Housing supply beginning to build

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

The end of globalisation?

The world's rich and powerful descend on Davos for the World Economic Forum this week and the event has a clear theme: the end of globalisation.

Warnings against "geoeconomic fragmentation" this morning come from the IMF and a raft of business leaders from companies including Goldman Sachs and Blackstone.

In the broadest sense, companies spent decades moving production offshore, bringing down costs via cheaper labour. That boosted economic growth in emerging economies, increased savings for manufacturers and importers and provided low-priced goods to consumers. The process tripled the size of the global economy and lifted 1.3 billion people out of extreme poverty, according to the IMF.

Tensions over trade, technology standards, and security - particularly between the US and China - have been growing in recent years, exerting a powerful force in the other direction. The pandemic-induced chaos in supply chains produced another surge in the nearshoring, onshoring and reshoring of supply chains. Around 30 countries have restricted trade in food, energy, and other key commodities since the beginning of the war in Ukraine.

The jury is out on whether this really is the end of the road for globalisation rather than a shifting of supply chains. Flora Harley weighs up the implications, both for real estate and the economy at large.

The supply of housing begins to build

The tight supply of housing has been the dominant feature of the UK housing market over the last two years, producing double-digit price growth which has continued even as inflation and mortgage rates have risen.

That may be about to change, writes Tom Bill.

The number of sales instructions outside the capital in the week ending 14 May reached its highest weekly level in ten years, according to Knight Frank data. Meanwhile, in a sign of greater focus on the part of sellers, the number of offers accepted across the UK was the highest weekly number in a decade.

“It feels like we are at a crossroads,” says James Cleland, head of the Country business at Knight Frank. “The number of buyers is still very high and now vendors are sensing that the market may be at its peak, hence taking offers and bringing houses to the market. It is a sudden recognition that now is the time to act, brought on by all of the obvious factors coalescing at the same time.”

Meanwhile, Nationwide CEO Joe Garner on Friday warned "there is a risk of a downward movement in house prices, given the pressure on household budgets". You can find our forecasts here.

People shopped in April

Stephen Springham unpicks a "staggeringly robust" set of retail sales figures for April. The value of sales excluding fuel climbed +1.3% compared to the same month a year ago, according to the ONS.

There are some interesting underlying themes - the rebalancing of online back to physical shopping is now levelling out and the data presents some conflicting signals as to the degree that consumers are being squeezed by inflation. However, we've talked before about the degree to which inflation hits differently depending on where you sit on the income scale and it's clear that many consumers are willing to spend after months on the sidelines. Here's Stephen:-

"Those surprised at the resilience of retail sales shouldn’t be – during past recessions and times of hardship, retail sales have tended to defy expectations and out-perform the wider economy. Not bad for a much-maligned sector and one that is supposedly dead and wholly dependent on online for any semblance of life."

NYC rents

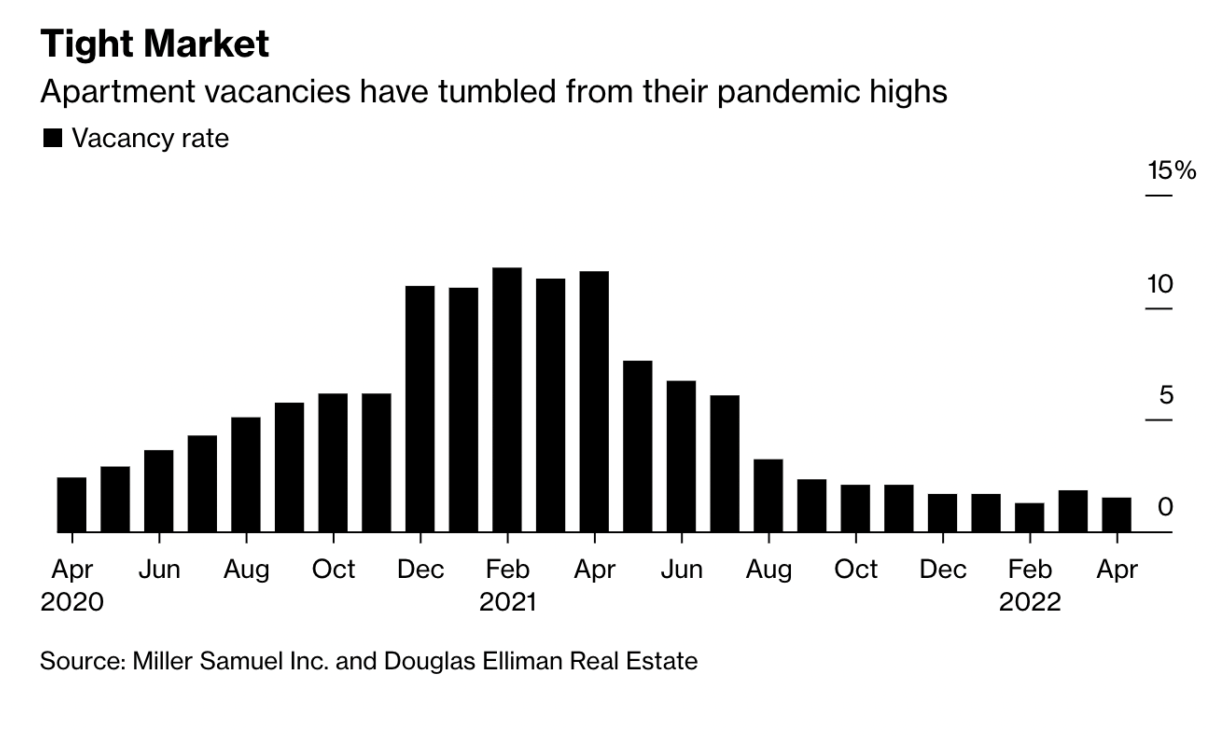

Airbnb stock now outnumbers rental apartments in New York City - see Bloomberg's coverage of data from AirDNA and Douglas Elliman Real Estate.

That stat illustrates the degree to which a shortage of properties is driving up rents. The net effective median rent surged by the highest annual rate on record (39%) to the highest level on record ($3,970) during April. Listings also declined by the most on record (see chart courtesy of Bloomberg).

For more on New York's housing market, I recommend Jonathan Miller's weekly note.

In other news...

Bank of England sees need for further interest rate rises (Reuters), The West braces for Shanghai shock as zero-Covid nightmare ends (Telegraph), demand for rare examples of iconic sneakers is pushing prices sky high (FT), and finally, corporate virtue signalling is ripe for ridicule (Times).