UK Logistics Market Outlook 2022: Rising Occupancy Costs And Limited Labour

As the cost of renting warehousing space rises, space optimisation will be of heightened importance, operators will look to improve how efficiently they use space.

Operators will need to look more strategically at locations where they can tap into an available labour pool. We foresee the geography of the logistics market widening as labour availability rises up the agenda for occupiers.

4 minutes to read

Rental growth

We anticipate sustained rental growth in 2022. Rents have been rising across the country, average rents across the UK rose around 8.9% in 2021, and some markets have seen double-digit growth over the past year. The shortage of space coupled with limited supply is driving competition and rental growth. In London, prime rents have risen 25% (units over 50,000 sq ft) in 2021 and smaller units have recorded even stronger growth, with prime rents for units sub-20,000 sq ft rising 56% over the year.

Rental growth is expected to average 6.7% in 2022, across the UK. In the same pattern as last year, the strongest growth is anticipated in London, the South East, and Eastern regions.

As tenants face rising rents, smaller businesses and those operating on very lean margins will feel the impact most. However, for large operators, rent is a relatively small part of their cost base. That said, for operators looking to move or expand, space optimisation will be of heightened importance, given the higher costs. They may look to make greater use of the height, through the installation of mezzanine levels or implement automation technologies that can help improve the utilization of space.

Labour

The tightening of the labour market and upward pressure on wages is a more significant factor in driving up operational costs.

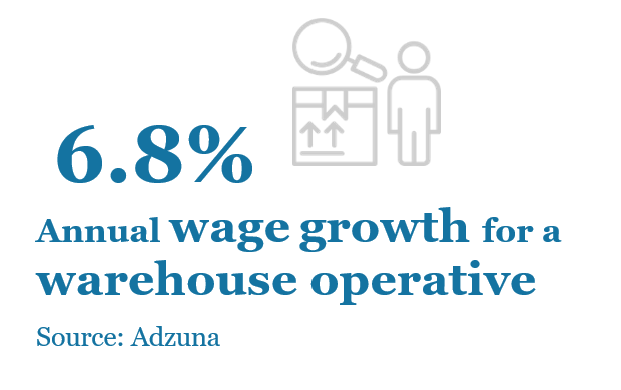

The average warehouse operative salary is £22,646, having risen 6.8% year-on-year, compared to an annual change of -6.4% for all jobs (Adzuna). With retailers and distribution firms expanding their online retail and home delivery networks, the demand for warehouse workers has risen. Vacancies are highest in the Midlands, though the South East, East, and South West also have high numbers of job vacancies.

As the most established markets face dwindling labour pools, labour availability will be a key factor driving growth outside these locations. Operators will need to look more strategically at locations where they can tap into an available labour pool and this will mean venturing further from the established markets where competition for labour is fierce.

We foresee the geography of the logistics market widening as labour availability rises up the agenda for occupiers.

Mitigating supply chain risks

Supply chain risks remain present. While the risks from Covid wane, new risks are present on the horizon. The Russian invasion of Ukraine poses a new threat to commodity supplies and pricing and will have a ripple effect across global manufacturing and supply chains in 2022. Firms will continue to look at ways to broaden their supplier base and hold additional stock to protect their order books.

Supply disruptions will trigger price increases for manufacturers and will impact various sectors, including aerospace and automotive as well as the production of semiconductors, batteries, and some medicines.

Cost of energy & transportation

Energy and transportation costs will continue to rise and this will have a significant impact on operating costs for manufacturers and distribution firms. The pricing of container rates, especially those servicing transpacific routes, is expected to continue rising, this, along with rising fuel prices is putting upward pressure on occupiers’ transportation costs.

In 2021, energy prices were rising rapidly and the war in Ukraine will put additional pressures on energy and fuel prices. This may prompt faster adoption of green, onsite energy production.

Business rates revaluation

The next Business Rates Revaluation comes into effect on 1st April 2023 and will result in changes in rates payable across England, Scotland, and Wales. It is 6 years since the last revaluation took place. For England and Wales, the revaluation is based on rental values at 1st April 2021 when the markets were subject to significant turbulence. For Scotland, the revaluation is to be based on rental values as at 1st April 2022. The aim is to redistribute the tax base to reflect changes in rental values.

The rental growth between the two valuation dates will determine the uplift in business rates payable, and with strong rental growth recorded over the period, the impact could be significant, though the impact will be felt differently across different markets. Across the UK as a whole, prime rents rose an average of 29.9% (units over 50,000 sq ft) since the last revaluation date.

The Knight Frank Business Rates team has compiled rental growth data across 10 regional sub-markets to assess the impacts, with projected rates following the revaluation in 2023/24.