Endgame in sight for strong UK house price run

Robust March performance, but supply is building as headwinds strengthen in UK housing market.

3 minutes to read

Annual house price growth was at its highest level since 2004 in March, hitting 14.3% according to Nationwide.

The lender highlighted that the race for space had seen the average price of a detached property increase by £68,000 since the onset of the pandemic, compared to a rise of £24,000 for flats.

It added that the trend was making it harder for people to trade up, with the average price gap between flats and terraced houses in the UK having doubled since the onset of the pandemic (from £12,000 to more than £25,000).

On a quarterly basis Wales remained the strongest performing region, with house prices up by 15.3% year-on-year. London, where the average house price is the highest in the UK, was the weakest performer with an increase of 7.4%.

Halifax reported a ninth month of house price growth, up 1.4% in March, which was the largest increase since last September. It pushed the annual rate of change to 11%, with the familiar story of high demand and limited supply fuelling the rise.

However, with the cost of living rising alongside borrowing costs we may be entering the endgame for double-digit price growth as our newly published forecasts set out.

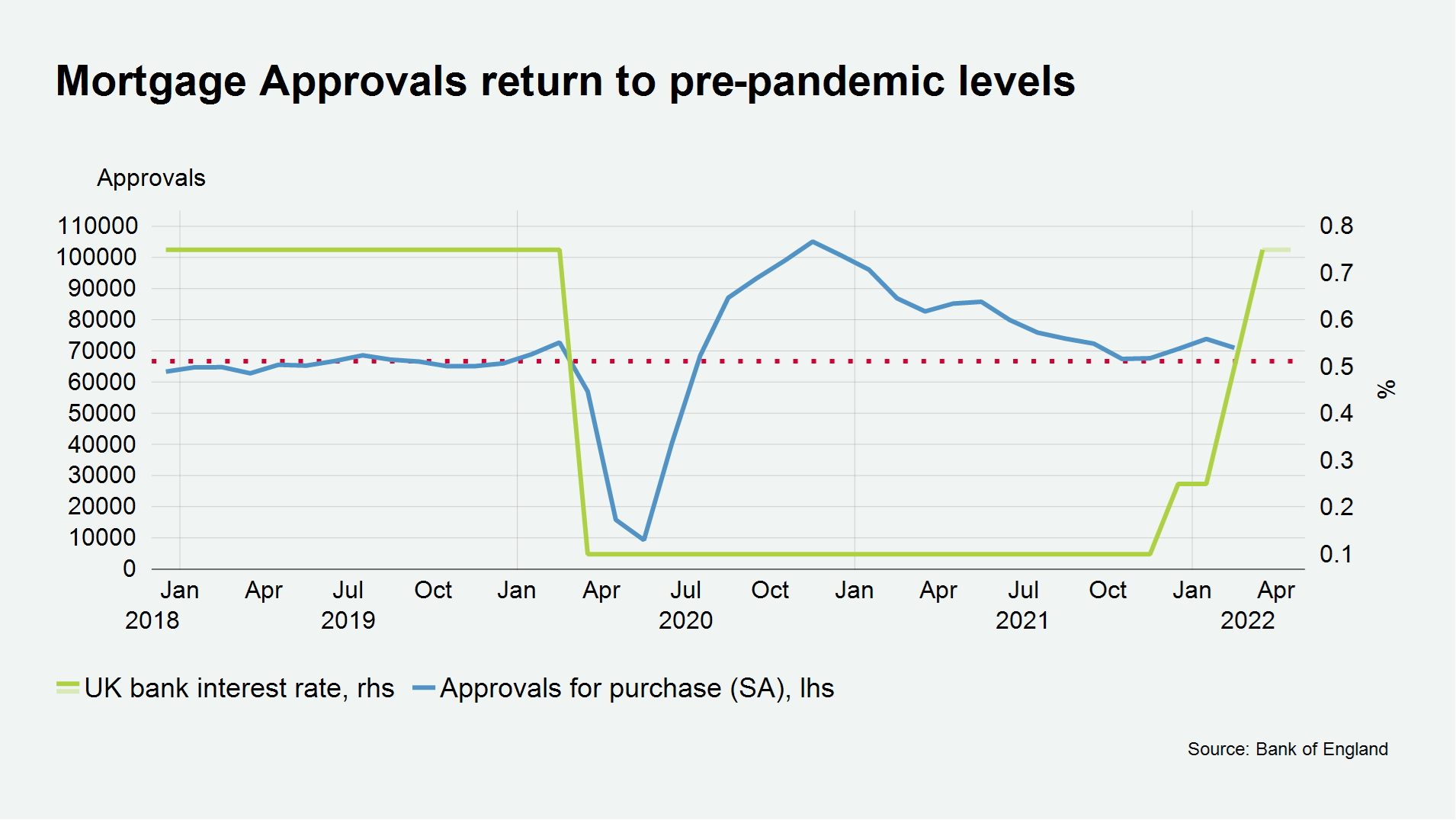

Mortgage approvals for home purchase declined in February to 70,993. They stand 32% below November 2020’s pandemic-fuelled peak of 105,086 although they remain above the monthly average for 2019 (see chart).

Supply is now coming through for the spring market. The latest sentiment survey from RICS showed that new instructions turned positive in March for the first time in 12 months.

A net balance of +8 respondents reported a rise in the volume of new listings. New buyer enquires were +9 in March, marking the first time since the pandemic that supply and demand have been so closely aligned.

However, while there have been reports of sliding consumer confidence – with the GfK Consumer Confidence Index stating sentiment had slid to lows last seen in late 2020 – it is yet to register with homeowners.

Current price expectations in the IHS Markit Household Price Sentiment Index reached +61 in March compared with +59 in February. Future price expectations climbed from +66 in February to +66.4. A score of more than 50 indicates positive sentiment.

Prime London Sales

Prices continued their upwards trajectory in prime London sales markets in March as demand in the capital rebounded after the pandemic.

In prime central London, average prices grew by 2.1% in the year to March, which was the strongest annual rate of growth since May 2015.

In addition to the re-opening of the economy, relatively good value is driving demand in central London after six years of subdued activity.

Prime London Sales Report: March 2022

Prime London Lettings

Landlords remained in the driving seat in the rental market across London and the Home Counties in March.

Low supply and high demand means that average rental values in prime central London increased by 3.5% in the first three months of the year. In prime outer London, there was a rise of 2.5%.

Annual growth has reached record levels due to how far rental values fell in the early months of last year as the market became flooded with short-let rental properties due to pandemic staycation restrictions.

Average rental values increased by 21% in prime outer London and by 26.3% in prime central London in the year to March.

Prime London Lettings Report: March 2022

The Country Market

Low supply remains the biggest challenge facing buyers in property markets outside of London, but sellers are increasingly sensing a window of opportunity against a backdrop of resilient demand.

While new instructions outside of London were below the five-year average in March, the gap has reached its smallest level since April 2021 at -2%.

The number of new instructions was also the highest in a calendar month since June last year. While demand has been extremely high in recent months a lack of supply has produced an imbalanced property market with strong house price inflation.

Sellers heed call to action as spring market commences

For further insight into the UK residential property market, subscribe below.

Subscribe