Earth Day 2022: how can commercial real estate occupiers play their part?

Occupier sentiment is changing as real estate adapts to new environmental trends, here we explore these latest trends influencing occupier demand.

8 minutes to read

Earth Day is celebrated every year on 22nd April to raise awareness and support for environmental protection. Real estate is playing an increasingly important role in how we tackle climate change and this is impacting how people invest and operate in property.

The World Green Building Council claims that the built environment is responsible for around 39% of energy-related carbon emissions, with 28% of this being operational emissions. As such, taking this opportunity to reflect on the necessity of environmental protection and climate action, we cannot overlook the role of commercial real estate in the fight against climate change and how, as a result, environmental concerns are shaping corporate occupiers’ real estate decisions and strategies.

Here we will explore five key environmental trends that are currently shaping occupier demand.

1. Occupiers are embedding Environmental Social Governance (ESG) into their corporate strategies

Risk management solutions provider Alcumus has published findings from its recent survey of 621 senior managers at businesses across the UK, US and Canada. It found that 90% of respondents have adopted environmental, social and corporate governance considerations in their corporate strategies, with this rising to 94% among the companies with 250 employees or more.

A recent related trend is also ensuring that company leaders are being held personally accountable for their organisations’ sustainability. We are increasingly seeing executive remuneration being tied to environmental performance, with bonus payments being dependent on sustainability targets being met.

Recent examples of this include Swiss multinational bank UBS. In its new climate roadmap, outlining its route to Net Zero, the bank claims that its revised compensation programme introduces sustainability objectives, linked to the firm's climate priorities, against which its executives will be individually assessed in alignment with their annual performance assessments. Similarly, at US software giant Salesforce, a portion of executive pay is now reliant on their success in reducing air travel emissions and increasing the sustainability of its supply chain.

Why does this matter?

Real estate comes under greater scrutiny when its owners and occupiers have green targets to hit. As more companies embed ESG aims and emission reduction targets into their corporate strategies, we will see more capital being invested in sustainable real estate solutions, the retrofitting of inefficient spaces, and property technologies for measuring and improving buildings’ operational carbon footprint.

2. Companies want all of their energy to be clean energy

Commitments to renewable energy are an essential component to decarbonisation strategies. To reduce their Scope 2 emissions, relating to indirect emissions from the generation of purchased electricity, heat and steam, an increasing number of multinational occupiers are aiming to operate on 100% renewable energy. Companies leverage power purchase agreements and invest in on-site renewable power capabilities to ensure they have all the clean power they need.

A recent instance of this can be found at US life sciences services company, Charles River Laboratories. The company is committed to renewably powering its European and North American activities by 2023, and a new wind power deal with Spanish energy provider Repsol will reportedly fulfil its European demands by that target year. Similarly, IT consultancy Cognizant has announced a goal to source 100% renewable energy for all of its leased and owned facilities by 2026. To achieve this, the firm will enter into new power purchase agreements with clean energy developers, engage with its facilities’ property owners, and expand its use of on-site solar energy capabilities. Amazon’s approach, meanwhile, is more focused on in-house generation. With 169 solar rooftops across its real estate portfolio, in addition to multiple ‘utility-scale’ green energy projects around the world, the tech titan is well on-track to achieve its 2025 100% renewable energy target.

Why does this matter?

While solutions such as power purchase agreements and Renewable Energy Certificates (RECs) are likely to do most of the heavy lifting for large corporate occupiers, the falling cost of solar energy installations means that, for many, sustainability starts at home. Occupiers value solutions such as photovoltaic or solar arrays that enable them to power their sites with clean energy from their rooftops, allowing them to take ownership of where their energy comes from and, in the long-term, reducing the cost of this essential overhead.

3. Investors expect more from their portfolio companies

We are increasingly seeing institutional investors establishing sustainability targets that encompass the activities of their portfolios. The Carlyle Group, for instance, have recently announced a set of emissions targets: it is aiming for 75% of its portfolio companies’ Scope 1 and 2 emissions to be covered by Paris-aligned climate goals by 2025; and, long-term, it is aiming to achieve Net Zero across its investments by 2050.

As a result, many are getting actively involved in their portfolio companies’ pursuit of greater sustainability. Returning to the Carlyle Group, the private equity giant has recently completed a carbon footprinting programme, assessing the Scope 1 and 2 emissions of the majority-owned companies in its key buy-out funds. As a result of its findings, Carlyle’s dedicated ESG & Impact team is providing support to its companies, to help them understand their environmental footprint and gather more robust emissions data. Now, in its most recently-invested US buyout fund, the proportion of portfolio companies that track their carbon footprints has increased from 22% to 100%.

In line with this, investors’ expectations of their portfolio companies’ approach to environmental concerns are increasing. Aviva Investors, for example, announced in January that each of their portfolio companies’ boards have received a tailored letter, detailing a call to action. Alongside targeted demands for each organisation, Aviva is demanding that its portfolio companies publish action plans, threatening to vote against the boards in Annual General Meetings if their expectations are not met.

Why does this matter?

The capital businesses need to grow is flowing towards sustainable prospects. To ensure they remain within the big investors’ crosshairs, public and private companies alike should be keen to sure up their ESG strategies, publicly demonstrate their commitment to addressing environmental concerns, and invest in delivering their sustainability aims. This will manifest itself in green building policies, the leasing of workspaces with green building accreditations, and investment in solutions to improve energy efficiency.

4. The green finance market is booming

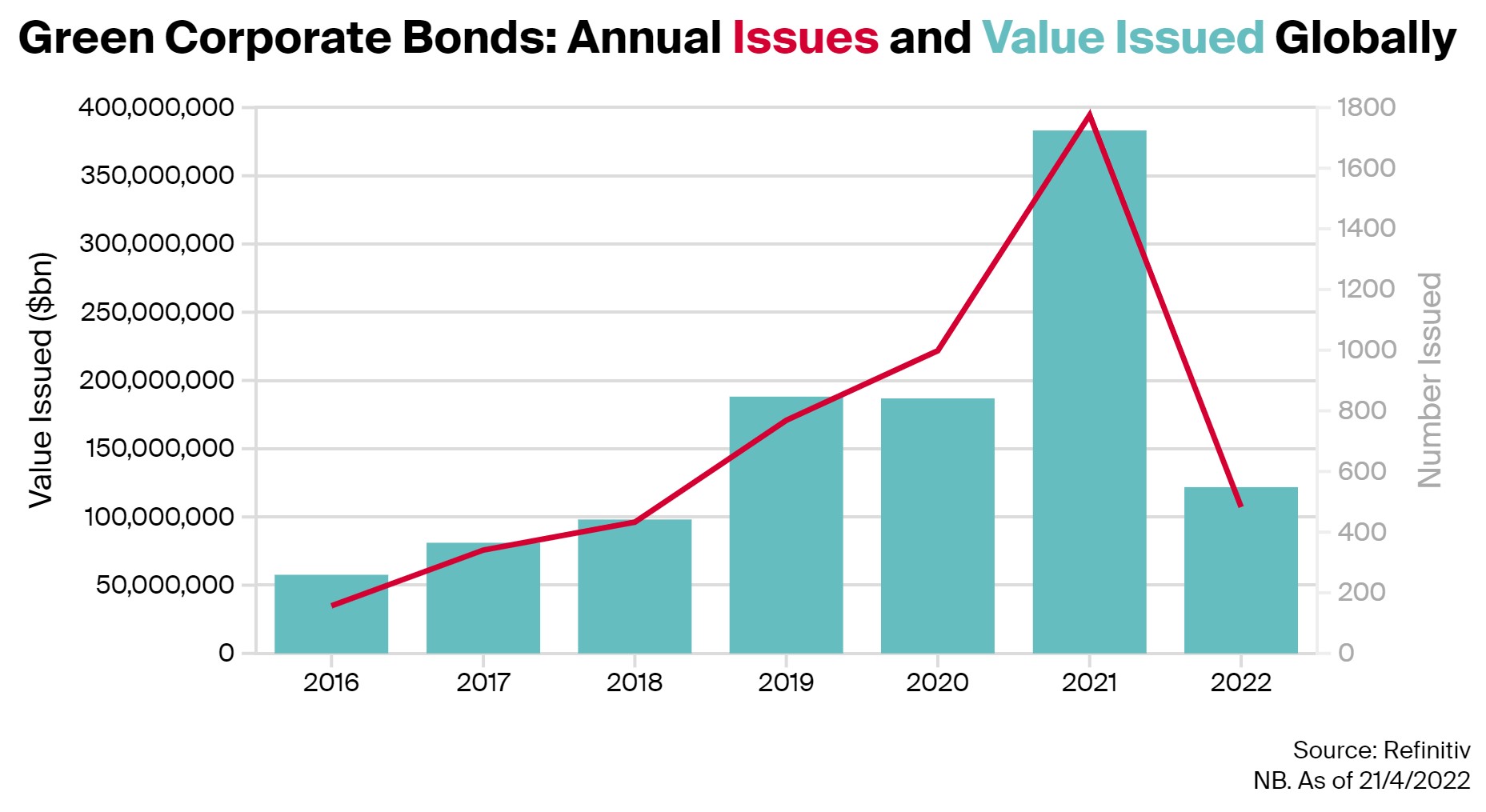

According to data from Refinitiv, 2021 saw the value of green corporate bonds issued globally rise by more than $200bn, smashing the record set in 2019. Indeed, we appear to be set for another bumper year. The year-to-date total (as of 21st April 2022) has surpassed $120bn – more than was issued annually in both 2017 and 2018.

In addition to this, the green loan market is reaching new heights. Just six weeks into 2022, Refinitiv recorded more than $40bn of announced sustainability-linked loans globally – up more than 50% against the same period in 2021.

What does this mean?

Green bond and loans exclusively fund green projects that contribute to an environmental objective (inclusive of other related and supportive expenditures, such as admin costs or R&D). As such, this growing market, and the increasing scale and scope of the funding opportunities being made available, is fuelling investment in green energy infrastructure, green buildings, and even corporate emissions reduction projects, in which occupiers are investing in improving the sustainability of their operations and facilities. The growth of the green finance market is sure to develop the supply of green buildings, improve the sustainability of buildings, and power occupiers’ emissions reduction strategies, as well as develop green energy capabilities and capacity.

5. Compliance and sustainability are becoming increasingly integrated

Climate change is not going to be reversed by the free market alone. In recent months, global institutions and regulators have been ratcheting up the pressure on corporates, pushing forward with new legislation, regulations and reporting requirements.

Examples include the United Nations, which last month launched a new group, tasked with developing higher standards for setting, measuring and tracking Net Zero commitments. Meanwhile, the European Commission has adopted a directive to enforce the integration of corporate sustainability due diligence into company policies, ensuring they identify and appropriately address the negative environmental impacts of their activities.

Public companies globally are also set to find themselves the topic of increased regulatory scrutiny. The United States’ Securities and Exchange Commission (SEC) has released proposals for new rules, requiring US listed companies to disclose information on climate risks, their plans to address them, and KPIs relating to their climate footprints. Similarly, the Singapore Exchange has established new sustainability and transparency rules for its users. In a phased roll-out, climate-related disclosures are being made mandatory, on a ‘comply or explain’ basis.

As a result of this trend, we are seeing ESG reporting merging with compliance. A recent study by risk and compliance software provider NAVEX Global found that nearly 90% of participating compliance managers and executives, from large companies across the US, UK, France and Germany, include ESG reporting as part of their compliance programmes.

What does this mean?

Sustainability is now, for many, a requirement for continuing operations. With ESG KPIs being publicly reported, and meeting environmental standards being essential to complying with legal requirements, sustainability is at the top of the corporate agenda. Therefore, for many corporate occupiers behind the curve in terms of their environmental performance, investment in sustainability solutions needs to be a priority with regard to their capital expenditure strategies and real estate search criteria.