Prime global rents peaked in Q1 2022

The Prime Global Rental Index, increased 11.3% in the year to June, down from 11.9% in March 2022.

2 minutes to read

The dip is small and average annual growth remain in double digits. The index tracks the movement in luxury rents across 10 global cities.

New York comes out on top with annual growth of 39%. Prime rents in Manhattan now sit 17% above their pre-pandemic levels.

London posted 27% annual growth in the year to June putting it in second place, but recent data shows this figure is starting to ebb.

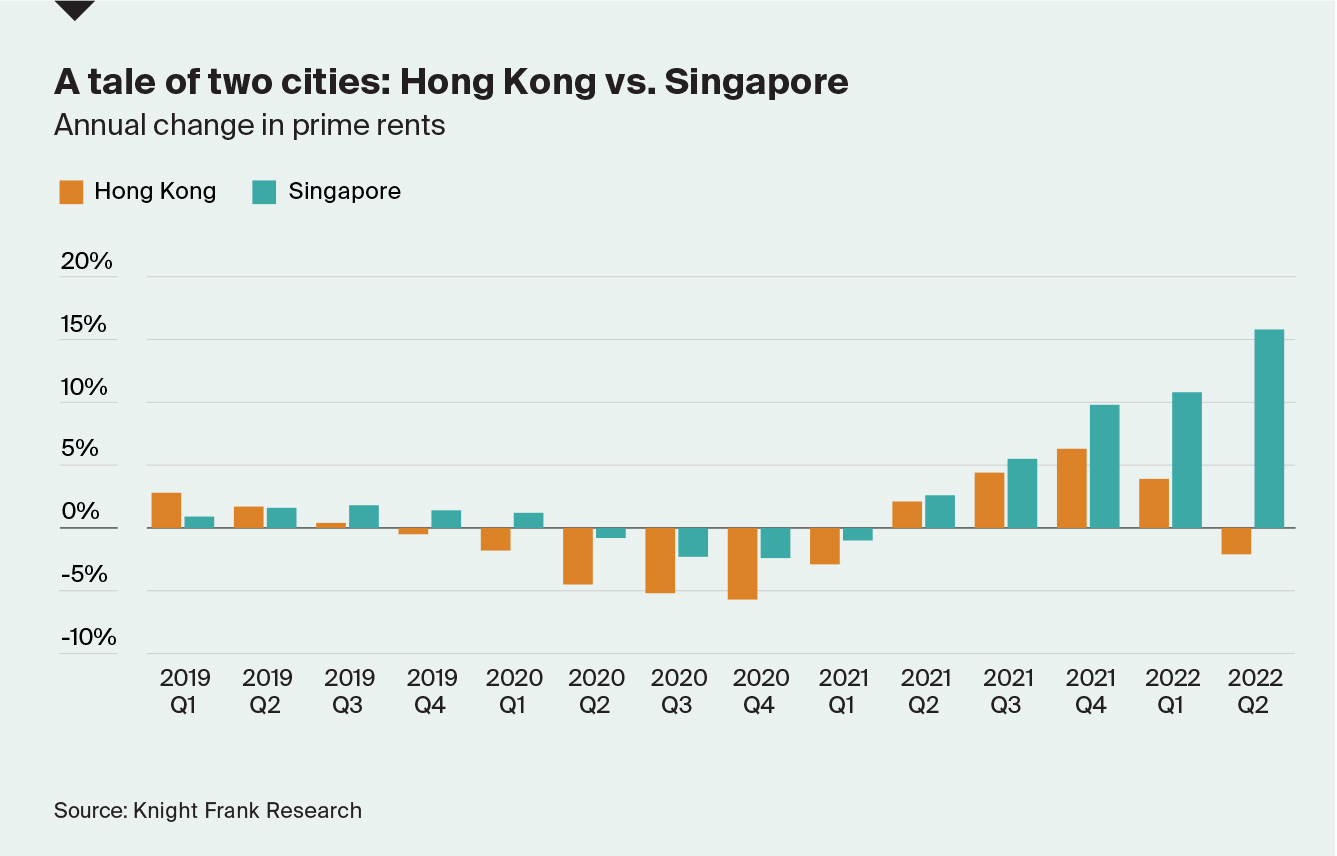

Singapore has leapfrogged Toronto (15.3%) this quarter to take third place with rental growth of 15.8%. April saw the city-state reopen leading to an uptick in expatriates and returning professionals, many opting to rent.

The city’s foreign workforce currently totals 656,000 according to government statistics.

It’s a similar story in Sydney (10.4%) where tight stock levels are set against strengthening demand from returning expats and workers relocating from other Australian cities. Supply chain disruptions and weather events have delayed construction.

Hong Kong (-2.1%) and Auckland (1.6%) sit at the bottom of the rankings table this quarter. Expatriates have been the major source of rental demand in Hong Kong but due to prolonged border closures and travel restrictions, demand has wavered, although this is set to ease in the coming weeks. For Auckland, it’s a tenant’s market as supply is estimated to have increased 16% year-on-year pushing rents lower.

The story of the post-pandemic rental recovery is evolving. Higher mortgage rates have the capacity to increase both demand and supply in the rental sector. Deteriorating affordability in the sales market will push some buyers to rent instead, and with fewer buyers, some sellers may become accidental landlords.

Investors are also targeting the rental market as an inflation hedge. In previous cycles residential rents have proved more resilient than other property types, especially in periods when supply is tight. From 1974 to 1985, another period of high inflation, rents increased by 7-12% a year according to analysis by The Economist.