Global city house prices rise at the fastest rate since 2004

Making sense of the latest trends in property and economics from around the globe.

3 minutes to read

Global house prices

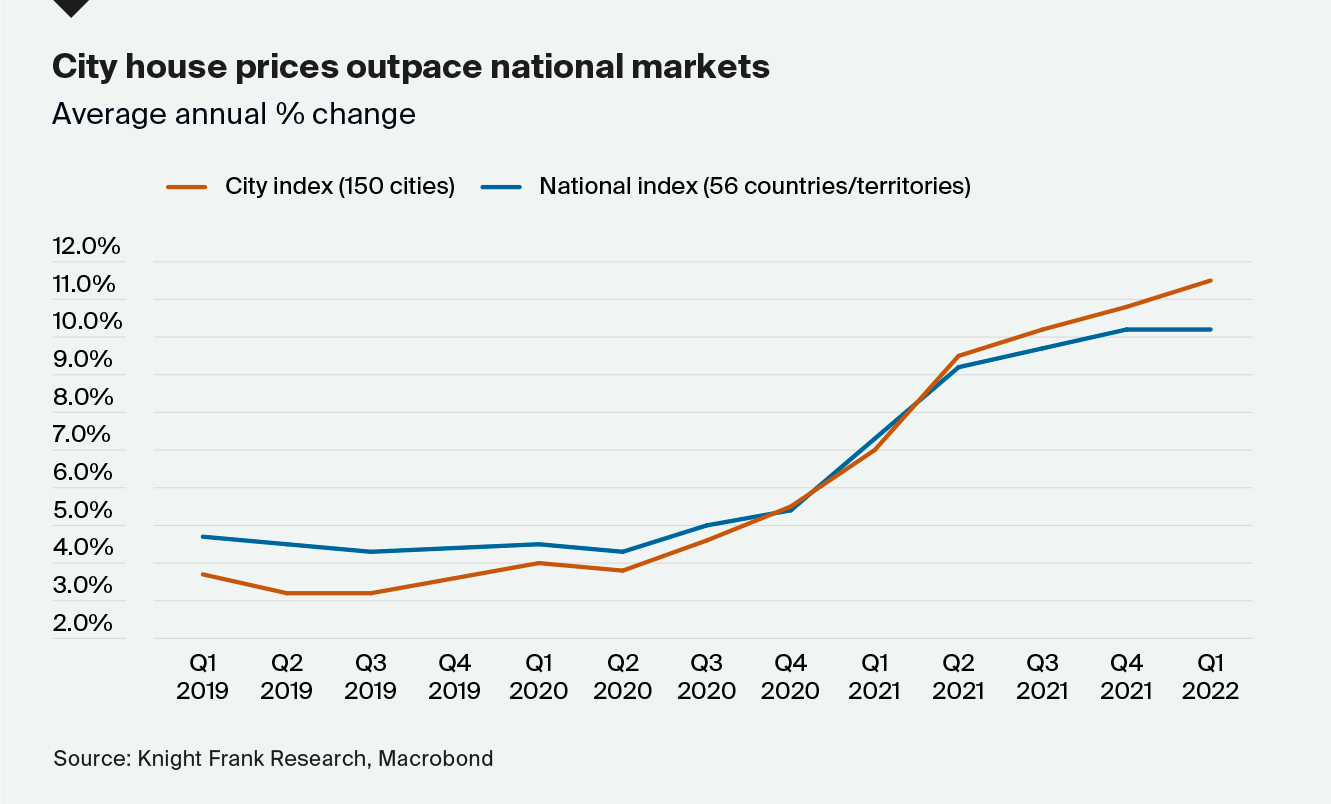

Annual house price growth across 150 cities is rising by an average 12%, the fastest rate since Q3 2004, according to Knight Frank's latest Global Residential Cities Index.

City house prices are now outpacing their national markets (see chart), suggesting that the so-called "race for space" trend, which bolstered rural and suburban markets, has calmed amid the reopening of workplaces.

The market cycle is also shifting as large parts of the world move from a pandemic to post-pandemic landscape - see Kate Everett Allen's analysis. Inflationary pressures are surging, and the cost of debt is increasing as interest rates track higher.

Set against the backdrop of heightened uncertainty, rising taxes and more property market regulations (e.g. a ban on foreign buyers in Canada), we expect the rate of price growth to slow in most markets. However, we do think a sudden shift to negative price growth is unlikely for most cities in 2022.

Jobs

Much will depend on the pace of rising interest rates. Central bankers in several major economies are attempting to engineer "soft landings" - effectively putting the brakes on growth to stop economies overheating without tipping them into recessions.

The Federal Reserve has been particularly assertive on that front and the latest data from the jobs market suggest that, so far, employers remain in good shape. Employers added 390,000 jobs in May, the 17th monthly gain. The unemployment rate remained at 3.6% for the third straight month.

Average hourly earnings rose 0.3%, capping annual growth at 5.2%. That's moderated a little from 5.5% growth a month earlier, which is encouraging. A separate official release last week revealed that job openings fell to 11.4 million at the end of April, down from 11.9 million the previous month. That's another small sign of cooling, but with almost two jobs available for every person seeking work, there is still some way to go.

More on jobs

The ratio of vacancies to unemployed people in the UK tipped above one for the first time in April. There hasn't been a better time to look for a job in half a century, James Reed, chairman of the recruitment firm Reed, tells the Telegraph.

The tightness of the labour market is the dominant theme because it has outsized implications for monetary policy, however it's just one of a number of interesting indicators that suggest people continue to re-evaluate their options. The number of students taking CFA exams, a gateway into the world of finance, has collapsed, for example. The FT's take suggests that cancellations during the pandemic have weighed heavy on applications, however the piece quotes a senior CFA Institute staff member who admits that the long hours, low pass rate and lack of flexibility is turning off Gen Z.

Similar themes emerge in this Bloomberg piece on staff at major banks and technology firms leaving for start-ups. Departures from large institutions to fintech start-ups are up 75% since the onset of the pandemic, according to workplace intelligence firm Revelio. Bumper pay packets are part of the draw, as are flexible routines, a better work-life balance and better career prospects, according to Revelio's economist Lisa Simon.

In other news...

Head of US property group Greystar shrugs off UK economy worries (FT), and finally, how ESG investing came to a reckoning (FT).