Housing delivery returns to pre-pandemic levels...for now

Leading indicators suggest that housing delivery rates in England have bounced back sharply since plunging in 2020, but how long can the momentum last?

3 minutes to read

This question is being asked against the backdrop of planning reform being shelved, the end of Help to Buy looming, and ongoing build cost pressures.

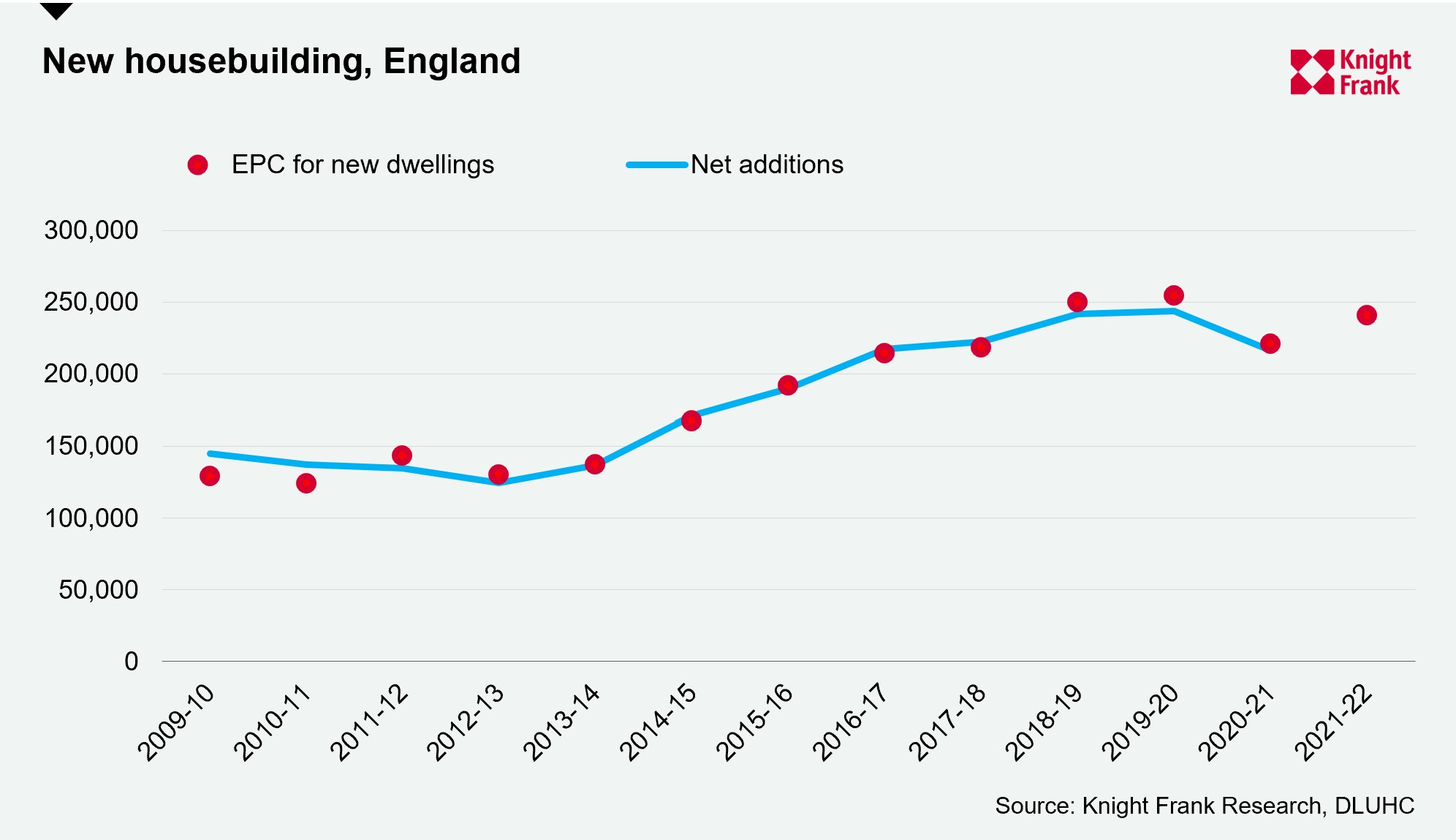

Pre-pandemic, housing supply was ticking up in England. While still far below the government’s target of 300,000 homes a year by the mid-2020s, output had eclipsed 240,000 for two consecutive years, marking the strongest output since records began.

All that changed of course in 2020 due to the onset of the pandemic which led to some construction firms shutting sites during the first UK lockdown between late March and June. In all, net additions fell 11% to a five-year low of 216,489 in 2020-21.

To get a picture of housing output levels during the current financial year, 2021-22, we have analysed new data capturing energy performance certificates (EPCs) granted to new homes. Historically, EPC records have proven to be a good forward indicator of supply, as the below chart shows.

In 2021/22 there were 240,944 EPCs recorded, suggesting that high levels of housing demand over the past 12 months have contributed to a return to pre-pandemic delivery rates. This will be confirmed once the government releases its net additions figures later this year.

In London, supply has also been robust over the past 12 months, with 37,684 EPCs recorded in 2021/22, not far off the 48,870 net additional dwellings recorded for 2019/20. Furthermore, the latest Molior data for the capital shows that new starts more than doubled in Q1 2022 compared to Q1 2021 to reach 5,320.

Delivery challenges

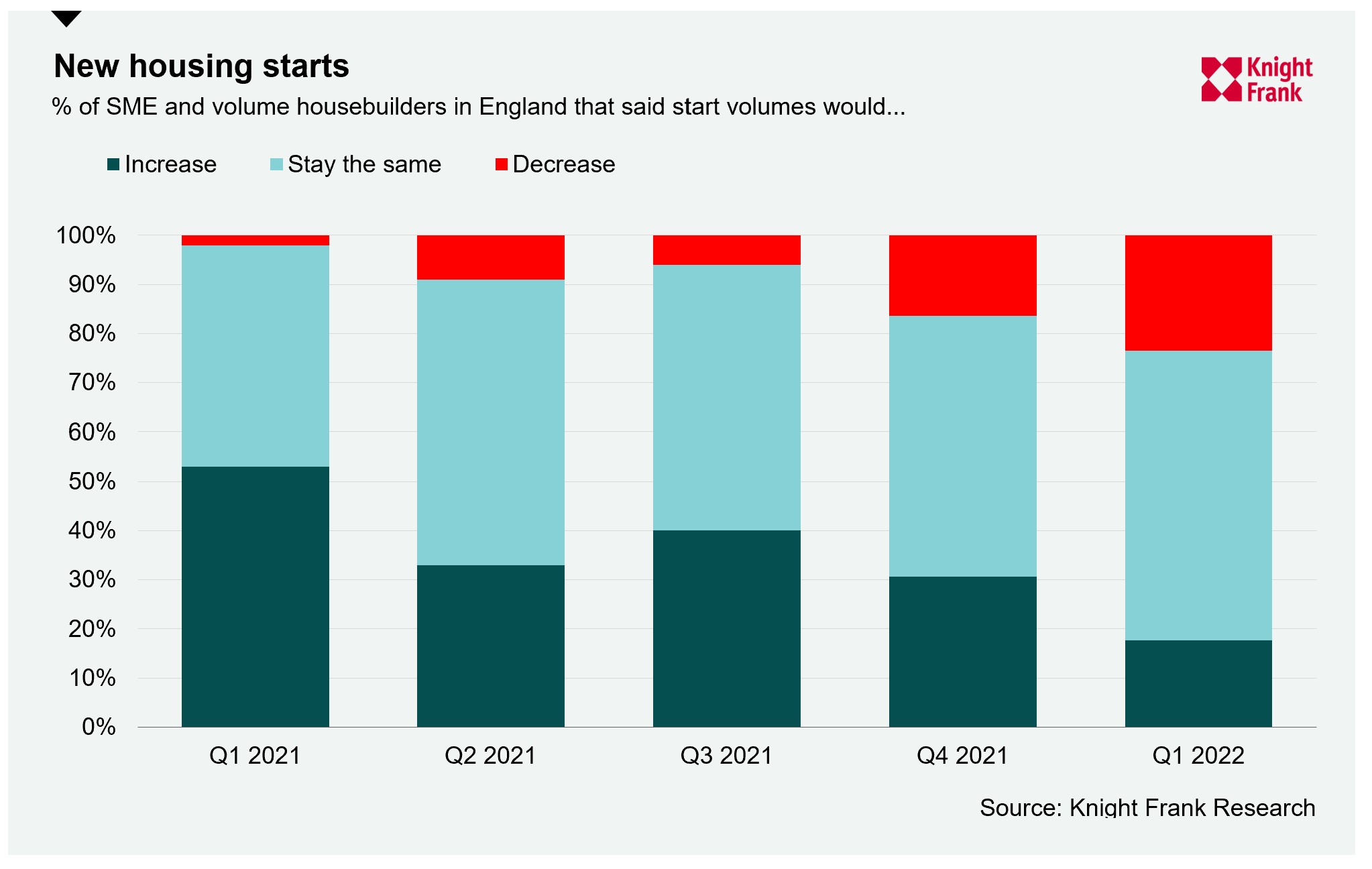

However, signs are emerging that this high rate of delivery could slow moving forward. In our fifth survey of volume and SME housebuilders across England, a quarter of respondents said they expected new starts to fall in the second quarter. It is the first time since we began the survey that a higher proportion are expecting new starts to fall than rise (see table below).

In the new homes market, an expected slowdown in house prices this year and the phasing out of Help to Buy could moderate build out rates.

The cooling housing market will have a more significant effect on delivery in areas such as London, where prices are more sensitive to the recent sharp increases in build costs. Currently, demand remains strongest for housing-led greenfield sites outside London in areas where house price inflation continues to offset build costs.

The end of Help to Buy and changes to the scheme which took effect in spring 2021 means housebuilders will need to seek alternative sales exits. Following the introduction of the current scheme in April last year, with eligibility restricted to First Time Buyers and new regional price caps brought in, legal completions using the equity loan scheme in England have already reduced: the most recent data shows completions in Q4 2021 were 58% down on Q4 2019 and down 41% from the same period in 2019.

Finally, the government’s plans to stimulate more housing delivery through major planning reforms have been shelved. They were not part of the Queen’s speech in May, with the government having retreated following wide-scale resistance to the plans. Instead, smaller measures emerged such as 'street votes' on 'local design codes' to allow residents to decide what sort of new buildings should be allowed in their area. But new layers of local approval on areas of design could stifle rather than stimulate delivery, as we discuss on this Intelligence Talks podcast.