Will peer pressure leave its mark on the office market?

Making sense of the latest trends in property and economics from around the globe.

5 minutes to read

The office

On March 16 2020, Boris Johnson asked us all to start working from home where it was possible to do so. More than two years on, a quick glance at the morning's papers reveal the degree to which working habits are yet to fully settle, whether you're reading about the possible impact that working from home has on your mental health or the innovative ploys from occupiers and developers to draw workers back - anyone for puppy yoga?

The latter piece hones in on a key issue - the disconnect between employers and employees in relation to future workstyles. Some 23% of UK based respondents to a recent survey said they would quit if their employer announced that all employees must return to the worksite five days per week, while in continental Europe the average equivalent was in the mid-teens. The figures are more startling still in America, where a whopping 50% of US workers would rather resign than be forced back to the office full-time.

Lee Elliott tackles what all this means in his latest update of the House View, our sector-by-sector take on the key issues in real estate.

As Lee notes, the genie is out of the bottle and it is fanciful to think of a return to pre-pandemic levels of occupancy of circa two thirds full. However, across Europe our quarterly dashboards show a robust office market with strong demand from occupiers in select sectors for prime office space. It's clear that the office will remain a key strategic device for occupiers, but the role it performs will focus on creating connection and galvanising culture rather than administering email. The flight towards hybrid workstyles doesn't negate the need for the office either. Instead, a world with a more transitory workforce challenges the view that the office is the only workplace in town.

The current environment adds a few more moving parts to the issue. Firstly, the degree to which occupiers that have taken better quality space generates pressure on peers to follow, and secondly, the degree to which any labour market distress generates greater presenteeism and visibility in the workplace - I recommend the full piece, linked above, for more.

Super prime

The sobering prospect of higher interest rates means more sellers are coming forward to satisfy exceptionally high demand across the UK property market.

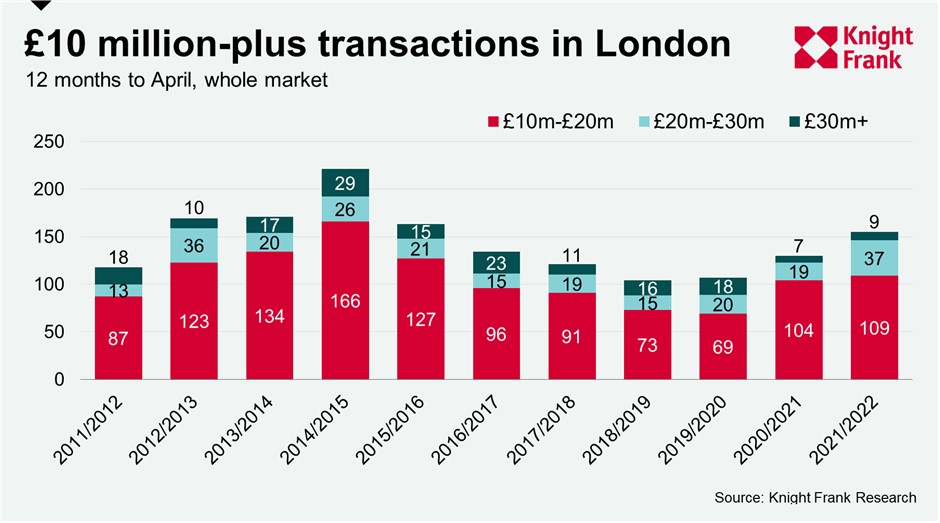

The same is true at the very top of the market in the capital, where there are even more reasons for buyers and sellers to act now. There were 155 transactions above £10 million in London in the year to April, whole-market data shows. That was an increase of 19% on the previous 12-month period and the highest total since 2015/16. The figure could rise as the Land Registry updates.

The weakness of the pound is one big driver of activity. Another is demand from international buyers, which though not yet back to pre-Covid levels, is building. See the full piece for more.

Business confidence ticks lower

Two fairly large surveys have revealed the degree to which corporate confidence is heading south.

First, June's S&P Global / CIPS UK Manufacturing PMI registered business confidence at its lowest level since May 2020. The number of firms expecting production to rise over the coming year fell to 47%, from 55% in May. Firms raised concerns about flat domestic demand, weaker export markets, inflationary pressure, the effect of the increased cost of living on consumer demand and supply chain issues.

Similarly, 54% of 5,700 companies surveyed by the British Chambers of Commerce said they expected turnover to increase during the coming year, the lowest share since late 2020. A record 65% of companies said they planned to raise their prices in the next three months.

Mortgage lending

Mortgage approvals for the purchase of homes, an indicator of future borrowing, ticked up to 66,200 in May, from 66,100 in April. That's slightly below the 12-month pre-pandemic average of 66,700, according to Bank of England data published on Friday.

Here is Knight Frank head of UK residential research Tom Bill on those numbers:

“There are two reasons that demand for mortgages is holding steady despite the presence of a cost-of-living squeeze that will get worse before it gets better. First, buyers are faced with more choice as a growing number of prospective sellers sense prices may be peaking. Second, with lenders pulling their cheapest products on a weekly basis, there is extra urgency to act sooner rather than later. As rates rise further and supply normalises, we would expect UK price growth to calm down this year before falling to low single digits in 2023.”

Indeed, FT analysis of data published alongside that release reveals the average interest rate on newly drawn mortgages increased by 13 basis points to 1.95 per cent in May, marking the fastest six-month increase since 2012.

The Africa Report

As we launch our biennial 2022/23 Africa Report, we are optimistic about the fortunes of the continent’s real estate markets, although clearly, lingering Covid-related legacy challenges remain and are in some cases being exacerbated by global geopolitical events.

That said, with oil prices being sustained at well over US$100 per barrel, oil-exporting nations in Africa will undoubtedly experience an economic boost, while others that need to import oil may face additional headwinds this year. Read our introduction to the report for more.

In other news...

These major economies will be in recession next year, Nomura says (Bloomberg), Miami tower sells in bet on revival (Bloomberg), UK four-day week trial sees jump in productivity (Times), Eurozone inflation hits record 8.6% in June (FT), and finally, Jeff Bezos clashes with Biden administration again over inflation (FT).