Surge in offers accepted as sellers sense slowdown in Country market

Speed of UK sales accelerate outside of London as spring selling period makes strong start.

2 minutes to read

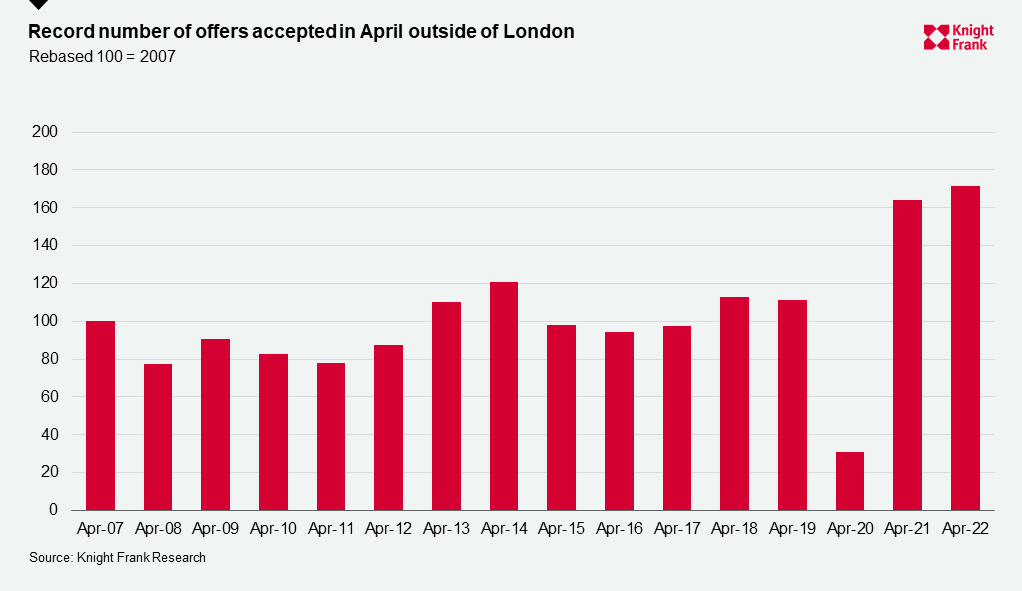

The number of offers accepted in the country market in April was the highest for the month in 15 years, surpassing the previous record set last year during the stamp duty holiday.

After a period of record-breaking growth that saw prices in the country market hit a new peak in March, sellers have been motivated to act during one of the property market’s busiest months to crystallise gains ahead of an expected slowdown later this year.

With the cost of living rising and supply starting to pick up, Knight Frank expects double-digit growth in the Country to decline to single digits by the end of 2022.

“Having taken stock during the first three months of the year people are now coming to market and being decisive. Where property is realistically priced, it is selling quickly and attracting competition,” said Russell Grieve, office head at Knight Frank Haselmere.

This fresh impetus has also seen sale times reduce.

The median time from instruction to an offer being accepted fell from 57 in March to 56.5 days in April. This is the shortest time since last June, when the figure was 54.5 days during the frenzied final month of the full stamp duty saving.

“This is the time to sell and people have recognised the market is hot. It’s also a good time to accept an offer, as more property will continue to come to the market over the next few months.

“We’re still seeing a lot of demand, with lifestyle changers looking to buy in the area, alongside families and those looking to down-size,” said Charles Probert, office head at Knight Frank Hereford & Worcester.

The demand/supply imbalance that has kept upward pressure on prices looks set to persist through the spring market, although supply continues to build gradually. Market valuation appraisals were up 3% in April versus the five-year average, excluding 2020.

That said, the number of new prospective buyers was up 25% versus the five-year average, excluding 2020. We expect strong demand to decline over the course of the year as the economic backdrop becomes more uncertain.