Is it too early to start talking about falling interest rates?

Making sense of the latest trends in property and economics from around the globe.

5 minutes to read

A US recession

Can the US Federal Reserve execute an aggressive series of rate hikes aimed at reigning in inflation without tipping the economy into recession? Probably not, according to investors.

The 2-year US Treasury note yield rose briefly above the benchmark 10-year US Treasury yesterday, in a strong signal that markets are bearish on the US economy. The FT has done the maths: yield curve inversions of this nature have preceded every US recession in the past 50 years.

Critics of the Fed blame it for sitting on its hands for too long. Its long-held position that inflation would prove transitory eventually left it with little option but to slam on the brakes, likely causing a spike in unemployment and a recession.

Former Treasury Secretary Larry Summers has been among the Fed's most vocal critics and takes the view that enduring a short recession is worth it to avoid the inevitable alternative - both unemployment and inflation averaging above 5% for the long term. For more, I highly recommend this conversation between Summers and the NYT's Ezra Klein.

The Fed's first hike earlier this month is already being felt in the housing market. US mortgage rates are now rising at the fastest rate since 1994, though it's going to take time before we see that translate into any easing of house price growth in the most active markets. Today, we take a closer look at the outlook for Miami, where sales soared 40% in 2021 compared to a year earlier.

The UK perspective

Both the UK and Europe are suffering from broadly similar supply-side inflationary pressures, though the US is more insulated from rises in energy prices, but the real key difference is on the demand side. The truly colossal economic stimulus provided in the US dwarfs that of most other nations as a share of GDP and the post-pandemic rebound in the demand for goods is creating a worse imbalance than we're seeing in the UK or Europe.

The difference is encapsulated by the Bank of England's view that the cost of living crisis will eat into inflation enough to avoid aggressive action by the BoE. Governor Andrew Bailey reiterated that view during a speech yesterday when he said the imminent "historic shock" to incomes would cause both growth and demand to slow.

If things do play out how the BoE expects, the path of borrowing costs is likely to be markedly different on either side of the Atlantic. Bloomberg reports that traders are already betting on a return to rate cuts in the UK within the next two years, the most aggressive positioning since 2007.

The resilient consumer

We're still waiting for meaningful signs that the UK consumer is gripped by a cost of living crisis. Stephen Springham dissects the latest retail figures from the ONS:

"The retail sector generally is firmly in recovery mode and nationally (though obviously not universally) there is still demand that is slowly being released. For all intents and purposes, those that have money and are willing to spend it are outweighing those less fortunate/privileged, who are maybe at the far sharper end of the ‘cost of living crisis’."

Stephen's view is reinforced by Bank of England data published yesterday showing consumers spent a net £1.5 billion on credit cards during February. Capital Economics chief economist Paul Dales puts that down to consumer confidence over a cost of living squeeze pushing consumers towards debt - see his comments in the FT.

Still, something has to give. The British Retail Consortium's latest survey shows retailers increased their prices by the most in almost 11 years this month. That measure has now risen for five straight months.

Legally green

London's grade A office buildings are in short supply relative to demand as occupiers rethink their needs amid a return to on-site work. The legal sector is at the epicentre of the race for the best space.

Top law firms took more than a quarter of all the office space leased in the City of London last year, according to Knight Frank Research shared with the FT. The 1.1m sq ft of space taken by the sector is the most since before the Brexit referendum. Some 94% of that space was in grade A buildings, compared to 74% five years ago.

“A big part of that is talent and retention," Richard Proctor, our head of tenant representation in London tells the paper. "Wellbeing is playing a part and we have got a lot of law firms which have committed to hit net zero carbon [emissions] by certain dates. A lot of them are taking the opportunity to move to far more sustainable buildings.

The new logistics hot spots

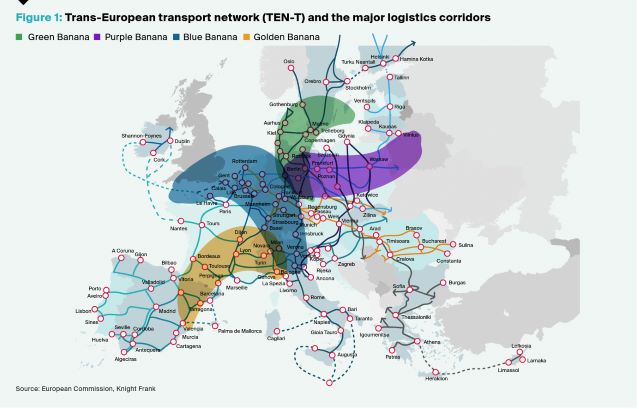

A lack of conventional policy tools to support economic growth and the push for more decarbonisation policies are encouraging large-scale infrastructure projects across Europe.

These will inevitably increase the need for new multi-modal warehouse facilities accessible by different transport modes, offering opportunities for logistics investors and developers alike. A new Knight Frank report out today outlines some key hot spots.

The most established logistics corridor in Europe is the so called ‘Blue Banana’ which runs through the Rhine-Alpine TEN-T network and includes major economic centres such as the Randstad region in the Netherlands, and the German Rhine- Ruhr and Rhine-Neckar regions (see below). These well-connected locations offer opportunities in or near major urban centres with high population densities where competition for land is strongest and supply of industrial and logistics stock is most constrained.

See the report for more.

In other news...

Signs of opposition to UK solar (Telegraph), EY Brexit tracker finds 7,000 finance jobs have left London for EU (Reuters), and finally, Canary Wharf proposes £500m lab project to reinvent financial hub (FT).