Pandemic boom fades in Scotland’s country market but activity remains brisk

Prime Scottish Index 109/ Small Country House 107.3/ Large Country House 103.4.

2 minutes to read

Scotland’s country market is calming down after a pandemic-inspired boom last year.

While demand in city markets such as Edinburgh remains exceptionally strong, Scotland’s country market is returning to its seasonal rhythm that sees sales activity peak in the third quarter.

“While it’s certainly not all doom and gloom we are in a very different place to where we were last year. Buyers are definitely more cautious and is there is a slight question over location or condition they are holding off,” said James Denne, office head at Knight Frank’s Melrose office.

There was no change in the average price of a country property in Scotland in the three months to June, which left average prices 3.9% higher than a year ago.

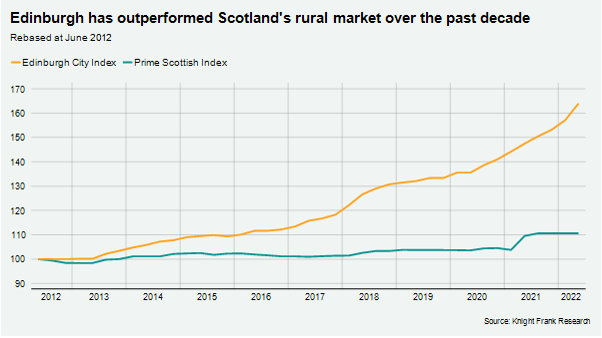

However, given the relatively low volume of rural sales in Scotland compared with city markets, average prices have lagged more economically active locations such as Edinburgh in recent years (see chart). While average prices have increased by 64% in Edinburgh over the past ten years, the increase in rural Scotland of 11% has been more modest.

Furthermore, a large part of the price growth in Scotland’s country market came recently because of the escape to the city trend. This saw expats lured back to take advantage of the market’s relatively good value, greenery and space, freed from the constraints of being near a city for work by the widespread adoption of hybrid working.

It led to Scotland’s country market enjoying its best performance in four years in 2021.

Despite a process of normalisation being underway, the number of offers accepted was up 22% in the three months to June versus the five-year average (excluding 2020) as buyers that missed out in the busy period last year acted to secure a property, many no doubt acting ahead of further interest rate rises.

“We’re entering a crucial period for the Scottish country market. While premium homes continue to sell well it feels a little thinner in terms of buyers around the £1m mark this year. At the same time, some sellers that were 50/50 about coming to market this year have decided to move due to concerns around the increasing cost of living, which has increased supply” said Tom Stewart-Moore, head of Knight Frank’s rural business in Scotland.

After a record number of viewings in the country market last year, viewings were down 5% in the three months to June versus the five-year average (excluding 2020). This is despite improving supply, with new instructions up by 32% in the same period.