Prime residential rents in global cities rising at fastest rate since 2010

The new Prime Global Rental Index tracks the movement in luxury residential rents across ten cities globally.

2 minutes to read

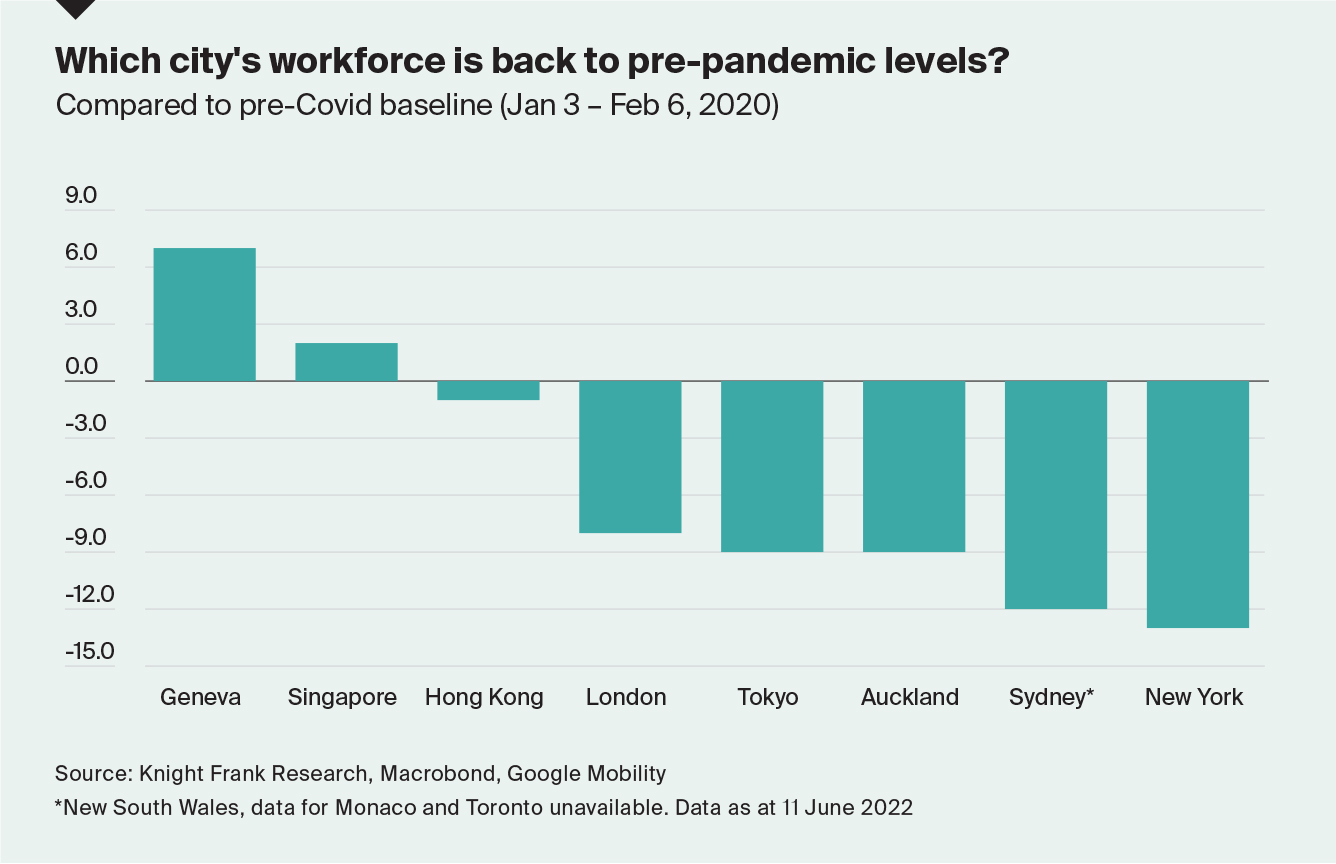

This first set of results confirm the extent to which top tier cities are seeing demand return and stock dwindle as workers, along with international students and corporate tenants return to the prime end of the market.

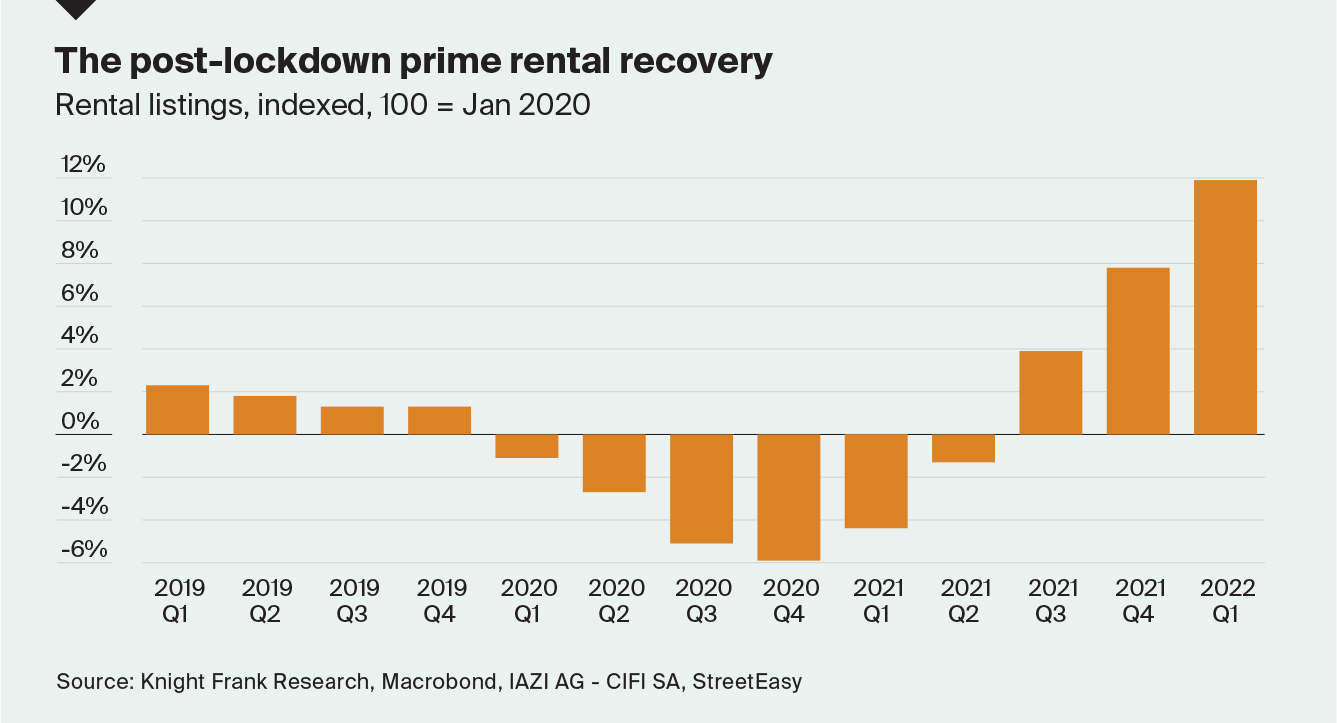

New York and London lead the rankings with rents up 38.5% and 26.4% respectively in the year to Q1 2022, although this largely represents a return to pre-Covid levels.

Toronto (17.2%) and Singapore (10.8%) also registered double-digit rental growth on an annual basis.

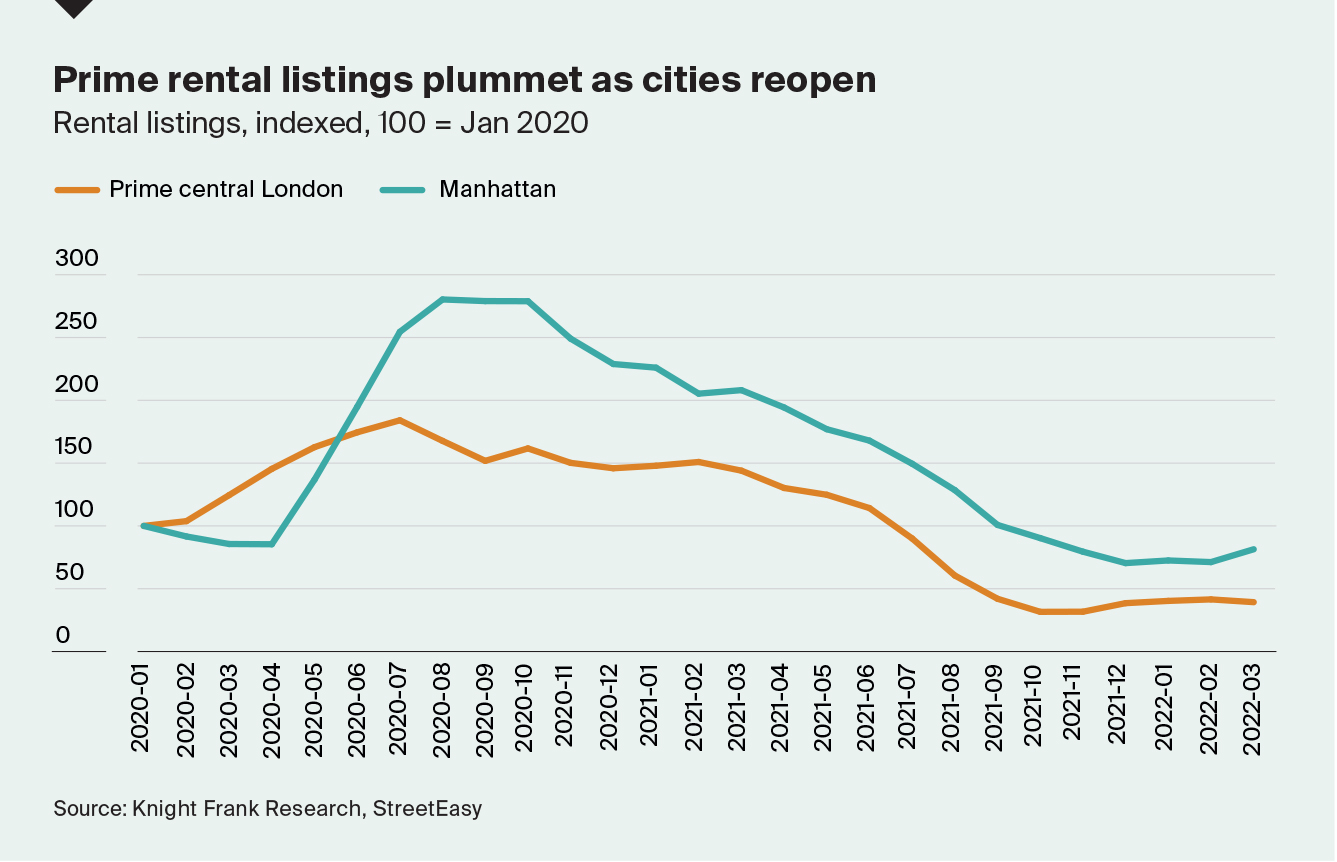

Key to this trend has been the lifting of Covid restrictions and a lack of supply, in part borne out by the sales boom which motivated some landlords to sell, not rent, during the pandemic.

The pandemic has also made people reflect on where they want to live, and initiatives that allow people to live and work remotely in another country, such as digital nomad and welcome visas are creating a more transitory workforce. Globally, many untethered workers sold up to take advantage of the housing boom in 2021 and are now considering their options, adding to a growing sense of flux in the market, further exacerbated by the 'great resignation' trend.

The surge in rents reflects a reversal of large falls in 2020, which helped attract tenants back to the city. But with rents now reaching pre-pandemic levels, economic growth stuttering and the labour market weakening we expect prime rental growth to cool rapidly over the remainder of 2022.

Toronto may prove one exception. Here, rental listings are down 23% in the year to March 2022 and Canada’s ban on foreign buyers may push demand higher as those relocating from overseas are forced to rent, not buy.

Hong Kong is the only city to see prime rents decline over a quarterly basis, down 1.1% in the three months to March 2022. A new wave of Covid-19 infections and the resulting border closures saw domestic tenants the only source of demand.

The inverse relationship between residential sales and rental markets means the performance of each city’s sales markets in the coming months will be a key factor to monitor. In prime central London, there are early signs that supply may be slowly picking up as prices soften and disappointed vendors unable to achieve their price ambitions opt to rent their home instead.

Photo by Siegfried Poepperl on Unsplash