Inflation: a global view on what it means for property markets

Property markets around the globe are experiencing similar inflation themes, with some regional nuances. Knight Frank's global property experts highlight the key talking points.

7 minutes to read

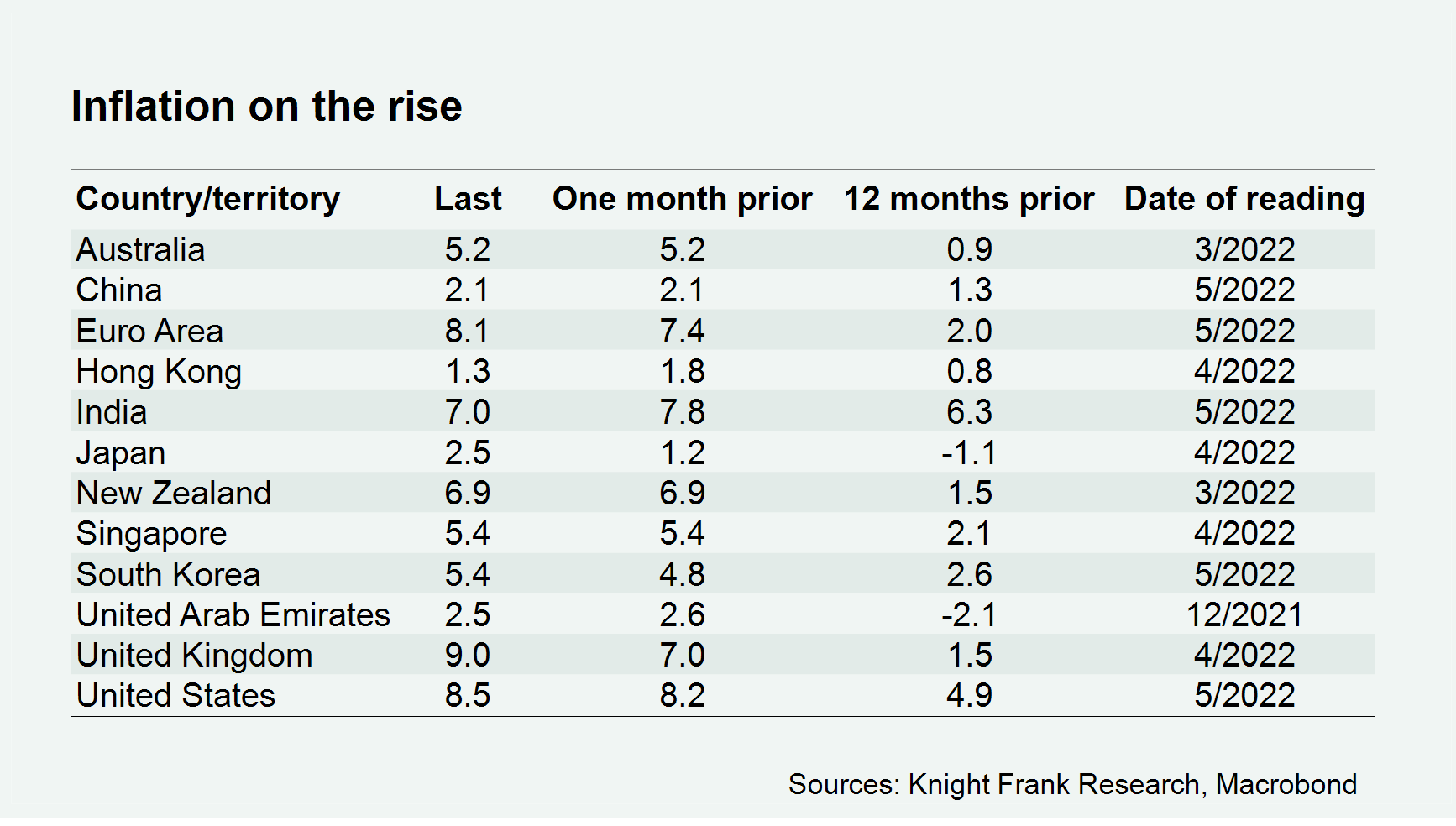

Inflation is reaching multi-decade highs in all corners of the globe, for some this is set to worsen in the short-term, for others, there are signs it may have peaked.

Inflationary pressures continue as food prices increase, with 26 countries restricting exports in some guise, as well as oil rising above $120 in May and June in the wake of the EU ban on the majority of Russian oil imports. Whilst regional and sectoral variations exist, property markets are underlined with positive and strong foundations.

Cost-of-living crisis

Confidence is weakening due to cost-of-living pressures and continued negative headlines, but what consumers say and what they do may be different. Despite consumer confidence dropping in the UK, (reaching a record low) the UAE, Australia and beyond, there are contradicting metrics. Consumers may be more buoyant than headline indicators show, for example month-on-month retail spending in the UK grew in April despite that reading.

Economies expanding

Fundamentally, economies are still in expansion mode even if the pace is slowing. Purchasing Managers Indices (PMI’s), which register manufacturing and service provider activity, are still very much in growth territory, albeit at a slower pace as the bounce back effects fade. Across the economies we examine above, the average Composite PMI from Markit in May was 53.7 (anything above 50 indicates expansion), down from a peak in a year earlier of 55.8. Other than Asian economies and the UAE, we saw a slowdown in confidence in May, most notably the UK dropping from 58.2 to 51.8, yet still firmly sat in expansionary territory.

Globally, there are nuances to this slowing story with the UAE set to expand at a more rapid pace and strong fundamentals across Asia-Pacific. Faisal Durrani, Knight Frank’s head of Middle East Research noted that the UAE’s economy is set to expand by 6.5% in 2022 and is increasingly diversifying. Christine Li, head of Asia-Pacific Research at Knight Frank, notes that Asia-Pacific is a global engine for growth with record levels of foreign direct investment (FDI) in markets offering a boost to the economy. All economies across Asia, as well as the UAE, registered a rise in their May PMI readings, with all above 50 except the Chinese mainland owing to Covid lockdowns which have since been lifted.

Strong labour markets

Strong labour markets offer further support to growth and households. From the UK to Australia and the US we are experiencing near, if not record, low rates of unemployment. In fact, the number of unemployed outnumbers the current number of vacancies in many markets such as the US. This labour market strength will support wages growth and consumer spending given the perceived higher level of job security.

Finance cost rising

The cost of finance has risen sharply globally with some property sectors more vulnerable than others. Lending rates have risen sharply ahead of expected Central Bank moves. Ben Burston, chief economist at Knight Frank Australia notes that despite the Reserve Bank of Australia (RBA) having moved rates by 25 bps (to 0.35% at time of speaking), the cost of debt has risen by around 200. Since then, the RBA has implemented an additional 50bps rise to 0.85%. The rise in the cost of debt has been the case across European markets too, noted Will Matthews, head of commercial research in the UK.

Sentiment may have shifted in sectors that have seen the greatest growth due to rising rates. Residential and industrial in Australia for example, noted Burston, are sectors which have seen yield compression and are ones which may be more susceptible to repricing. There may be a shift towards sectors which are higher yielding, such as offices and retail. The retail sector is a special case, notes Matthews, and unlikely to be affected by this move as debt financing was not easy to secure prior and therefore is often not used.

Is property an inflation hedge?

Demand remains robust and the prospects of property as an inflation hedge comes to the fore. Though this is much debated and heavily nuanced, property is still perceived as an inflation hedge. Underlining demand, global investment volumes in Q1 2022 were 30% higher than 2021’s level over the same period although this pace may subdue as the year progresses. There is appetite among private investors too. The Wealth Report Attitudes Survey confirmed that 23% of global UHNWIs are looking to bolster portfolios with income producing property, and 20% are looking at investing indirectly through REITS and funds for example.

There is also a significant amount of equity targeting property markets. The amount of equity that has been raised, and continuing to be raised, and not deployed yet is sizeable. This represents a lot of capital undeterred by the rising finance costs. For example, according to INREV Capital Raising Survey 2022, more than €254 billion was raised for non-listed real estate in 2021 globally, and only around 53% was invested.

Residential markets vary in exposure, even those most vulnerable due to growth and regulation are unlikely to crash. In housing markets The Economist used Knight Frank data to assess which were most exposed to rising finance costs. It points out that house prices are unlikely to plummet but that the pain of rising mortgage rates will be harder to bear in some countries than others.

One market already seeing the bite, due to a rate and regulation double-hit, is New Zealand. Chris Farhi, head of insights, data & consulting at Knight Frank’s partner Bayley’s, noted a combination of headwinds arising from new responsible lending regulations and increasing interest rates. Sales volumes during the first four months of 2022 were 14% lower than the average of the same period during 2018 and 2019. Our Global House Price Index shows the annual rate of growth for New Zealand slowing from over 20% in Q3 2021 to just shy of 14% in Q1 2022.

Prime property markets safer

Prime markets, typically defined as the top 5%, may be less susceptible to changes due to a higher prevalence of cash purchasers. The Wealth Report Attitudes Survey revealed that cash would be the primary finance strategy for home purchases in 2022, particularly for UK and Australasia. Durrani noted that in Dubai’s case they are seeing an increasing level of cash buyers. So far in 2022 around 18% of buyers were leveraged, down from 40% in 2021 and more than 50% in 2007. The Emirate’s property market is one bucking the growth susceptibility trend with the busiest May in 13 years.

Inflation regulations

The UAE is also deploying regulatory measures to curtail inflation. The government are regulating prices of some 11,000 goods to curtail the extent to which produces can pass on higher prices to consumers, Durrani noted. Retailers must seek governmental approval before increasing prices of these items which include fresh and dry milk, fresh chicken and eggs, bread, flour, sugar, salt, rice and legumes, cooking oil, mineral water and other items.

Countries across the Asia-Pacific region are implementing strategies to avoid currency fluctuations. Learning from the 2013 ‘taper tantrum’, when the Federal Reserve announced an intention to taper asset purchases, emerging markets were left vulnerable. As an example, Li pointed to the Indonesian Rupiah which lost 20% of its value at the time. As this can add to inflationary pressures, through imports as well as cause economic volatility, the region’s Central Banks have been pre-emptively supporting their currencies, for example Singapore has raised rates, and currency reserves across the region are at record highs.

Property market resilience

The message is clear, inflation is going to be a main feature of 2022 and will weigh on consumers ability to spend. However, economies are in a better position than previous periods of rising inflation or interest rates and property markets will reflect this resilience.

Subscribe for more

For more market-leading research, expert opinions and forecasts, sign up below.

Subscribe to our newsletter

Photo by Pang Yuhao on Unsplash