The Spring Statement, the resilient consumer and is this the end for globalisation?

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Rolling back the years

The Office for Budget Responsibility publishes its outlook alongside the Spring Statement and yesterday's was at least as interesting as the Chancellor's output. The document includes some very large numbers that you really need to roll back the years to put into context.

Firstly, the OBR predicts that real household disposable incomes will fall by 2.2% in 2022-23, the largest fall in a single financial year since official records began in 1956-57. Much of that fall is driven by inflation, which the OBR thinks will peak at close to 9% in the fourth quarter of this year. That would be the highest level of consumer price inflation in around 40 years, when the second oil shock pushed inflation into double digits in the late 1970s and early 1980s.

The OBR's outlook is underpinned by expectations in financial markets that further interest rate rises will take the Bank of England's base rate to a peak of 1.9% by the third quarter of 2023. That would take interest rates to their highest level since January 2009, when the Bank cut the rate from 2% to 1.5%. A month later, the BoE slashed the rate to 1% and interest rates haven't surpassed 1% since. During subsequent years, average UK house prices climbed 74%.

The housing market

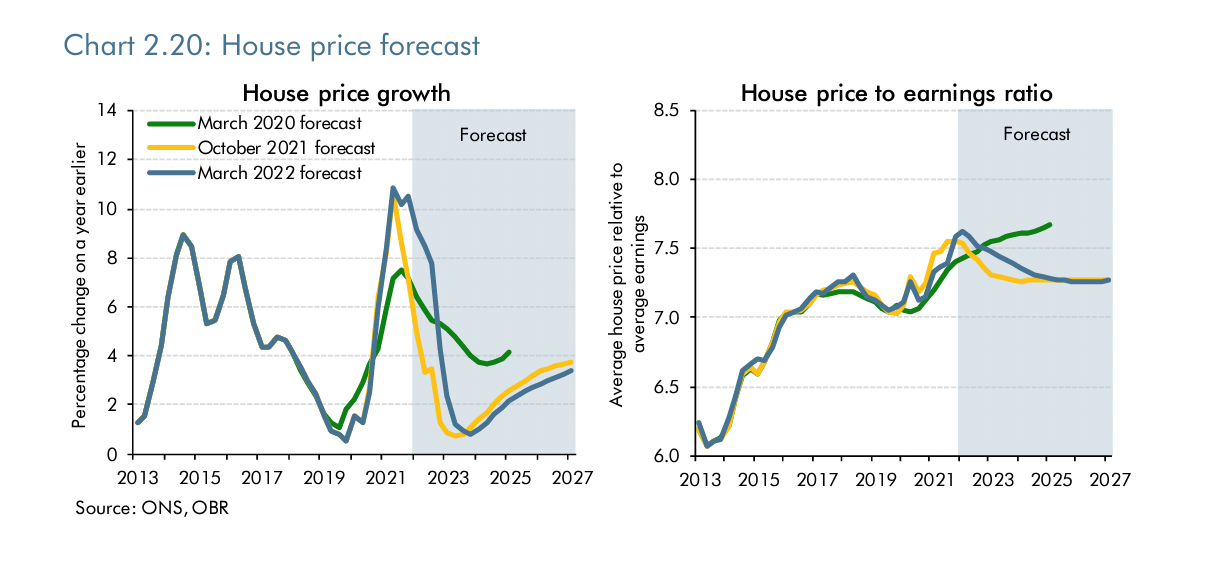

The OBR expects demand in the housing market to ease over the next year due to the fall in real incomes and a rise in interest rates, causing house price inflation to slow to around 1% by late 2023 (see chart below). Further out, it expects swelling incomes to push annual house price growth to 2% by 2025 then towards 4% by 2027.

Meanwhile, it expects transactions to return to around 1.4 million a year, a level consistent with longer-term average rates of housing market turnover.

Growth in residential construction will slow to 2.6% this year, from 12.6% in 2021, as supply bottlenecks weigh on construction in the near term, particularly due to the rising cost of materials such as timber and bricks.

The consumer

Various economic indicators continue to show signs of resilience, though sentiment is starting to wobble. Retail sales figures out this morning show sales volumes dipped 0.3% in February compared with January, which is still 3.7% above pre-pandemic levels.

Meanwhile, Britain's services and manufacturing sectors continued to grow sharply through March, according to the flash composite purchasing managers’ index (PMI) published by S&P Global and IHS Markit. However, escalating fuel, energy and staff costs resulted in the steepest rise in prices charged since the index began in 1999. Business optimism slid to its lowest level since October 2020.

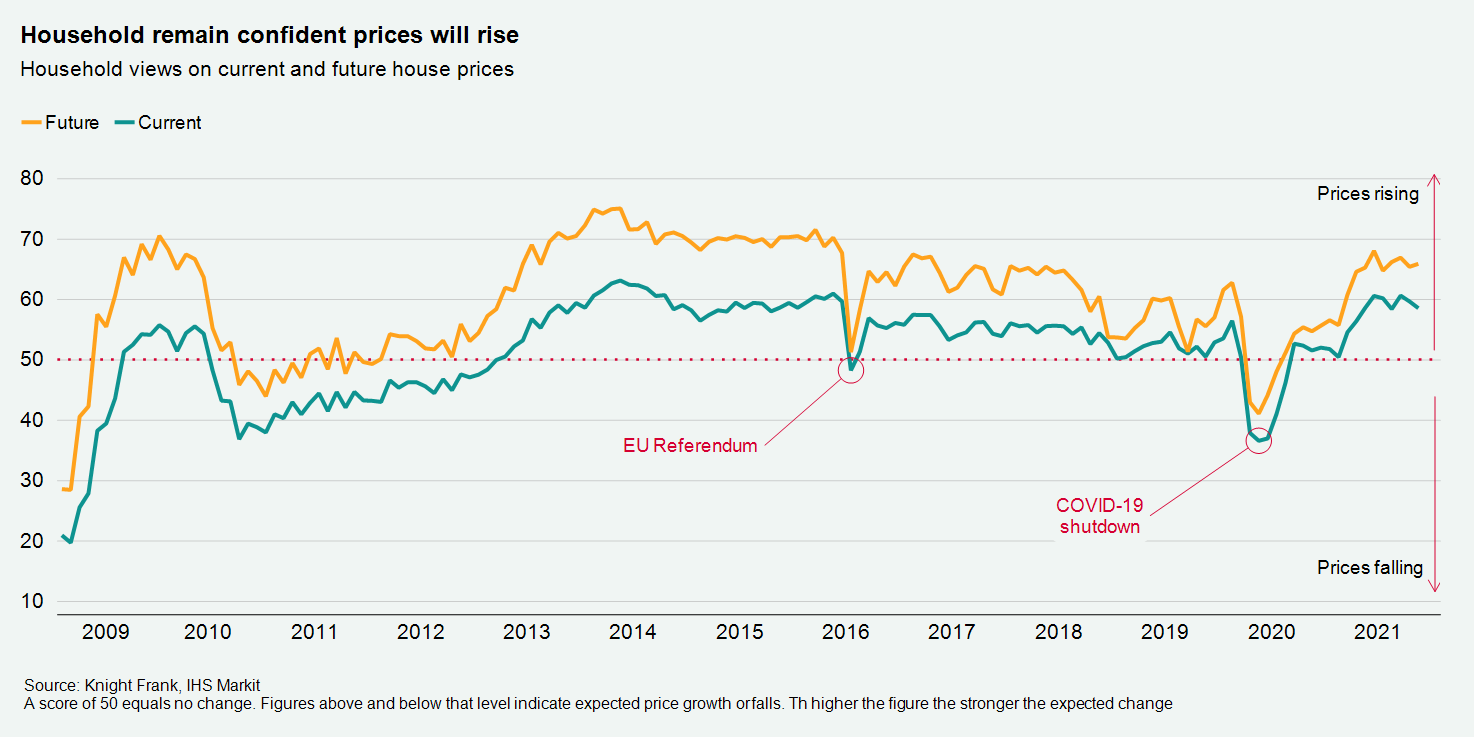

Gfk's measure of consumer confidence also slid back to levels not seen since late 2020, with respondents citing spiralling inflation, higher interest rates and the war in Ukraine. House market sentiment on both current and future house price growth remains resilient, however (see chart below). The readings for both ticked up in March, reinforcing our view that high transaction numbers and elevated pricing are likely to continue over the next few months.

For more on how we believe the next few months are likely to play out, I can recommend this week's episode of Intelligence Talks, out today. Anna Ward is joined by our head of retail research Stephen Springham, and head of residential development research Oliver Knight to tackle how increasing energy and household bills are impacting sentiment, both for shoppers on the high street and buyers of new homes. Listen here, or wherever you get your podcasts.

Globalisation

"The Russian invasion of Ukraine has put an end to the globalization we have experienced over the last three decades."

That was BlackRock chairman and CEO Larry Fink in his influential annual letter to shareholders, published yesterday. Oaktree Capital Management founder Howard Marks expressed similar sentiments in his FT column yesterday.

As Mr Marks notes, companies have spent decades moving production offshore, bringing down costs via cheaper labour, boosting economic growth in emerging economies, increasing savings and competitiveness for manufacturers and importers, while providing low-priced goods to consumers. The reversal of this model will come with costs, particularly in the form of significant inflation over the short term.

Mr Fink's letter is worth reading in full - it's effectively a State of the Union for capitalism. His comments on net zero are interesting too, namely that Russia's invasion of Ukraine will "inevitably" slow progress over the short term, while further out will accelerate the shift to clean energy, with high prices for fossil fuels making renewables more competitive.

In other news...

China under pressure, a debate (Chartbook), working from home tax break to cost 25 times more than expected (Telegraph), will war make Europe’s switch to clean energy harder? (NYT), and finally is America's economy entering a new normal? (NYT).