City house prices outperform national housing markets in Q2

City prices stole a march on their national counterparts in Q2 2022, although neither saw the sudden downturn that many anticipated.

2 minutes to read

The average house price across 150 cities worldwide increased by 11.7% in the year to Q2 2022, up from 11.5% last quarter. On a national basis, across 56 countries and territories, house prices increased 10% down from 10.9% the previous quarter.

In the developed world, cities underperformed compared to their suburban and rural markets during the pandemic and what we’re seeing is likely to be a recognition of value as cities reopen to workers, tourists and students.

Resilience

Of the 150 cities tracked, 138 of the saw city prices increase in the 12 months to Q2 2022, down only marginally from 142 cities last quarter.

Perhaps most surprisingly, there are still 66 cities recording annual price growth in excess of 10%, up from 64 last quarter.

And whilst many are forecasting a notable slowdown due to recessionary fears, energy prices, rate rises and geopolitical concerns, there are still only 12 cities where prices are falling on an annual basis.

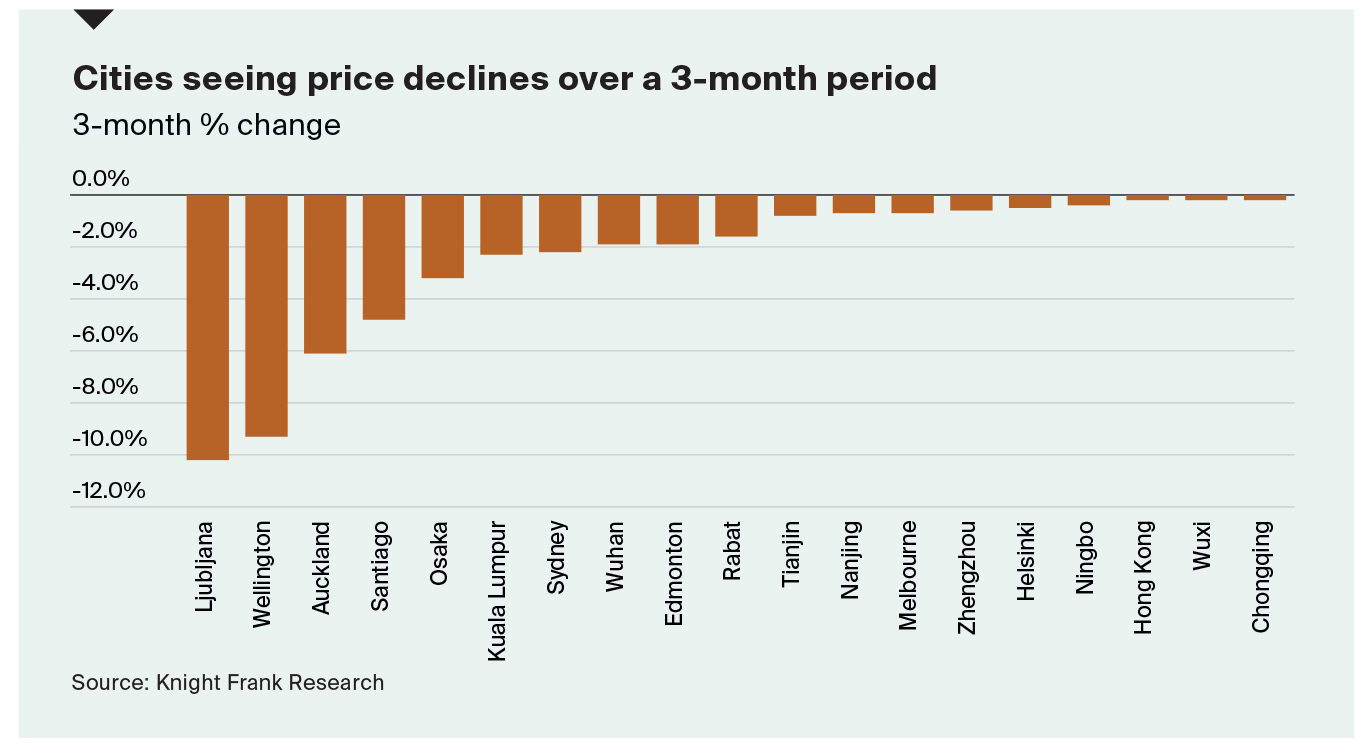

Note however that analysis over the last three months sees this figure jump to 20 cities with those in Sweden, the Chinese mainland, Finland, New Zealand and Australia well represented (see chart below).

US cities

US cities are still performing strongly with nine in the top 20 rankings. Miami leads the pack with annual city price growth of 34%. However, with mortgage rates nudging 6% in the US and existing home sales down we expect the pace of growth to weaken in the remainder of 2022.

The triple-digit price growth in three Turkish cities is in part due to inflation nudging 80% and a lack of supply due to higher construction costs.

In short, cities are outpacing national markets and whilst rapid interest rate rises may bring about sudden corrections (see Wellington in New Zealand) where these are gradual and incremental price growth is likely to slow not reverse.