France’s prime prices see record growth

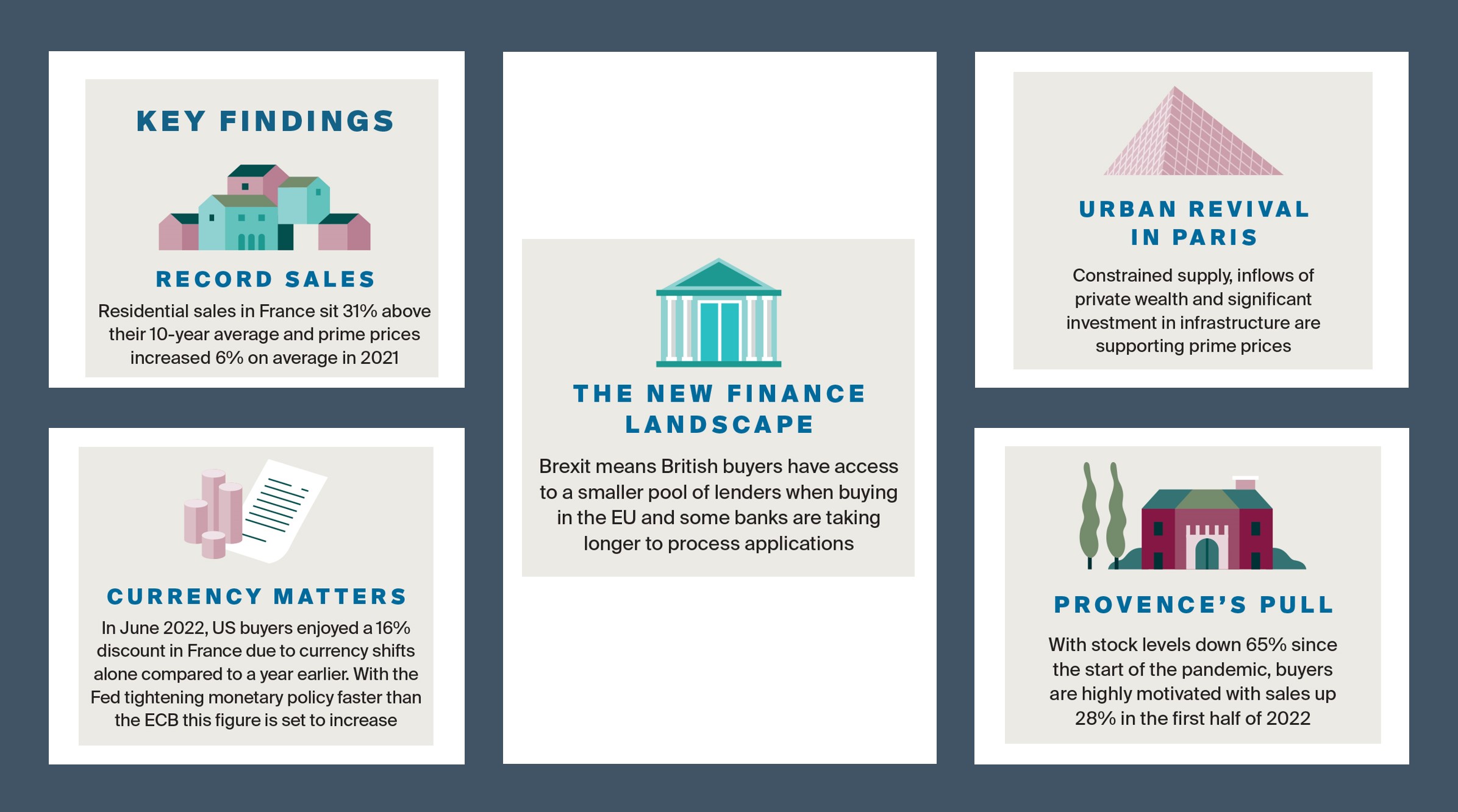

Residential sales in 2021 sit 31% above their ten-year average.

2 minutes to read

The pandemic has seen French buyers re-evaluate their housing requirements and working practices, in many cases relocating, upgrading, or acquiring that long-yearned for second home. In 2021, when borders reopened, they were joined by pandemic weary overseas buyers, for whom the French lifestyle resonated even more strongly.

Although there are signs that the exuberance of the last few years is starting to ebb, the evolving landscape presents opportunities for buyers who have been stymied by the lack of stock and the speed with which some markets, Provence in particular, have been moving.

Buyers are still not in the driving seat, however. Having identified a property of interest there is a need to expedite plans, particularly at price points below €2 million. Vendors, for their part, should avoid prevaricating, a dose of realism is needed given the shifting economic and geopolitical landscape.

Bricks appeal

Acquiring a tangible asset that offers a source of reliable income, a potential hedge against inflation and a means to diversify investments whilst mitigating risk, against a backdrop of volatile equity markets and commodity prices, is an increasingly appealing prospect.

Cash-rich private equity funds have got the memo, with many active in Paris.

If the story of 2021 was the race for space and the preoccupancy with larger homes, this year urban markets are getting in on the act as second homeowners crave culture and connectivity, and investors eye the return of tourists.

Think finance

Rate rises mean it is more expensive to take out a mortgage than it was and post-Brexit there is a smaller pool of lenders British buyers can access.

Buyers looking to take out a mortgage to fund their second home or investment property in France need to seek advice early in the homebuying process as Felicity Sullivan of Knight Frank Finance explains in the report.

Currency play

With much of the world raising interest rates, the impact on currency markets is a constantly moving feast. One thing is clear, the Fed is hiking faster than the European Central Bank (ECB) which presents US buyers, or those with currencies pegged to the dollar, with a window of opportunity. US buyers currently enjoy a 16% price discount compared to a year ago due to currency shifts, which explains why US searches for French property on Knight Frank’s website were up 37% in May 2022 on an annual basis.

Outlook

Sales activity is expected to be healthy but more muted in 2022, with a marginal slowdown in sales having been noted in the first half of the year. The Russia-Ukraine conflict has heightened uncertainty and will impact buyer sentiment given the backdrop of sharply rising inflation and tighter financing conditions.