Fighting inflation with inflation, mortgage inversion, and country house buyers are getting younger

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

Fighting fire with fire

The Bank of England hiked the base rate for a third consecutive time yesterday, putting the key interest rate back to its pre-pandemic level of 0.75%.

The minutes of the Monetary Policy Committee meeting reveal a more cautious approach, with the summary suggesting "some further modest tightening... may be appropriate in the coming months". Only a month ago four of the committee's nine members wanted to hike by half a percentage point, which would have been the largest increase in borrowing costs since the BoE became operationally independent 25 years ago.

Of course a lot has changed in a month. Russia's invasion of Ukraine has "significantly" increased economic uncertainty and growth in economies that are net energy importers, like the UK, is likely to slow. Inflation should hit 8% in the second quarter but could track higher, the MPC said.

Fighting inflation with inflation appears to be the new strategy. Officials believe energy prices will eventually stop rising and the squeeze in real incomes will put "significant downward pressure on domestically generated inflation." The committee is much more uncertain over the path of the bath of the base rate over the coming months, citing risks on both sides.

Mortgages

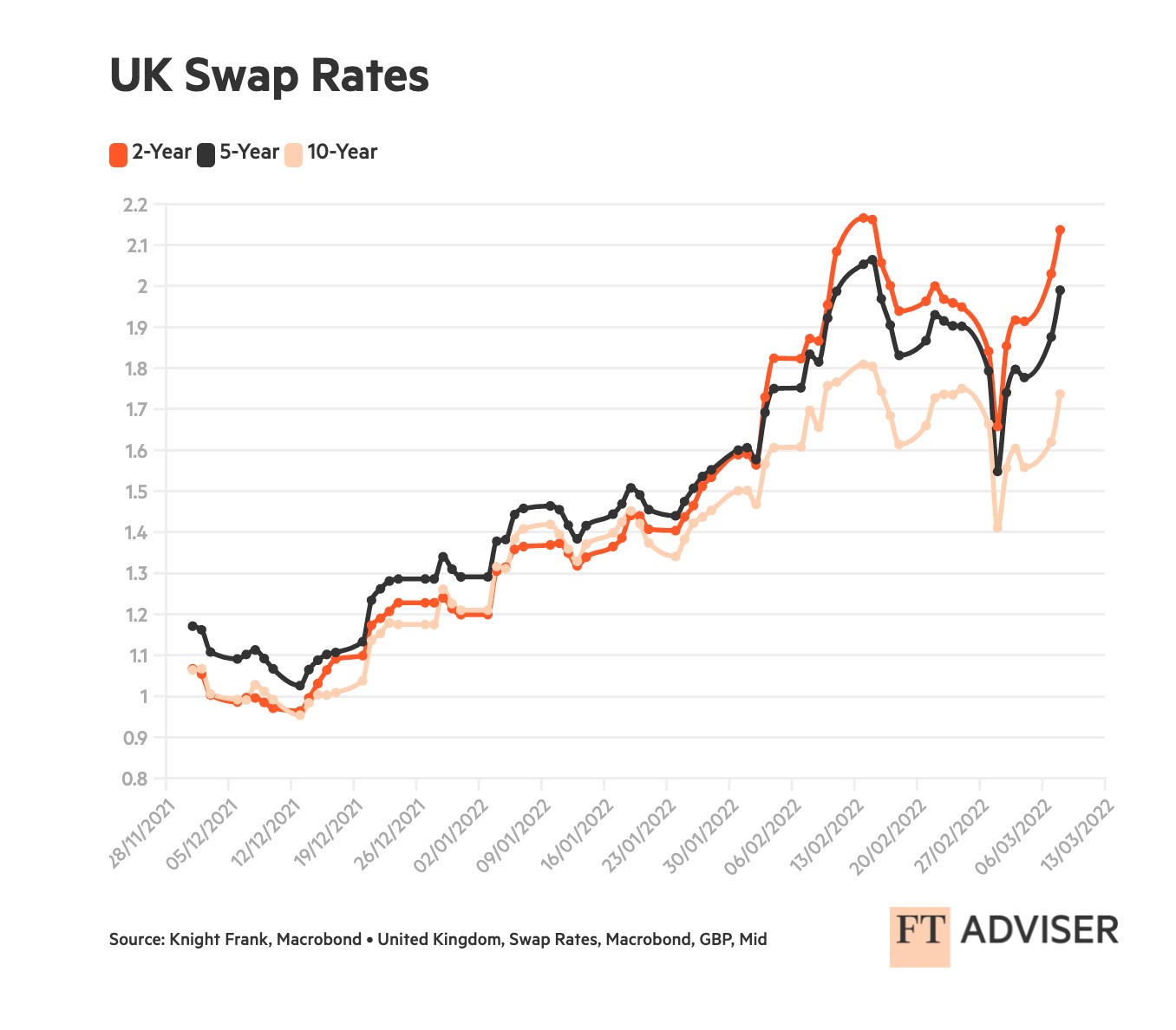

The prevailing volatility is having some odd effects on the mortgage market. Lenders purchase swaps to hedge themselves against movements in interest rates and as a result, swap rates are generally a reliable leading indicator for the path of mortgage rates.

In late February the 2-year swap rate began tracking higher than the five and ten (see chart) and some providers are now pricing two-year fixed mortgages higher than five, which in turn are now more expensive than ten-year products. Simon Gammon of Knight Frank Finance tells FT Adviser he hasn't seen this in more than twenty years in the business:

"Swap rates suggest that investors believe we're going to see a spike in costs and rates over the next 12 months to two years before markets start to normalise. That's likely why we're seeing this anomaly.”

You can read Simon's thoughts on how to navigate the mortgage market here.

The Fed

The US Federal Reserve approved its first interest rate rise in three years on Wednesday. Officials indicated there could be as many as six more over the course of 2022, with consensus suggesting the rate could be at 1.9% at the end of the year before hitting 2.8% in 2023.

Data published alongside the release showed that manufacturing and construction are surging. The pace of new-home building increased at the fastest pace since 2006. The rate on 30-year fixed rate mortgages climbed above 4% for the first time in three years, up from a little over 2% in January.

Long-term forecasting in the current environment is hard, but it's worth flagging this Bloomberg piece on traders betting that interest rates will start to fall again from 2024, the logic being that aggressive interest rate hikes will slow economic growth and even tip the economy into recession.

Country buyers younger

Homebuyers are getting younger in the country market.

Higher rates of stamp duty in recent years for higher-value properties mean that an increasing number of homebuyers are missing out a rung on the property ladder and are trading up directly from a London apartment to a family home in the country to minimise transaction costs.

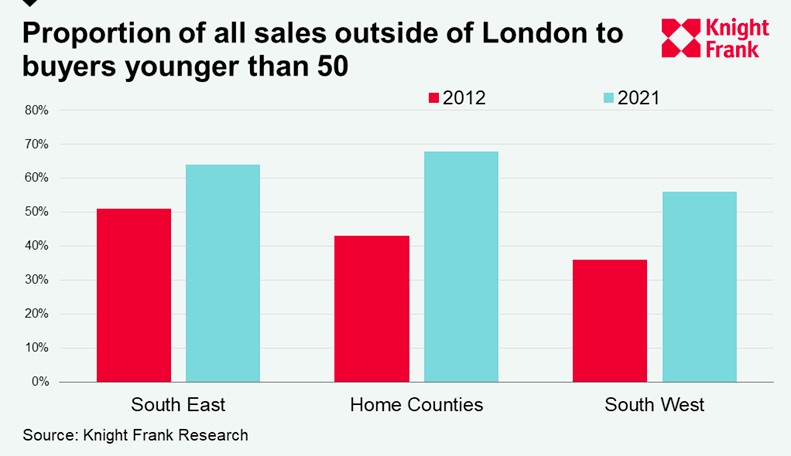

The proportion of sales outside of London to buyers under 50 has increased from just under half (48%) in 2012 to 60% last year, as families move from cities such as London at an earlier stage in life (see chart).

“We’re seeing the traditional move out of London to the country happening sooner than it used to, something that the pandemic and last year’s stamp duty holiday encouraged as part of the race for space,” says James Cleland, head of Knight Frank’s Country Business.

In other news...

The releases published alongside the Bank of England's base rate decision yesterday included some other useful titbits:

Firstly, the BoE's twelve regional agents interview at least 700 businesses across the UK each quarter. Here is the latest. In construction, lead times for many materials continued to be lengthy, though availability has improved since the summer. Companies reported placing orders early and buying larger quantities of materials in order to limit the effect of shortages, though this was easier for larger firms than for smaller companies.

The industry's imports from Russia are pretty limited, you can see a breakdown from Construction Products Association economics director Noble Francis here.

The BoE also surveys around 3,000 chief financial officers to gauge Covid's impacts on sales, employment and investment. Here is the latest. By February, as this guidance to work from home was removed, respondents said the proportion of hours worked at offices had returned to November levels, with around 24% of hours worked from home, 4% unable to work, and 72% worked on business premises.

Respondents expect a gradual return to business premises, but working from home remains significantly above pre-pandemic levels over the medium term, at around 17% of hours to be worked from home in 2023 and beyond. That is around two and a half times more hours worked from home than pre-pandemic.

Elsewhere - WHO says global rise in COVID cases is 'tip of the iceberg' (Reuters).