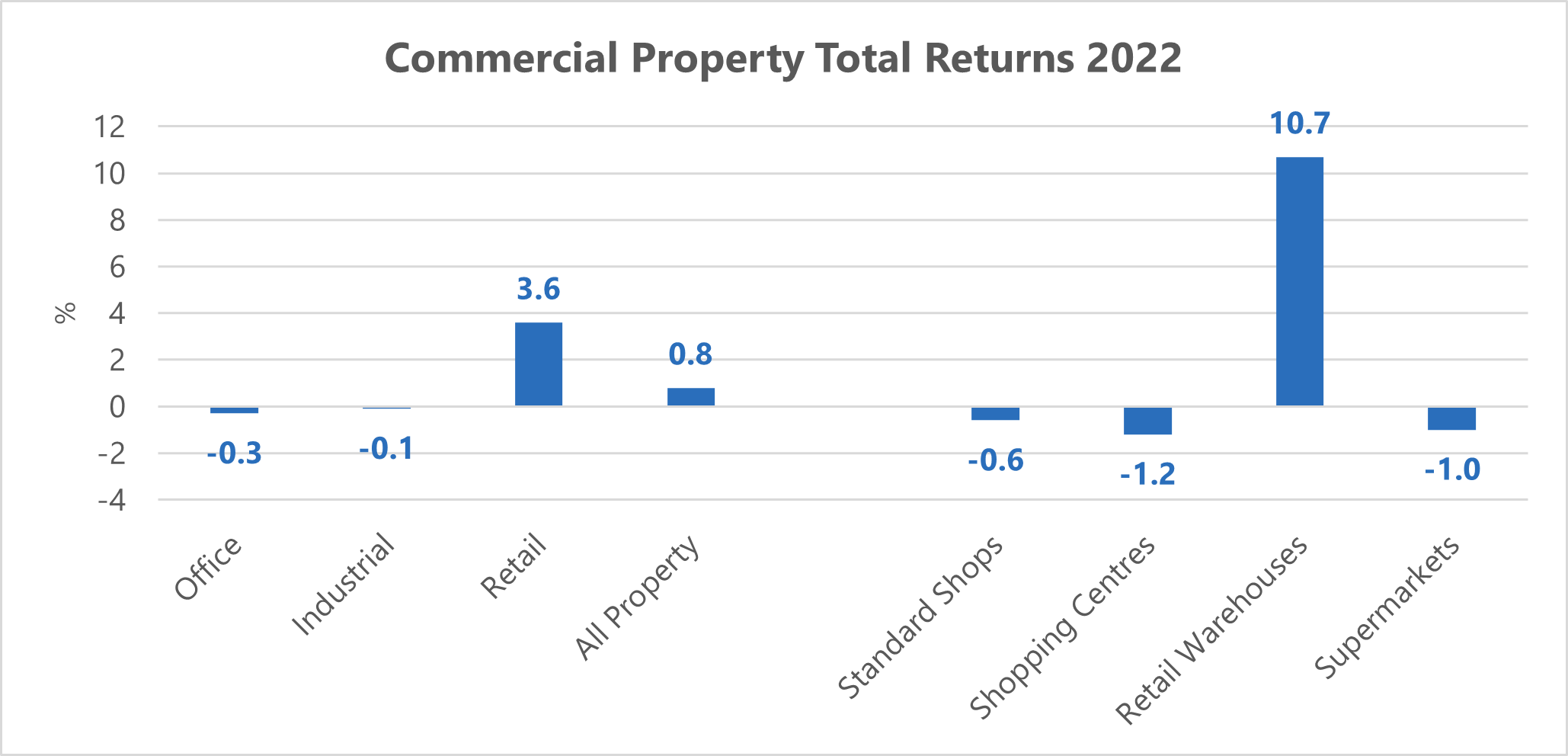

Retail is also the only major commercial property sector forecast to achieve a positive total return in 2022.

Positive retail return

Retail is projected to record a total return of 3.6% this year, compared to negative total returns in both offices (-0.3%) and industrial (-0.1%).

Retail’s positive total return will be driven entirely by income return (5.3%), with capital values set to decline by -1.5%. But this rate of decline is still better than both offices (-4.1%) and industrial (-3.4%).

Investor demand has been checked rather than completely de-stabilised and sentiment is likely to remain subdued for the rest of 2022 at least. Significant levels of high street stock are likely to come to the market in the coming months and there is a slight risk of over-supply.

In general, there is far better liquidity for smaller lot sizes. At the same time, this perceived lack of liquidity is holding back some shopping centre sales and while debt was previously challenging, in the current market it is virtually impossible.

Source: Real Estate Forecasting, Knight Frank

Investment Yield Guide 2022

Read more or get in contact: Stephen Springham, head of retail research

Subscribe for more

For more market-leading research, expert opinions and forecasts, sign up below.

Subscribe here