What will plug the Help to Buy sales gap?

The end of Help to Buy is a symbolic moment: representing the curtain going up on government backed new-build housing loans to first-time buyers.

4 minutes to read

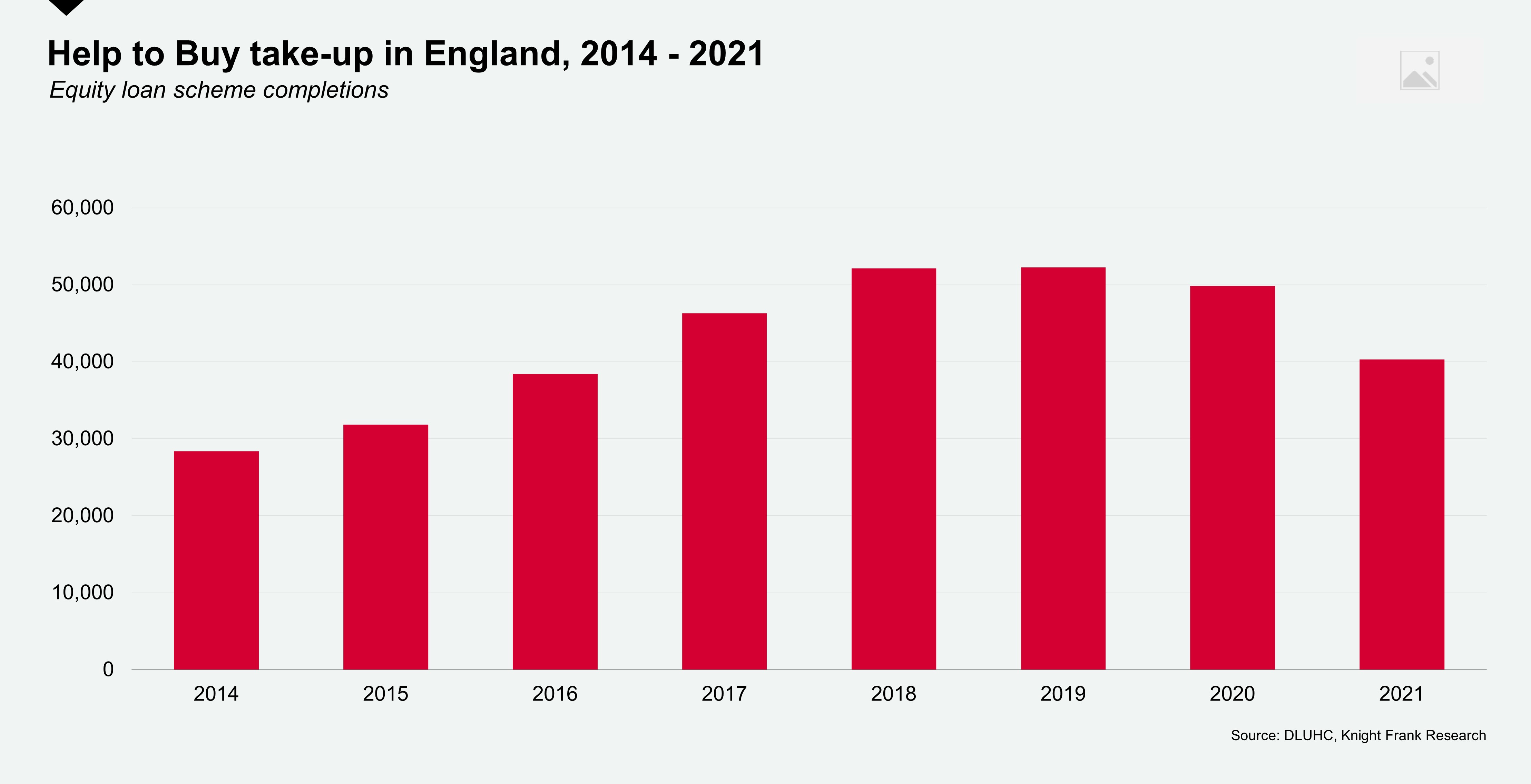

Since its inception in 2013, the popularity of Help to Buy has grown to support on average around 50,000 new build sales per year in England between 2017-2020, easing to just over 40,000 for 2021.

Last year's figure was impacted by the narrowing of the scheme from April 2021 under which only first-time buyers are now eligible. This itself was a significant change: around 18% of buyers since 2013 – the equivalent of 51,820 borrowers – were existing or previous homeowners who were able to use the scheme to help make their next move. New regional caps have also limited sales in parts of the country, especially the North East and the Midlands.

So how will the end of Help to Buy impact future new build sales from next March onwards? Here we look at the alternatives and assess how effective they will be in plugging the gap left by the ending of the scheme.

Currently, our agents are advising on a flurry of Help to Buy deals as the scheme draws to a close, with Homes England having brought forward the ending of the programme two months earlier than originally planned. The revised scheme formally closes in March next year, but buyers will now have until end October this year to reserve their properties rather than the end of December.

First Homes

First Homes is a new for-sale affordable housing product prioritised for local first-time buyers. The government has confirmed First Homes will be sold at a discount of at least 30% below market value subject to two regional price caps. These are £420,000 in London and £250,000 in the rest of England after the discount has been applied to all initial sales.

Announced in May 2021, the scheme is still relatively small scale with a 1,500 pilot with £150m available funding running across 100 locations up to 2023. Its success also depends on the appetite of developers to get involved and self-fund the programme.

The numbers of homes being built is expected to increase as developers and local authorities begin to incorporate new planning policies.

The government has a stated ambition to deliver 10,000 First Homes a year.

Deposit Unlock

The housebuilding sector is making efforts of its own to come up with alternatives. Notably, with Deposit Unlock, a new scheme devised in collaboration with lenders and the housebuilding industry. Some 17 housebuilders and counting currently signed up representing around 60% of the overall new homes market, according to the HBF.

Deposit Unlock enables first time buyers and existing homeowners to purchase a new-build home with a 5% deposit. The scheme sees housebuilders pay the cost of insuring mortgages through a percentage of income through house sales. So instead of the lender taking out insurance, the housebuilder pays for it.

More lenders are adopting the scheme, such as Nationwide last October, and it should therefore rollout across the UK eventually. Nationwide offers the loans on properties worth up to £750,000, broadening its reach. It should be a significant help for first-time buyers of new build property given the lack of high street lending at high loan to value. There is an ambition to support 20,000 new homes sales annually through the scheme.

Build to Rent

While the ambition is there to meet part of the sales gap, ultimately the fast-growing Built-to-Rent (BTR) market will play a key role in absorbing the loss of sales via Help to Buy.

An increasing number of housebuilders are looking to do bulk deals with build-to-rent operators to help de-risk their schemes. There are currently nearly 70,000 complete and operational BTR units across the UK, a figure which has more than doubled over the last five years alone. Analysis of the future pipeline suggests delivery of new BTR units will continue to rise at a similar rate.

Grant-funded affordable housing

The government first unveiled an £11.5bn Affordable Homes Programme back in September 2020. The fund is available for the provision of new affordable housing only, split 50:50 between homes for rent and homes for sale. It aims to deliver 180,000 new homes between 2021 and 2026.

The programme also includes shared ownership as an affordable tenure type, with key changes to the original model. In its current form, the minimum share a buyer can purchase of a shared ownership home is 25%, but the government’s new model for the scheme has seen this reduced to 10% from April 2021.

Previously, owners could buy additional shares in their shared ownership home – via a process known as ‘staircasing’ – in chunks of 10% or more. The new format gives shared owners more flexibility and allows them to staircase in 1% increments.

In August last year, the government announced an £8.6bn funding allocation, as part of its overall £11.5bn programme, towards 57,000 homes for ownership, 6,250 affordable rural homes, and 29,600 homes for social renting.

Subscribe for more

For more market-leading research, expert opinions and forecasts, sign up below.

Subscribe to our newsletter

Thumbnail: Photo by Tierra Mallorca on Unsplash

Main: Photo by Toa Heftiba on Unsplash