Country market sees flurry of activity as ‘race for space’ set to slow

Offers accepted outside of London hit 15-year high and new instructions leap in May.

2 minutes to read

The ‘race for space’ increasingly feels like it is nearing its peak.

Demand and prices surged in property markets outside of the capital during the pandemic as people reassessed how and where they lived.

However, stock levels failed to keep pace with demand and sellers were left frustrated as a lack of purchase options created a vicious circle of low supply.

Now, there are signs that normality is creeping back.

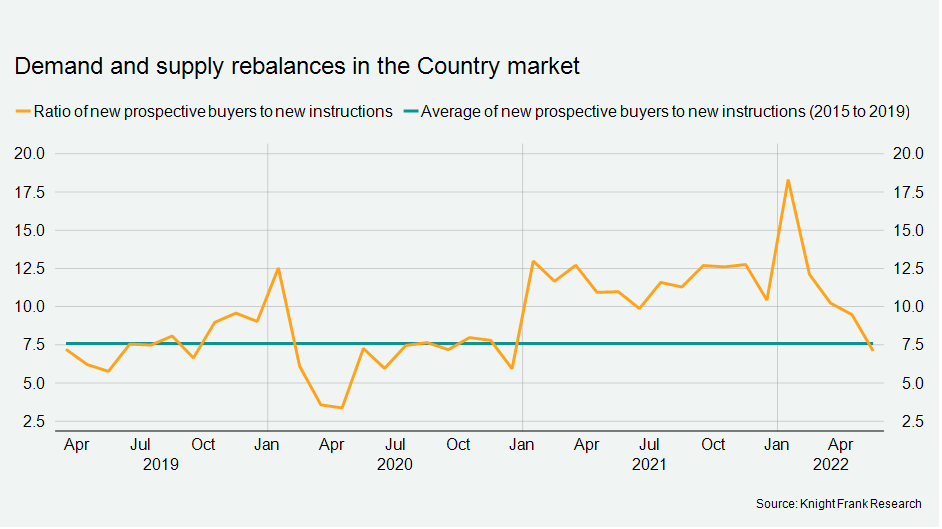

The ratio of new prospective buyers (demand) to new instructions (supply) was 7.1 in May outside of London, which was the lowest reading since December 2020.

It was largely the result of growing supply. The number of new sales instructions outside of London in May was the sixth highest figure in a decade.

Meanwhile demand is robust but showing early signs of waning. While the number of new prospective buyers was 22% above the five-year average (excluding 2020) in May, this was down from +25% in April. It was the fourth consecutive month the gap between the five-year average has narrowed.

“Some of the heat has come out of the market. People are no longer prepared to make as many sacrifices for the property they want,” said William Ward-Jones, office head at Knight Frank Stratford upon Avon.

Supply picked up in May as more owners sensed prices may be peaking, which the latest data from Halifax and Nationwide underlines.

The trigger appears to have been the Bank of England, which raised the base rate to 1% last month and made some grim economic predictions against the backdrop of rising inflation, which is expected to peak at above 10% later this year.

As supply rises and demand remains strong for now, the property market is in a sweet spot of high activity. Outside of London, the number of offers accepted reached a 15-year high for the month of May.

We forecast a soft landing in the country market, which will see double digit growth become single digit by the year’s end.

“While we’re seeing an inevitable fall in the number of new buyers coming into the market after a record run, there’s plenty of existing buyers that haven’t bought yet,” said James Cleland, head of the Country Business at Knight Frank.

“The country market remains strong with a good pipeline of deals in place. Ultimately, people haven’t returned full-time to the office and property markets outside of the capital will continue to benefit from this shift,” added James.

Despite the strong growth in the country market since the pandemic, it continues to offer good relative value compared to the capital.