Future Demand: Who’s buying?

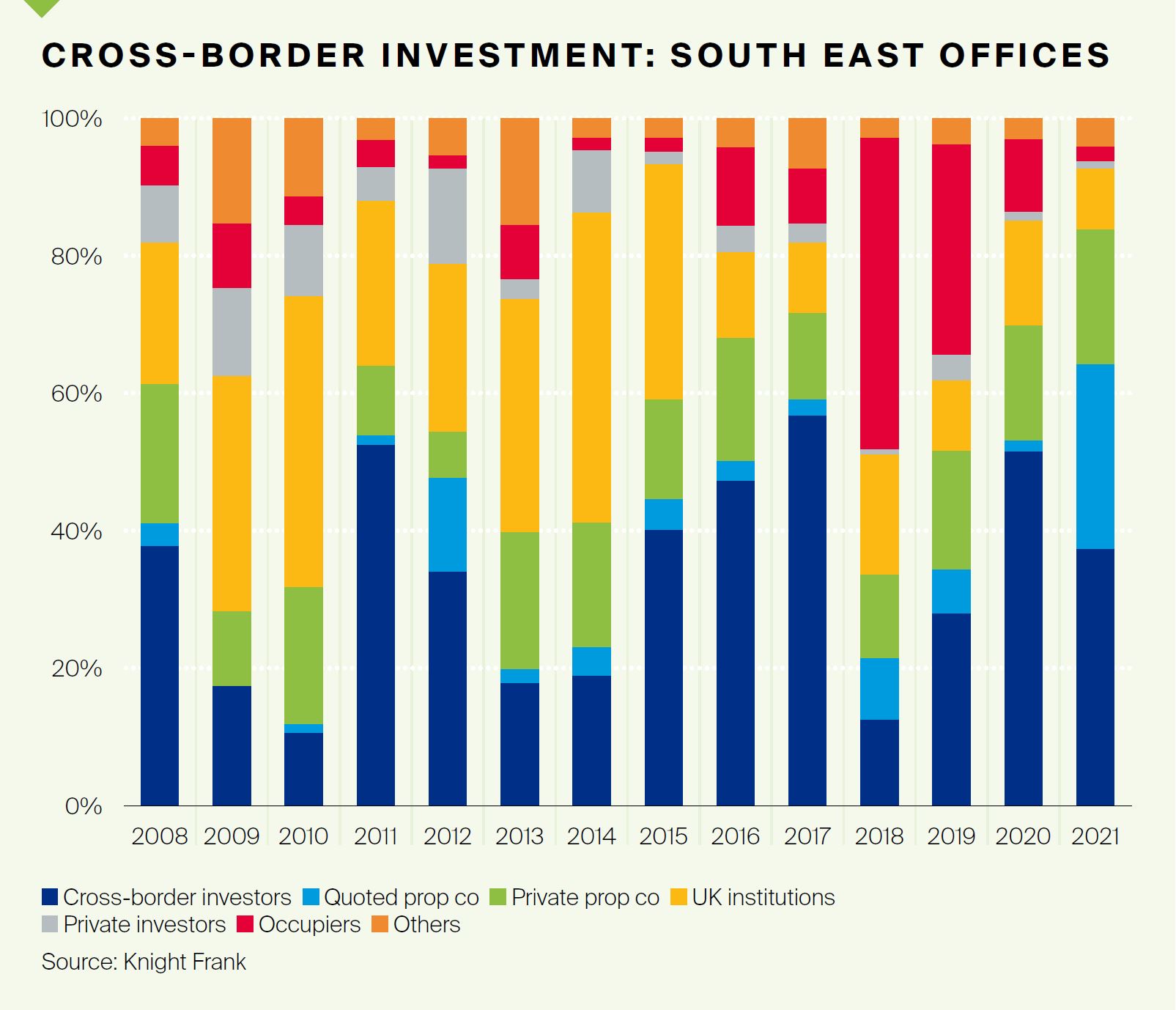

The investor landscape in the south east has realigned in recent years, consistent with the experiences of the wider UK.

4 minutes to read

Pre-pandemic, institutional investors accounted for an average 32% of domestic UK office investment; in 2021, this share of domestic investment had fallen to 20%. This pattern is mirrored in the south east, with institutional investors’ proportion of the market falling from 28% pre-pandemic to 14% in 2021. Institutional activity, however, will remain a strong influence on the market. Institutional investors are expected to focus on a strategic downsizing of their office exposure, with a renewed focus on prime opportunities in the south east.

As institutional investors scale back, who’s taking over?

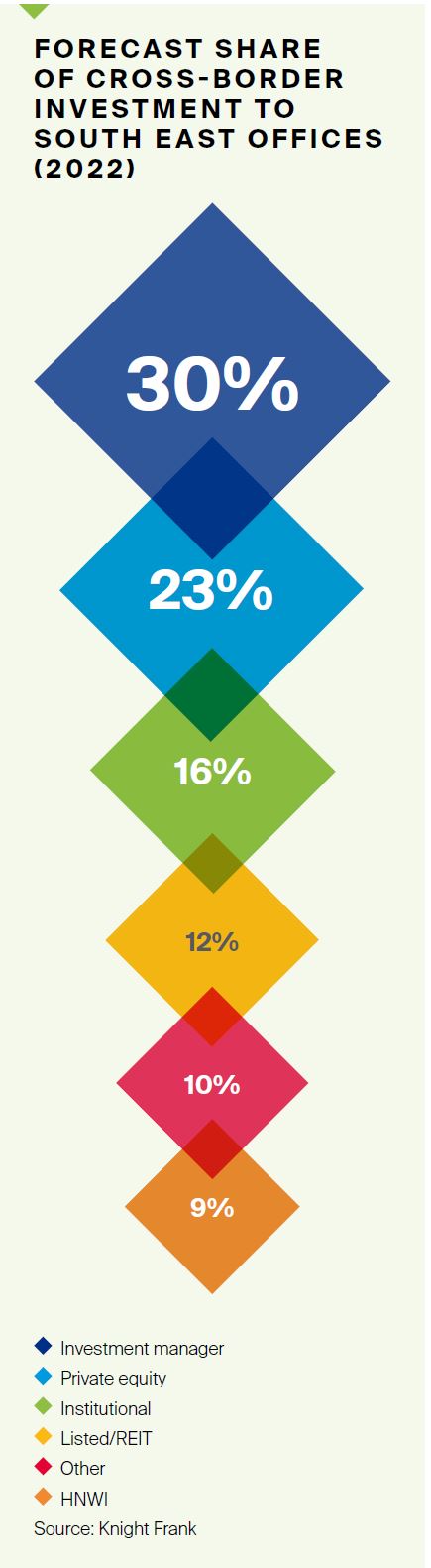

Cross-border private equity buyers and investment managers have emerged as frontrunners for office assets across the UK and in the south east. Using a capital gravity model from our Active Capital research, we have forecasted where we expect cross-border capital to allocate money in the year ahead. A record year for UK offices is anticipated, with the sector set to be the most invested asset class globally in 2022.

Investment managers and private equity are expected to be the driving force behind this investment, with a 30% and 23% share of cross-border investment respectively. Private equity investors from the US, Greater China and Switzerland are expected to be particularly active.

Click to enlarge image

Private equity a key player

French and US private equity firms such as Corum and Kennedy Wilson, alongside investment managers including Longmead and Trinova, are expected to be particularly interested in the south east “core plus” office market in the year ahead. The south east offers larger lot sizes and a relative ‘day one’ yield discount compared with prime UK cities and

alternative sectors, including the industrial sector where yields have reached record low levels. As pricing in this category stabilises, global equity firms could pay even greater attention to the market. Equity is also expected to target refurbishment opportunities in markets where the supply/demand balance is strong and rental growth projection supports the level of capital expenditure required. This is where we may record the widest range of investor type. UK funds will remain active in prime markets, along with property companies and development managers who require a three- to five-year project. Although an exciting proposition for some, this could be a cause for concern in markets where rents have stagnated and/or are not at a level to support these rising costs. Pressure on rents, coupled with the ESG journey some of these assets may need to embark on, underscores the delicate balance between opportunity and challenge.

Turning challenge into opportunity

As a result of the pandemic, some office markets in the south east face a challenging future. This has created opportunities to explore alternative uses, with industrial buyers able to underwrite land values in excess of the historic office use. For example, British Land and London Metric have been able to sit on short- to medium-term income in order to unlock alternative use potential.

Life sciences

The life science sector remains an important part of the south east office market, with a queue of investors seeking exposure. There is genuine depth to the market, with investors such as Blackstone/ BioMed, Oxford Properties, Kadans and Tishman Speyer seeking space in the core Golden Triangle of Oxford/ Cambridge/London, while investors such as Mission Street, British Land and UBS have been more focused on some less established centres.

Data centres

Data centres have quickly become an asset class of interest in markets such as Slough, Hayes and other areas of the M4 corridor. In locations with appropriate site size and where power supply is sufficient, vendors have been considering the planning options open to them. Where vendors choose to exit, more opportunistic investors have been prepared to take on the planning risk, seeking higher return potential. A recent example includes Segro’s £435 million acquisition of 950,000 sq ft of office stock on the Bath Road in Slough, with a view to converting to data centres.

Click to enlarge image

What next?

The diversification of investor demand places the south east office market in good stead for the next phase of the current cycle. Stock selection will continue to be critical. As occupiers move back into their offices, established markets look set to perform well. Having been so active over recent years on the acquisition side, councils are now under increasing pressure to reduce debt and selectively exit assets. This could create an interesting investment environment for buyers over the next year.

Download Navigating the property lifecycle PDF