The big implications of the mini-budget

Making sense of the latest trends in property and economics from around the globe

3 minutes to read

Parity calls

When the Bank of England opted to hike the base rate by 0.5% on Thursday, the minutes published alongside the decision were unusually light on detail. After all, the following day's mini-budget was "likely" to contain news that was "material for the economic outlook", so a fuller assessment would have to be done later, the Bank said.

Indeed, much has changed since Thursday. Markets balked at Friday's announcement of a debt-financed package that included the largest set of tax cuts in fifty years. The pound dropped to $1.035 during trading in Asia this morning, a new all time low.

The scale of the borrowing only partly explains the reaction. Rather, the government's intention to stimulate demand while the Bank of England tries to do the opposite has created a much more complex policy environment. Mr Kwarteng said on Sunday that more tax cuts were coming.

Stamp duty

The stamp duty cut announced on Friday will raise the level at which the levy becomes payable to £250,000, from £125,000, which will mean a saving of £2,500 for all buyers.

First-time buyers will not pay any stamp duty on the first £425,000 (up from £300,000) and the value of any property on which they can claim this relief will rise to £625,000 from £500,000. Other measures affecting the residential property sector include the liberalisation of planning rules and the release of land to speed up development in “investment zones”.

All-in-all, that amounts to a short-term increase in activity in the housing market. Demand for one-bedroom flats and two-bedroom houses may pick up more notably due to the greater incentives on offer to first-time buyers. The weak pound will continue to stimulate activity among overseas buyers.

But as Tom Bill notes in his fuller analysis this morning, what the Chancellor is giving away to domestic buyers will be more than taken back by the Bank of England. Many buyers will find the impact of rising mortgage rates soon eclipses the benefit of the stamp duty cut, which we believe will keep downwards pressure on prices next year.

Mortgage rates

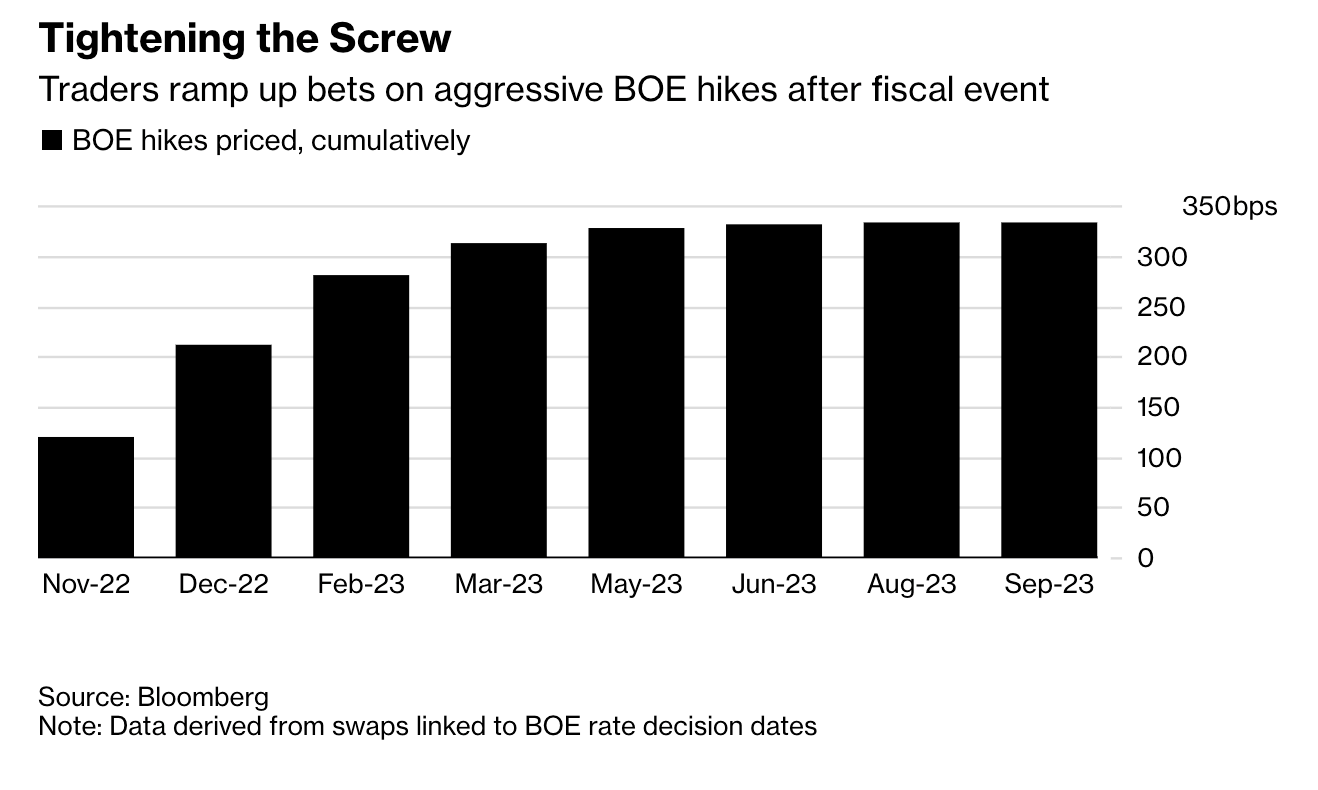

Traders ramped up bets that the BoE will act more aggressively during coming meetings as a result of Friday's mini-budget. Market pricing currently implies that the base rate will peak at more than 5.5% during the second half of 2023 (see chart courtesy of Bloomberg.)

Mortgages are likely to be repriced starting this week. Yields on 10-year gilts surged to 3.77% this morning. Moves in gilt yields tend to feed into the swaps market, which the lenders use to price mortgages.

“We’re in for a bumpy week,” Simon Gammon of Knight Frank Finance tells the FT. “If the last few months are anything to go by, the notice that mortgage brokers have been given that a rate is being withdrawn is hours, not days.”

Online retail

Consumers moved much of their spending online during the pandemic, accelerating what looked like an inevitable drift away from spending in physical stores.

Much of that looks to be unravelling, according to the latest figures from the ONS. Here is Stephen Springham:

"With virtually no exceptions, all online metrics were heavily in negative territory on both a year-on-year and month-on-month basis.

"If the rate of decline continues over the next few months, the inconceivable may actually become a reality – online penetration is lower than pre-pandemic levels. Something that nobody predicted and very few will accept."

In other news...

IMF bailouts hit record high (FT), new town centre could be built from scratch off M25 (Times), cities outside London lagging those in former East Germany (Times), and finally, Barclays tells dealmakers to return four days a week (Bloomberg).