Edinburgh price growth moderates but deal volumes accelerate

Buyers and sellers move quickly sensing tougher lending conditions ahead

2 minutes to read

Edinburgh Index 132.8 / Quarterly change 0.9% / Annual change 9.9%

Tight supply is helping support prices in Edinburgh, but buyers are becoming more cautious as the cost of borrowing rises.

Financial markets have reacted negatively to the government’s mini-budget last month, which has sent the cost of fixed-rate mortgages higher. The uncertainty continued last week with the sacking of chancellor Kwasi Kwarteng.

Consequently, we have revised our UK House Price Forecasts down.

However, at present the supply/demand imbalance that has characterised the Edinburgh market since the pandemic’s onset persists and is supporting pricing.

New prospective buyers registering in the Edinburgh region were up 28% versus the five-year average in the third quarter, while new instructions for sale were 1% below in the same period.

This has contributed to supply remaining tight, with property available to buy 34% lower in the 12 months to September than the previous year.

“A great house in the right location is still attracting strong competition. Homes that come with a compromise, such as being near a busy road, are taking longer to sell.

“However, with supply so tight it remains a busy market despite the gloomier economic outlook,” said Edward Douglas-Home, head of Scottish residential at Knight Frank.

As in other UK markets, the prospect of rising mortgage rates is motivating buyers and sellers alike to get deals done.

Offers accepted were up by 19% in the third quarter in Edinburgh versus the five-year average, and by 38% in September by the same measure.

Price growth moderates

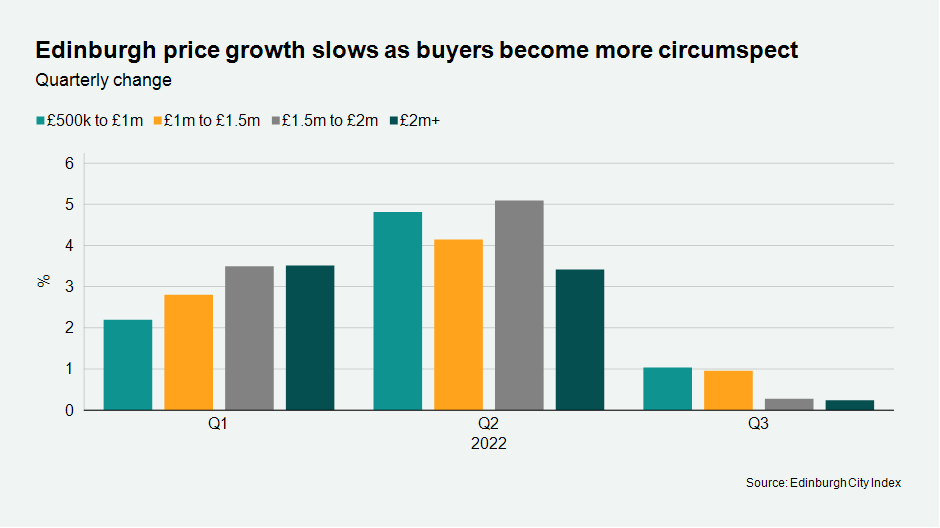

Price growth moderated in the third quarter following a record performance in the second. Average prices in Edinburgh increased by 0.9% in the three months to September, taking annual growth to 9.9%.

While this was the weakest rate of growth since the market reopened in Scotland in June 2020, average prices in Edinburgh have climbed 22% since that time.

Price growth was weaker at the top of the market in the three months to September (see chart). The top value bands have seen some of the strongest growth since the pandemic but, due to a larger percentage of discretionary sales, they are also more susceptible to changes in sentiment.

With the UK economic picture becoming more uncertain, activity at the top end of the market may come under pressure as some buyers and sellers pause their plans.

However, the resurgence of flats, which fell out of favour in the first period of the pandemic as buyers sort more space and gardens, has continued.

Flats outperformed houses in Edinburgh for the second consecutive quarter, with average price growth of 1.1% in the three months to September compared with 0.7% for houses.